MARKETS TODAY March 20th, 2023 (Vica Partners)

Happy Monday!

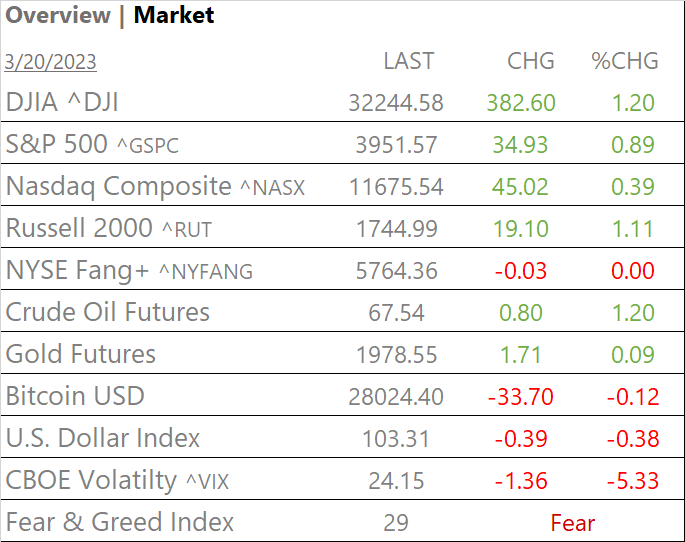

Last week, even with the Banking failures the major US indices advanced. The S&P 500 up ended +1.4%, while the FANG+ index was +9%, as mega- and large-cap tech stocks continued to benefit from rotations out of financials and energy. The 2yr treasury yield declined 125bps from the inter-week highs while the yield curve started to de-invert.

Overnight, Asian markets finished lower with shares in Hong Kong leading the region. The Hang Seng was down 2.57% while Japan’s Nikkei 225 was off 1.42% and China’s Shanghai Composite, lower by 0.48%. European markets in contrast were sharply higher today with shares in France leading the region. The CAC 40 was up 1.27% while Germany’s DAX up, 1.12% and London’s FTSE 100 up, 0.93%.

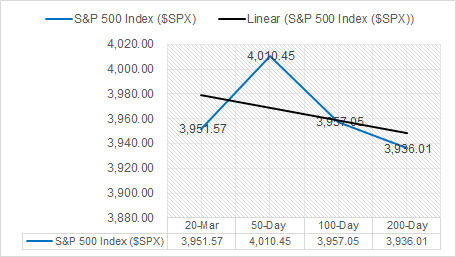

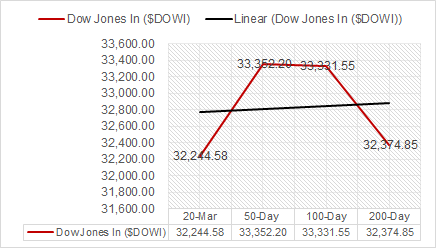

US equities closed higher Monday with S&P500 ending at 3952 firmly above 200d (3936). All 11 of the S&P 500 sectors were higher. Materials and Energy outperformed, and in a “reversal of last week” mega cap/tech lagged. Yields moved higher while the USD Dollar index lower. Oil rose >1, gold was flat and Bitcoin mostly flat. There was no US economic data released today.

Takeaways

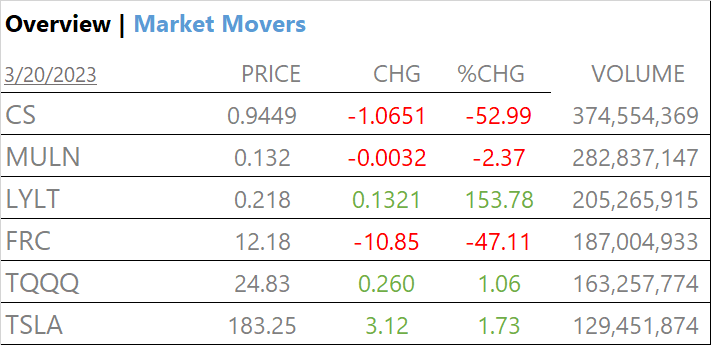

- Bank news, First Republic (FRC) downgraded to junk status by S&P Global

- Key Indices close higher

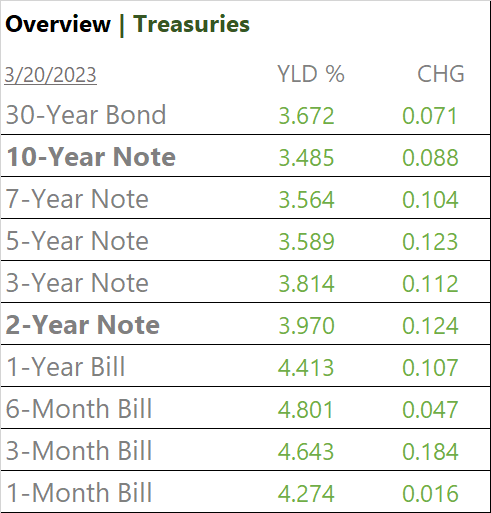

- Yields rise

- All 11 S&P sectors higher: Cyclicals outperform/ Tech underperforms

- Fear & Greed index rating = Fear

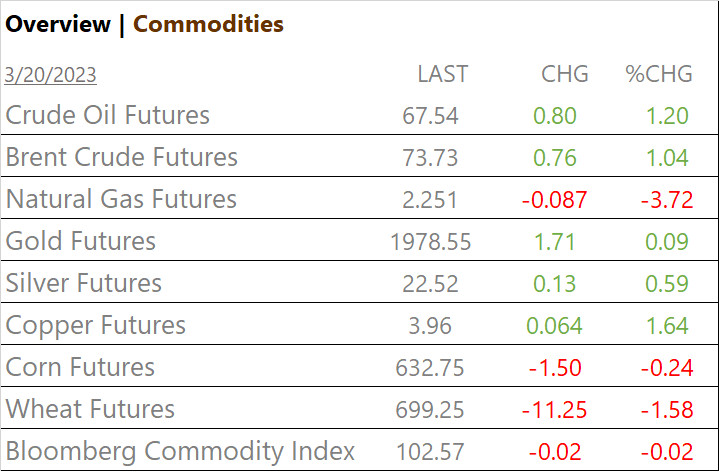

- Bloomberg Commodity Index, flat

- Gold testing 2K

- Crude Oil Futures rise >2%

- Bitcoin flat

- USD Index, down

Last word, Ahead of Wednesday’s rate decision the Fed needs to stick with its 25bps rate hike, especially after the ECB went 50bps yesterday. Expect that the central bank will continue to say it remains committed to fighting inflation (as we are nowhere close to 2% target) but that they understand the need to modify as recent banking failures indicate risks to the economy.

Sectors/ Commodities/ Treasuries

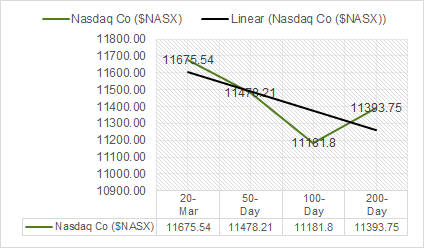

Key Indexes (50d, 100d, 200d)

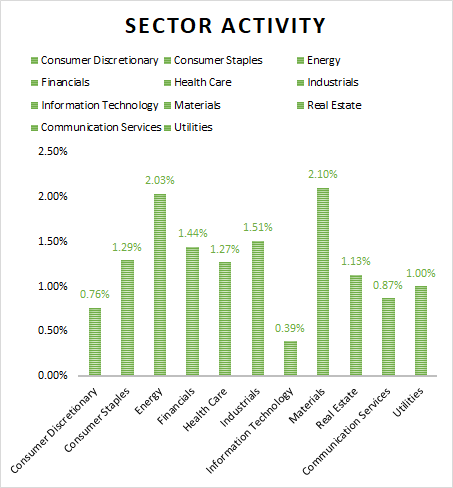

S&P Sectors

- All 11 of the S&P 500 sectors were higher, Materials +2.10% and Energy +2.03% outperform/ Information Technology +0.39, underperforms

Commodities

US Treasuries

Economic Data

US

- No major US economic news data release today

- Summary: ahead of Wednesday’s rate decision the consensus thought is that the Fed will stick with a 25bps rate hike.

- Tomorrow; Existing Home Sales

News

Company News/ Other

- Former head of Google China joins ChatGPT frenzy by starting own venture – South China Post

- First Republic shares tumble again as liquidity worries linger; peers rebound – Reuters

- Giant bank deal triggers political backlash in Switzerland Reuters

Central Banks/Inflation/Labor Market

- Federal Reserve and Global Central Banks Act to Shore Up Dollar Access – NY Times

China

- China must ‘tolerate failure’ in science and tech to close gap with US, by reforming risk-averse research environment – South China Post

Market Outlook and updates posted at vicapartners.com