MARKETS TODAY July 11th, 2023 (Vica Partners)

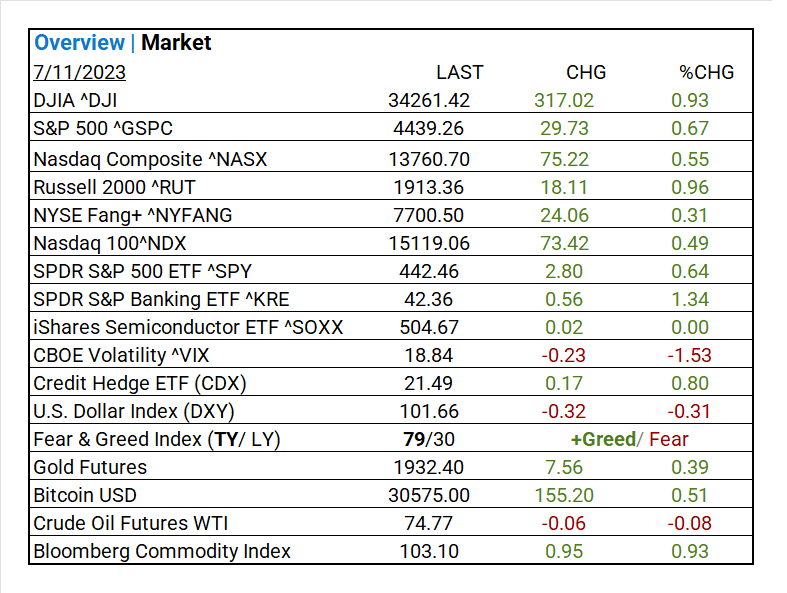

Overnight/US Premarket, Asian markets finished higher, Hong Kong’s Hang Seng +0.97%, China’s Shanghai Composite +0.55%, Japan’s Nikkei 225 +0.04%. European markets finished higher, France’s CAC 40 +1.07%, Germany’s DAX +0.75%, London’s FTSE 100 +0.12%. S&P futures were trading at +0.1% above fair value.

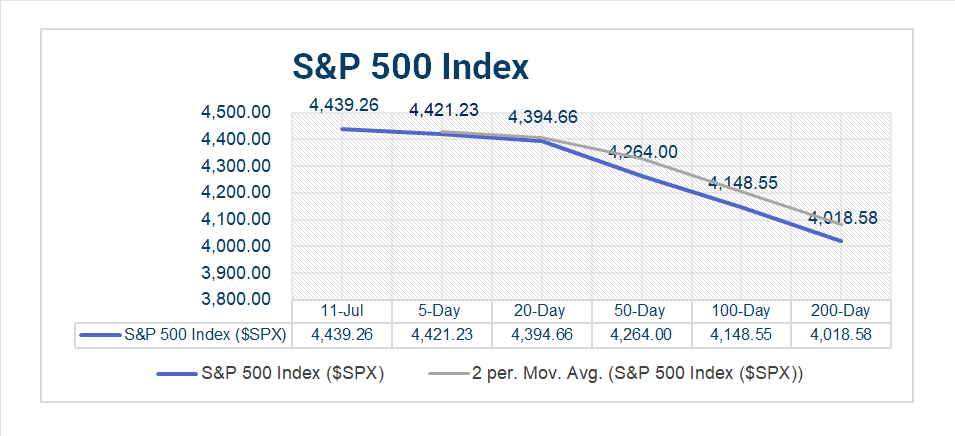

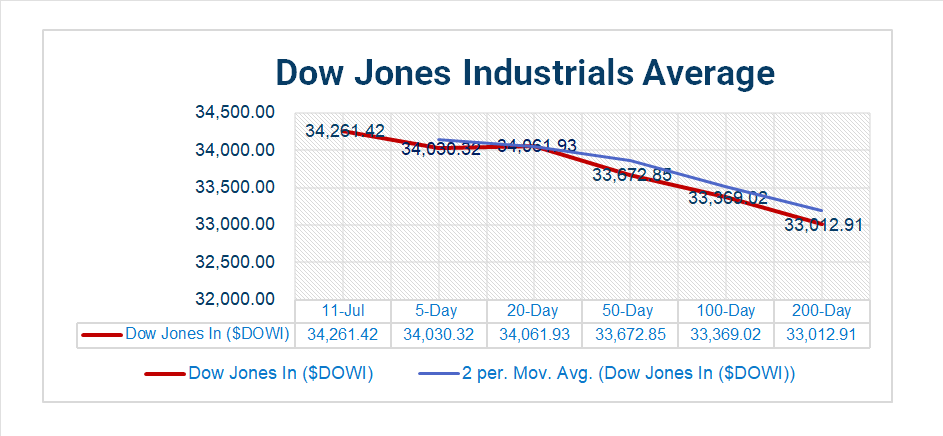

Today US Markets finished higher, S&P 500 +0.67%, DOW +0.93%, NASDAQ +0.55%. 10 of 11 S&P 500 sectors advancing: Energy +2.20% outperforms/ Health Care 0.00% lags. On the upside, DOW leads majors, Russell 2k, S&P Banking ETF ^KRE, IPO’S, Front End Treasuries Yields, Gold, Bitcoin, Bloomberg Commodity Index. In economic news, the NFIB Business Optimism Index with a beat as it reached a 7-month high in June.

Takeaways

- S. small businesses more optimistic

- DOW +0.93% leads majors, Russell 2k +0.96%

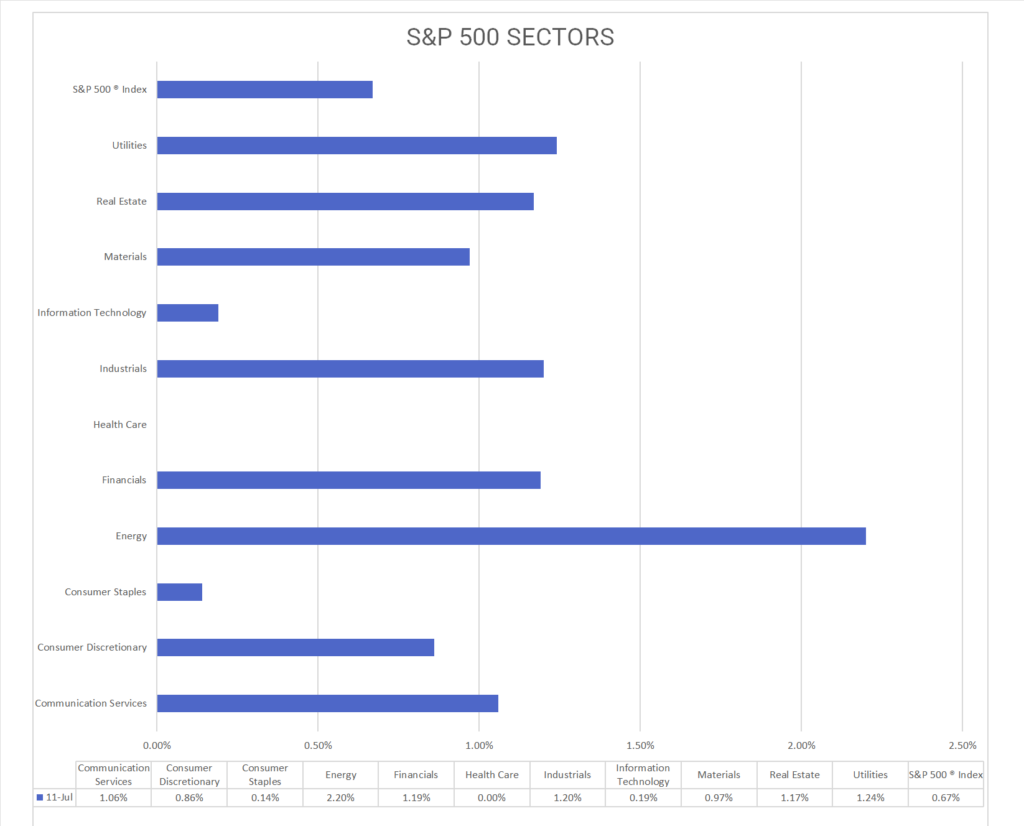

- 10 of 11 S&P 500 sectors advancing: Energy +2.20% outperforms/ Health Care 0.00% lags

- S&P Banking ETF ^KRE +1.34%

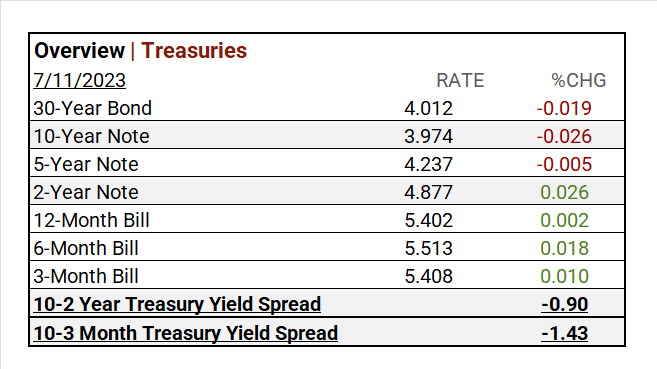

- Front-end yields rise

- Nordic Semiconductor (NDCVF) with earnings beat

- Pivotal CPI data on Wednesday

- Q2 earnings session kickoff on Friday

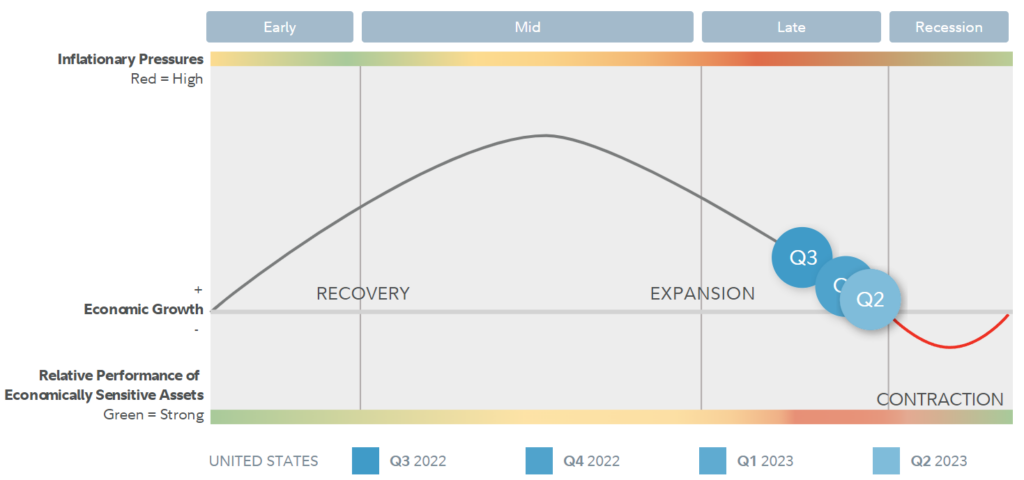

Pro Tip (reiterate): The 52 economists surveyed by the Wall Street Journal each month predicted that the economy would move into a recession in Q3 of 2008. However, in Sept, the last month Q3, the average 52 economists forecast continuing growth for Q3, Q4 of 2008.

Sectors/ Commodities/ Treasuries

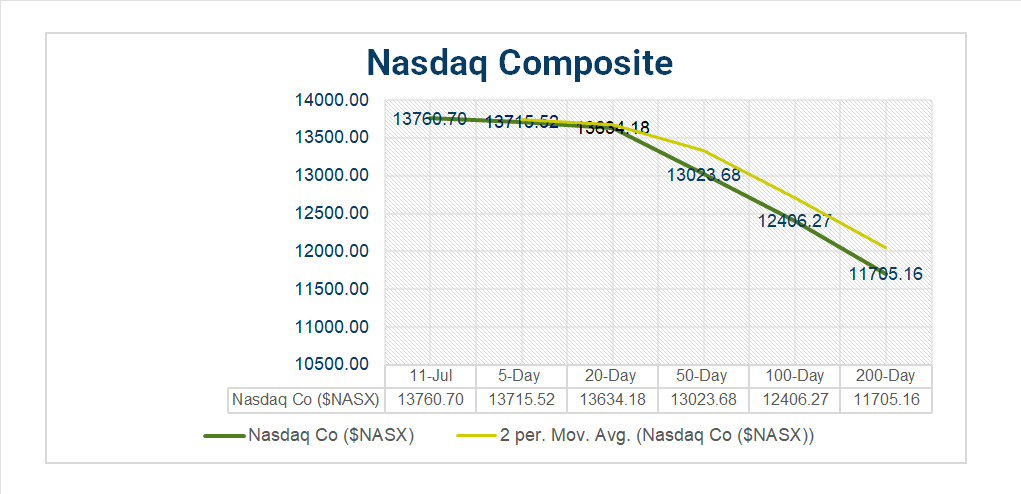

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 10 of 11 S&P 500 sectors advancing: Energy +2.20% outperforms/ Health Care 0.00% lags.

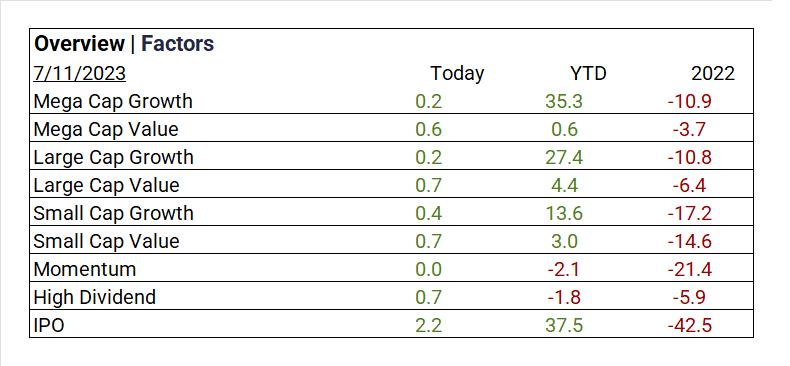

Factors

US Treasuries

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Lithium Miners. Nasdaq 100^NDX 14,500 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. We continue to emphasize business quality and strength of balance sheet for all investments.

Notable Earnings Today

- +Beat: Nordic Semiconductor (NDCVF)

- – Miss: E2open Parent Holdings (ETWO)

- – Pending: Commer Intl Bank (CMGGF)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Sociedad Quimica y Minera (SQM), Nordic Semiconductor (NDCVF)

Economic Data

US

- Consumer Credit Change; act $7.24B, fc $20.25B, prior $20.32B

- NFIB optimism index; period June, act 91, fc 89.6, prior 89.4act -0.2%, fc -0.2, prior -0.1%

News

Company News/ Other

- Amazon’s Prime Day to Test Consumer Demand – WSJ

- The Next Challengers Joining Nvidia in the AI Chip Revolution – WSJ

Energy/ Materials

- China Controls Minerals That Run the World—and It Just Fired a Warning Shot at U.S. – WSJ

- ESG Debate Finds a Few US Politicians Open to Frank Discussions – Bloomberg

Central Banks/Inflation/Labor Market

- Bank of Canada Set to Hike Rates Again Amid Inflation Slog – Bloomberg

- Historic Rate Increases Leave Some on Wall Street Wanting More – WSJ

Asia/ China