Stay Informed and Stay Ahead: Market Watch, July 16th, 2024.

Early-Week Wall Street Markets

Key Takeaways

+ DOW, S&P 500, NASDAQ up; Russell 2k outperforms; Industrials led; top industry: Passenger Airlines.

+ June Retail Sales beat forecasts; the July Homebuilder confidence index sluggish and down from June.

+ Long-term yields pullback more than short-term. Small-caps value rally, crude oil, Brent crude, gold, silver, and copper rose. Direxion Daily Small Cap Bull 3X up 10.22% on solid 39.2M volume. UnitedHealth (UNH) big earnings beat.

Summary of Market Performance

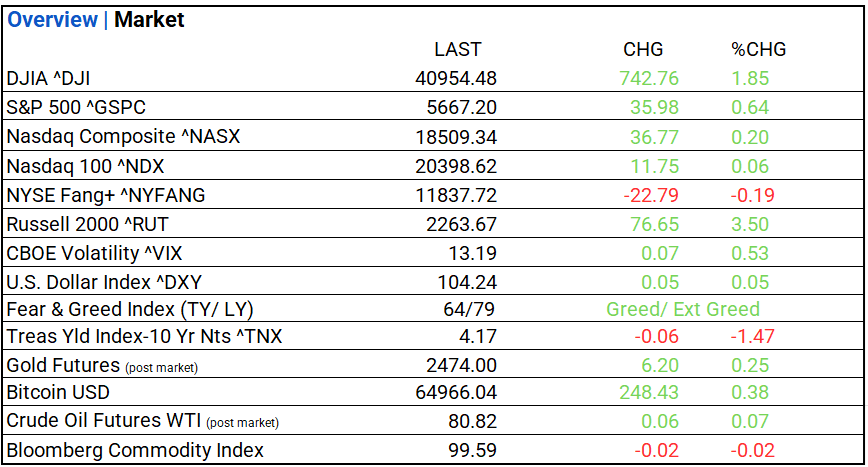

Indices & Sectors Performance:

- Today, major US stock indices—DOW, S&P 500, NASDAQ—up. Russell 2k outperforms. Among eleven sectors, nine gain. Industrials led, Communication Services AND Information Tech trailed. Top industries: Passenger Airlines Industry (+5.80%), Household Durables Industry (+5.68%) and Health Care Providers & Services Industry (+4.33%).

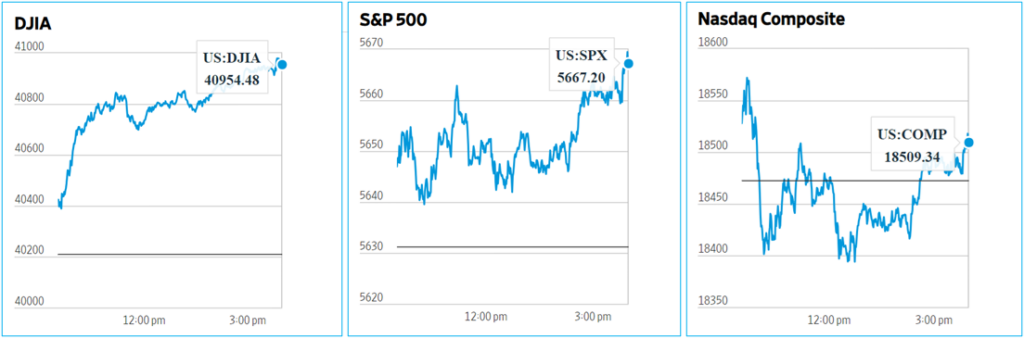

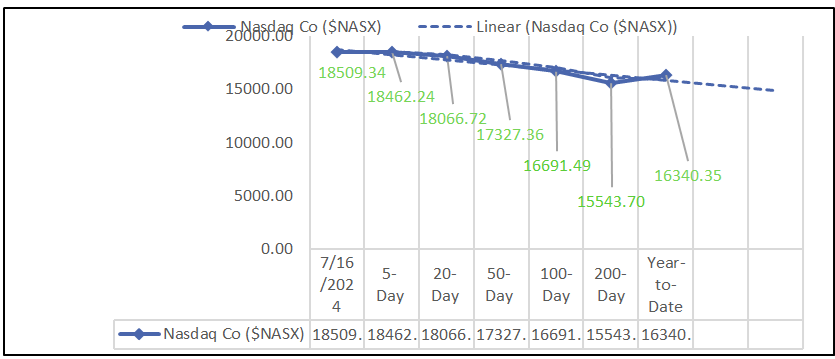

Chart: Performance of Major Indices

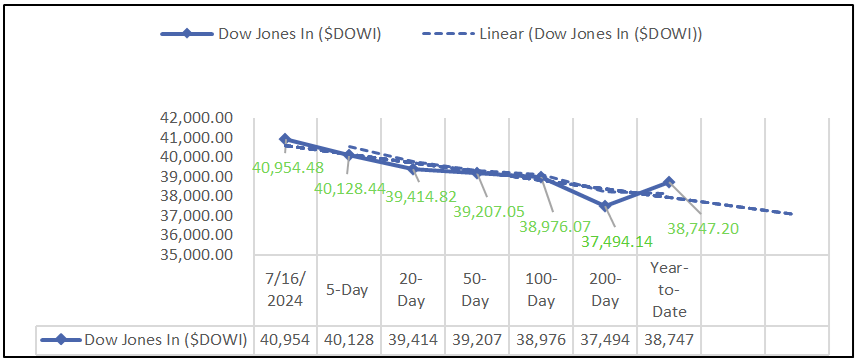

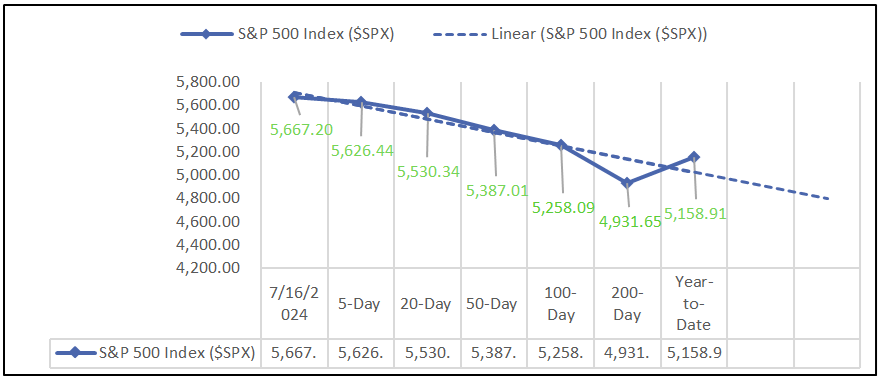

Moving Average Analysis:

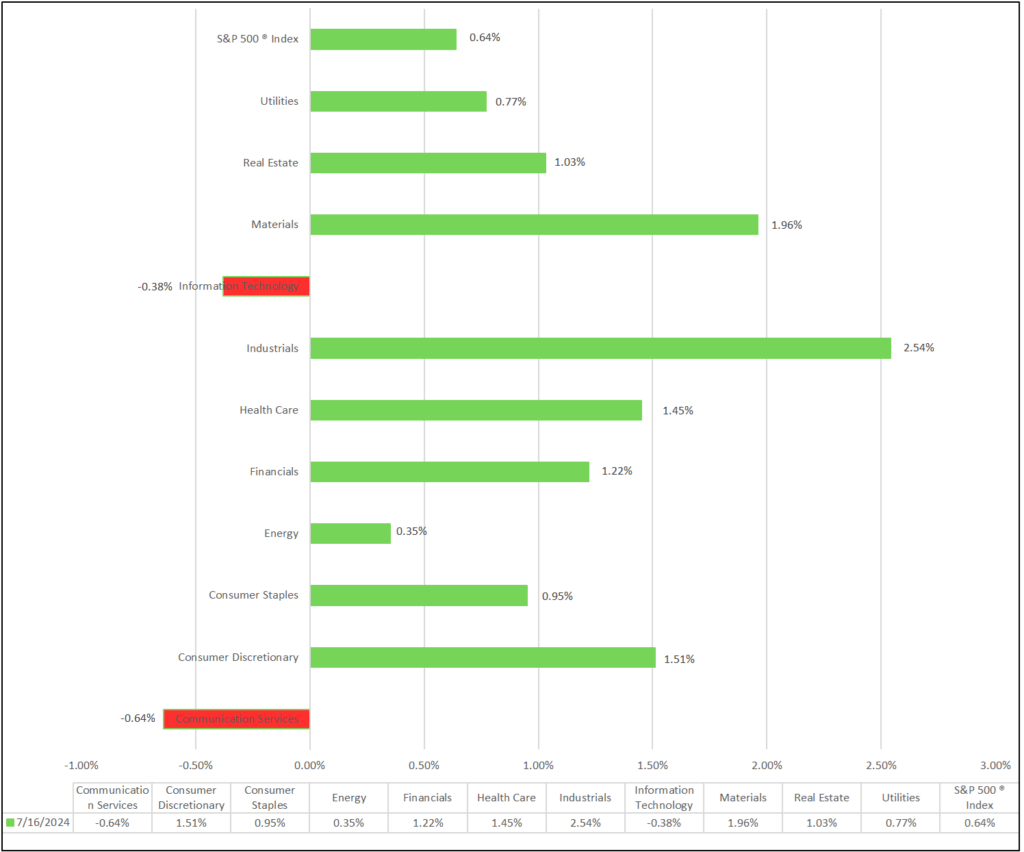

S&P 500 Sectors:

- Among eleven sectors, nine gain. Industrials led; Communication Services trailed.

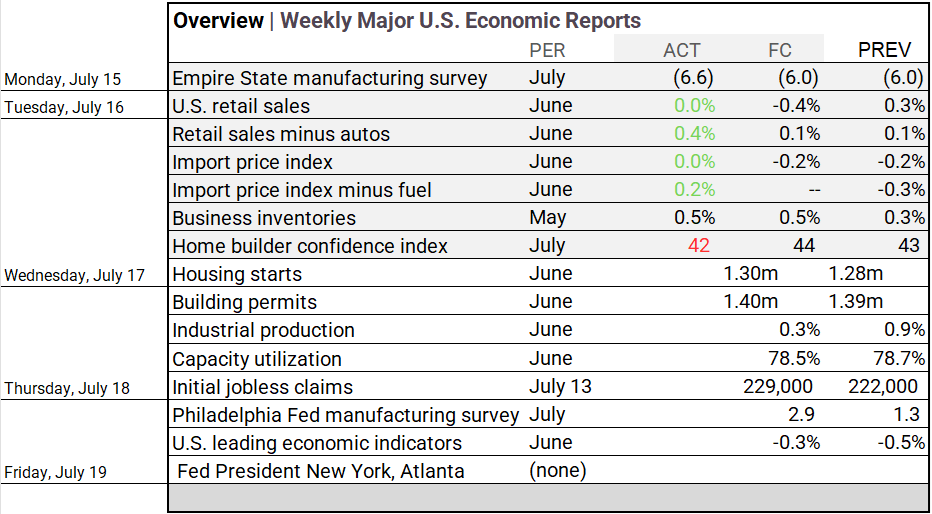

Economic Highlights:

- June’s Retail Sales beat forecasts, with the July Home builder confidence index down from June.

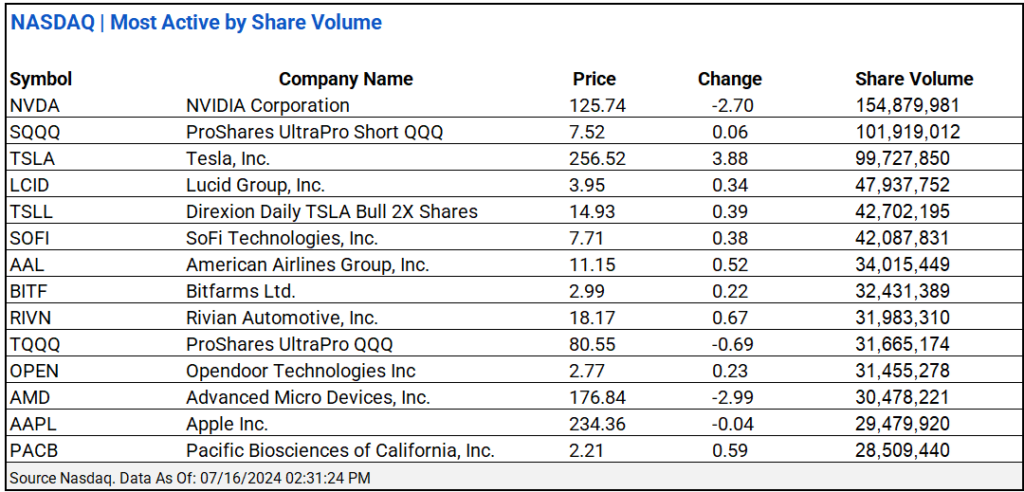

NASDAQ Global Market Update:

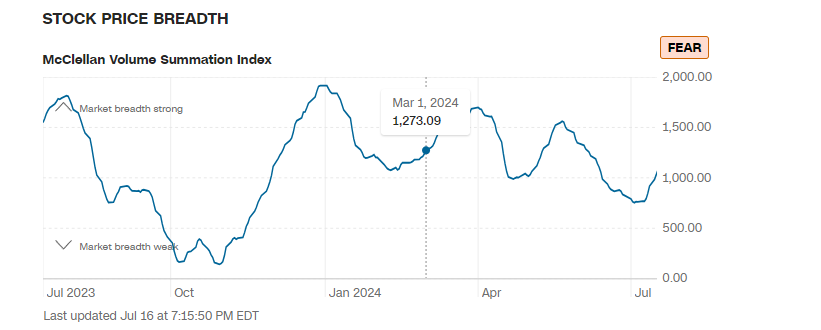

- NASDAQ showed positive sentiment with a total share volume of 5.81 billion, 517 new highs, 33 new lows, and an advance/decline ratio of 3.47/ NVIDIA and Tesla led active company trading.

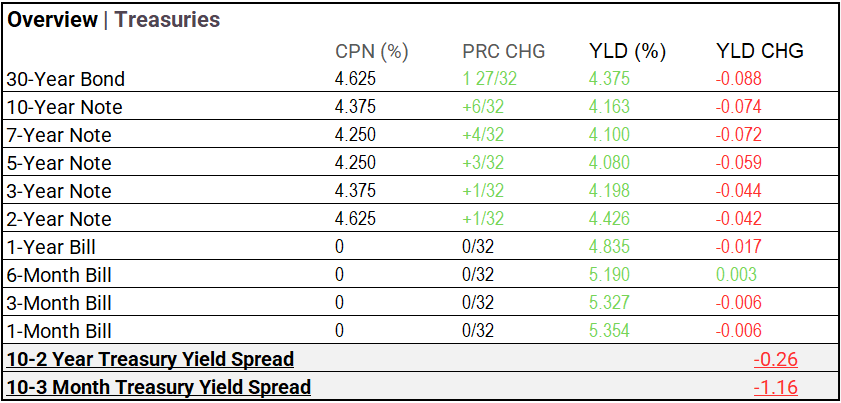

Treasury Markets:

- Long-term yields dropped more significantly than short-term yields, indicating a decrease in market expectations for future interest rates. The 30-year bond yield fell by 0.088%, while the 1-month bill yield decreased by 0.006%.

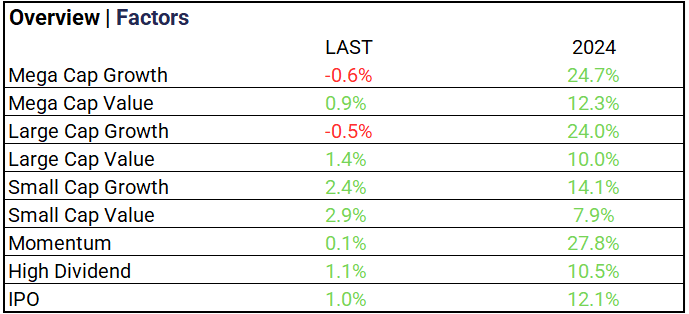

Market Factors:

- Small-cap value stocks rose 2.9%, while mega-cap growth declined <0.6%>.

Currency & Volatility:

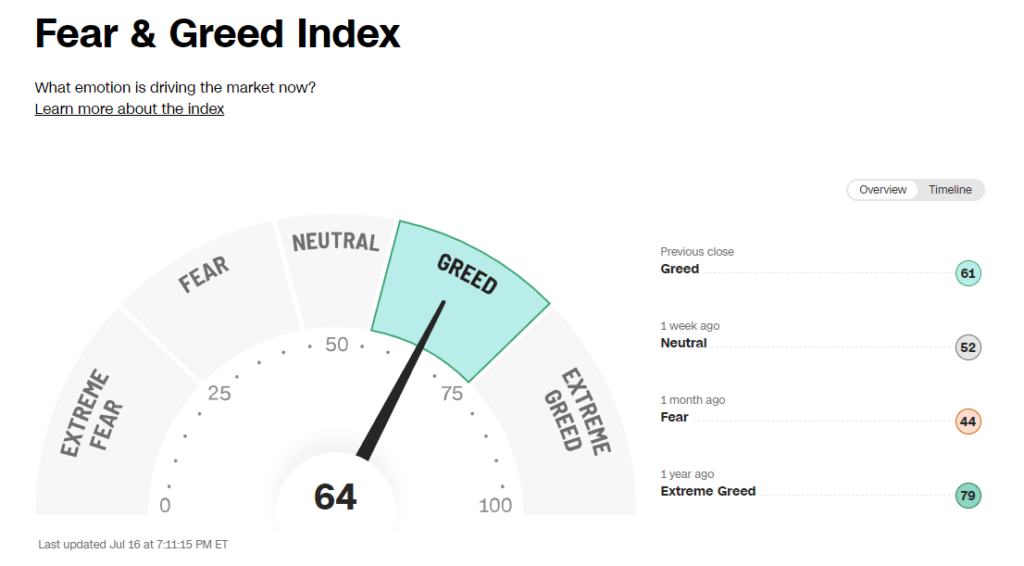

- The VIX moderately rose to 13.19, while the Fear & Greed Index rose to 64 (Greed).

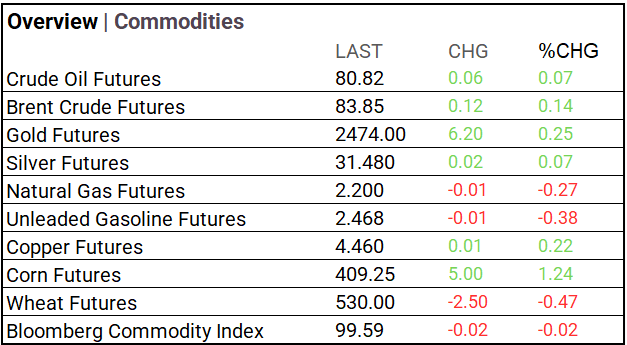

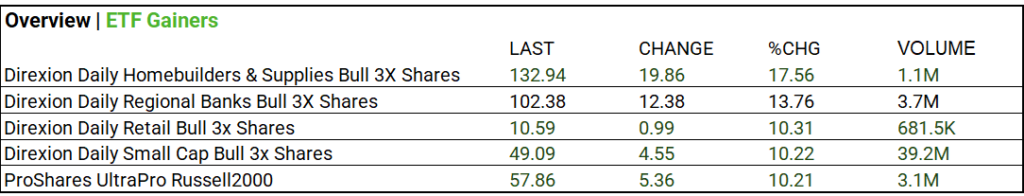

Commodities & ETFs:

- Commodity markets: Crude oil, Brent crude, gold, silver, and copper up, while natural gas, unleaded gasoline, and wheat down. Corn rose. Bloomberg Commodity Index slightly down.

- ETFs: Direxion Daily Regional Banks Bull 3X +13.76% on 3.7M volume; Direxion Daily Small Cap Bull 3X +10.22% on 39.2M volume.

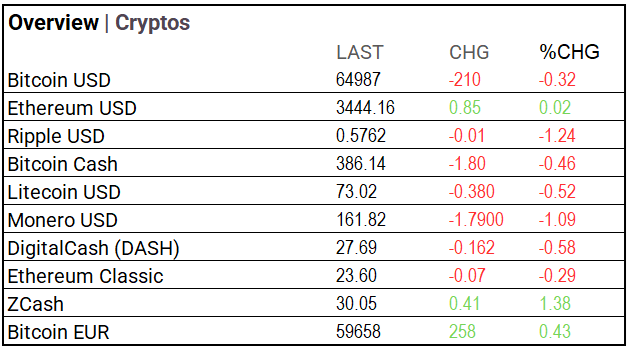

Cryptocurrency Update:

- Bitcoin rose $248 to $64,966, Ethereum saw moderate gains, and ZCash was up 1.38%.

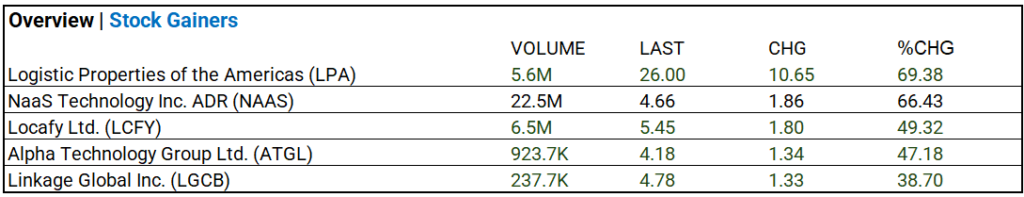

Stocks:

- NaaS Technology Inc. ADR (NAAS) jumped 66.43% on 22.5M volume.

Notable Earnings:

- UnitedHealth (UNH), Bank of America (BAC), Morgan Stanley (MS) beat.

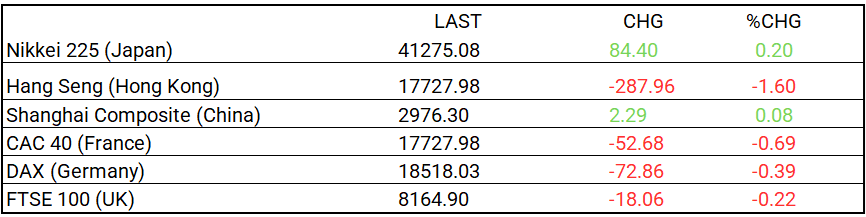

Global Markets Summary:

- Asia mixed, Nikkei up 0.20%, Hang Seng down 1.60%; Europe declined.

In the NEWS:

Central Banking, Monetary Policy & Economics:

- Pro Take: The Yield Curve Hasn’t Been Alone in Predicting a Recession – WSJ

- US Retail Sales Excluding Autos Rise by Most in Three Months – Bloomberg

Business:

- J.B. Hunt Profit Falls as Rates, Freight Volumes Tumble – WSJ

- Spirit Air Warns of Revenue Drop on Lower Bag, Seating Fees – Bloomberg

China:

- China’s third plenum: Xi Jinping tells party to show ‘unwavering faith’ in reform plan – SCMP