MARKETS TODAY June 7th, 2023 (Vica Partners)

Yesterday, US markets finished higher, S&P 500 +0.24%, DOW +0.03% and the Nasdaq +0.36%. 6 of 11 of the S&P 500 sectors advance: Financials +1.33% outperforms/ Health Care -0.88% lags. On the upside, Russell 2k/ Small Cap Stocks, USD Index, Gold, Bitcoin and the Bloomberg Commodity Index. In economic news, no domestic report releases.

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng +0.80%, China’s Shanghai Composite +0.08% and Japan’s Nikkei 225 -1.82%. US S&P futures were trading at 0.1% below fair value. European markets finished lower, Germany’s DAX -0.20%, France’s CAC 40 -0.09% and London’s FTSE 100 -0.05%.

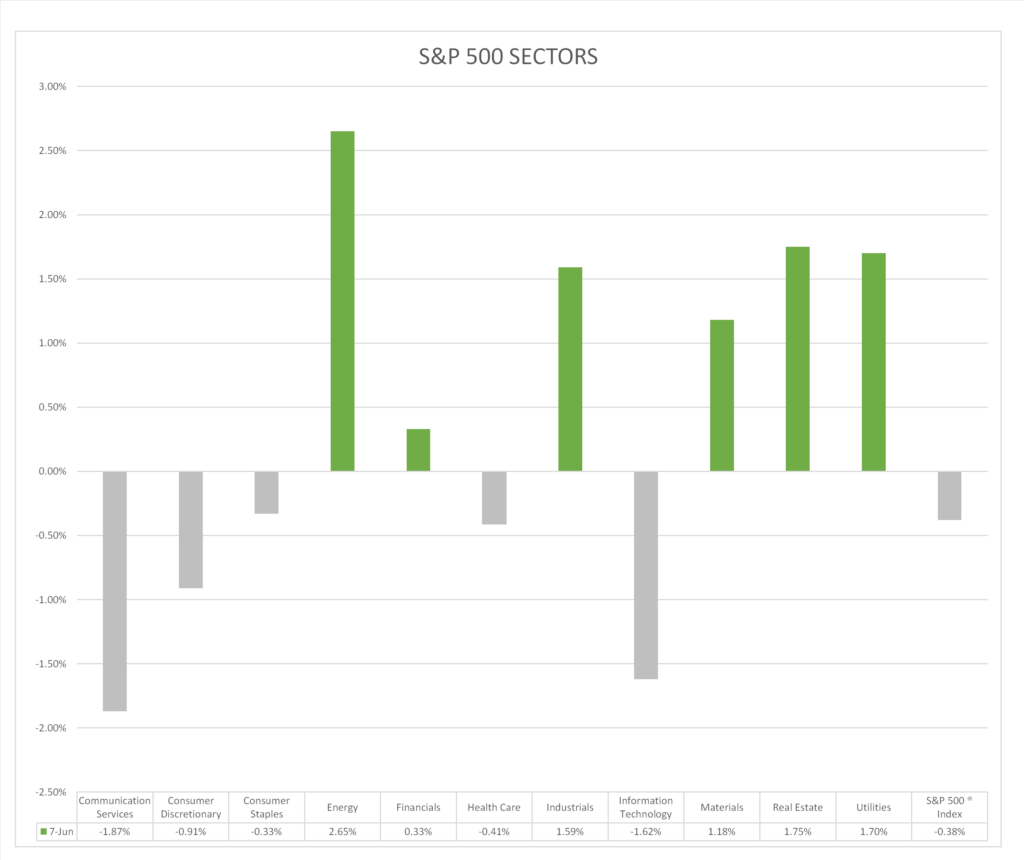

Today US Markets finished mixed, S&P 500 -0.38%, DOW +0.27% and the Nasdaq-1.29%. 6 of 11 of the S&P 500 sectors lower: Energy +2.65% outperforms/ Communication Services -1.87% lags. On the upside, Russell 2k, Treasury Yields, Brent Oil and the Bloomberg Commodity Index. In economic news, the trade deficit in the US narrowly missed estimates and U.S. consumer-credit growth in April moderately exceeding estimates.

Takeaways

- Fear and Greed Index/ Extreme Greed

- Can 9 Tech Mega Caps Growths continue to drive bull market?

- Russell 2000 (RUT) leads Indices +1.8%

- Small Caps outperform/ growth +1.4%, value +1.8%

- FANG+ lags, down 2.9%

- 6 of 11 of the S&P 500 sectors lower: Energy +2.65% outperforms/ Communication Services -1.87% lags

- SPDR S&P Banking ETF (KRE) +>3.3%

- Brown Forman A (BFa),beats and Campbell Soup (CPB), misses on earnings

Pro Tip: Stock shorting/short selling, can be beneficial for financial markets; a) Pricing/ Value – shorts incorporate negative information into the stock’s price, which can contribute to a more accurate valuation b) Allocation of Capital – shorts redirect capital away from overvalued or underperforming stocks c) Market Liquidity – shorts provide additional sell-side liquidity, which can facilitate smoother and more efficient trading (learn more here)

Sectors/ Commodities/ Treasuries

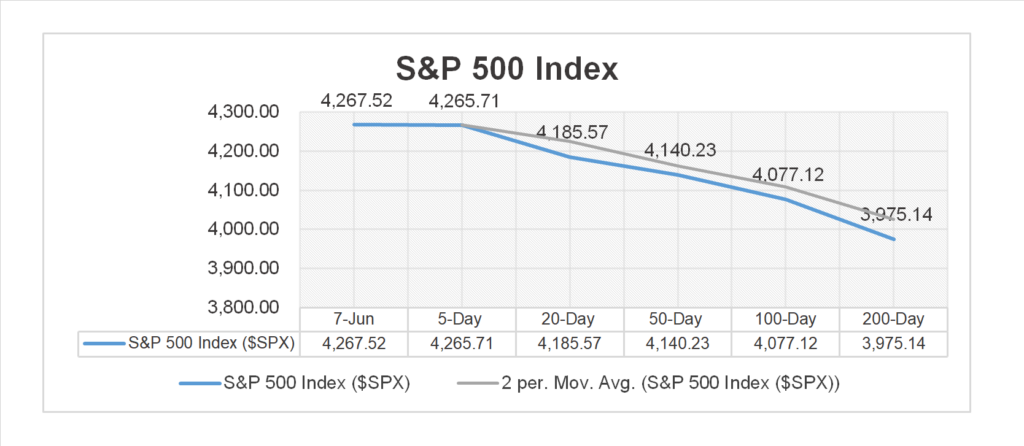

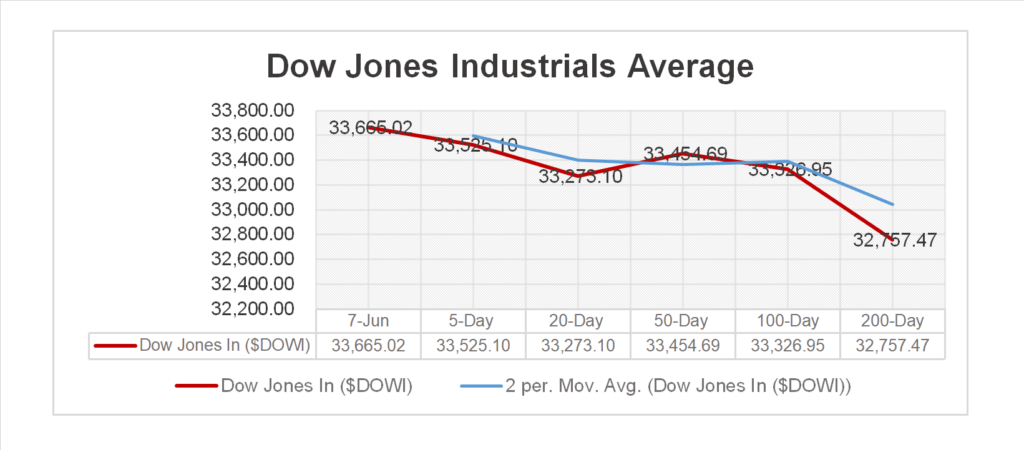

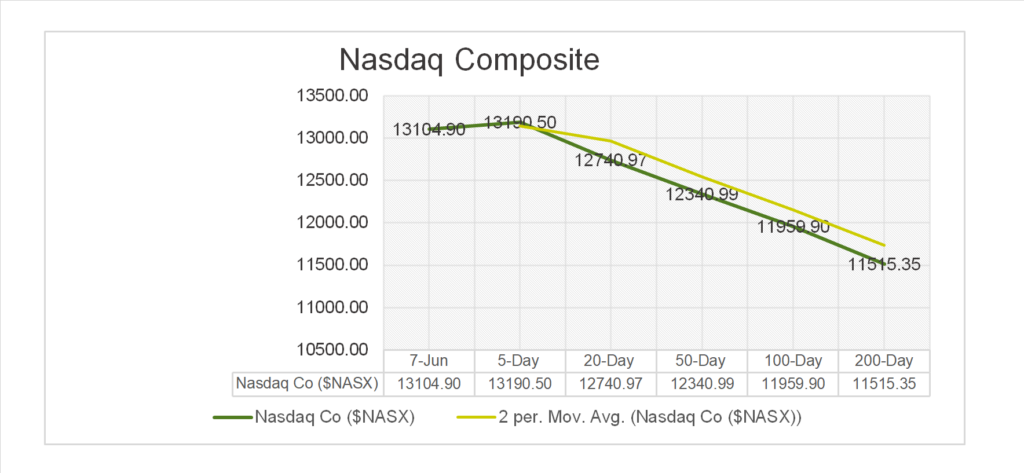

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors lower: Energy +2.65%, Real Estate +1.75% and Utilities +1.70% outperform/ Communication Services -1.87%, Information Technology -1.62% lag

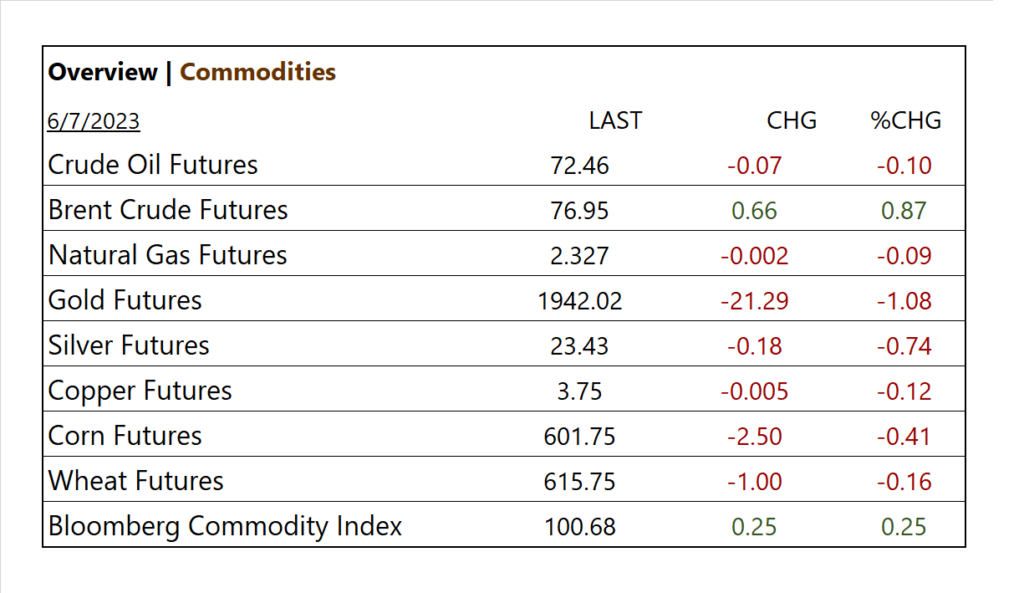

Commodities

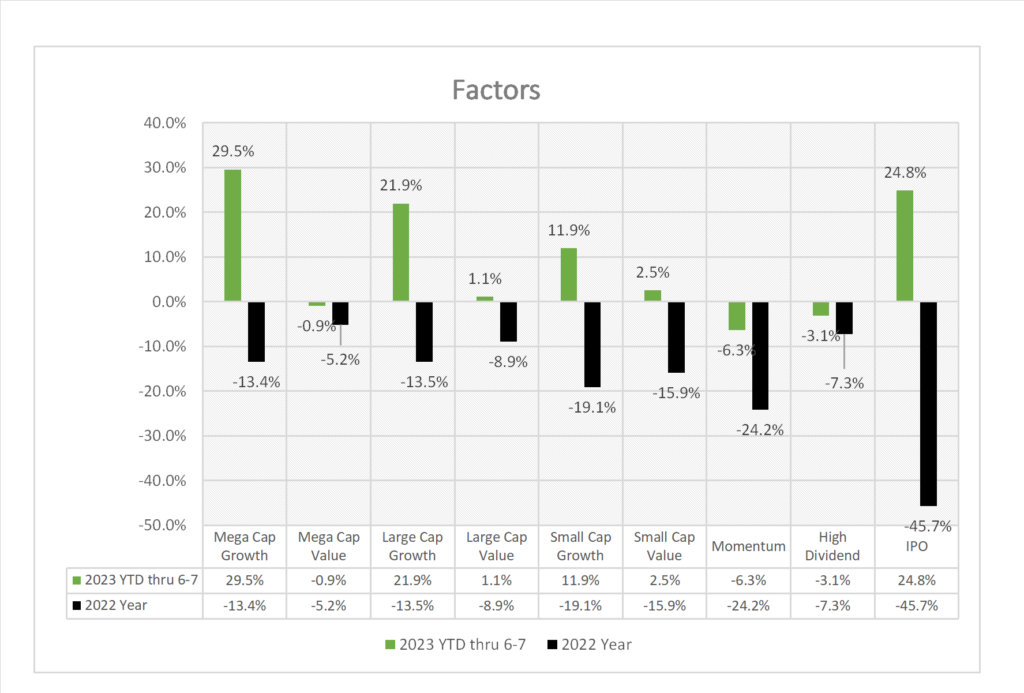

Factor/ Mega Cap Growth Chart (YTD)

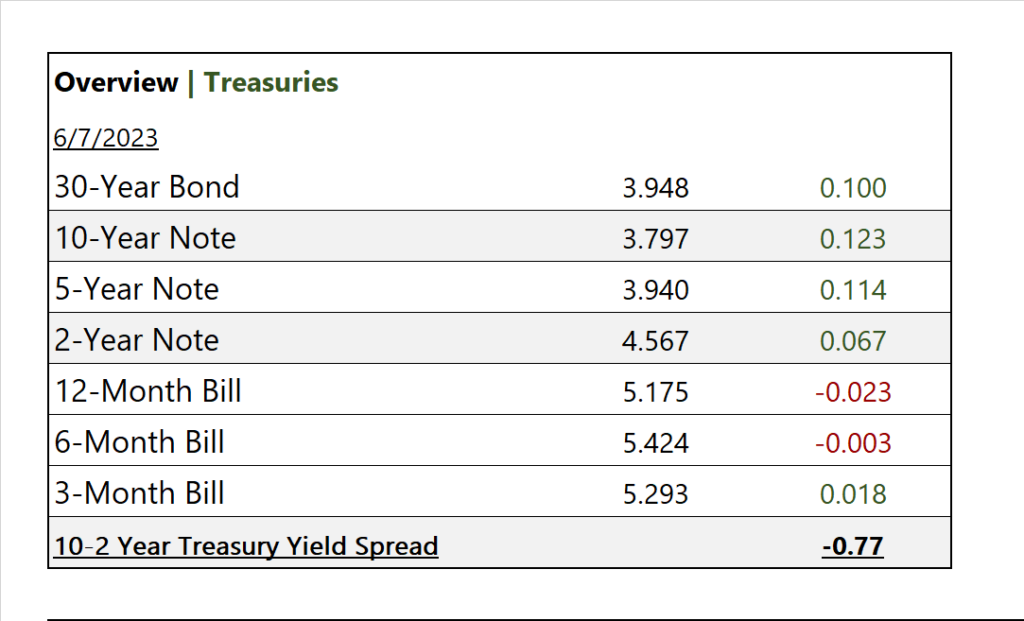

US Treasuries

Notable Earnings Today

- +Beat: Brown Forman A (BFa), Ollies Bargain Outlet Holdings Inc (OLLI)

- – Miss: Campbell Soup (CPB), United Natural Foods (UNFI)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- Mortgage Apps; act -1.4%. prev. -3.7%

- US. trade deficit; period April, act $-76.4B, fc -$75.2B, prev. -$60.6B

- Consumer credit; period April, act 23.0 B , fc $22.0B, prev. $22.83B

News

Company News

- Mercedes Teams Up With Green Steelmaker to Slash Emissions – WSJ

- Google DeepMind Unveils AI System to Discover Faster Algorithms – WSJ

Energy/ Materials

- Here’s What Refining Margins Say About the State of the Oil Market – Bloomberg

- US crude inventories notch surprise drawdown on refinery runs –EIA – Reuters

Central Banks/Inflation/Labor Market

- Bank of Canada Upends Markets by Boosting Policy Rate to 4.75% – Bloomberg

- Fed seen on hold in June, but one-third of economists expect a hike soon – Reuters

China