Stay Informed and Stay Ahead: Market Watch, July 30th, 2024.

Early-Week Wall Street Markets

Key Takeaways

- DOW rose while the S&P 500 and NASDAQ declined. Energy/Financial higher, Tech Lower. The top industry was Distributors.

- The Consumer Economic Expectations Index remains historically low below 80, reflecting significant pessimism.

- Treasury yields fell, Value stocks outperform, Brent crude, gold, silver, natural gas, and copper rose. Cryptos pulled back. NVDA shorts were big ETF winners, with AMD and PYPL up on strong earnings.

Summary of Market Performance

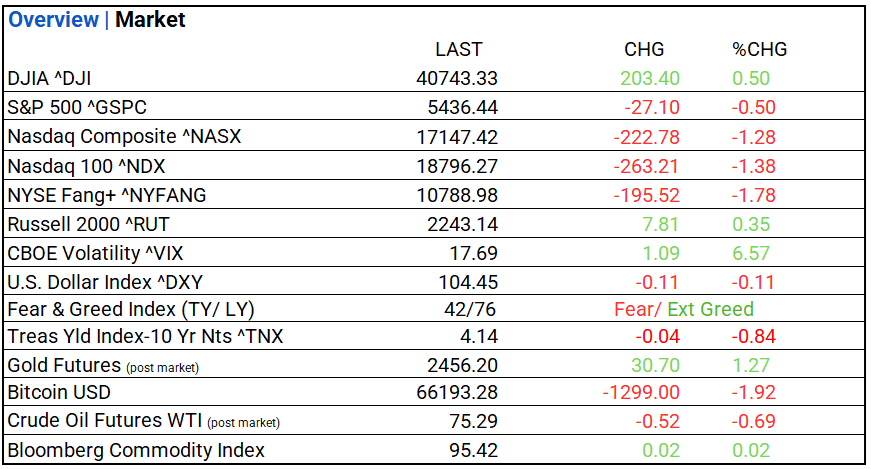

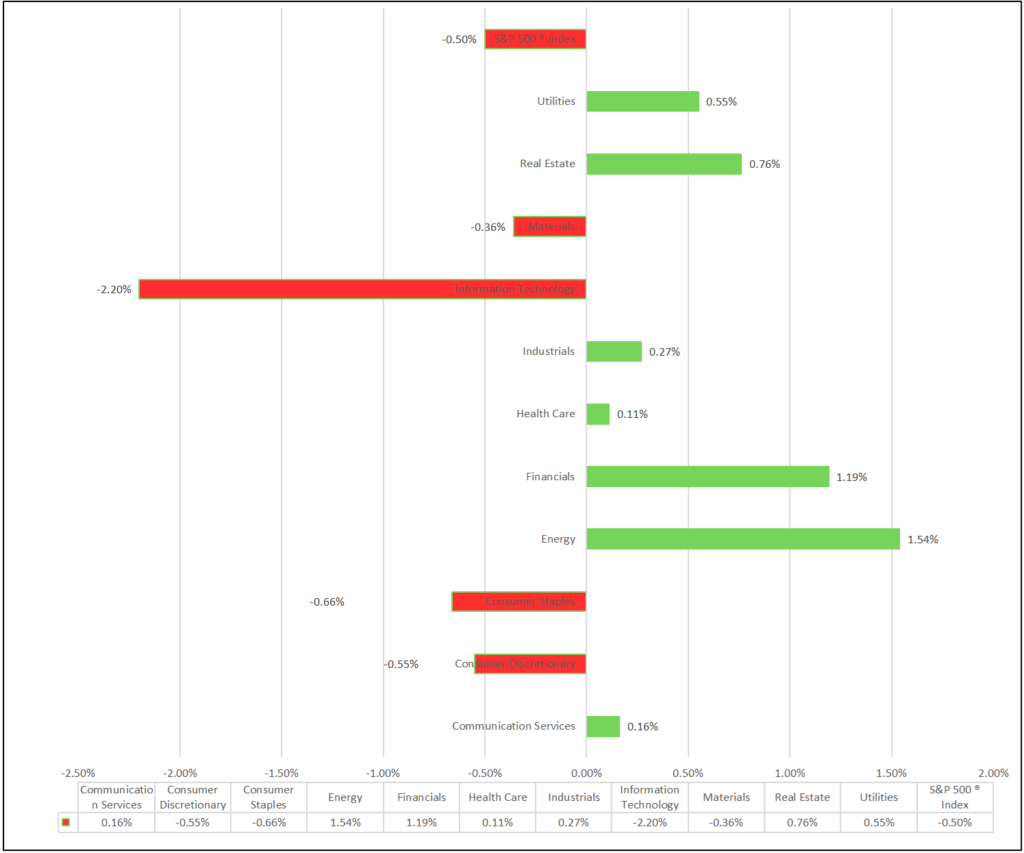

Indices & Sectors Performance:

- DOW rose while the S&P 500 and NASDAQ declined, 7 of 11 S&P 500 sectors higher: Energy/Financial higher, Tech Lower. Top industries included Distributors (+2.04%), Life Sciences Tools & Services (+2.01%) and Consumer Finance (+1.80%).

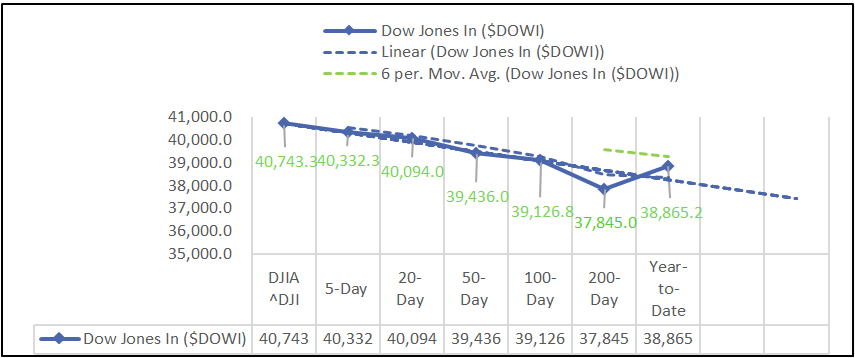

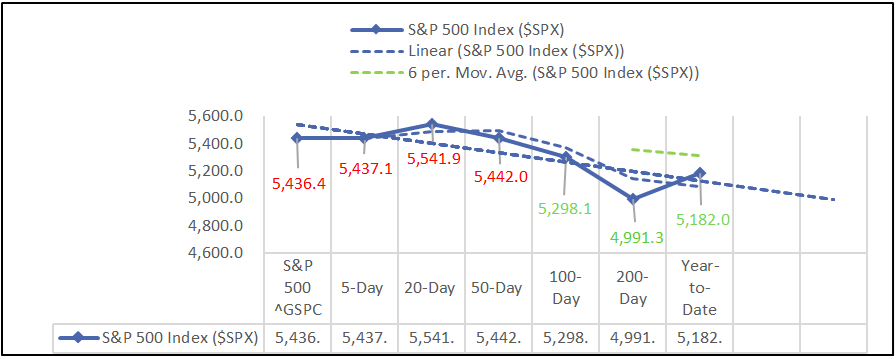

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, seven gain. Energy leading and Tech trailing.

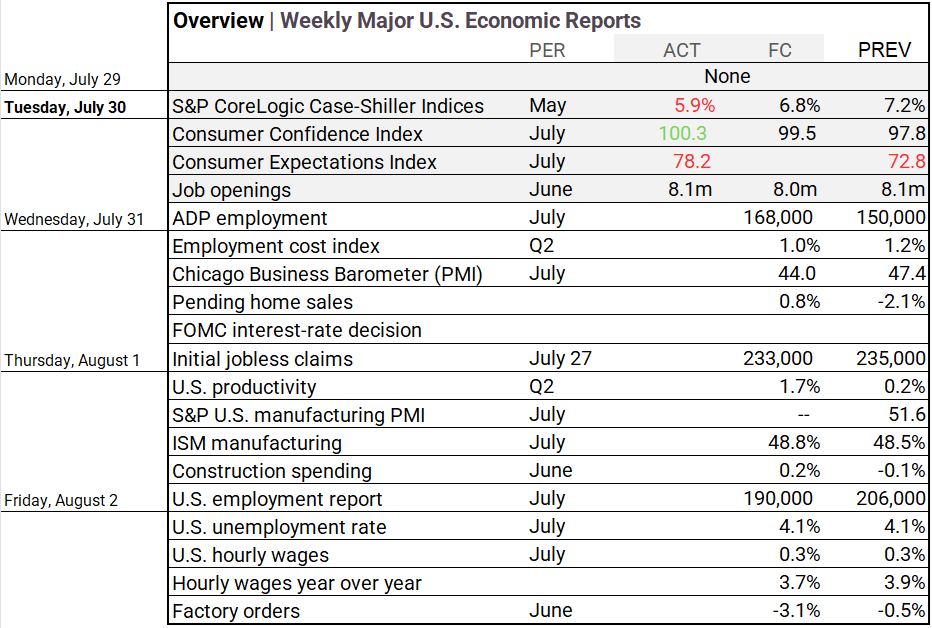

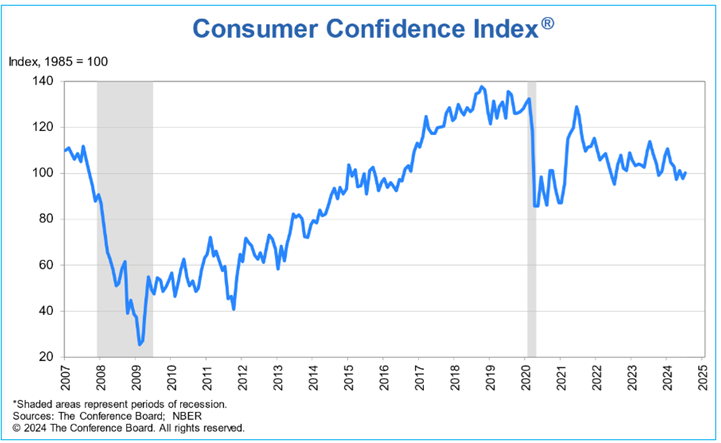

Economic Highlights:

- Consumer confidence in July improved, but the Consumer Expectations Index remains historically low below 80, reflecting significant pessimism. The S&P CoreLogic Case-Shiller Indices for May were soft, and June job openings were largely in line with expectations.

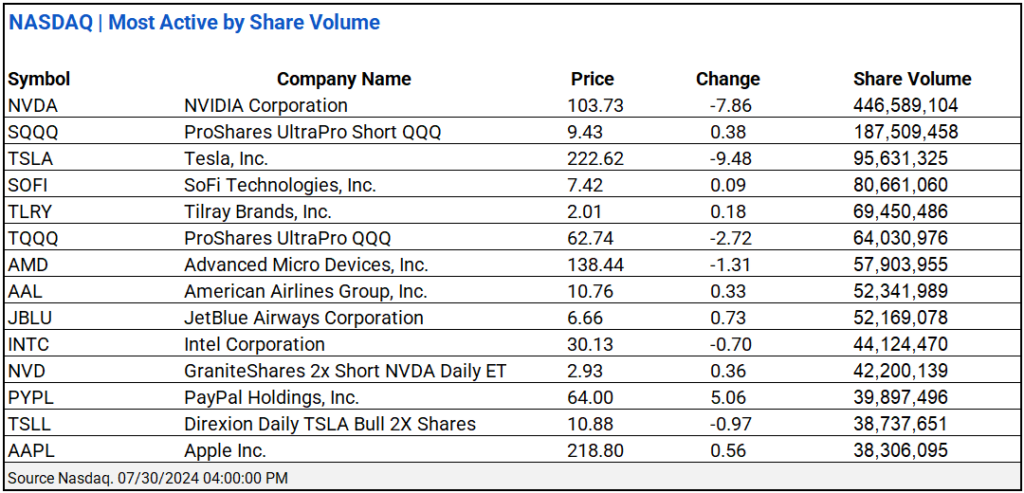

NASDAQ Global Market Update:

- NASDAQ total share volume was 5.16 billion, with an advance/decline ratio of 0.86, NVIDIA Corporation and ProShares UltraPro Short QQQ led active trading.

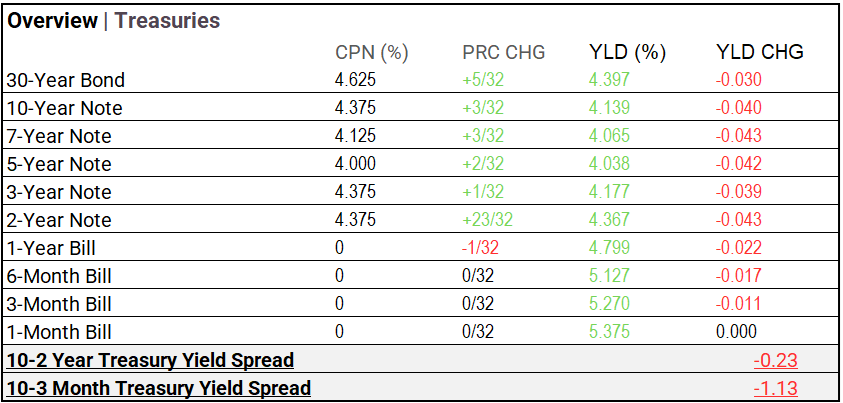

Treasury Markets:

- The 30-Year, 10-Year, 7-Year, 5-Year, 3-Year, 2-Year, 1-Year, 6-Month, and 3-Month Notes all saw declining yields, while the 1-Month Bill yield remained unchanged, as the market anticipates a rate cut tomorrow.

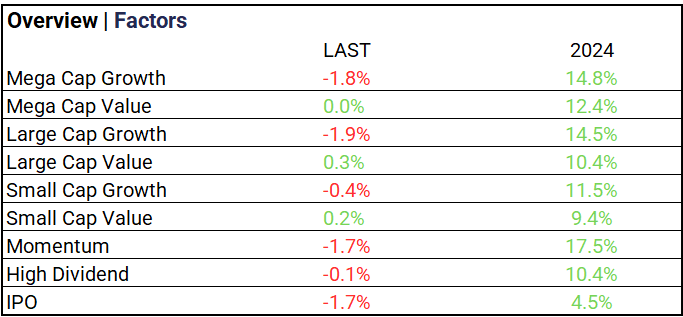

Market Factors:

- Value holds small gains, with large caps leading at 0.3%, while mega-cap growth and momentum lag.

Currency & Volatility:

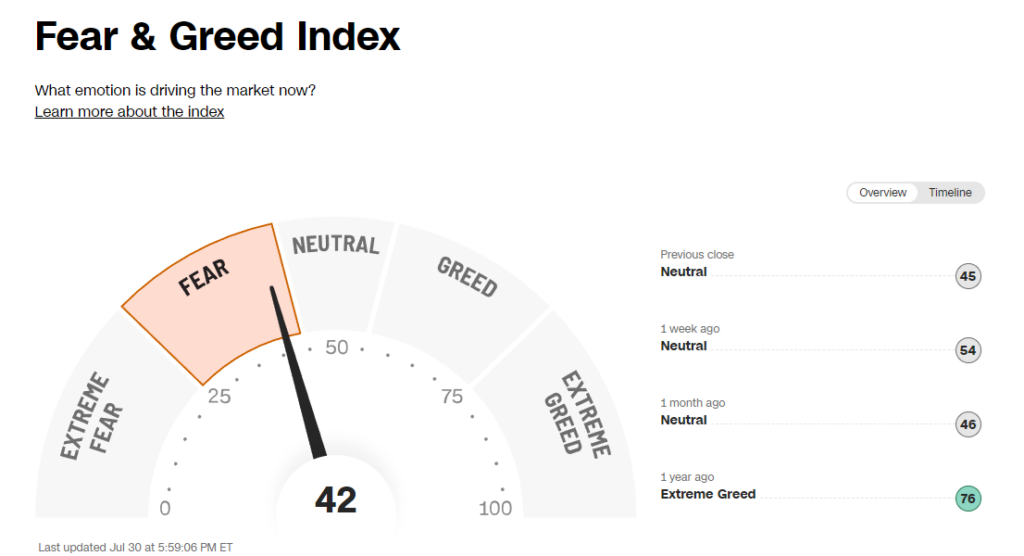

- The VIX rose to 17.69 (+6.57%), and the Fear & Greed Index shifted back to “Fear” from last year’s “Extreme Greed.”

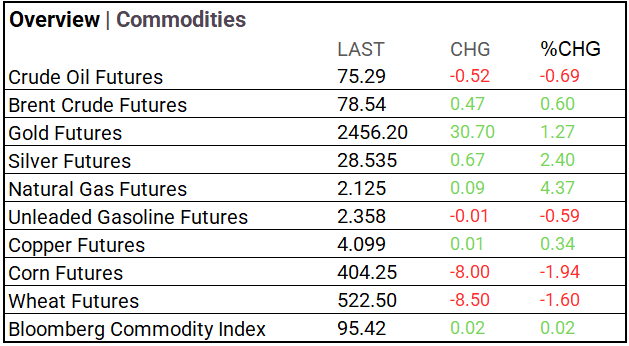

Commodities & ETFs:

- Commodity markets were mixed: crude oil and corn fell, while Brent crude, gold, silver, natural gas, and copper rose. Wheat and unleaded gasoline also fell. The Bloomberg Commodity Index was unchanged.

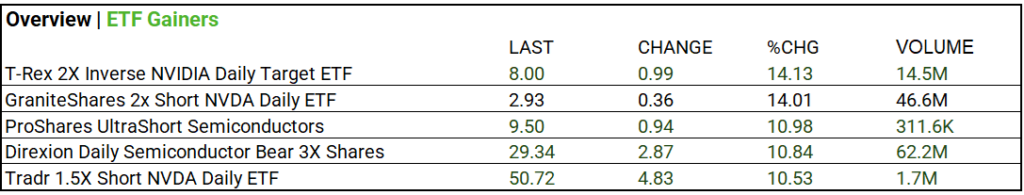

- ETFs: GraniteShares 2x Short NVDA Daily ETF +14.0% and Direxion Daily Semiconductor Bear 3X Shares +10.8% were the large volume movers.

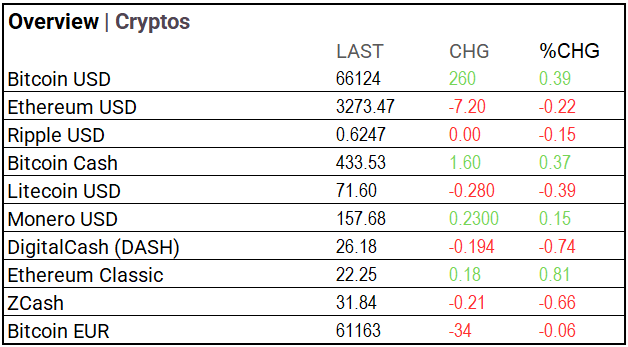

Cryptocurrency Update:

- Bitcoin and Bitcoin Cash rose, Ethereum and Litecoin fell, while Monero and Ethereum Classic saw slight gains. DigitalCash and ZCash declined.

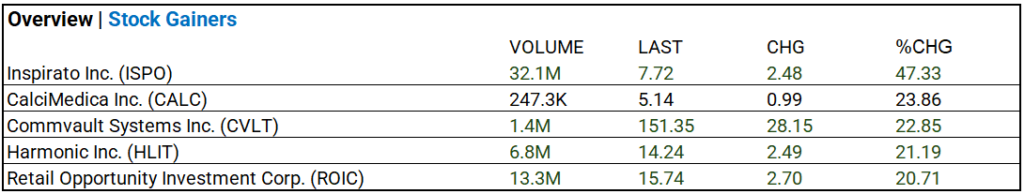

Stocks:

- Inspirato Inc. (ISPO) led advancers 47.33% to 7.72 with a volume of 32.1M.

Notable Earnings:

- Microsoft (MSFT), Merck&Co (MRK), AMD (AMD), Pfizer (PFE), Arista Networks (ANET), and PayPal (PYPL) beat; P&G (PG), Airbus Group NV (EADSY), BP ADR (BP), Mondelez (MDLZ), Starbucks (SBUX), and Illinois Tool Works (ITW) miss.

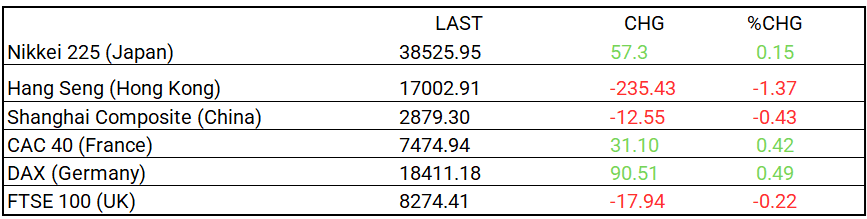

Global Markets Summary:

- Asia mixed: Nikkei up slightly, Hang Seng and Shanghai Composite down. Europe mostly up.

Strategic Investment Adjustments and Historical Market Trends:

- Focus on long-duration bonds, which benefit from rate cuts due to their inverse relationship with interest rates. As the Fed eases rates, their value rises since fixed payments become more attractive compared to new, lower-rate bonds.

- Stay the course with Nasdaq/Tech for long-term growth in semiconductors, while diversifying with small-cap and bank index ETFs to manage risk.

- Historically, election years support market growth due to increased fiscal stimulus and investor optimism.

In the NEWS

Central Banking, Monetary Policy & Economics:

- Eurozone Economy Keeps Pace Despite German Weakness – WSJ

- US Job Openings Hold Steady, Defying Recent Slowdown Trend – Bloomberg

Business:

- Starbucks Asks for Time With a Turnaround as Sales Slip – WSJ

- China’s Mega-Grocers Turn to an Upstart to Win Back Shoppers – Bloomberg

China:

- China’s factory activity contracts for third straight month, adding to economic headache – SCMP