MARKETS TODAY May 17th, 2023 (Vica Partners)

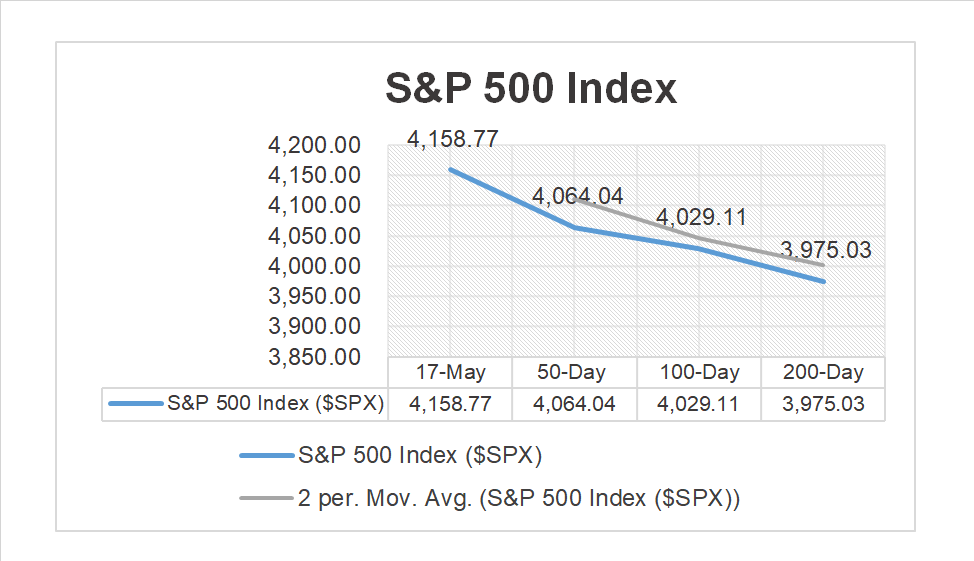

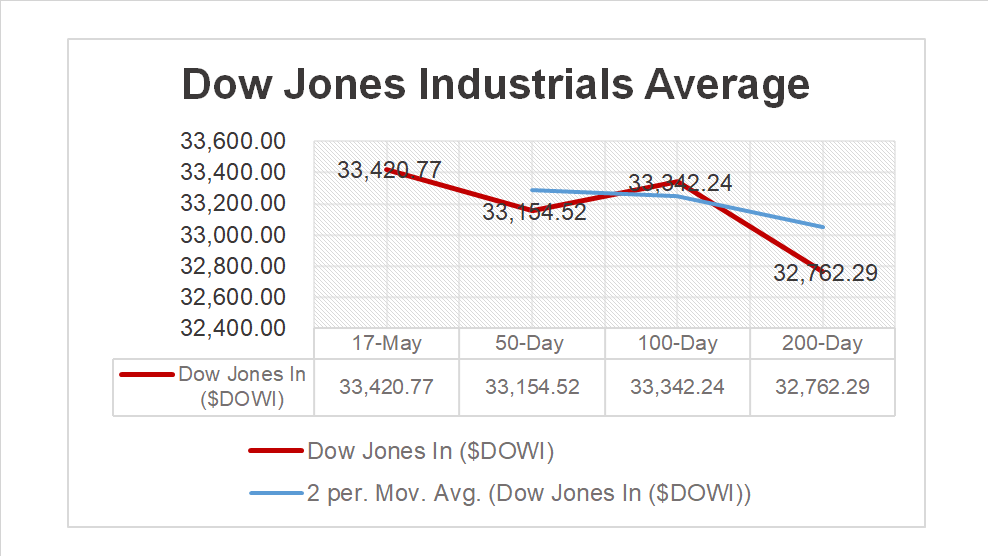

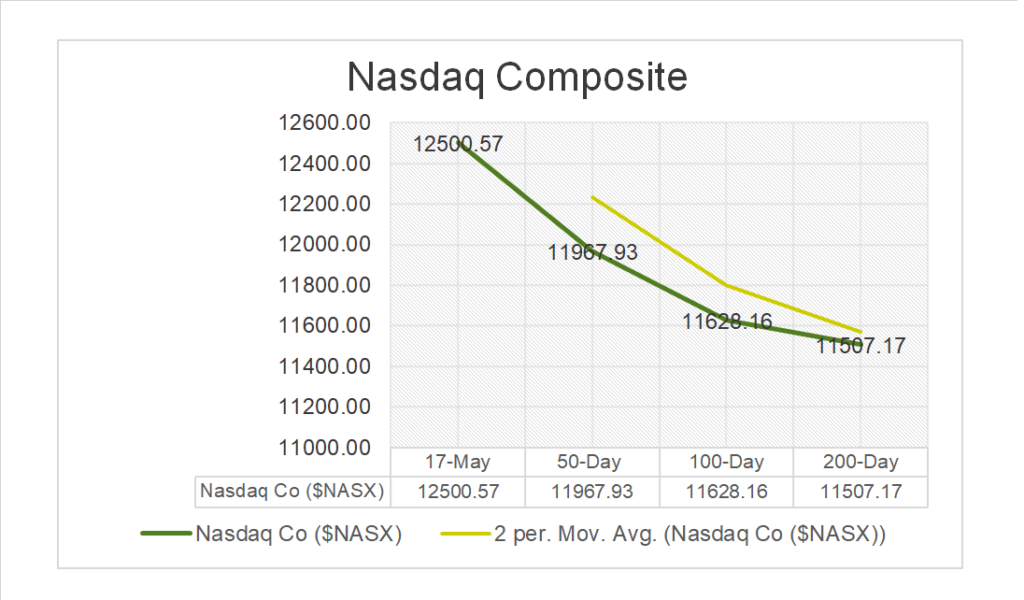

Yesterday US Markets finished lower, S&P 500 -0.64%, DOW -1.01% and the Nasdaq -0.18%. 10 of 11 of the S&P 500 sectors declined, Real Estate -2.30% and Energy -2.24% lagged/ Information Technology +0.09% outperformed. NYFANG+, Treasury Yields and the USD Index gained. In economic news, Retail sales increased by 0.4% in April but below 0.8% analyst estimates. Home Builder Confidence Index with surprise beat.

Overnight/Premarket Asian markets finished mixed, Japan’s Nikkei 225 +0.84%, Hong Kong’s Hang Seng -2.11% and the Shanghai Composite -0.21%. European markets finished. US futures were trading at 0.4% above fair value.

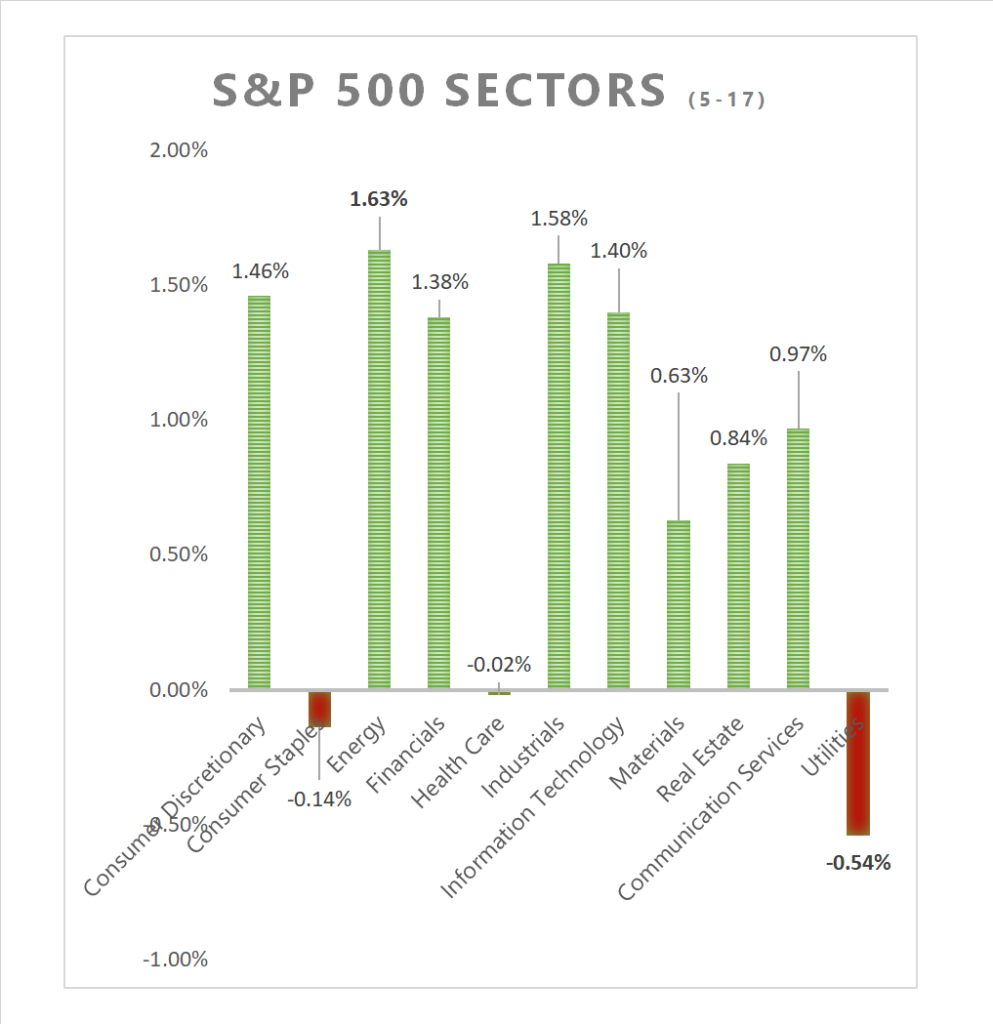

Today US Markets finished higher, S&P 500 +1.19%, DOW +1.24% and the Nasdaq +1.28%. 8 of 11 of the S&P 500 sectors higher, Energy +1.63% and Industrials +1.58% outperform/ Utilities -0.54% lags. On the upside, Russel 2000 +2.21%. Treasury Yields. USD Index, Oil and Bitcoin gain. In economic news, Housing Starts/building permits were in line with estimates. Crude inventories above consensus, Gasoline below.

Takeaways

- Western Alliance Bancorp grew deposits >$2bn since quarter’s end, sparks Market rally

- SPDR S&P Banking ETF (KRE) rebounds, up >7%

- Energy and Industrials outperform

- iShares Semiconductor ETF (SOXX) +2.5%

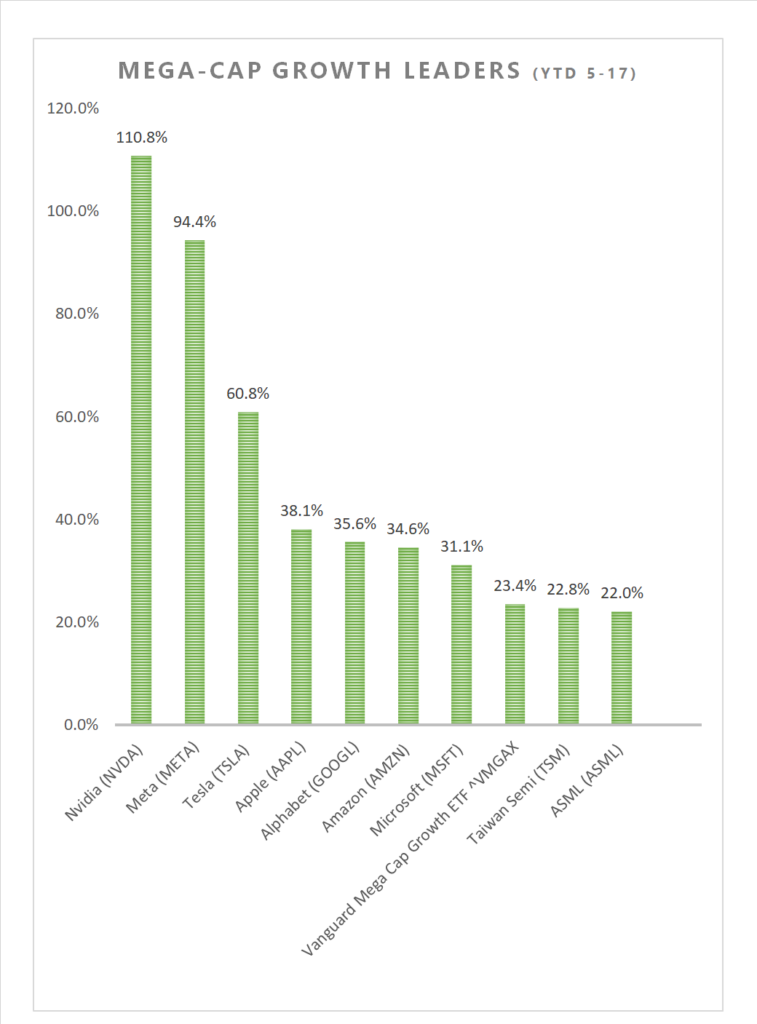

- Tech mega cap growth leader NVIDIA (NVDA) hits 52 week high

- Yields rise

- CBOE Volatility Index (VIX) declines >6%

- Cisco (CSCO) beats, Target (TGT) misses on earnings

Pro Tip: Quants, or quantitative analysts, can provide solid insights and teach everyday investors a variety of key concepts and strategies. 1 min. read!

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors finished higher: Energy +1.63% and Industrials +1.58% outperform/ Utilities -0.54% lags.

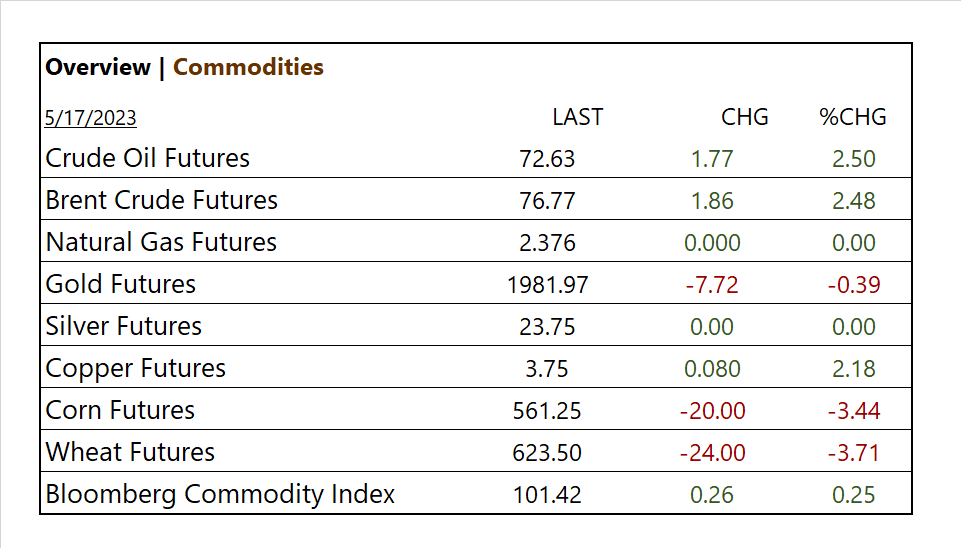

Commodities

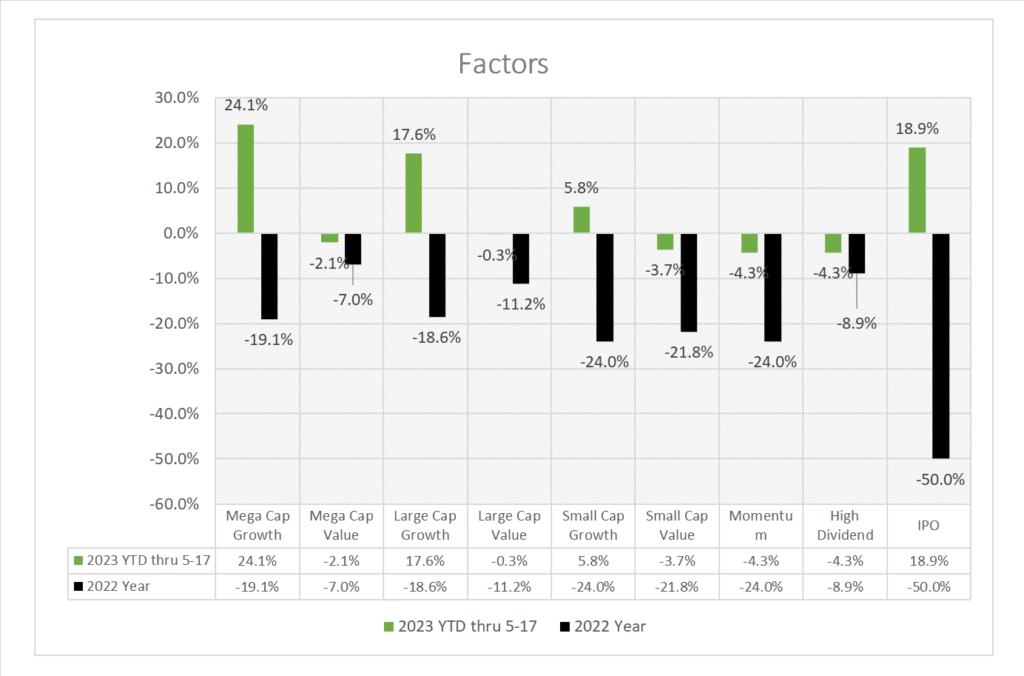

Factors (YTD)

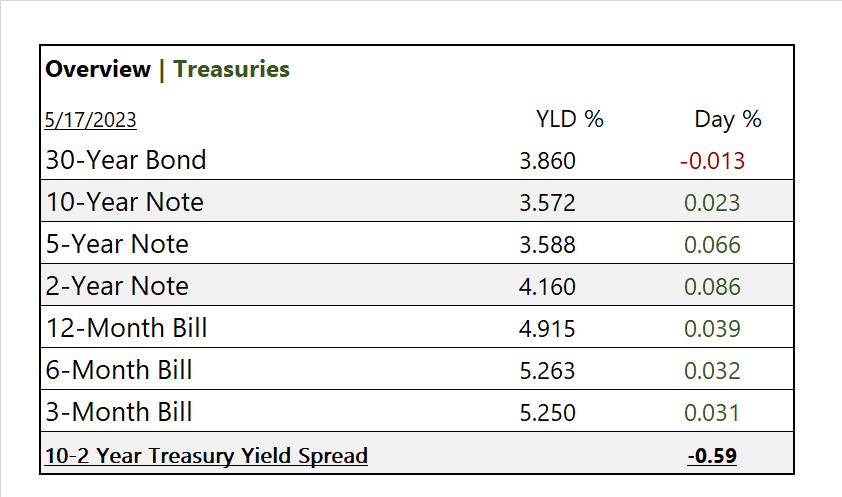

US Treasuries

Notable Earnings Today

- +Beat: Tencent ADR (TCEHY), Cisco (CSCO), Siemens ADR (SIEGY), Synopsys (SNPS), Copart (CPRT), Dynatrace Holdings LLC (DT), Wix.Com Ltd (WIX), Jack In The Box (JACK), Arcos Dorados (ARCO)

- – Miss: TJX (TJX), Target (TGT), Take-Two (TTWO), Commerzbank AG PK (CRZBY)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Baidu (BIDU), Nu Holdings (NU)

Economic Data

US

- Housing starts; period April, act 1.40m, fc 1.40m, prev. 1.37m

- Building permits; period April, act 1.42m, fc 1.43m, prev. 1.44m

- US crude oil inventories; period May 12, act +5.04m barrels, fc -0.92m drop Gasoline Inventories; act -1.38m, fc +1.06m

News

Company News/ Other

- Pfizer to raise $31 bln for Seagen takeover in largest debt offering – Reuters

- Regional Bank Stocks Rise After Western Alliance Update – WSJ

- Traders Bet on More Big Bond Swings – WSJ

- Commercial Real Estate Prices in the US Fall for First Time Since 2011 – Bloomberg

Central Banks/Inflation/Labor Market

- Morning bid: Fed rates to stay higher for longer, debt drama goes on – Reuters

- Treasury’s Plunging Cash Pile Raises Risk of Early June X-Date – Bloomberg

China

- China’s central bank pledges policy efforts to stabilize growth, employment, prices – China Daily

- US-sanctioned Huawei sharpens focus in home market through new strategic cooperation pacts with local governments, boosting firm’s push into traditional industrie – SCMP

- China’s Record-High Youth Unemployment Rate Likely to Worsen – Bloomberg