MARKETS TODAY April 27th, 2023 (Vica Partners)

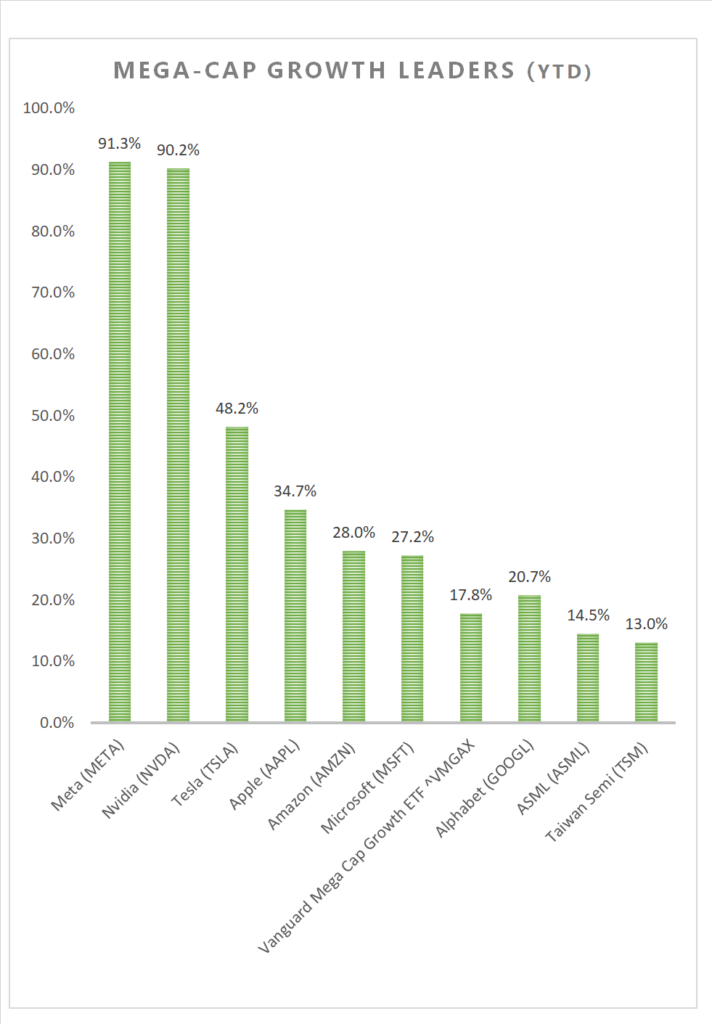

Yesterday, US Markets finished mixed with The NY FANG+ up 2%/ Mega Cap Growth +>1.2% leading gainers. 2 of 11 of the S&P 500 sectors finished higher, Information Technology outperformed. The Cboe Volatility Index steadied, Treasury Yields rose across the curve and Meta beat earnings in afterhours. In economic news, weekly Mortgage Applications and Durable Goods orders rose.

Overnight, Asian markets finished higher, Shanghai Composite up 0.67%, Hong Kong’s Hang Seng up 0.42%, Japan’s Nikkei 225 up 0.15%. Pre-market, Pre-market, European markets finished mixed, CAC 40 +0.23% DAX +0.03%, FTSE 100 -0.27%. US futures were trading at +0.60% above fair value.

Today, US Markets rally, DOW up +500 points with Nasdaq/Tech leading advancers. All 11 of the S&P 500 sectors finished higher, Communications with breakout outperformance/ Energy lagged. On the upside, Treasury Yields rose across the curve, Bitcoin +4% and Amazon with BIG earnings beat in afterhours. In economic news, weekly jobless claims filing for unemployment dropped last week.

Takeaways

- Recession not a Thursday market concern

- Volatility Index dropped close 10%

- The NY FANG+ up 3.79%

- Big Tech continues to handily beat on earnings, Meta gains 14% today

- 11 of the S&P 500 sectors higher, Communication Services outperforms

- Bitcoin up $1.2k

- Amazon with a BIG earnings beat in after hours

Pro Tip: The forward price-to-earnings ratio (forward P/E) is a valuation metric that compares a company’s current stock price to its expected earnings per share (EPS) over the next 12 months. In general, a lower forward P/E ratio suggests that a company’s stock may be undervalued relative to its earnings potential. As a guideline, a forward P/E ratio of 15 or lower is considered reasonable, while a forward P/E ratio of 20 or higher may suggest that the stock is relatively expensive (learn more).

Sectors/ Commodities/ Treasuries

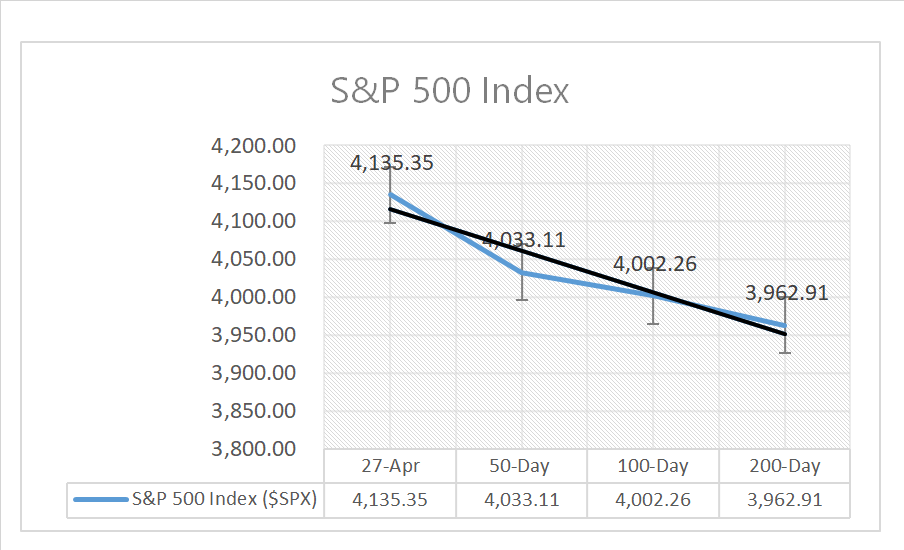

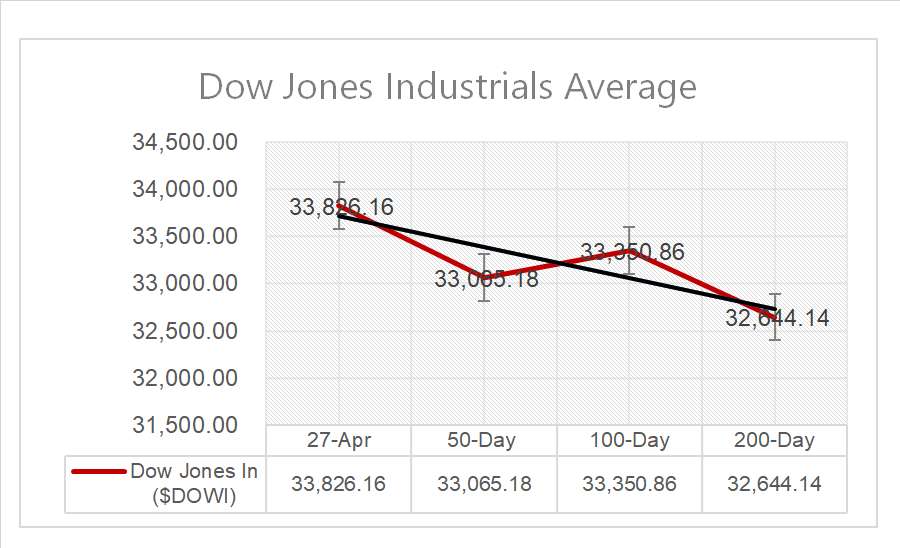

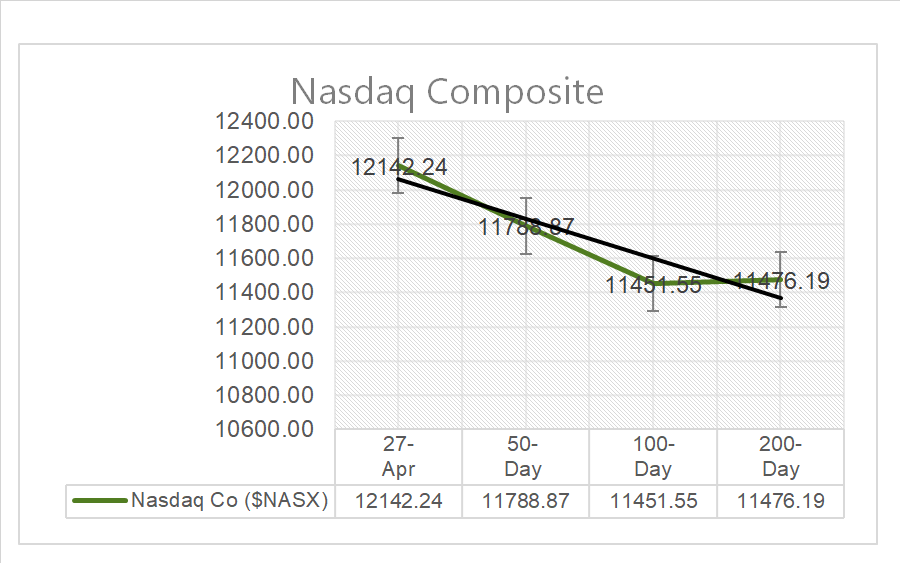

Key Indexes (50d, 100d, 200d)

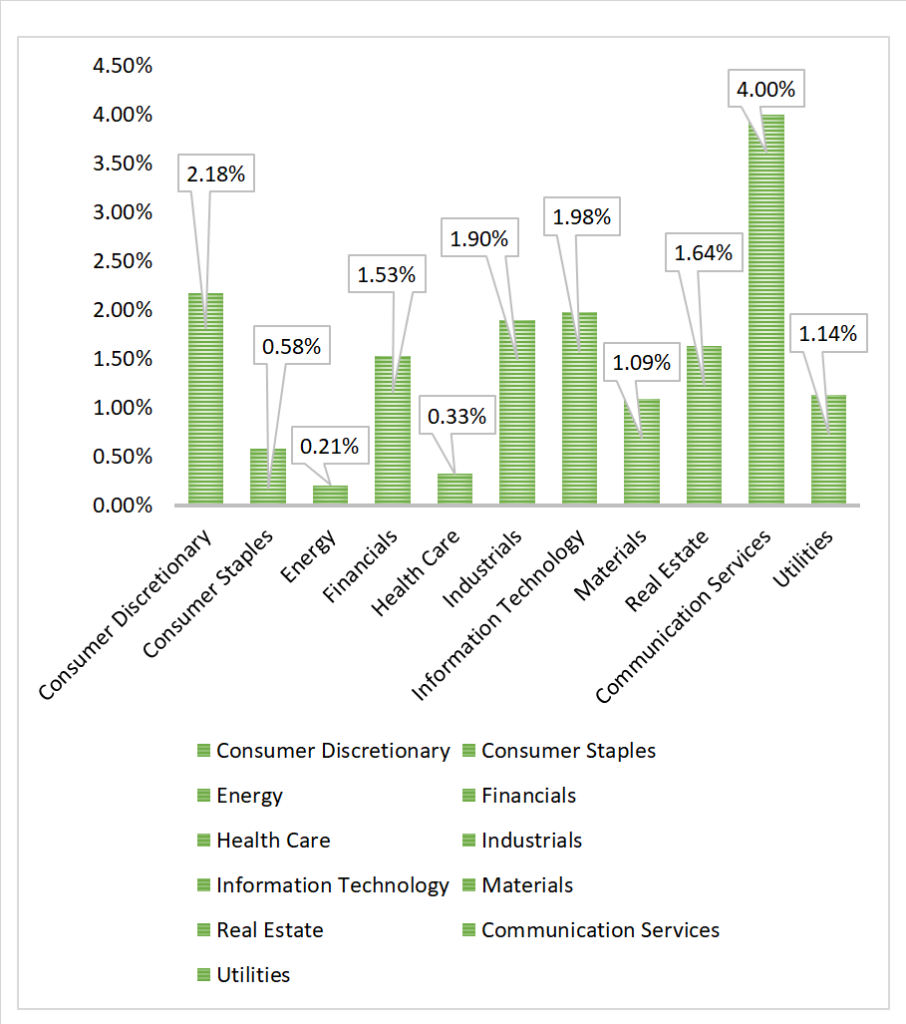

S&P Sectors

- All 11 of the S&P 500 sectors finish higher, Communication Services +4.0% and Consumer Discretionary +2.18 led advancers/ Energy +0.21% and Health Care +0.33% lag

Commodities

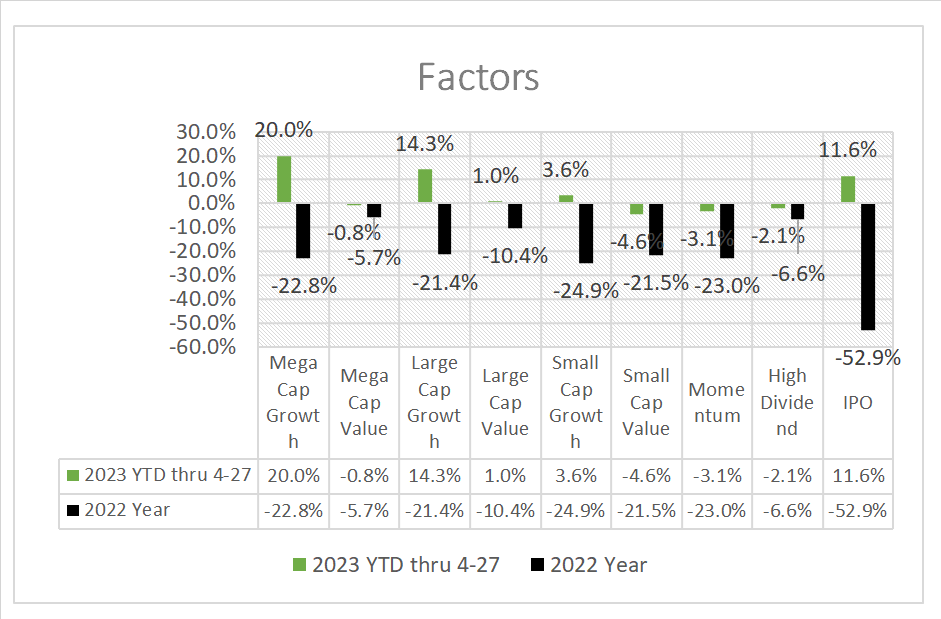

Factors (YTD)

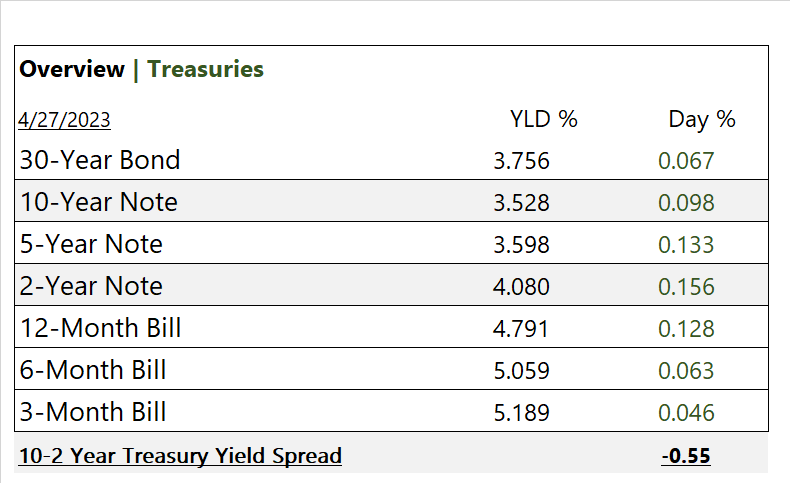

US Treasuries

Notable Earnings Today

- +Beat: com (AMZN), Mastercard (MA),Merck&Co (MRK), Comcast (CMCSA), Honeywell (HON), Caterpillar (CAT), Northrop Grumman (NOC)

- – Miss: Eli Lilly (LLY), AstraZeneca ADR (AZN), Bristol-Myers Squibb (BMY), Sanofi ADR (SNY), Altria (MO)

- * Strong support – Meta Platforms (META) Microsoft (MSFT), Alphabet (GOOG,GOOGL), Visa (V), NVIDIA (NVDA), Amazon (AMZN), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP), Coca-Cola (KO), PACCAR (PCAR), Centene (CNC), Humana (HUM), Mastercard (MA),

Economic Data

US

- Initial jobless claims; period April 22, act 230,000, fc 249,000, prev. 245,000

- Continuing jobless claims; period April 15, act 1.858m, prev. 1.861m million

- Pending home sales; period March, act -5.2%, fc 0.5% , prev. 0.8%

News

Company News/ Other

- Chinese EV giant BYD’s first-quarter profit jumps fivefold – Reuters

- AbbVie posts weak sales of newer drugs as Humira faces fresh competition, shares fall – Reuters

- Why No Buyer Has Emerged for First Republic – WSJ

Central Banks/Inflation/Labor Market

- US pending home sales slump unexpectedly in March – Reuters

- US economy grew at weak 1.1% rate in Q1 in sign of slowdown – AP

- Recession Can Wait—the GDP Report’s Bright Side – WSJ

China