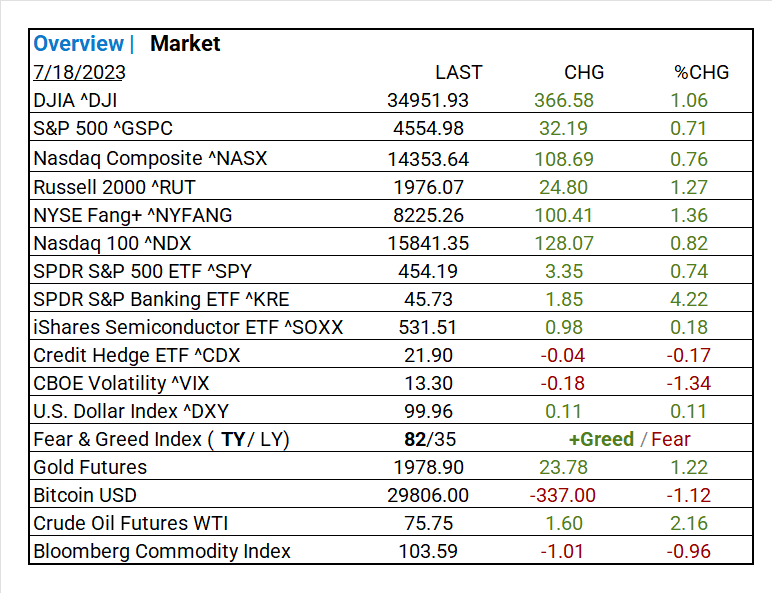

MARKETS TODAY July 18th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 gained 0.32%, while Hong Kong’s Hang Seng -2.05% and China’s Shanghai Composite -0.37%, ended lower. European markets finished higher, France’s CAC 40 gained 0.38%, Germany’s DAX 0.35% and London’s FTSE 100 0.26%. S&P futures opened trading at 0.02% below fair value.

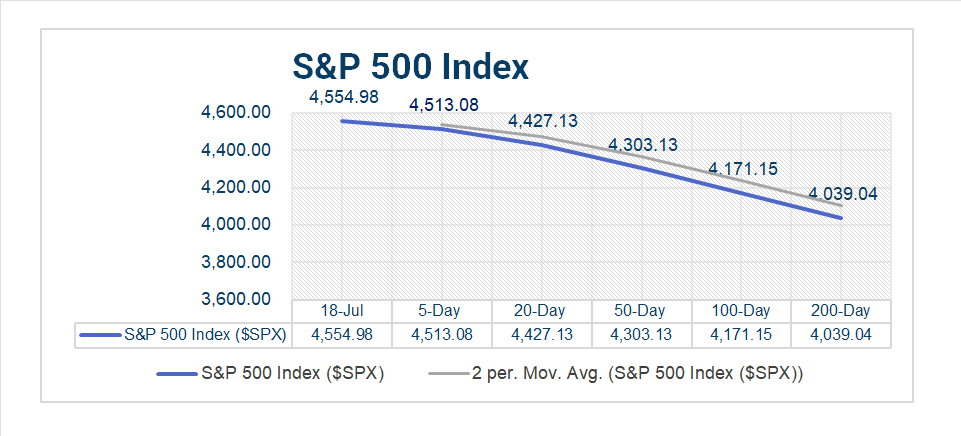

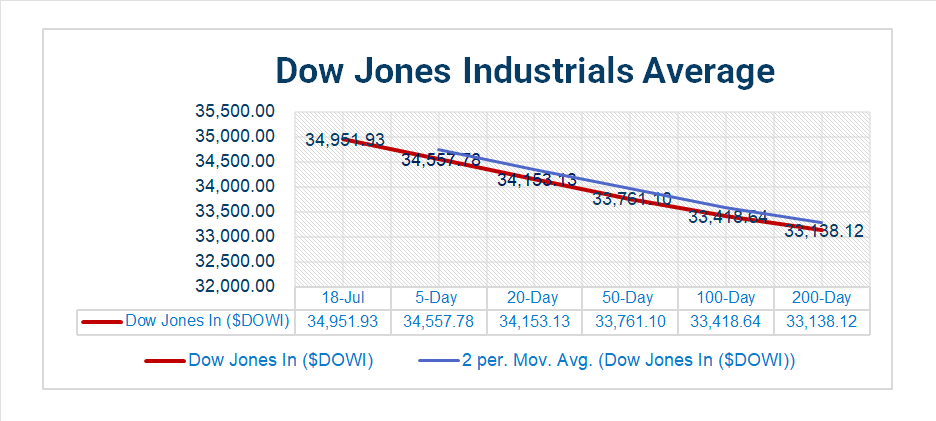

Today US Markets finished higher, S&P 500 +0.71%, DOW 1.06%, NASDAQ +0.76%. 8 of 11 S&P 500 sectors advancing: Information Technology +1.26% outperforms/ Real Estate -0.82% lags. On the upside, DOW, NYSE Fang+, SPDR S&P Banking ETF ^KRE, Russell 2000 ^RUT, Capital Markets, Software, Passenger Airlines, Entertainment, Gold, and Oil.

In economic news, Retail Sales were mixed with headline below estimates, Industrial production and capacity utilization came in below expectations. Open business inventories were in line with estimates and the NAHB Housing Market index rose for the sixth consecutive month, hitting its highest level since last June.

Takeaways

- Economic data mixed

- Earnings off to strong start

- DOW +1.06% leads majors

- NYSE Fang+ up 1.36%

- Russell 2k +1.27%, SPDR S&P Banking ETF ^KRE +4.22%

- 8 of 11 S&P 500 sectors advancing: Information Technology +1.26% outperforms/ Real Estate -0.82% lags.

- Capital Markets+3.03%, Passenger Airlines +2.57%, Entertainment +2.51%

- Factors/ Small Cap Value

- Gold and Oil gain

- Bank of America (BAC) and Novartis ADR (NVS) earning beats

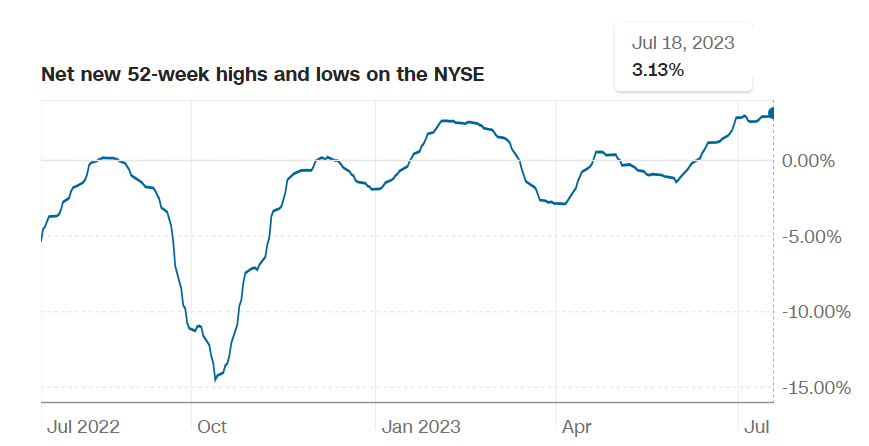

Pro Tip: The chart below shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

Sectors/ Commodities/ Treasuries

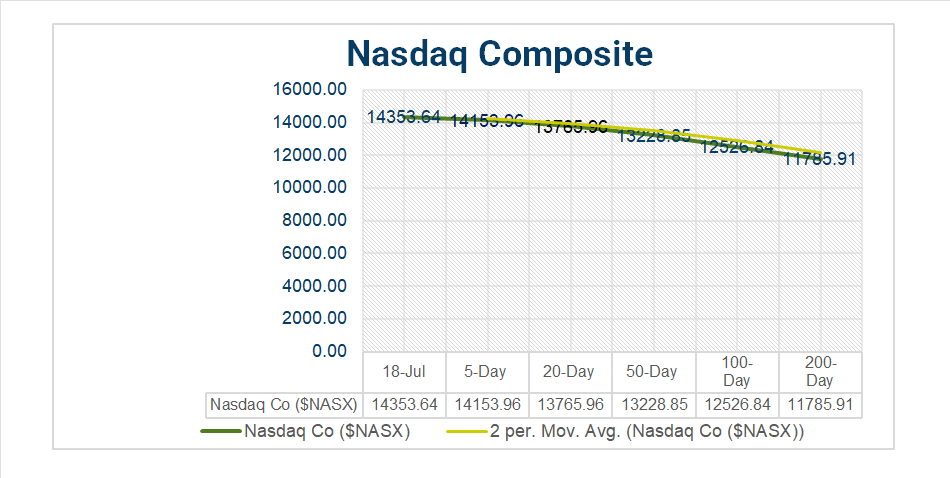

Key Indexes (5d, 20d, 50d, 100d, 200d)

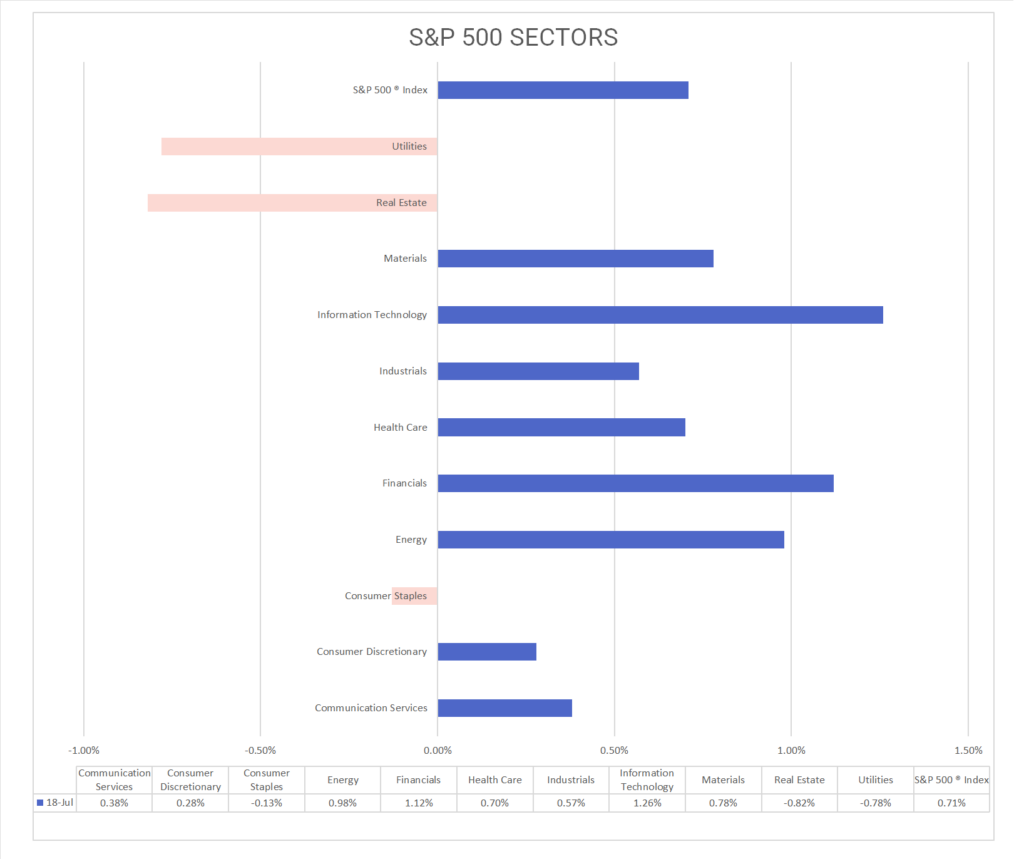

S&P Sectors

- 8 of 11 S&P 500 sectors advancing: Information Technology +1.26% outperforms/ Real Estate -0.82% lags.

- Information Technology/ Sub Software +2.88%. Others/ Sub Capital Markets+3.03%, Passenger Airlines +2.57%, Entertainment +2.51%, Banks +1.90%, Health Care Providers & Services +1.87%.

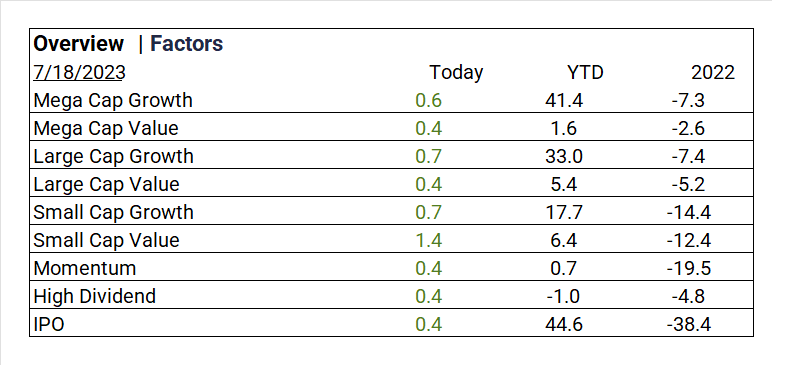

Factors

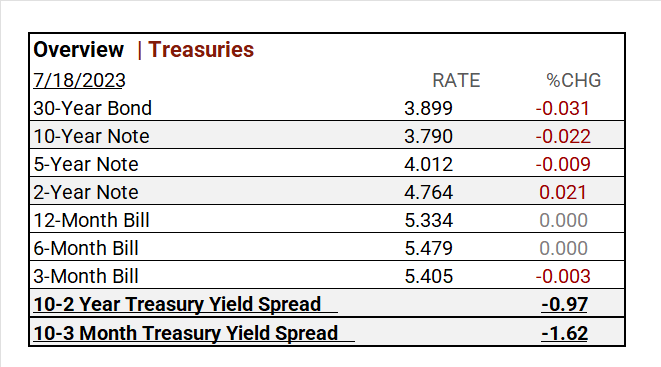

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: Bank of America (BAC), Novartis ADR (NVS), Morgan Stanley (MS), Charles Schwab (SCHW), Lockheed Martin (LMT), Prologis (PLD), Bank of NY Mellon (BK), Swedbank AB (SWDBY), Synchrony Financial (SYF)

- – Miss: PNC Financial (PNC), Interactive Brokers (IBKR), Omnicom (OMC), JB Hunt (JBHT), Western Alliance (WAL), Hancock Whitney (HWC), United Community Banks (UCBI)

Economic Data

US

- US. retail sales: period June, act 0.2%, fc 0.5%, prior 0.5%

- Retail sales minus autos: period June, act 0.2%, fc 0.3%, prior 0.1%

- Industrial production: period June, act -0.5, fc0, prior -0.5%

- Capacity utilization: period June, act 78.9%, fc 79.5%, prior 79.4%

- Business inventories: period May, act 0.2%, fc 0.2%. prior 0.1%

- Home builder confidence index: period July, act 56, fc 57, prior 55

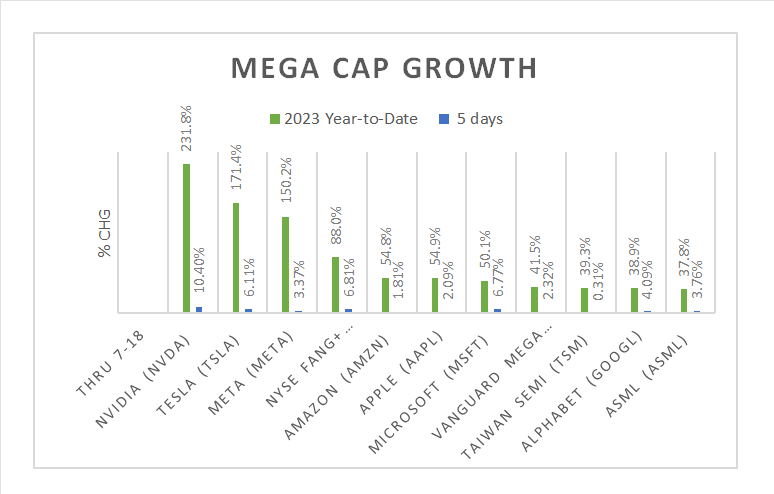

Vica Partner Guidance July ‘23

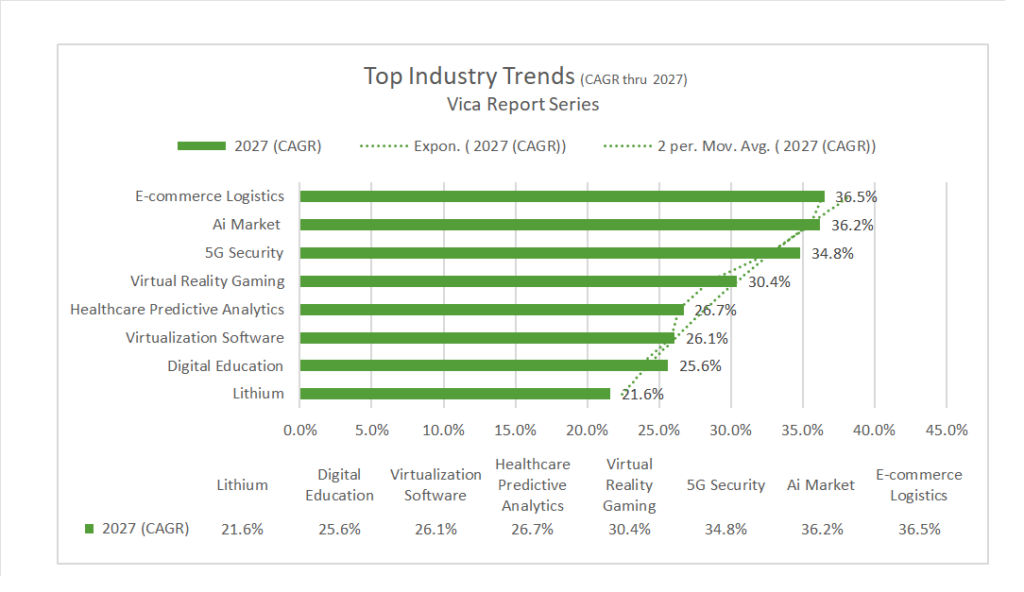

- Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Metals & Mining, Semiconductor & Semiconductor Equipment, Construction Materials, Energy Services. Nasdaq 100^NDX <15,000 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO), Sociedad Quimica y Minera (SQM).

News

Company News/ Other

- Lockheed Martin Projects Higher Sales as War Boosts Orders – WSJ

- Wall Street Can’t Shake Off Investment-Banking Slump = WSJ

Energy/ Materials

- US, China Seek Thaw on Climate as World Broils Under Extreme Heat – Bloomberg

- Ford Takes $3.6 Billion Hit for Following the Tesla Playbook – Bloomberg

Central Banks/Inflation/Labor Market

- US Retail Sales Edge Higher as Key Metric Shows Resilient Demand – Bloomberg

- German Inflation to Decrease From September, Bundesbank Says – WSJ

- Yellen Sees Disinflation Pressures at Work as Hiring Surge Fades – Bloomberg

Asia/ China

- US-China tech war: Washington’s curbs will only ‘travel towards tightening’ as national security trumps economics – SCMP

- The Man Charged With Steering the Yuan Through China’s Economic Turmoilom September, Bundesbank Says – WSJ