Stay Informed and Stay Ahead: Market Watch, June 28th, 2024.

Late-Week Wall Street Markets

Key Takeaways

+ Dow, NASDAQ, and S&P 500—fell. Six out of eleven sectors declined, with Real Estate leading and Communication Services trailing. The top performing industry was Consumer Finance.

+ The PCE index remained stable with reduced year-over-year inflation rates. Core PCE slightly increased but aligning with analysts’ expectations.

+ Bond yields rose. NASDAQ’s A/D ratio was 1.15. Mega Cap Growth and Momentum declined. Crude oil and Brent crude stable. Regional Banks Bulls gain.

Summary of Market Performance

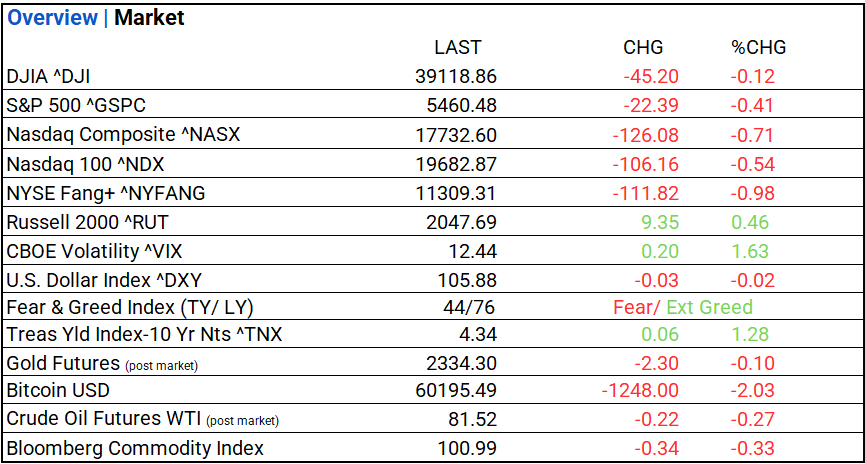

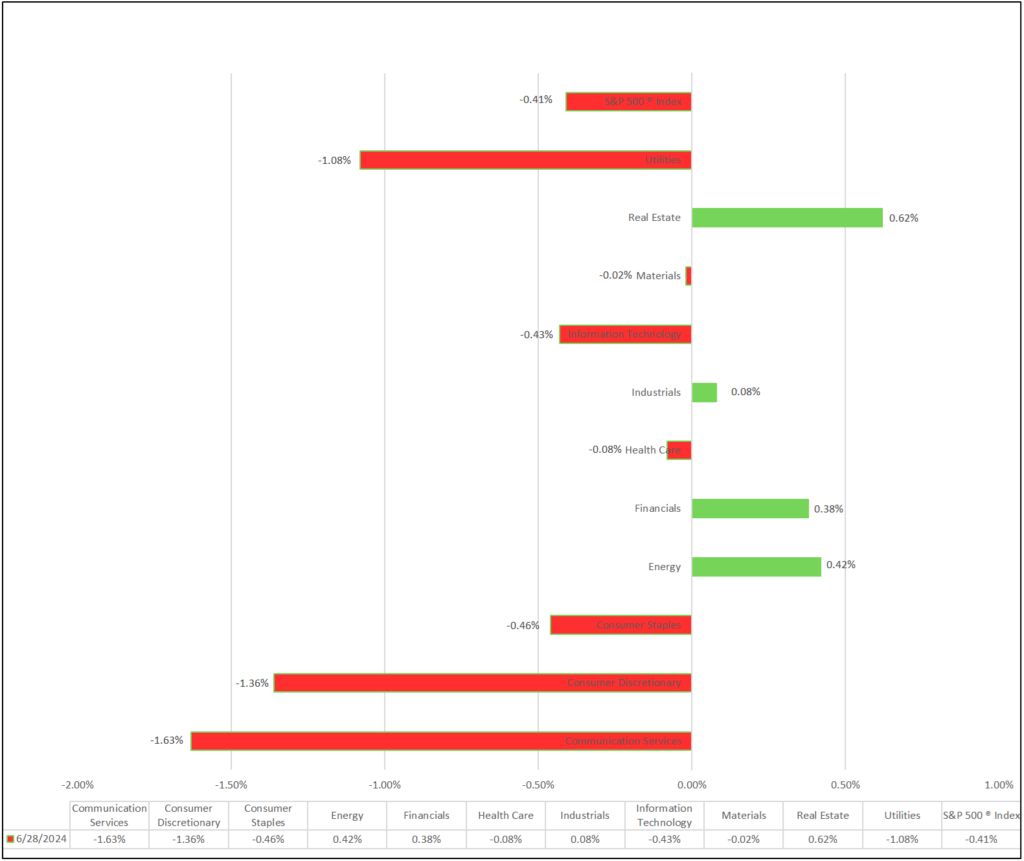

Indices & Sectors Performance:

- Today, major US stock indices—Dow, NASDAQ, and S&P 500—fell. Among eleven sectors, six declined, with Real Estate leading and Communication Services trailing. Top performing industries were Consumer Finance (+2.80%), Ground Transportation (+2.08%), and Banks (+2.03%).

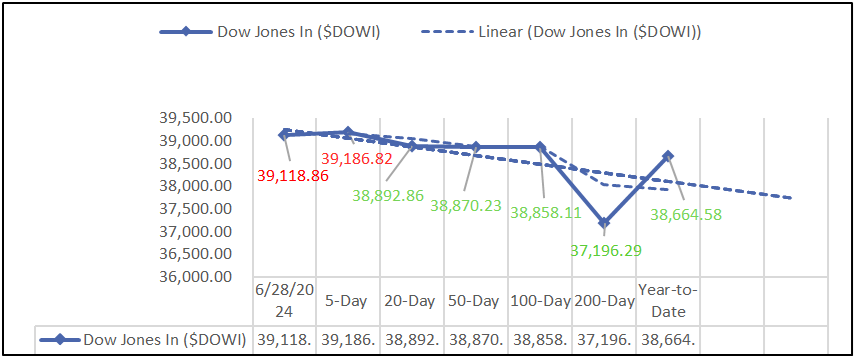

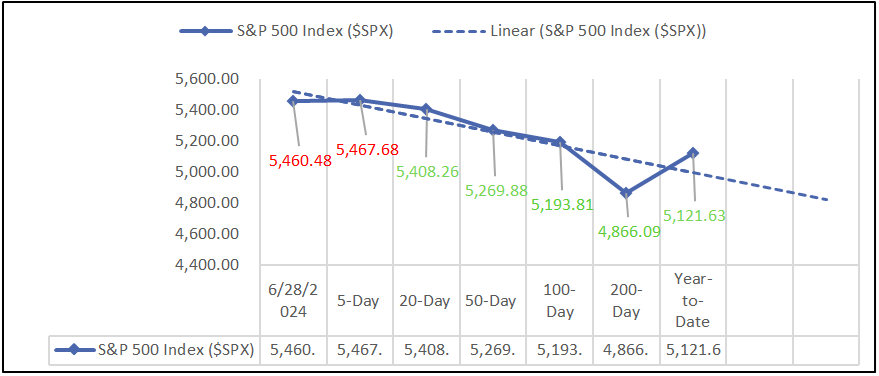

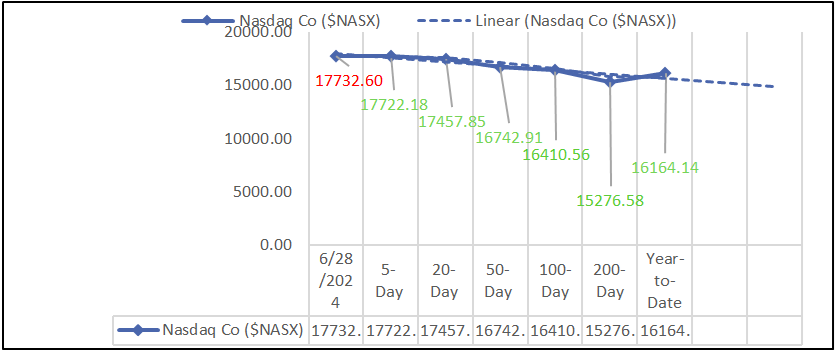

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

-

Among eleven sectors, six declined, with Real Estate leading and Communication Services trailing.

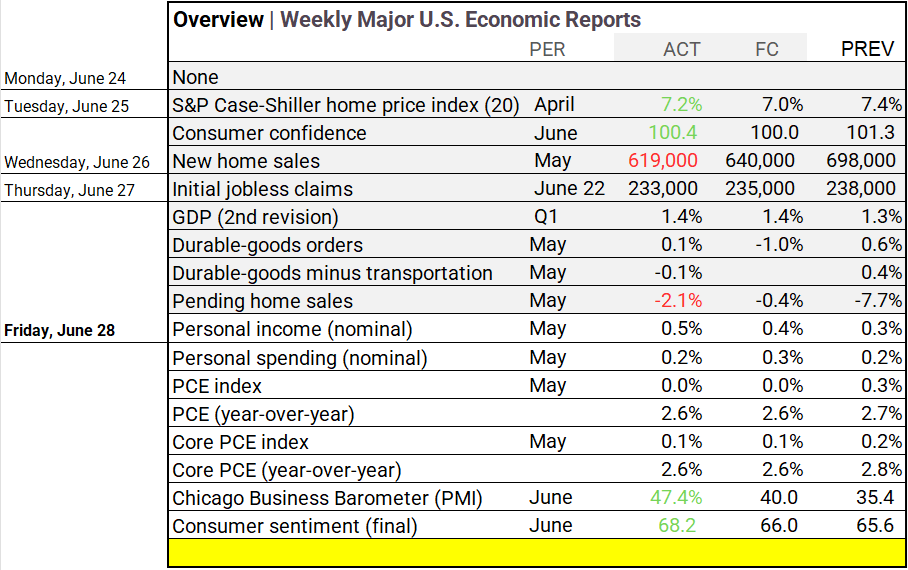

Economic Highlights:

- Today’s reports indicated a modest rise in May’s personal income and spending. The PCE index held steady with lower year-over-year inflation rates. Core PCE edged up, while June’s Chicago Business Barometer and consumer sentiment showed positive trends.

NASDAQ Global Market Update:

- Today’s NASDAQ showed mixed sentiment with a total share volume of 7.77 billion, 115 new highs, 156 new lows, and an advance/decline ratio of 1.15. NVIDIA and ProShares UltraPro Short QQQ led in active trading.

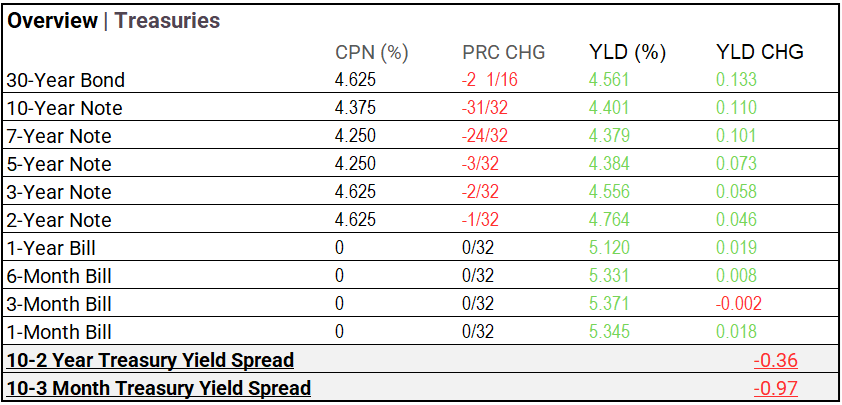

Treasury Markets:

- Bond yields rose, notably with the 30-year bond reaching 4.561% (up by 0.133%) and the 10-year note at 4.401% (up by 0.110%).

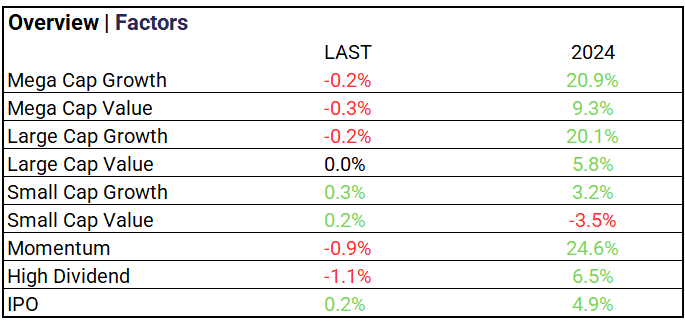

Market Trends:

- IPO sector rose by 0.2%, while Large Cap Growth increased by 0.3%. Mega Cap Growth and Momentum declined, with most other categories also seeing decreases.

Currency & Volatility:

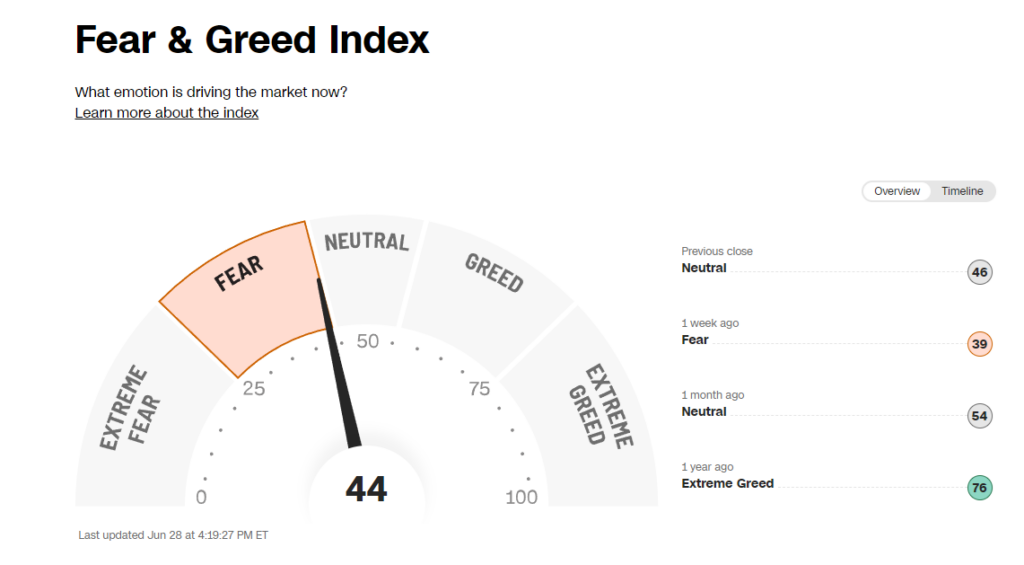

- The VIX rose to 12.44, reflecting moderate volatility. The Fear & Greed Index dropped to 44 from 76 last year, signaling a shift from Extreme Greed to Fear during this election year.

Commodities & ETFs:

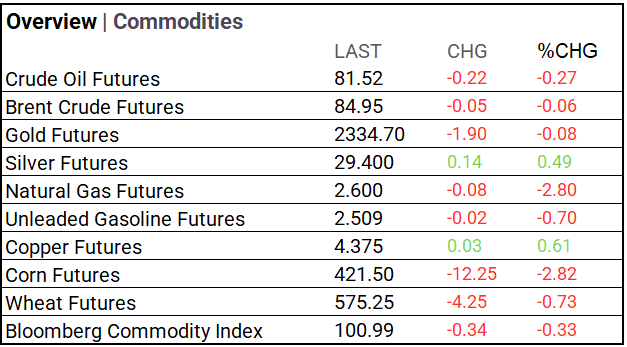

- Commodity markets showed mixed movement: Crude oil and Brent crude remained stable, unleaded gasoline saw a moderate decline, natural gas was volatile, silver rose, and gold declined.

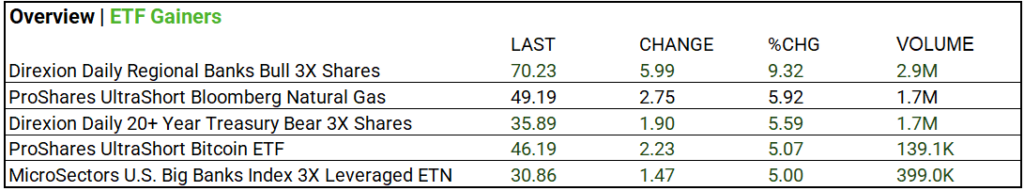

- ETFs: Bank bulls gained; Direxion Daily Regional Banks Bull 3X up 9.32% to 70.23 (2.9M), natural gas shorts rose.

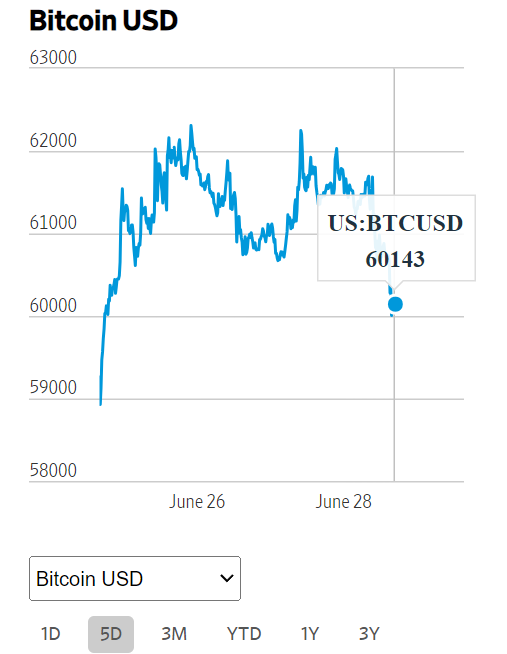

Cryptocurrency Update:

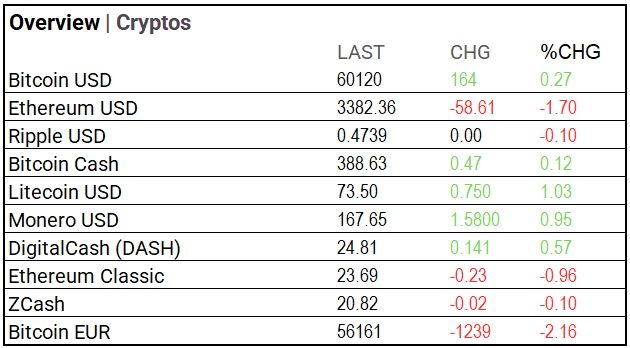

- Bitcoin held steady at $60,120 (+0.27%), while Ethereum dipped to $3,382.36 (-1.70%).

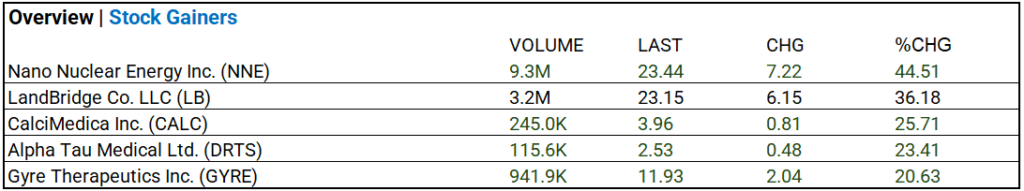

Stocks:

- Nano Nuclear Energy Inc. (NNE) saw significant activity with 9.3M volume, trading at $23.44, up 7.22% (+44.51% change).

Notable Earnings:

- No significant earnings report today.

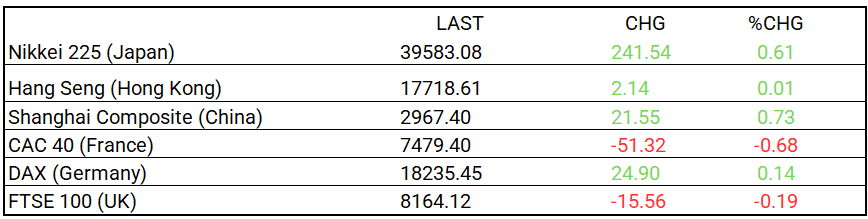

Global Markets Summary:

- Asia rises: Nikkei 225 leads with a 1.26% gain. Europe falls, notably France’s CAC 40 down by -0.69%.

In the NEWS:

Central Banking and Monetary Policy:

- Slowing U.S. Inflation Fuels Expectations of Interest Rate Cuts – Wall Steet Journal

- Fed’s Daly Says Latest Data Show Monetary Policy Is Working – Bloomberg

Business:

- Nike’s Slow Recovery Is Testing Investors’ Patience – Wall Steet Journal

- Tesla Investors Brace for Big Share Price Moves as Major Catalysts Loom – Bloomberg

China:

- Chinese companies ‘going global’ should learn from Japan’s mistakes, academic says – South China Morning Post