MARKETS TODAY April 12th, 2023 (Vica Partners)

It’s only Wednesday!

Yesterday, Key Indices closed mostly lower, Dow and Russell 2000 finished up for a 2nd consecutive day. 9 of 11 of the S&P 500 sectors were higher/ Materials and Energy, Information Technology lags. The SPDR S&P Banking ETF ^KRE was flat while Bitcoin rallied above $30K and Gold remained +2K. Small Business Optimism declined in March.

Overnight, Asian markets finished mixed as the Nikkei 225 gained 0.57% and the Shanghai Composite rose 0.41%, the Hang Seng lost 1.05. European markets finished higher today with shares in London leading the region. The FTSE 100 was up 0.50%, Germany’s DAX up 0.31% and France’s CAC 40 up 0.09%. S&P 500 US futures were trading +0.75% above fair value prior to market opening.

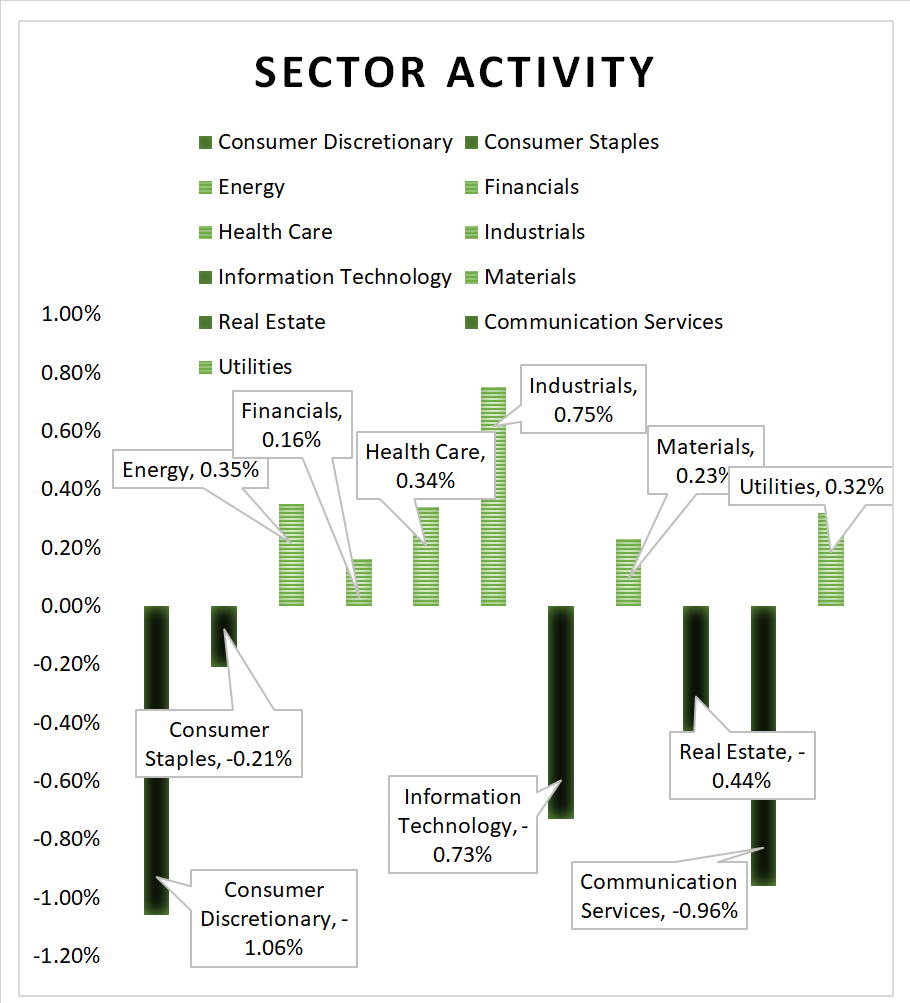

US markets today, Key Indices closed lower, Nasdaq and FANG+ underperform with Semiconductor ETF ^SOXX down 1.83%. 6 of 11 of the S&P 500 sectors were higher/ Industrials and Energy outperform, Communication Services and Information Technology lag. Yield decline across the curve. Gold maintains 2K level. In economic news, CPI headline inflation dropped in March, due to falling energy prices. Core price growth, which excludes the volatile food and energy indexes was inline but remained historically high from gains in shelter and transportation services.

Takeaways

- March FED minutes released late today contributed to selloff

- SPDR S&P Banking ETF ^KRE declines >1%

- Nasdaq and FANG+ underperform

- Industrials outperform

- Gold futures settle close to week high after U.S. inflation reading

- CPI headline inflation dropped, Core in-line

Pro Tip: BBSR… Buy breaks, Sell rallies

Sectors/ Commodities/ Treasuries

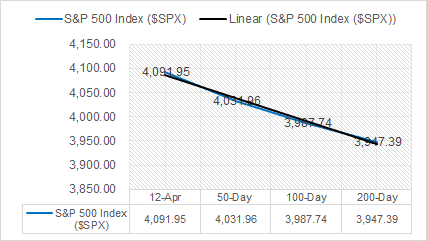

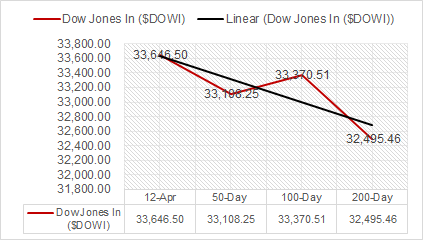

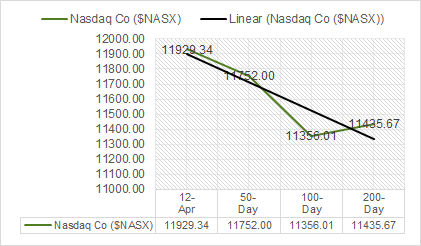

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors were higher / Industrials +0.75%, Energy + 0.35%, outperform, Communication Services -0.96% and Information Technology -0.73% underperform.

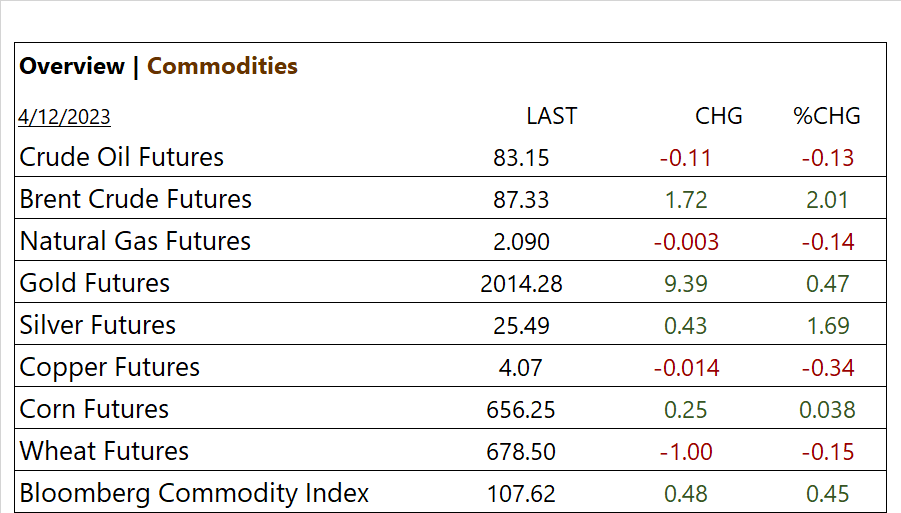

Commodities

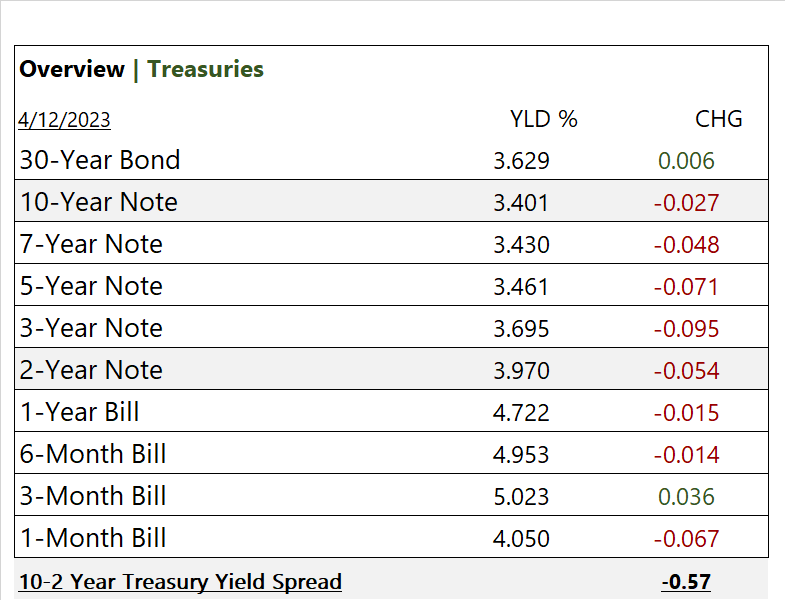

US Treasuries

Notable Earnings This Week (bold denotes today)

- + PriceSmart (PSMT), Greenbrier (GBX), Albertsons (ACI), Royal Gold (RGLD), Louis Vuitton ADR (LVMUY)?, Aeon ADR (AONNY)

- – Tilray (TLRY), CarMax (KMX)

- * Strong support – Qualcomm (QCOM), Vale (VALE), Rio Tinto (RIO), Analog Devices (ADI), Occidental Petroleum (OXY), United Health Care (UNH), Humana (HUM), Centene (CNC), Merck (MRK), OC (Owens Corning), Micron (MU). Halliburton (HAL), BRK-A, BRK-B

Economic Data

US

- Consumer price index; period March, act 0.1%, fc 0.2%, prev. 0.4%

- Core CPI; period March, act 0.4%, fc 0.4%, prev. 0.5%

- CPI year over year, period March, act 5.0%, fc 5.1%, prev. 6.0%

- Core CPI year over year; period March, act 5.6%, fc 5.6%. prev. 5.5%

- Federal Reserve March meeting minutes released today predicted a mild recession later this year as a result of U.S. banking crisis.

Summary – CPI data lower than anticipated with headline down to 5% vs 5.2% cons, prior 6%, driven primarily by energy prices. Core CPI 5.6% flat to consensus but up a tenth compared to prior. Shelter eased to 0.6% which was the largest contributor to the monthly all items increase. Shelter is the lowest in a year as home prices are falling. There was an acceleration in transportation services and an ongoing drop in medical services.

News

Company News/ Other

- Emerson Electric to buy NI Corp for $8.2 bln to deepen automation push – Reuters

- SoftBank to sell nearly all its stake in Alibaba – FT – Reuters

- Traders Boost Bets on US Rate Cuts This Year After CPI – Bloomberg

Central Banks/Inflation/Labor Market

- Buffett: Do not panic about U.S. banks and deposits – Reuters

- US consumer price gains slow; underlying inflation still hot – Reuters

- IMF warns global economy could see hard landing if inflation keeps rates higher for longer – AP

China

- Hong Kong officials reiterate commitment to cryptocurrency, DeFi regulation at Web3 Festival – SCMP