MARKETS TODAY July 10th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng +0.62%, China’s Shanghai Composite +0.22%, Japan’s Nikkei 225 -0.61%. European markets finished higher, France’s CAC 40 +0.57%, Germany’s DAX 0.42%, London’s FTSE 100 +0.30%. S&P futures were trading at -0.1% below fair value.

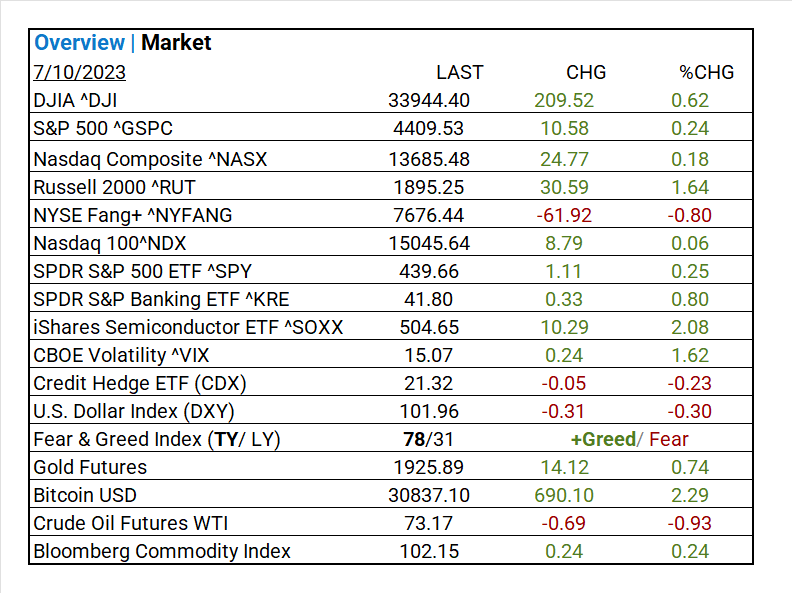

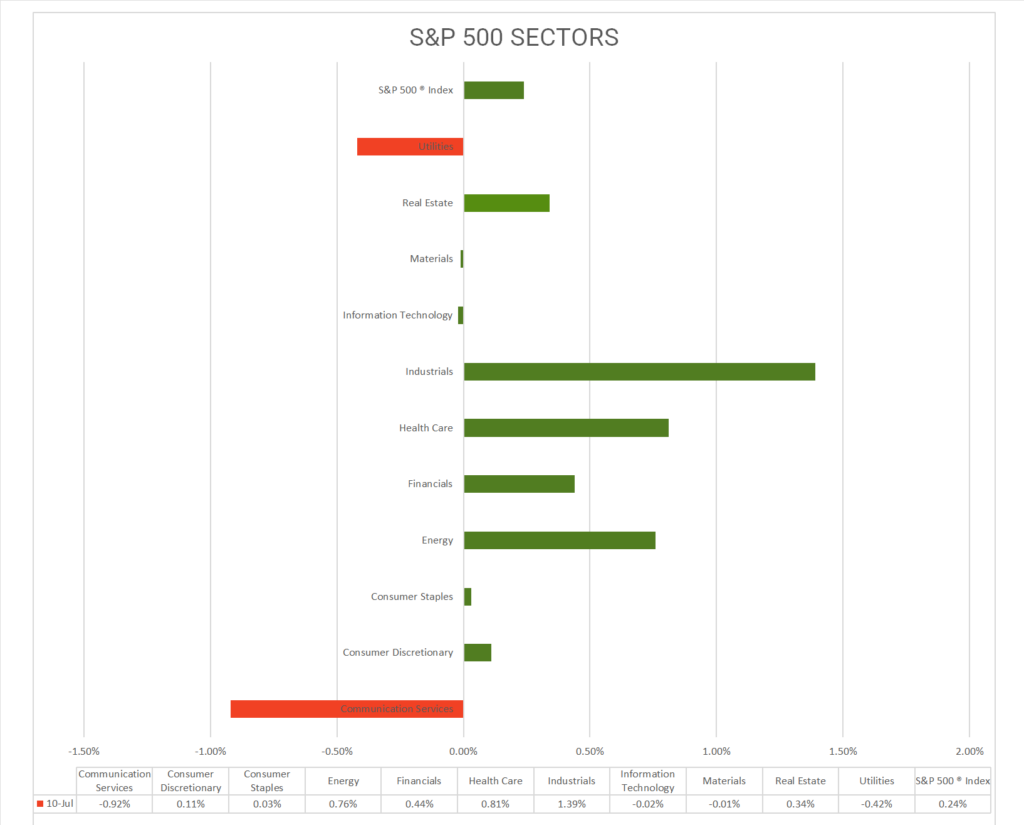

Today US Markets finished higher, S&P 500 +0.24%, DOW +0.62%, NASDAQ +0.18%. 7 of 11 S&P 500 sectors advancing: Industrials +1.39% outperforms/ Communication Services -0.92% lags. On the upside, DOW leads, Russell 2k, Semiconductor ETF ^SOXX, Sall Caps, Short Term Treasuries, Gold, Bitcoin, Bloomberg Commodity Index. In economic news, Mannheim used vehicle index sharply declines, wholesale inventories on consensus.

Takeaways

- China’s CPI and PPI came in below expectations.

- Mannheim with historical high monthly index decline

- DOW leads +210 points, Russell 2k +>1.6%

- 7 of 11 S&P 500 sectors advancing: Industrials +1.39% outperforms/ Communication Services -0.92% lags

- Semiconductor ETF ^SOXX +>2%

- S&P Banking ETF ^KRE +0.80%

- Gold, Bitcoin, Oil and Bloomberg Commodity Index rise

- Small Caps gain

- CPI data on Wednesday, investors expecting significant declines.

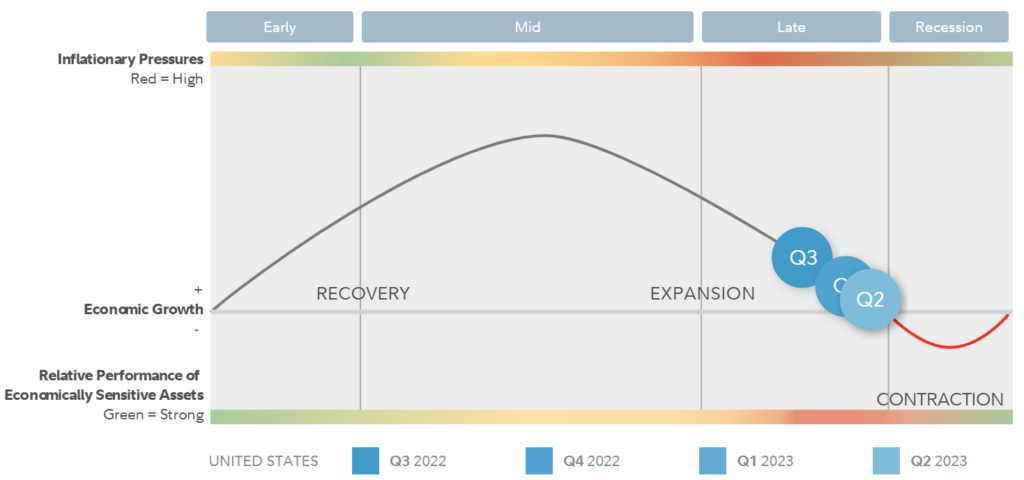

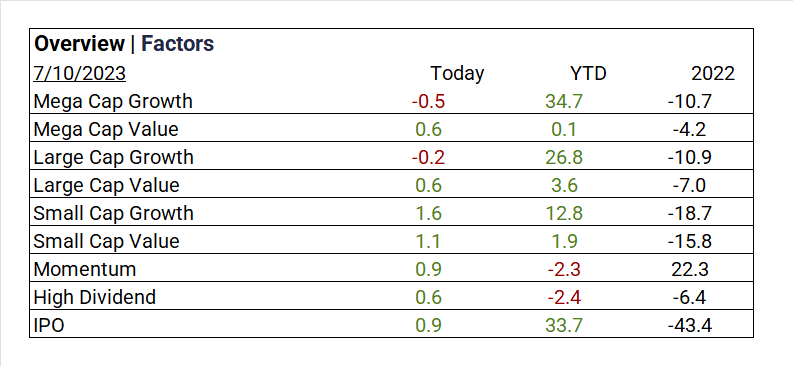

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Lithium Miners. Nasdaq 100^NDX 14,500 level is a buying opportunity. Undervaluation of Japanese equities and upside for Chinese Mega Cap tech. Q3/4 2023/ credit default swap (CDS) will pick-up. We continue to emphasize business quality and strength of balance sheet for all investments.

Market Consensus, Data from Morningstar shows $37 billion has exited U.S. equity funds this year while bonds have gathered $108 billion in assets, even as volatility in the latter asset class has remained higher, $404 billion flowed into money market funds. Note- Private Equity backed companies represented 17% of the follow-on share sales in the second quarter, up from only 6% a year earlier. In 2023 there were 28 deals worth $5.44 billion last quarter, up from eight deals totaling $1.23 billion in the year-earlier – data Vica Partners

Pro Tip: The 52 economists surveyed by the Wall Street Journal each month predicted that the economy would move into a recession in Q3 of 2008. However, in Sept, the last month Q3, the average 52 economists forecast continuing growth for Q3, Q4 of 2008.

Sectors/ Commodities/ Treasuries

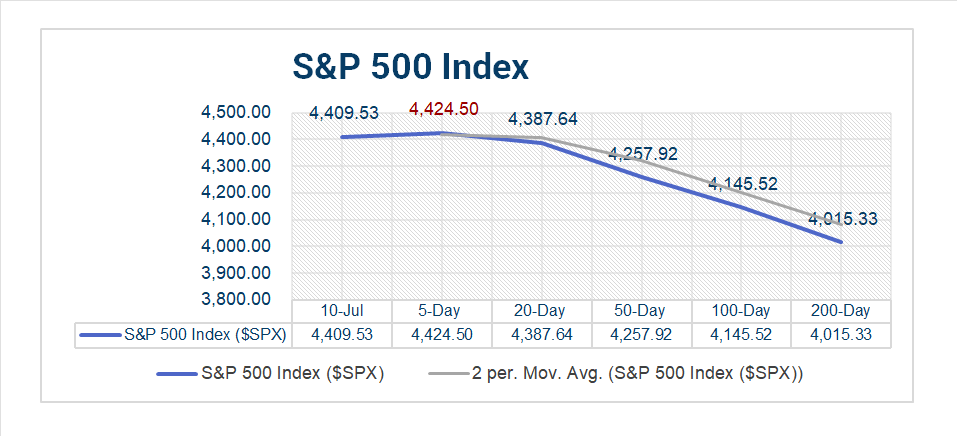

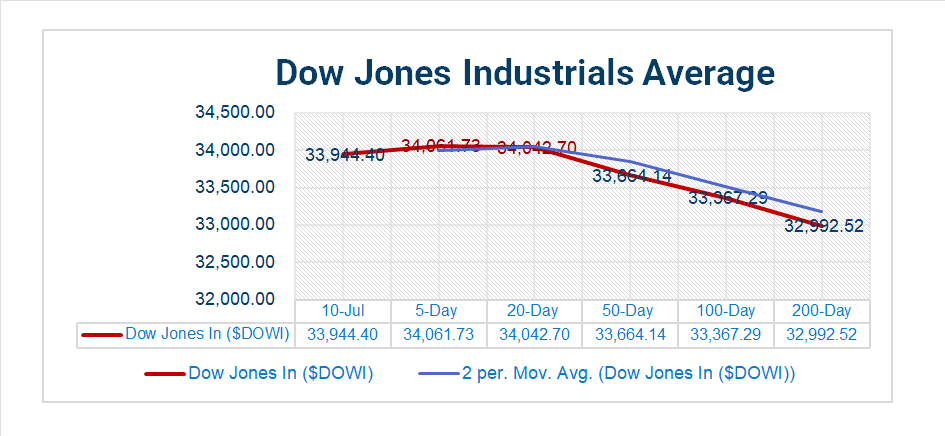

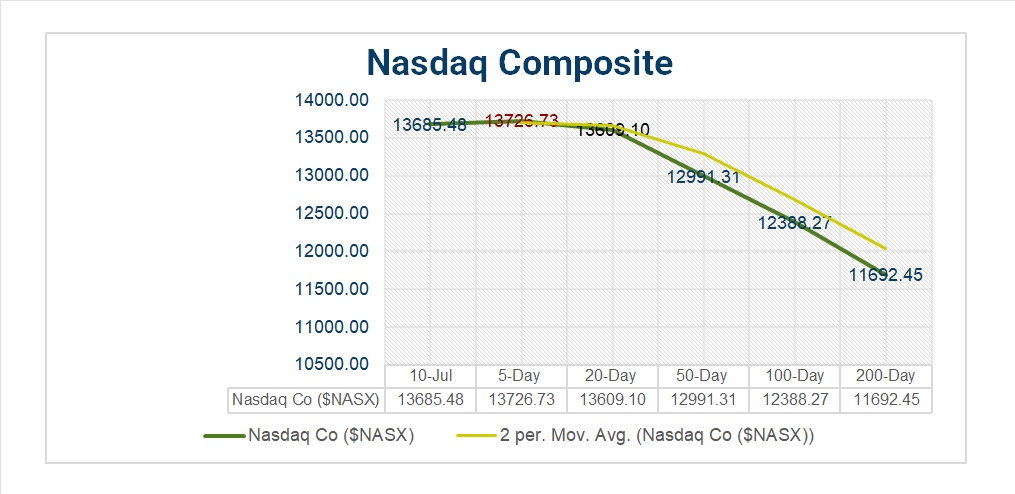

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 7 of 11 S&P 500 sectors advancing: Industrials +1.39% outperforms/ Communication Services -0.92% lags.

Factors

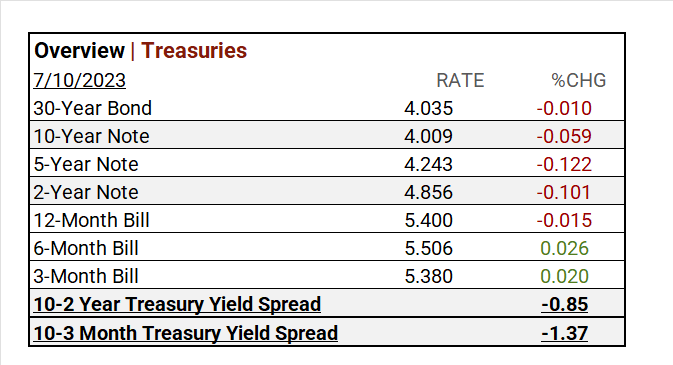

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: Helen of Troy Ltd (HELE), WD-40 (WDFC), PriceSmart (PSMT)

- – Miss: E2open Parent Holdings (ETWO)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Sociedad Quimica y Minera (SQM)

Economic Data

US

- Wholesale inventories; period May, act -0.2%, fc -0.2, prior -0.1%

- Mannheim used vehicle value index; Wholesale used-vehicle prices decreased 4.2% in June from May, down 10.3% from a year ago.

- Fed Vice Chair Barr; proposes new capital requirements for banks with $100 billion or more in assets, down from the current threshold of $700 billion.

News

Company News/ Other

- Chinese ride-hailing giant Didi narrows losses in first quarter on back of improved demand as domestic competition heats up – SCMP

- Shein Takes on Amazon in the Business of Selling Everything – WSJ

Energy/ Materials

- DNO Jumps After Biggest Gas Discovery in Norway in a Decade – Bloomberg

Central Banks/Inflation/Labor Market

- Banks’ Newest Fed Headache: Nonstop Instant Payments – WSJ

- Powell Haunted by Repo Crisis as Fed Aims to Cut Balance Sheet – Bloomberg

- Analysis: Yen May Weaken Further as Interest Rates Diverge – WSJ

Asia/ China