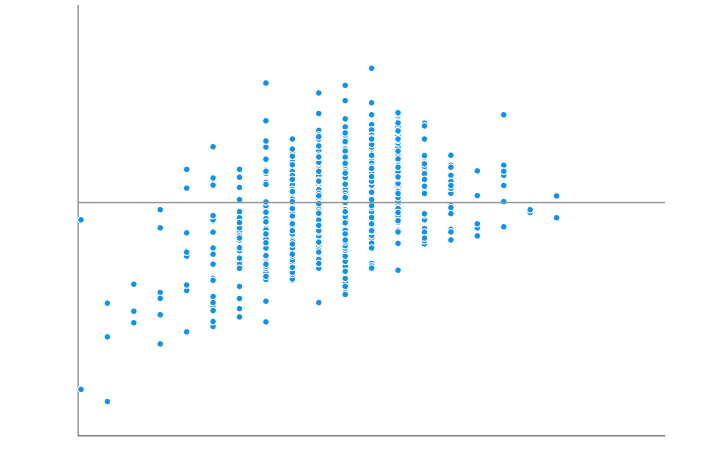

A double top is an bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. Often, an asset’s price will experience a peak, before retracing back to a level of support. It usually climbs before reversing back and regressing to mean average.