MARKETS TODAY March 2 (Vica Partners)

Opening Commentary

Markets were off to negative start this morning as jobs and labor data came in significantly higher than market estimates, renewing interest rate hike fears. Following the reports we had some strong retail earnings releases plus the uptrend in Materials with China re-opening and a Fed Hawkish comment all helped to move equites forward today.

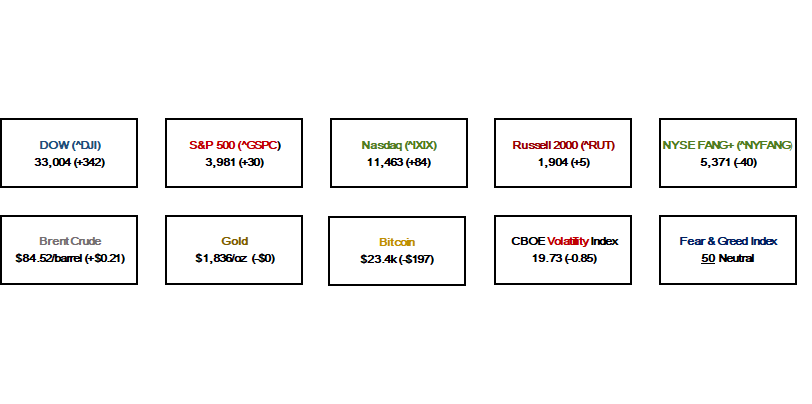

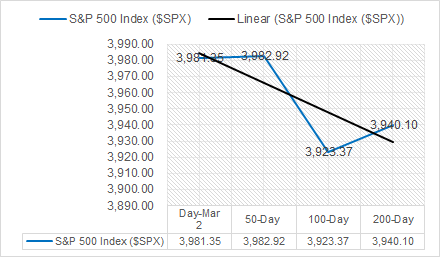

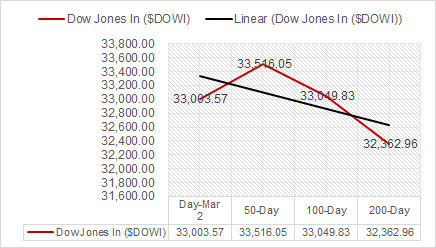

Indexes and Assets

Session Overview

- Indexes all up on late day rally, DOW led gainers

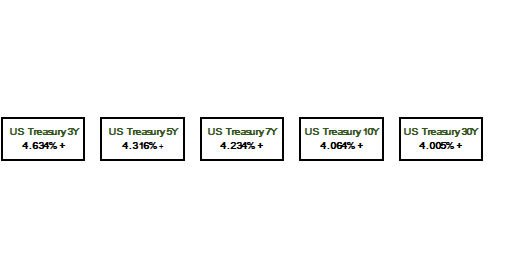

- Yields rise

- 9 of 11 S&P sectors higher: Utilities and Consumer Staples outperformed/ Financials and Consumer Discretionary underperformed

- Materials and Energy both continue to outperform on China re-opening

- Housing related stocks continue to pull back

- Broadcom (AVGO, Dell Tech (DELL), Hewlett Packard (HPE) with solid earning beats

- USD index up, Oil up, Bitcoin declines

- US labor market still tight as Weekly jobless claims in light

- Atlanta Feds Bostic supports Quarter-point US rate as it limits risk to economy

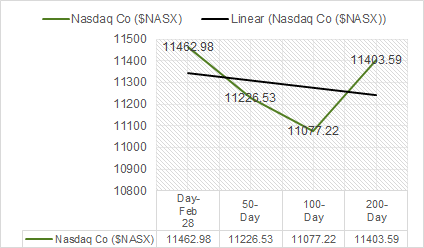

Key Index’s

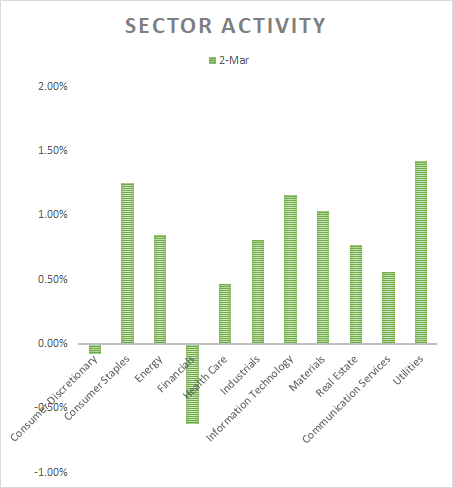

Sectors

- 9 of 11 S&P sectors higher: Utilities +1.42% and Consumer Staples +1.25%, outperformed/ Financials -0.62 and Consumer Discretionary -0.08% underperformed

Other Asset Classes:

- USD index: +0.49 to $104.97

- Oil prices: Brent: +0.25% to $84.52, WTI: +0.35% to $77.96, Nat Gas: -1.07% to $2.781

- Gold: -0.01% to $1,836.41, Silver: -0.30% to $20.91, Copper: -2.02% to $4.08

- Bitcoin: -0.83% to $23.4k

Notable Company Earnings

Beats/ Broadcom (AVGO), Soquimich B ADR (SQM), Best Buy (BBY), Macy’s Inc (M), Dell Tech (DELL), VMware (VMW), Toronto Dominion Bank (TD),Hewlett Packard (HPE)

Misses/ Costco (COST), Anheuser Busch ADR (BUD), Canadian Natural (CNQ), Kroger (KR), Bilibili (BILI), Hormel Foods (HRL), Nordstrom (JWN)

U.S Economic News

Topline: US labor market still tight as Weekly jobless claims come in at 190,000 and below analyst estimates. Continuing claims drop 5,000 to 1.66m. Q4 labor costs revised higher while productivity comes in soft at 1.7% in Q4, fails to beat 2.6% market estimate gain.

- Initial jobless claims: period Feb. 25, act 190,000, fc 197,000, prev. 192,000

- U.S. unit-labor costs (revision): period Q4, act 3.2%, fc 1.4%, prev. 1.1%

- U.S. productivity (revision): period Q4, act 1.7%, fc 2.5%, prev. 3.0%

- Fed speakers: Bostic: Quarter-point US rate increases best to limit risk to economy

Business News

- Elon Musk’s ‘Master Plan’ for Tesla fails to charge up investors – Reuters

- Coinbase, Galaxy Digital abandon Silvergate after lender flags risks to business – Reuters

- Credit Suisse offers higher deposit rates in Asia to woo the wealthy – sources – Reuters

International Related News and Other

- Apple blocks update to email app with ChatGPT tech – Reuters

- Blackstone defaults on $562 mln Nordic property-backed CMBS – Bloomberg

- China leads US in global competition for key emerging technology, study says – Reuters

Vica Momentum Stock Report

- Canadian Imperial Bank of Commerce (CM) $CM (Momentum A-) (Value B+) (Growth B-), moving averages/ 50-Day +12.67%, 100-Day +5.09%, 200-Day -14.04%, Year-to-Date +12.81

Strong Momentum Buy Rating

Company Profile: Canadian Imperial Bank of Commerce provides banking and financial services to consumers, individuals, and corporate clients in Canada and around the world.

Market Outlook and updates posted at vicapartners.com