MARKETS TODAY July 26th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, Hong Kong’s Hang Seng down 0.36%, China’s Shanghai Composite off 0.26% and Japan’s Nikkei 225 lower by 0.04%.

European markets finished lower, France’s CAC 40 down 1.35%, Germany’s DAX off 0.49% and London’s FTSE 100 was lower by 0.19%. S&P futures opened trading at 0.19% below fair value.

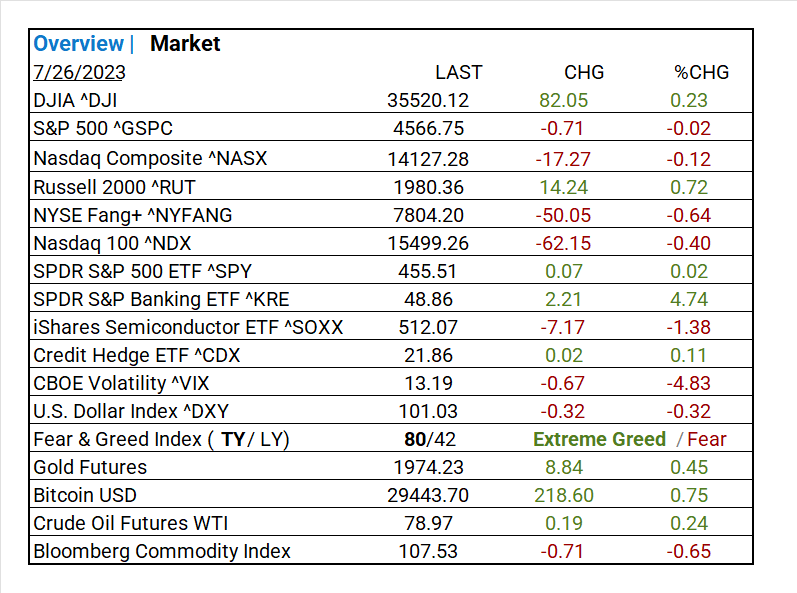

Today US Markets finished mixed, the DOW gained 0.23% while the NASDAQ was down 0.12% and the S&P 500 was off 0.02%. 6 of 11 S&P 500 sectors declining: Communication Services +2.65% outperforms/ Information Technology -1.30% lags. On the upside, Russell 2k, S&P Banking ETF ^KRE, Credit Hedge ETF ^CDX, Subs/ Ground Transportation, Interactive Media & Services, Office REIT’s, Factor/ High Dividend’s, Gold Futures, Bitcoin, and Oil WTI.

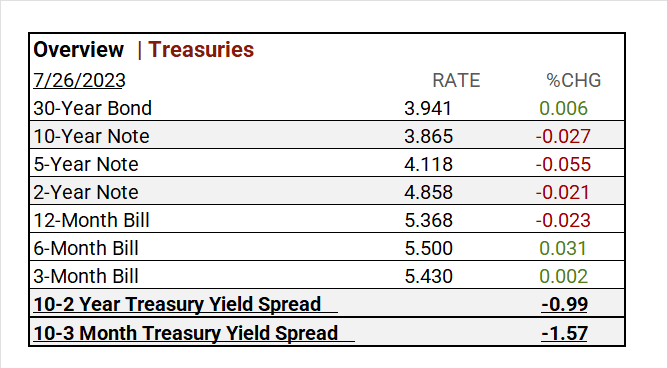

In US economic news, The Fed. FOMC unanimously raised the policy rate to 5.25%-5.50% range, the highest level in 22 years. New home sales in June missed analyst estimates.

Takeaways

- FOMC unanimously raised the policy rate to 5.25%-5.50% range (22 year high)

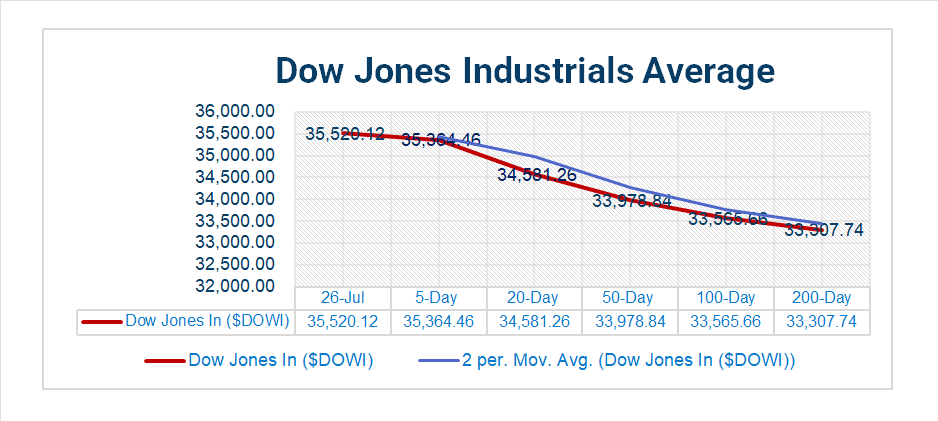

- DOW leads majors extends gains to 13 sessions, the longest winning streak since 1987

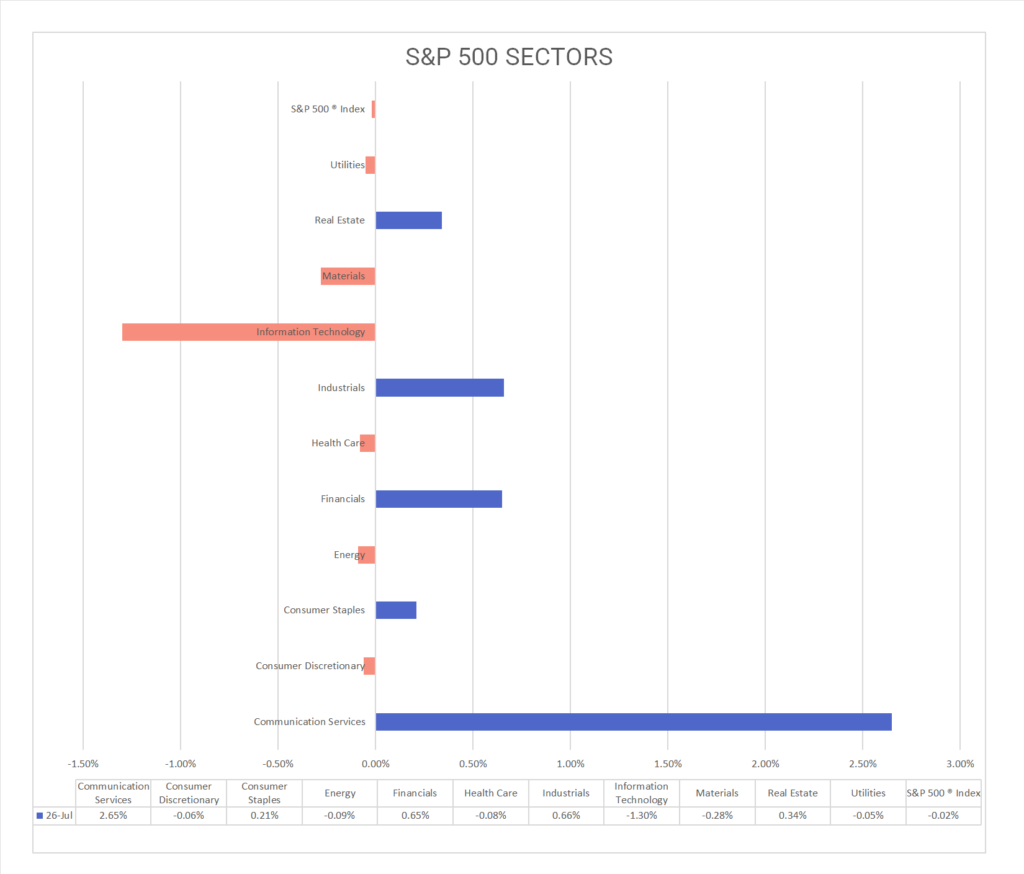

- 6 of 11 S&P 500 sectors declining: Communication Services +2.65% outperforms/ Information Technology -1.30% lags

- Sector Subs/ Ground Transportation +5.15%, Interactive Media & Services +4.28%, Office REITs +3.11%, Transportation Infrastructure+2.96%

- SPDR S&P Banking ETF ^KRE +4.74%

- Gold Futures, Bitcoin and Oil moderately up

- Meta Platforms (META), Coca-Cola (KO) w/ solid earnings beats

- Union Pacific (UNP), AT&T (T) w/ earning misses

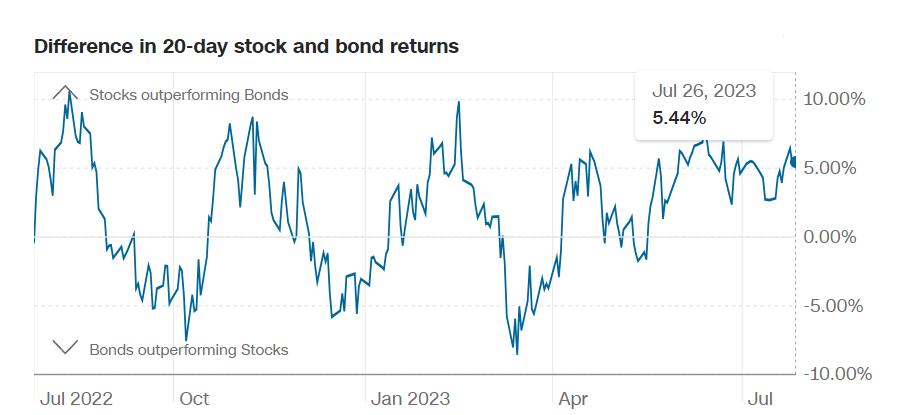

Pro Tip: Safe Haven Demand is the difference between Treasury bond and stock returns over the past 20 trading days. Stocks do better when investors are optimistic.

Sectors/ Commodities/ Treasuries

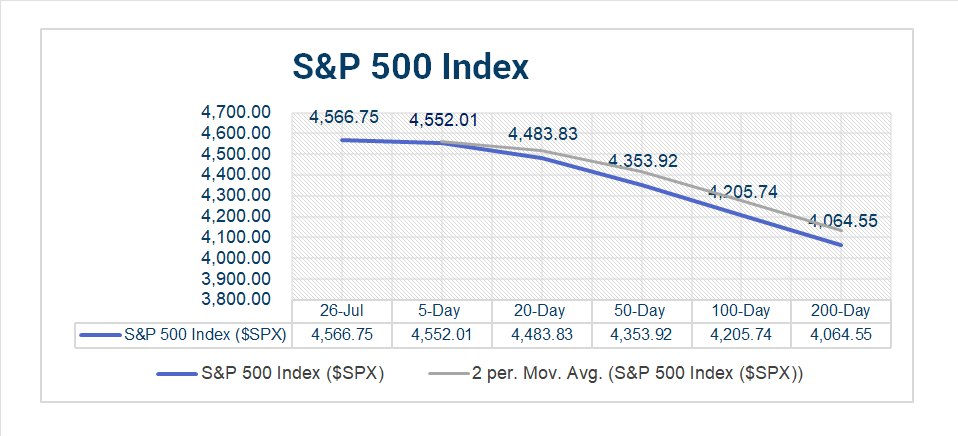

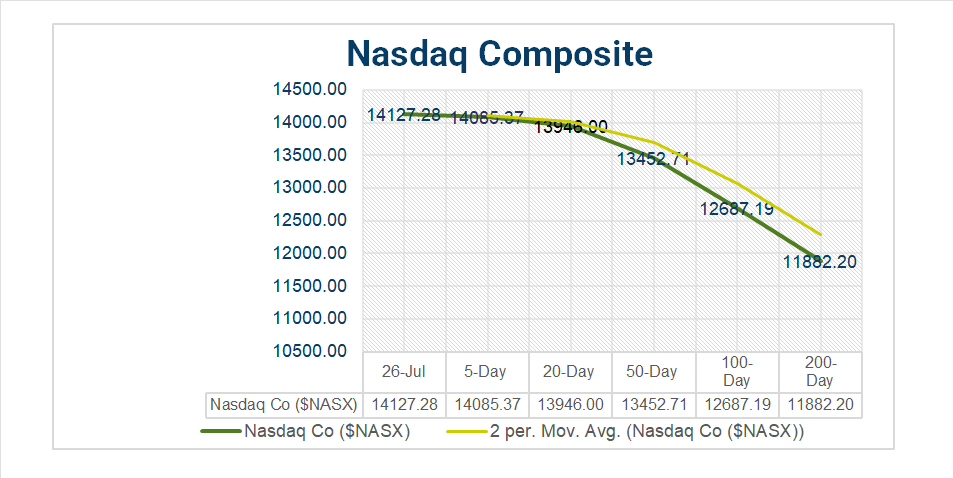

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 6 of 11 S&P 500 sectors declining: Communication Services +2.65% outperforms/ Information Technology -1.30% lags.

- Ground Transportation +5.15%, Interactive Media & Services +4.28%, Office REITs +3.11%, Transportation Infrastructure+2.96%, Professional Services +2.08%, Aerospace & Defense +1.74%, Industrial REITs +1.72%, Life Sciences Tools & Services +1.44%, Banks +1.32%.

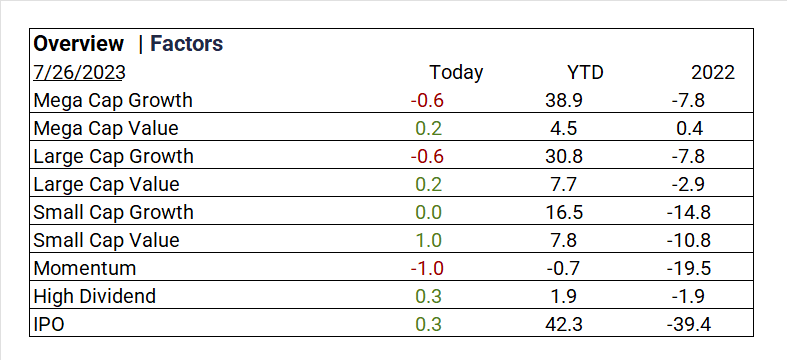

Factors

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

This Week ending 7/28

- >17% of S&P 500 names have reported, 40% more will release earnings this week.

- To date BIG picture, credit resilience, deposit stabilization, travel demand

- Technology sector, mega caps reporting META, MSFT, GOOGL

Notable Earnings Today

- +Beat: Meta Platforms (META), Coca-Cola (KO), ServiceNow Inc (NOW), Boeing (BA), ADP (ADP), Lam Research (LRCX), Equinor ADR (EQNR), Fiserv (FI), GSK plc DRC (GSK), General Dynamics (GD), O’Reilly Automotive (ORLY), CME Group (CME), General Dynamics (GD), Amphenol (APH), Hilton Worldwide (HLT), Lloyds Banking ADR (LYG), Otis Worldwide (OTIS), Hyundai Motor DRC (HYMTF), Hexagon ADR (HXGBY), Fortive (FTV), Rogers Communications (RCI), CGI Inc (GIB), Teledyne Technologies (TDY), Nissan Motor ADR (NSANY United Microelectronics (UMC)), Quest Diagnostics (DGX), RPM (RPM), Flex (FLEX), Owens Corning (OC), Penske Automotive (PAG), Lithia Motors (LAD), Capcom ADR (CCOEY), Wyndham Hotels (WH), Affiliated Managers (AMG), Silicon Labs (SLAB), Crescent Point Energy (CPG), Mr. Cooper (COOP)

- Yesterday late news +Beat: Louis Vuitton ADR (LVMUY)

- – Miss: Thermo Fisher Scientific (TMO), Union Pacific (UNP), Airbus Group NV (EADSY), AT&T (T), Equinor ADR (EQNR), Chipotle Mexican Grill (CMG), Santander ADR (SAN),TE Connectivity (TEL), Old Dominion Freight Line (ODFL), Hess (HES), eBay (EBAY)Advantest DRC (ATEYY), Deutsche Bank AG (DB), Check Point Software (CHKP), Nitto Denko Corp (NDEKY), Allegion PLC (ALLE), New Oriental Education&Tech (EDU), Stifel (SF), Prosperity Bancshares (PB), Evercore (EVR), OneMain Holdings (OMF), RPC (RES), Ryder System (R), Tower (TSEM)

Economic Data

US

- New home sales: period June, act 697,000, fc 725,000, prior 715,000

- FOMC decision on interest-rate policy: Fed raises policy rate to 5.25%-5.50% range.

Vica Partner Guidance July ’23, (updated 7-20)

- Q3/4 highlighting Energy Equipment & Services, Banks, Passenger Airlines, Metals & Mining. Real Estate Management & Development, Specialized REITs. Defensives Health Care Providers & Services and Gas Utilities also have upside. Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US.

- Cautionary, current valuations in question as Mega and Large Cap Growth moderating, Banks shortly may be overpricing. Current indicators are recessionary. Credit default swap (CDS) to pick-up through Q4/Q1.

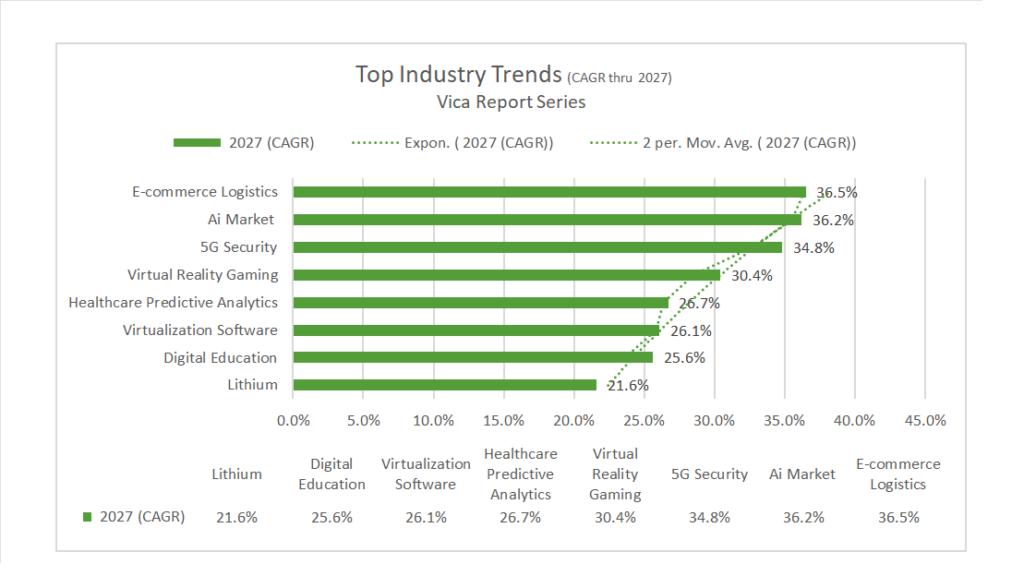

- Longer Term, Nasdaq 100^NDX companies will continue to outperform in the longer term along with Semiconductor Equipment. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

News

Company News/ Other

- Chinese e-commerce giant Alibaba’s cloud services unit extends support in China for Meta’s latest open-source AI model – South China Morning Post

- Amazon Cloud Unit Enters Health Care AI Market, Adds Chatbot Tools – Bloomberg

- Visa Faces Further Antitrust Scrutiny Over Payments Practices – Bloomberg

- Meta Sees Ad Business Rebound but Warns of Higher Spending in Metaverse – WSJ

Energy/ Materials

- A/C Makers Set to Break Records as Extreme Heat Grips the World – Bloomberg

- Big Automakers Plan Thousands of EV Chargers in $1 Billion U.S. Push – WSJ

- Why Chile’s New Approach to Lithium Matters Globally – Bloomberg

Central Banks/Inflation/Labor Market

- Dollar Won’t Weaken Until Fed Signals Interest Rate Cuts, Schwab Strategist Says – Bloomberg

- Bank Regulators Urge Flexibility in Commercial Real-Estate Loan Workouts as Defaults Grow – WSJ

Asia/ China

- Is China’s economic course correction too late, or is it too early to tell without the specifics being ironed out? – South China Morning Post

- Tech war: China’s hi-tech state fund grows to over US$8 billion in self-sufficiency drive – South China Morning Post