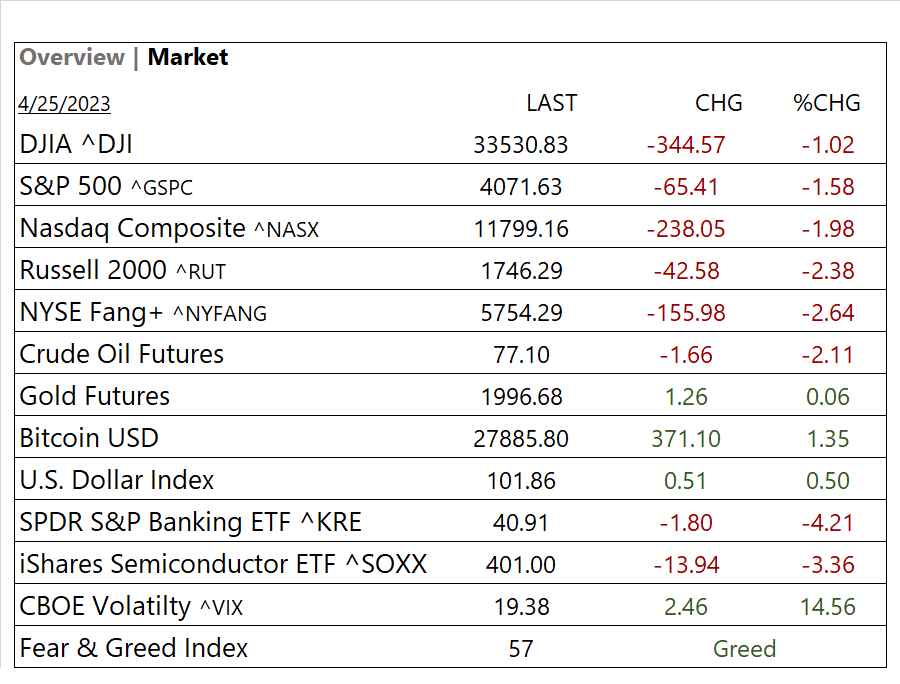

MARKETS TODAY April 25th, 2023 (Vica Partners)

Yesterday, US Markets finished mixed with DOW leading. 6 of 11 of the S&P 500 sectors finished higher, Energy outperformed/ Information Technology lagged. Treasury yields, USD Index, Bitcoin dropped. Oil, the Bloomberg Commodity Index and Gold rise. Dallas Fed Index declined indicating that the manufacturing contraction.

Overnight, Asian markets finished mixed, the Nikkei 225 +0.09%, Hang Seng -1.71% Shanghai Composite -0.32%. Pre-market, European markets finished mixed, the DAX+ 0.05%, CAC 40 -0.56%, FTSE 100 -0.27%. Premarket, S&P 500 US futures were trading 0.5% below fair-value.

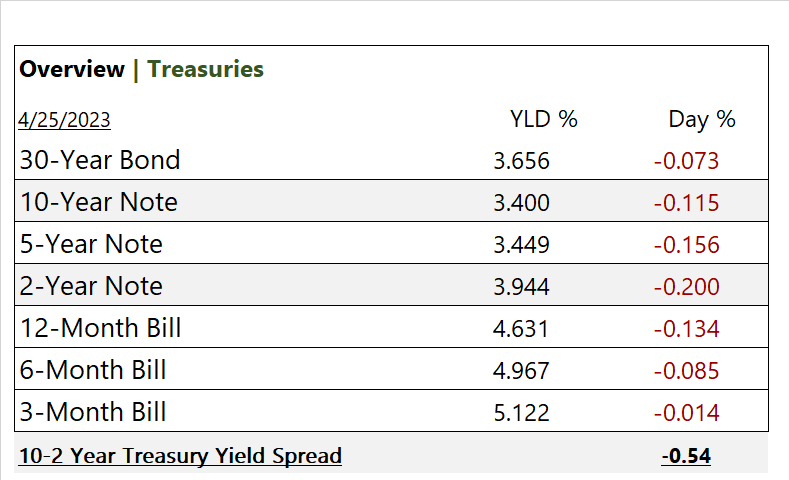

US Markets today, finished lower with all key indices in decline. All 11 of the S&P 500 sectors finished lower, Materials and Information Technology led decliners. SPDR S&P Banking ETF (KRE) <4.21%> as First Republic Bank shares lost half their value in session. Treasury Yields across the curve fall. Oil and the Bloomberg Commodity Index sharply decline. On the upside Bitcoin and Gold gain and BIG tech beats earnings in afterhours. In economic news, the Case-Shiller U.S. Home Price Index moderated in February with a 0.4% (YOY) gain, down from 2.6% in Jan. New home sales were up 9.6% (MOM), down 3.4% (YOY). US consumer confidence reached a 9-month low in April.

Takeaways

- Option traders set a record today betting against First Republic Bank (FRC)

- The Cboe Volatility Index jumped +14.56% in session

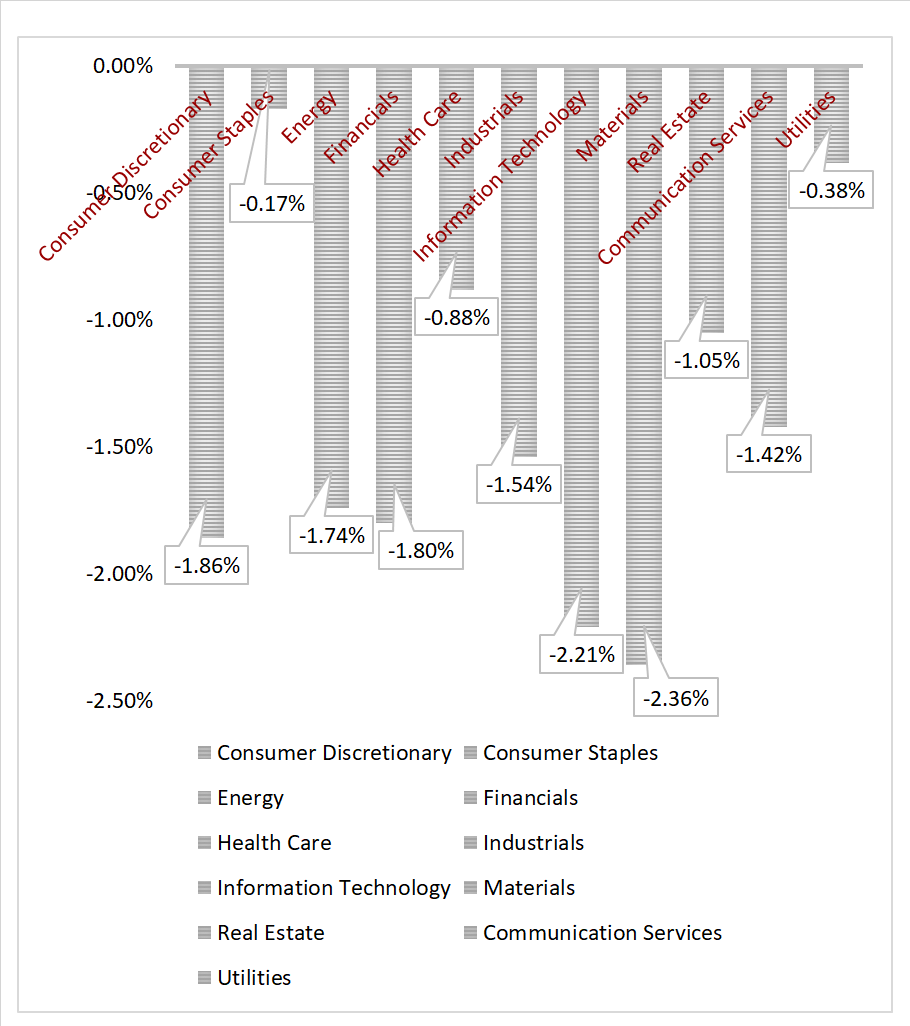

- All 11 of the S&P 500 sectors finished lower, Materials and Information Technology led decliners

- On the upside, Bitcoin and Gold gain

- After market earnings Microsoft , Alphabet and Visa all beat

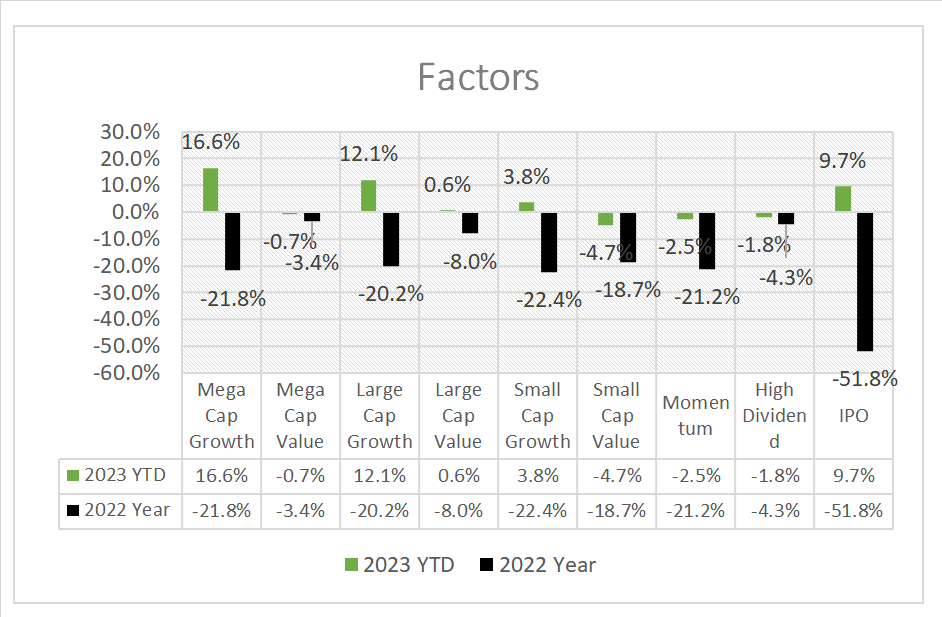

- Investor sentiment, Greed

Pro Tip: The main rationale behind momentum investing is that once a trend is well-established, it likely to continue! Research has shown that momentum trading has an edge in the stock market when used over a short timeframe, such as 3-12 months, and rotating every month. By rotating every month, momentum traders can continually adjust their portfolios to reflect the current market conditions and take advantage of the latest trends. It’s a high-risk strategy that requires risk management to use stop-loss orders and to maintain a diversified portfolio (more info here).

Sectors/ Commodities/ Treasuries

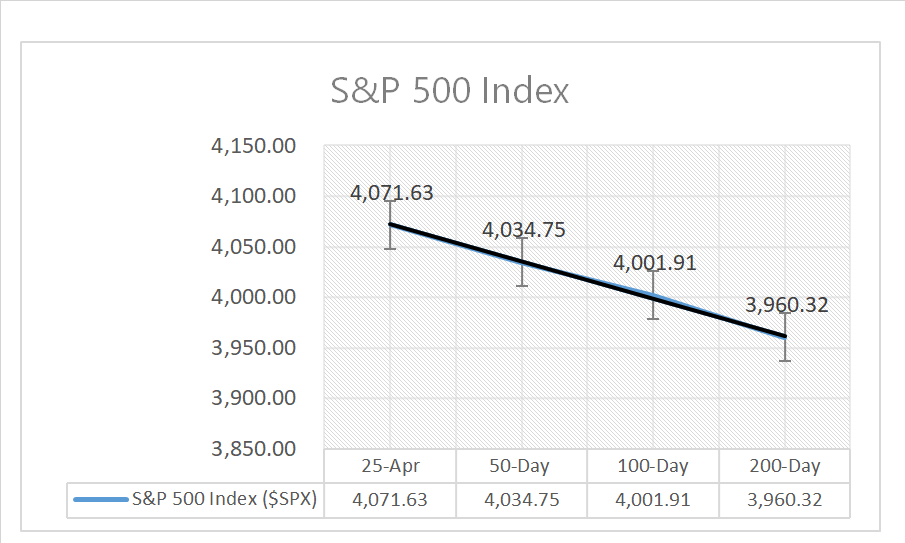

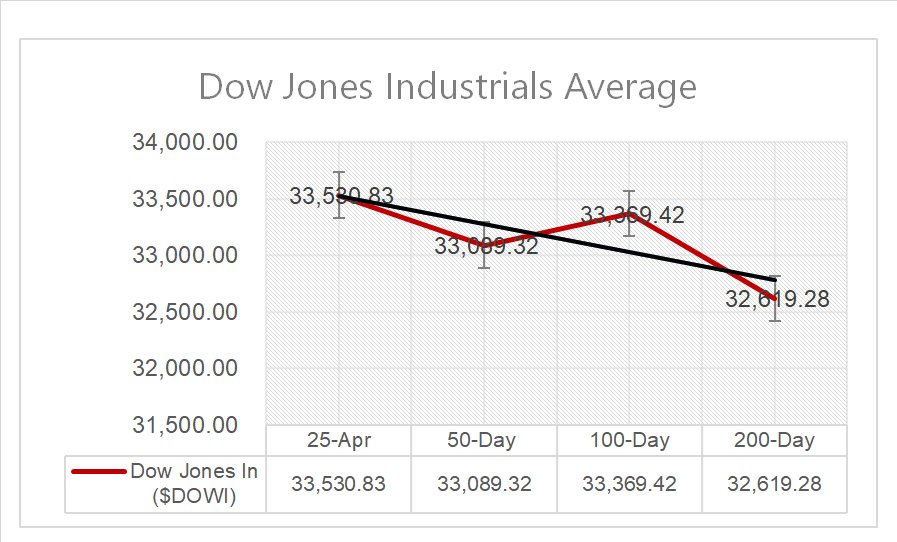

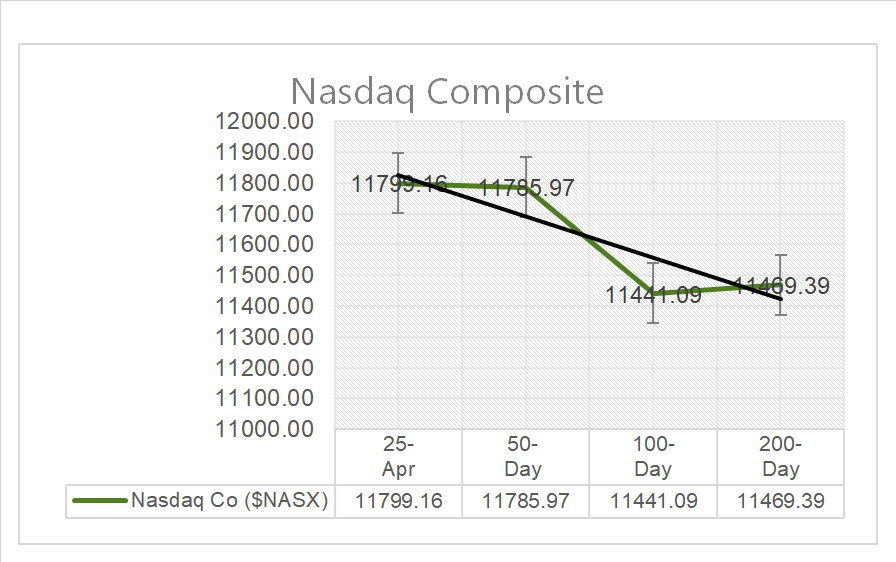

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors finish lower, Materials -2.36% and Information Technology -2.21% led decliners/ Consumer Staples -0.17% and Utilities -0.38% outperform

Commodities

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Microsoft (MSFT), Alphabet (GOOG,GOOGL), Visa (V), PepsiCo (PEP), Novartis ADR (NVS), McDonald’s (MCD), Danaher (DHR), NextEra Energy (NEE), Texas Instruments (TXN), Raytheon Technologies (RTX), General Electric (GE), Sherwin-Williams (SHW), 3M (MMM), Moody’s (MCO), Kimberly-Clark (KMB), General Motors (GM), PACCAR (PCAR), Centene (CNC), Halliburton (HAL), Corning (GLW), Tenet Healthcare (THC)

- – Miss: United Parcel Service (UPS), Verizon (VZ), UBS Group (UBS), Santander ADR (SAN), Spotify Tech (SPOT), Northern Trust (NTRS)

- * Strong support – NVIDIA (NVDA), QUALCOMM (QCOM), Analog Devices (ADI), Amazon (AMZN), Cintas Corp (CTAS), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP), Coca-Cola (KO), PACCAR (PCAR), Centene (CNC)

Economic Data

US

- Case-Shiller home price index (yoy); period Feb., act 0.4%, fc0.4%, prev. 2.5%

- New home sales; period March, act 683,000, fc 634,000, prev. 623,000

- Consumer confidence; period April, act 101.3, fc 104, prev. 104.0

News

Company News/ Other

- Hyundai Motor bolsters US presence with $5 bln EV battery venture – Reuters

- Carrier Nears Deal for German Industrial Manufacturer Viessmann – WSJ

- First Republic Shares Sink 27% After Earnings – WSJ

Central Banks/Inflation/Labor Market

- Fed up with low rates on deposits, US savers snap up government debt – FT

- US consumer confidence falls to 9-month low in April – Reuters

- Central Banks Unwind Dollar Funding Help – WSJ

China

- China completes landmark national real estate registration system – Reuters