MARKETS TODAY August 1st, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 gained 0.92%. Hong Kong’s Hang Seng down 0.82% and China’s Shanghai Composite unchanged.

European markets finished lower, and Germany’s DAX lost 1.26%, France’s CAC 40 down 1.22% and London’s FTSE 100 off by 0.43%. S&P futures opened trading at 0.22% below fair value.

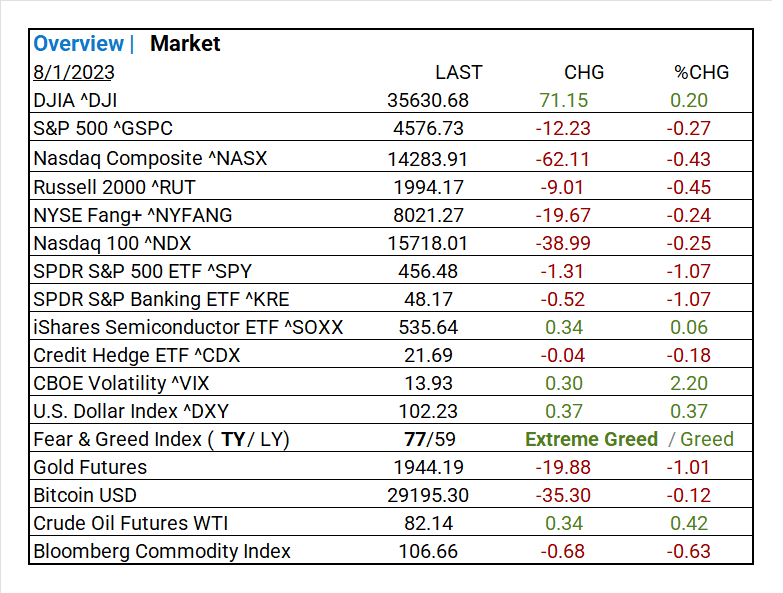

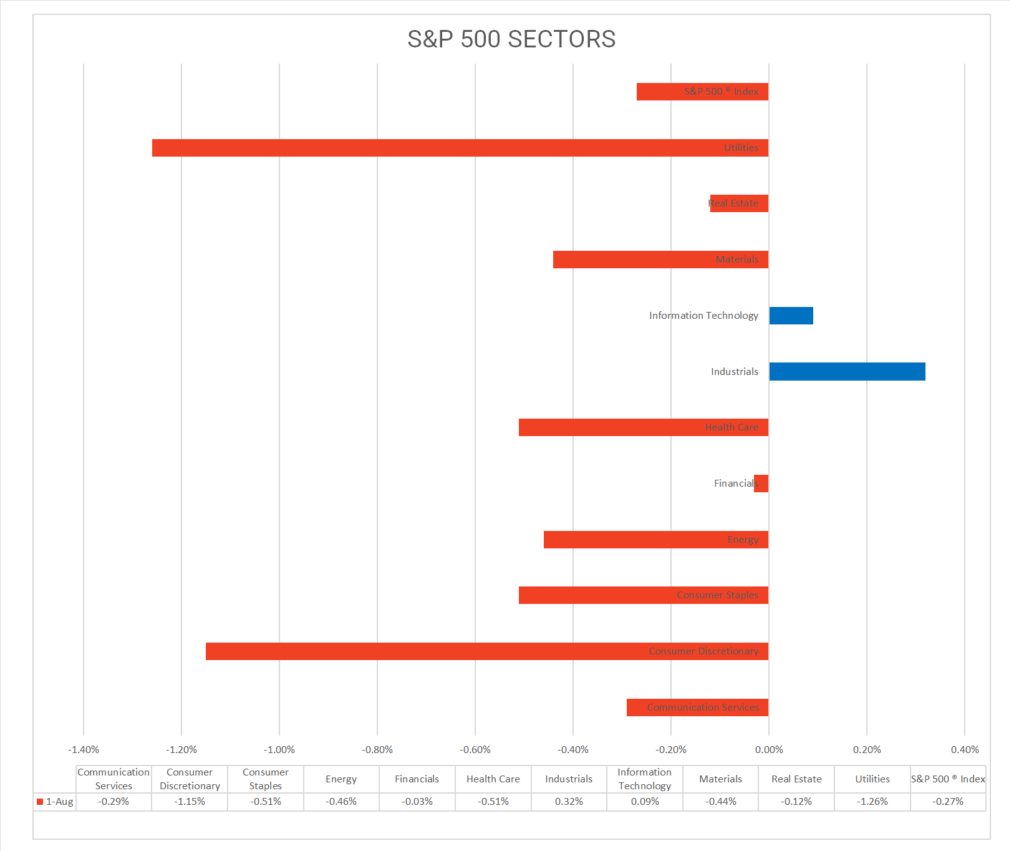

Today US Markets finished mixed, the DOW gained 0.20%, S&P 500 dropped 0.27% and NASDAQ lost 0.43%. 9 of 11 S&P 500 sectors declining: Industrials +0.32% outperforms/ Utilities -1.26% lags. On the upside, Industries: Communications Equipment, Machinery, Health Care REITs, US Treasuries, Semiconductor ETF ^SOXX, USD Index, Oil.

In US economic news, ISM manufacturing came in below estimates, JOLTS job openings down, Construction spending in line with estimates.

Takeaways

- Economic Data moderately deflationary, Job openings decline

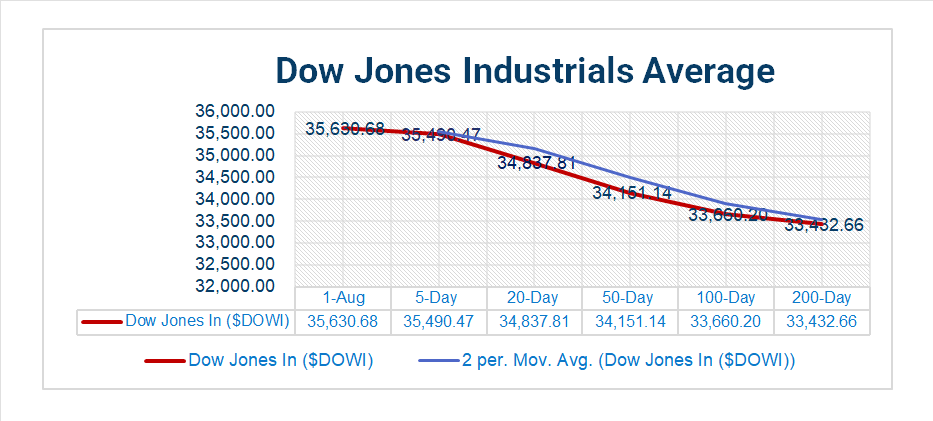

- DOW leads majors +0.20%

- 9 of 11 S&P 500 sectors declining: Industrials +0.32% outperforms/ Utilities -1.26% lags

- Industry/ Communications Equipment +3.32%, Machinery +1.69%, Health Care REITs +1.61%, Construction Materials +1.55%, Electrical Equipment +1.31%

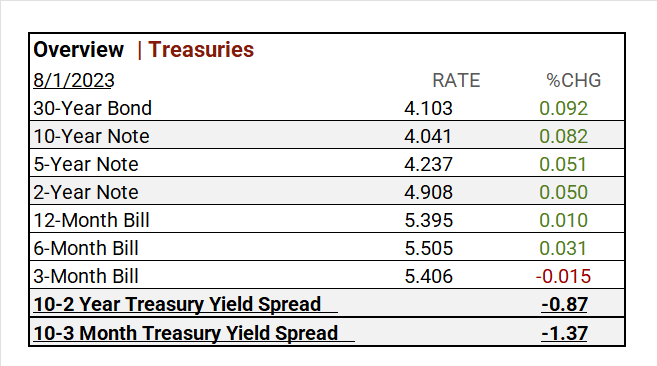

- US Treasuries across the curve

- USD Index up

- Oil gains

- Toyota Motor ADR (TM), Caterpillar (CAT) w/ solid earnings beats

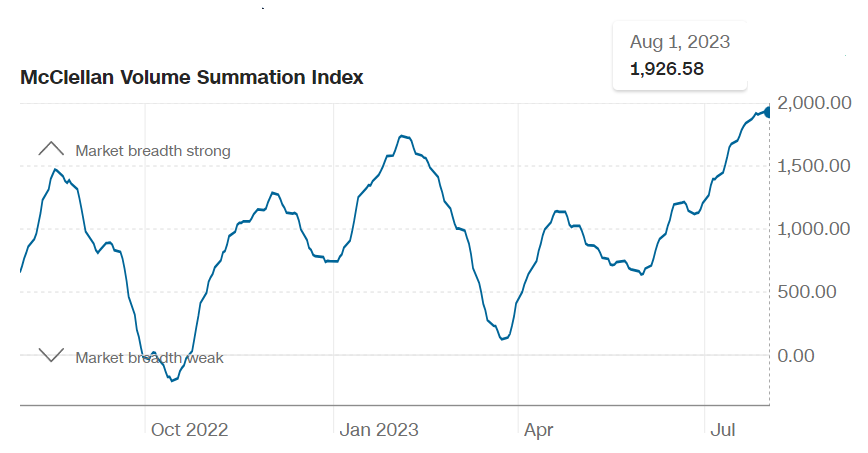

Pro Tip: McClellan Volume Summation Index, measures the volume, of shares on the NYSE that are rising compared to the number of shares that are falling. A higher number is a bullish sign.

Sectors/ Commodities/ Treasuries

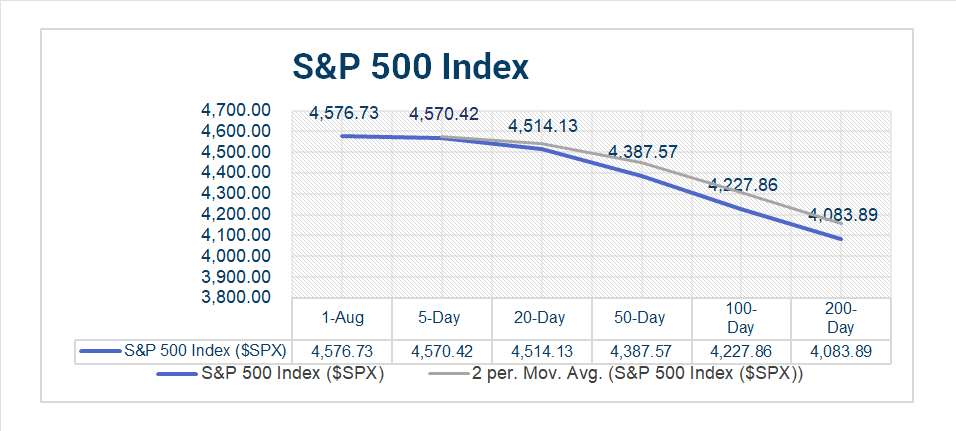

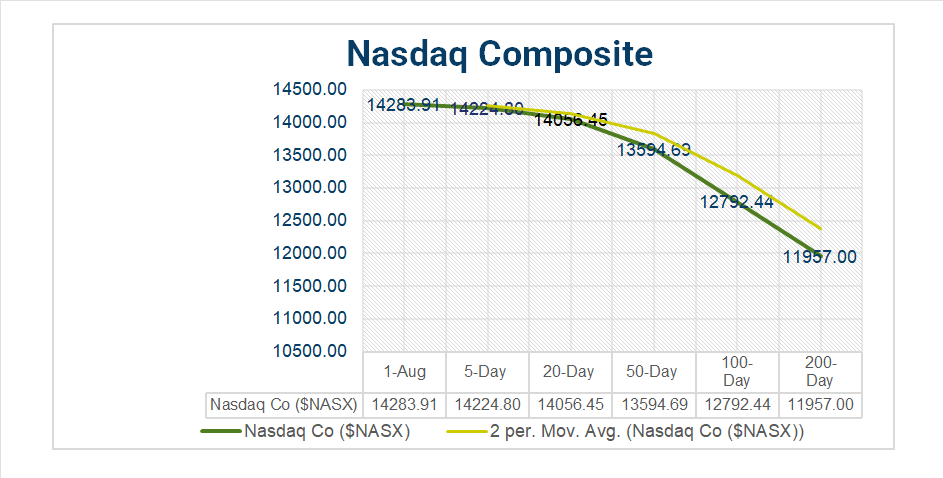

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 sectors declining: Industrials +0.32% outperforms/ Utilities -1.26% lag

- Industries: Communications Equipment +3.32%, Machinery +1.69%, Health Care REITs +1.61%, Construction Materials +1.55%, Electrical Equipment +1.31%

- YTD Leaders: Information Technology +45.81%, Communication Services +44.72%, Consumer Discretionary +35.51%.

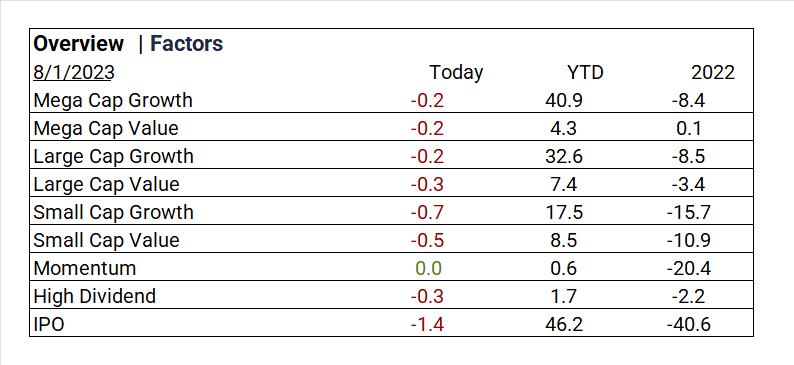

Factors

US Treasuries

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Q2 Actual (thru 7/28)/ a) 51% of S&P 500 companies reporting actual results, 80% of S&P 500 b) the blended earnings decline for the S&P 500 is -7.3%, c) for Q3 2023, 27 S&P 500 companies have issued negative EPS guidance and 18 S&P 500 companies have issued positive EPS guidance d) the forward 12-month P/E ratio for the S&P 500 is 19.4. This P/E ratio is above the 5-year average (18.6) and above the 10-year average (17.4).

Notable Earnings Today

- +Beat: Merck&Co (MRK), Toyota Motor ADR (TM), Pfizer (PFE), Caterpillar (CAT), Mitsubishi UFJ Financial ADR (MUFG), Eaton (ETN), Altria (MO), Marriott Int (MAR), Marathon Petroleum (MPC), Ametek (AME)

- – Miss: HSBC ADR (HSBC), BP ADR (BP), Uber Tech (UBER), Illinois Tool Works (ITW), Deutsche Post AG (DPSGY), Ecolab (ECL), Sysco (SYY)

Economic Data

US

- S&P final U.S. manufacturing PMI: period July, act 49.0, fc 49.0, prior 46.3

- Job openings: period June, act 9.58m, fc 9.6m, prior 9.62m

- ISM manufacturing: period July, act 46.4%, fc 46.8%, prior 46.0%

- Construction spending: period June, act 0.5%, fc 0.7%. prior 1.1%

Vica Partner Guidance July ’23, (updated 8-01)

- Q3/4 highlighting, Industries: Interactive Media & Services, Household Durables, Broadline Retail, Consumer Finance, Automobiles, Construction & Engineering, Semiconductor & Semiconductor Equipment, Construction Materials, Specialized REITs, Gas Utilities. Other: Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US. Look for continued strength in Mega and Large Cap Growth “the new defensives” Expect Energy Sector rally!

- Cautionary, Banks shortly may be overpricing. Current indicators are mixed. Credit default swap (CDS) to pick-up through Q4/Q1.

- Longer Term, NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment, Key Material like Lithium. Forward looking CAGR growth below:

- Company, we continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

- BIG Picture: Market bottoms are made on bad news and with deflationary signals the current market rally should come as no surprise. The combination of current Fed tightening, higher oil prices and a strong dollar should have given us a final bottom in ’23?

- Our biggest concern with the current rally is that the Government is not as effective as Free Markets in managing capital. Stock repurchases are just another way to deploy Capital. Consider that about 63% of the typical business cost is labor. I wholeheartedly trust the Free Market to better spend on CAPEX, R&D, and other.

- As for Bonds as an alternative investment for Stocks, a 10-year bond should have a return that is equal to or exceeds nominal GDP, and that is not the case today.

- The argument for Fed further tightening has its pundits. Raising rates to counter jobs in rapidly changing economy will NOT moderate on demands. In addition The Fed would benefit by rethinking its 2% target inflation number. A little extra pad like 3% today, protects the economy from Deflation.

News

Company News/ Other

- Uber Delivers First-Ever Operating Profit in Drive to Curb Losses – Wall Street Journal

- Hedge Fund Managers Scored Big. Investors? Not So Much. – Bloomberg

Energy/ Materials

- Asset Managers Pledging Climate Action Drop Ball When Investing – Bloomberg

- Sunak Pushes North Sea Oil, Gas in Latest Green Policy Shift – Bloomberg

Central Banks/Inflation/Labor Market

- Jobs Market Shows Signs of the Gradual Cooling the Fed Wants – Wall Street Journal

- Free-Spending Americans Fuel Upbeat Consumer Earnings Surprises – Bloomberg

Asia/ China

- From Gina Raimondo visit to deflation: 4 things to look out for in China’s economy in August – South China Morning Post

- BlackRock, MSCI Face Congressional Probes for Facilitating China Investments – Wall Street Journal