MARKETS TODAY April 10th, 2023 (Vica Partners)

Good Monday Evening,

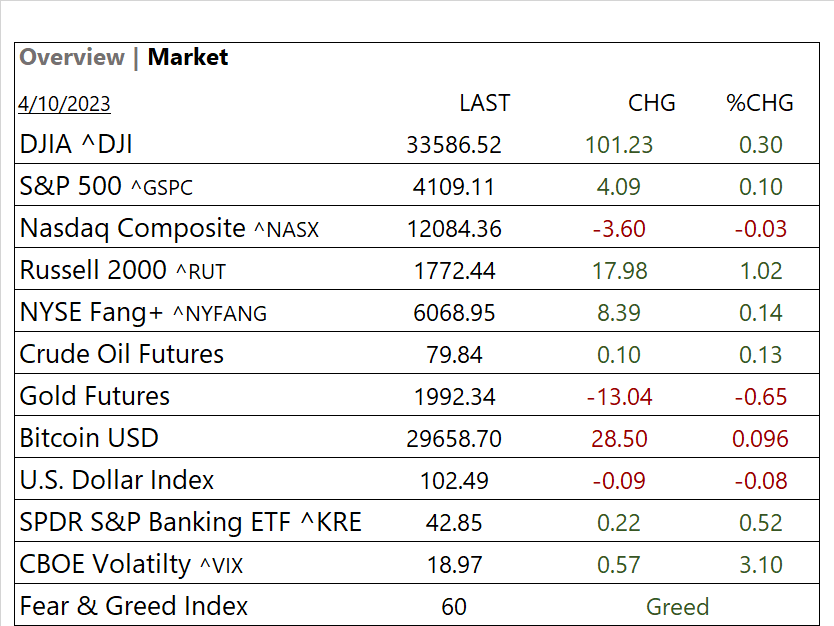

Last Week, March numbers indicate that inflation is declining as jobless claims topped forecast, indicating the labor marking is slowing however the housing and rental components of inflation remain high. The S&P 500 +1.34% but the overall market returned a -0.10% change. Defensives/ Health Care +4.24%, Utilities +3.90% outperformed while Oil was also up 6%. Investor market fear diminishing as the VIX continued trending down since a high of 30 in mid-March.

Overnight, Asian markets finished mixed as of the most recent closing prices. The Nikkei 225 gained 0.42% and the Hang Seng rose 0.28%. The Shanghai Composite lost 0.37%. Premarket, European markets finished broadly higher on with shares in London leading the region. The FTSE 100 was up 1.03% while Germany’s DAX up 0.50% and France’s CAC 40 up 0.12%. S&P 500 US futures were trading -0.50% below fair-value.

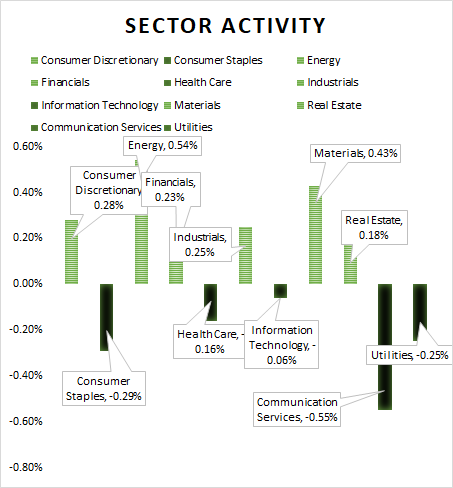

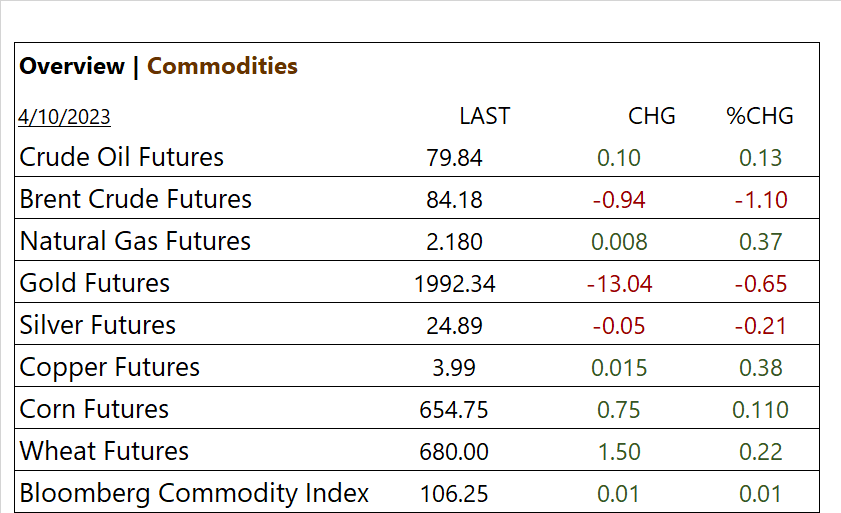

US markets today, Key Indices closed moderately higher, Dow and Russell 2000 lead. 6 of 11 of the S&P 500 sectors were higher/ Energy and Materials outperform, Communication lags. Bitcoin >$29K and Gold falls back >2K. In economic news, Wholesale Inventories rose less than expected in February.

Q1 2023 earning cycle starts on Friday and will set the short term Market tone. Analysts expect S&P 500 company profits to record the biggest drop since 2020. Key inflation reports thru Week CPI, PP and Jobs.

Takeaways

- Indices muted, Dow and Russell 2000 lead

- Wholesale Inventories rose less than expected in February

- Energy and Materials outperform

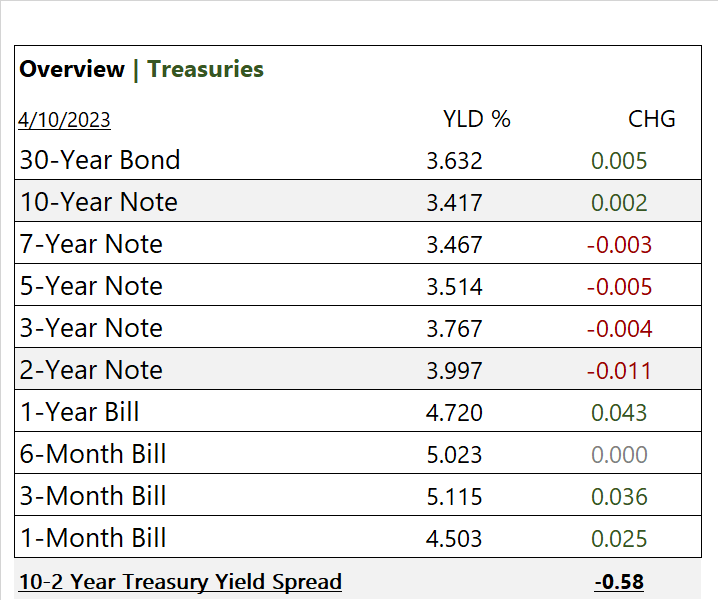

- 10-2 Year inverted Treasury Yield spread increasing

- Bitcoin testing $30K

- USD Index continues to slide

- Fear & Greed Index rating/ 60 Greed

Pro Tip: watch Oil Rig Companies as US gas reserves are historically low and production will need to ramp up to meet consumer demand.

Sectors/ Commodities/ Treasuries

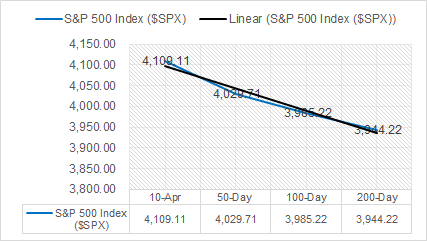

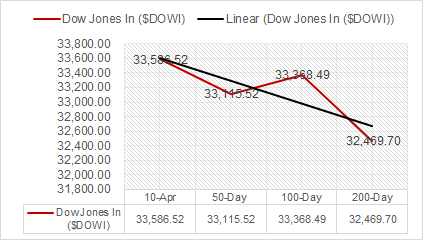

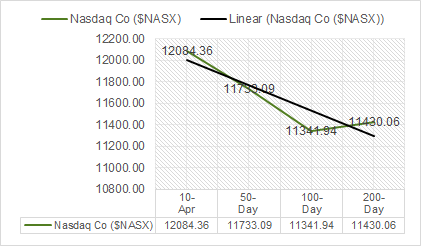

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors were higher / Energy + 0.54%, Materials +0.43% outperform, Communication Services -0.55% underperforms.

Commodities

US Treasuries

Notable Earnings This Week (bold denotes today)

- + PriceSmart (PSMT), Greenbrier (GBX)

- – Tilray (TLRY)

- * Strong support – Qualcomm (QCOM), Vale (VALE), Rio Tinto (RIO), Analog Devices (ADI), Occidental Petroleum (OXY), United Health Care (UNH), Humana (HUM), Centene (CNC), Merck (MRK), OC (Owens Corning), Micron (MU)

Economic Data

US

- Wholesale inventories; period Feb., act 0.1% , fc 0.2%, prev. -0.5%

News

Company News/ Other

- Global PC shipments slide in first quarter, Apple takes biggest hit, IDC says – Reuters

- Elon Musk: Tesla to build new battery factory in Shanghai – BBC

- US Consumer Prices Are Seen Staying Firm, Testing the Fed – Bloomberg

Central Banks/Inflation/Labor Market

- World Bank chief raises 2023 global growth outlook slightly, eyes debt progress – Reuters

- Food Prices Are New Inflation Threat for Governments and Central Banks – WSJ

China

- Chinese banks ditch bad loans amid property woes – Nikkei