MARKETS TODAY July 24th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 gained 1.23%, Hong Kong’s Hang Seng was down 2.13% and Hong Kong’s Hang Seng was off 0.11%.

European markets finished mixed, London’s FTSE 100 gained 0.19%, Germany’s DAX up 0.08% and France’s CAC 40 lost 0.07%. S&P futures opened trading at 0.16% above fair value.

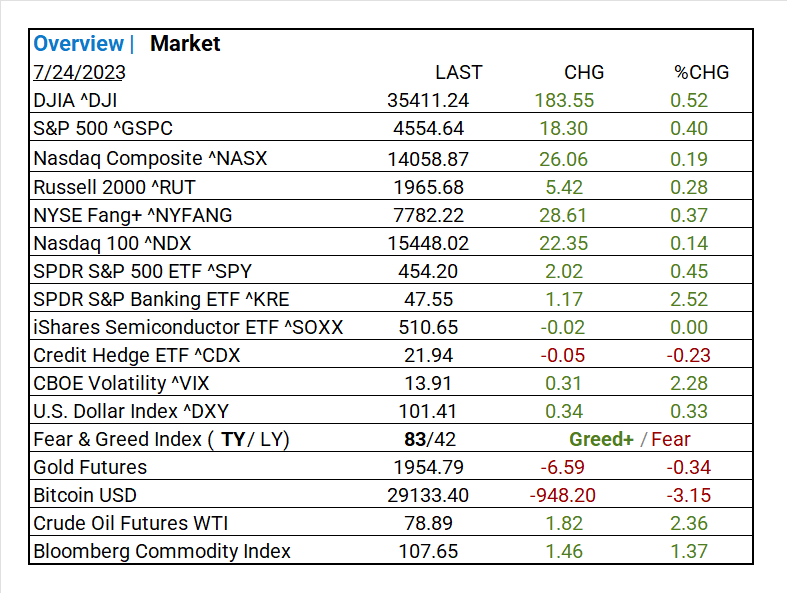

Today US Markets finished higher, the DOW gained 0.52%, S&P 500 was up 0.40% and the NASDAQ rose 0.19%. 9 of 11 S&P 500 sectors advancing: Energy 1.66% outperforms/ Utilities -0.28% lags. On the upside, NYSE Fang+, Banks, SPDR S&P Banking ETF ^KRE, Factor/ High Dividends, Metals & Mining, Energy Equipment & Services, US Treasuries, U.S. Dollar Index, Oil and the Bloomberg Commodity Index.

In economic news, U.S. Manufacturing PMI was a solid beat while Services PMI was a BIG miss indicating contraction.

Takeaways

- US. Manufacturing PMI beat, Services BIG miss

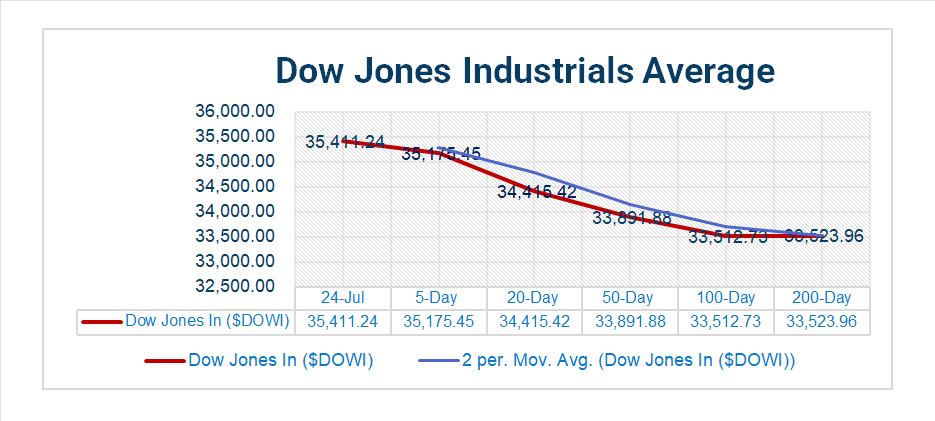

- DOW gained 0.52% and lead majors

- 9 of 11 S&P 500 sectors advancing: Energy 1.66% outperforms/ Utilities -0.28% lags

- SPDR S&P Banking ETF ^KRE +2.52%

- Metals & Mining +2.09%, Energy Equipment & Services +2.04%

- Big-cap Chinese technology names up >4%

- Oil Prices and Bloomberg Commodity Index jump on hike expectations

- >40% of SP500 companies report earnings this week

- Cadence Design (CDNS), NXP (NXPI) w/ earnings beats

- Nucor (NUE), Alexandria RE (ARE) w/ earning misses

- Commercial Real-Estate loans are defaulting

- Markets await Fed .25-point July hike

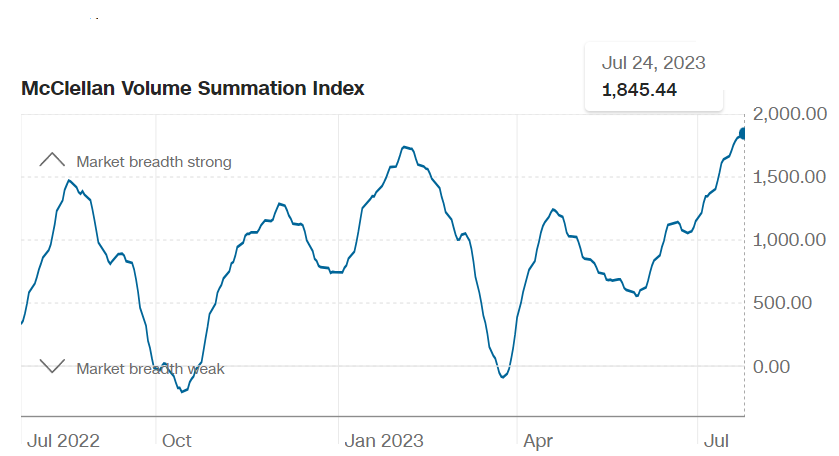

Pro Tip: McClellan Volume Summation Index, measures the volume, of shares on the NYSE that are rising compared to the number of shares that are falling. Higer numbers indicate positive sentiment.

Sectors/ Commodities/ Treasuries

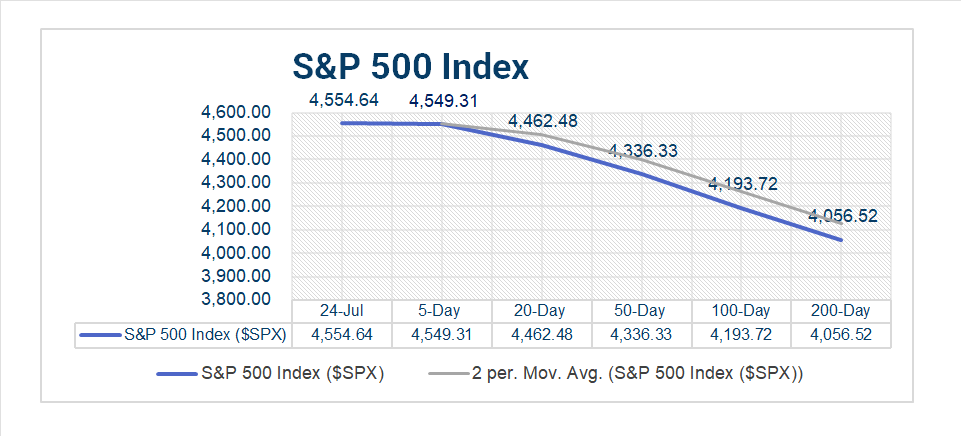

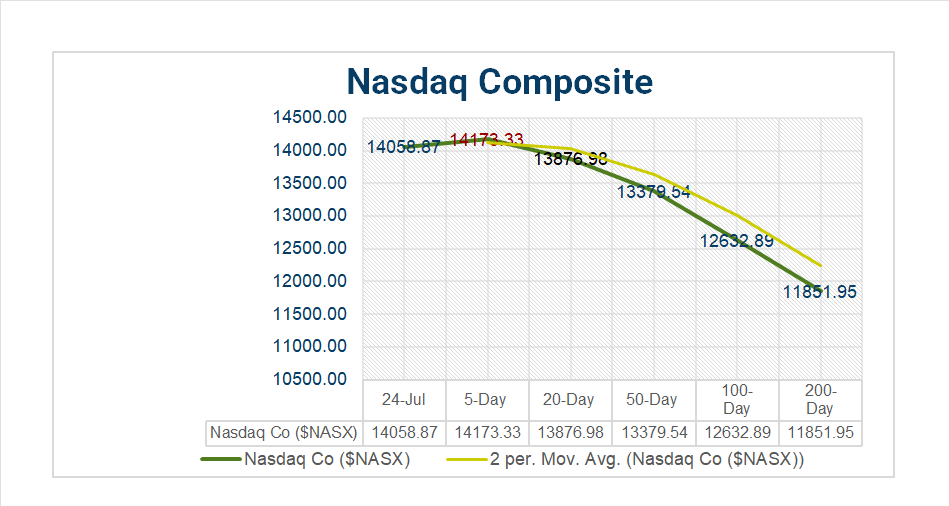

Key Indexes (5d, 20d, 50d, 100d, 200d)

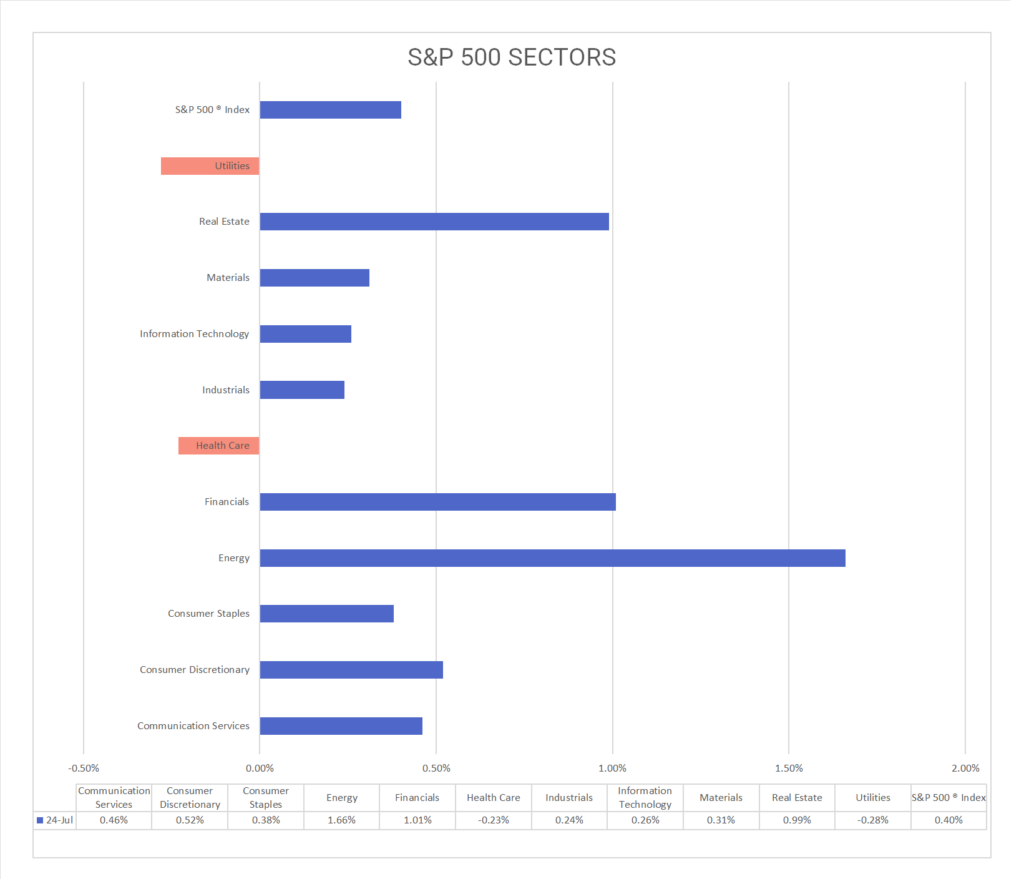

S&P Sectors

- 9 of 11 S&P 500 sectors advancing: Energy +1.66%, Financials +1.01% outperform/ Utilities -0.28%, Heath Care -0.23% lag.

- Metals & Mining +2.09%, Energy Equipment & Services +2.04%, Oil, Gas & Consumable Fuels +1.62%, Banks +1.77%, Specialized REITs +1.77%, Leisure Products +1.60%,

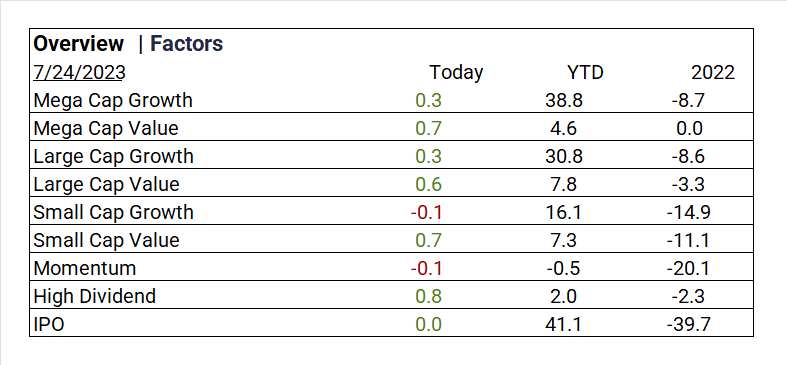

Factors

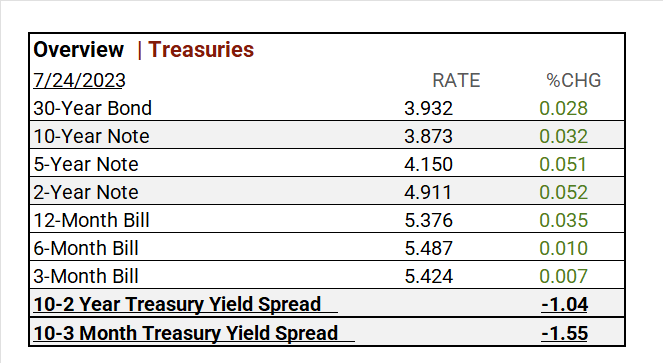

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

This Week TopLine Earnings (ending 7/28)

- >17% of S&P 500 names have reported, 40% more will release earnings this week.

- To date BIG picture, credit resilience, deposit stabilization, travel demand

- Technology sector, mega caps reporting META, MSFT, GOOGL

Notable Earnings Today

- +Beat: Cadence Design (CDNS), NXP (NXPI), Ryanair ADR (RYAAY), Brown&Brown (BRO), F5 Networks (FFIV), Medpace Holdings (MEDP), Range Resources (RRC)

- – Miss: Nucor (NUE), Alexandria RE (ARE), Domino’s Pizza Inc (DPZ), Bank of Hawaii (BOH), Crown (CCK), Cleveland-Cliffs (CLF), Whirlpool (WHR)

Economic Data

US

- S&P “flash” S. manufacturing PMI: period July, act 49.0, fc 46.7, prior 46.3

- S&P “flash” U.S. services PMI: period July, act 52.4. fc 54.0, prior 54.4

Vica Partner Guidance July ’23, (updated 7-20)

- Q3/4 highlighting Energy Equipment & Services, Banks, Passenger Airlines, Metals & Mining. Real Estate Management & Development, Specialized REITs. Defensives Health Care Providers & Services and Gas Utilities also have upside. Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US.

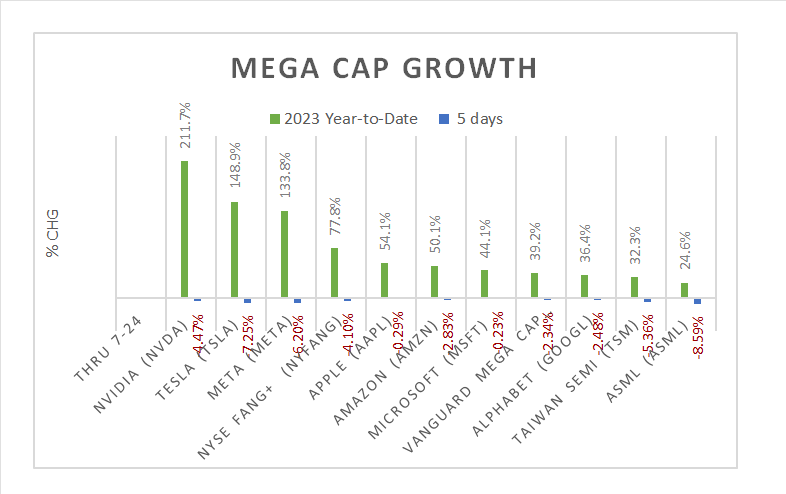

- Cautionary, current valuations in question as Mega and Large Cap Growth moderating, Banks shortly may be overpricing. Current indicators are recessionary. Credit default swap (CDS) to pick-up through Q4/Q1.

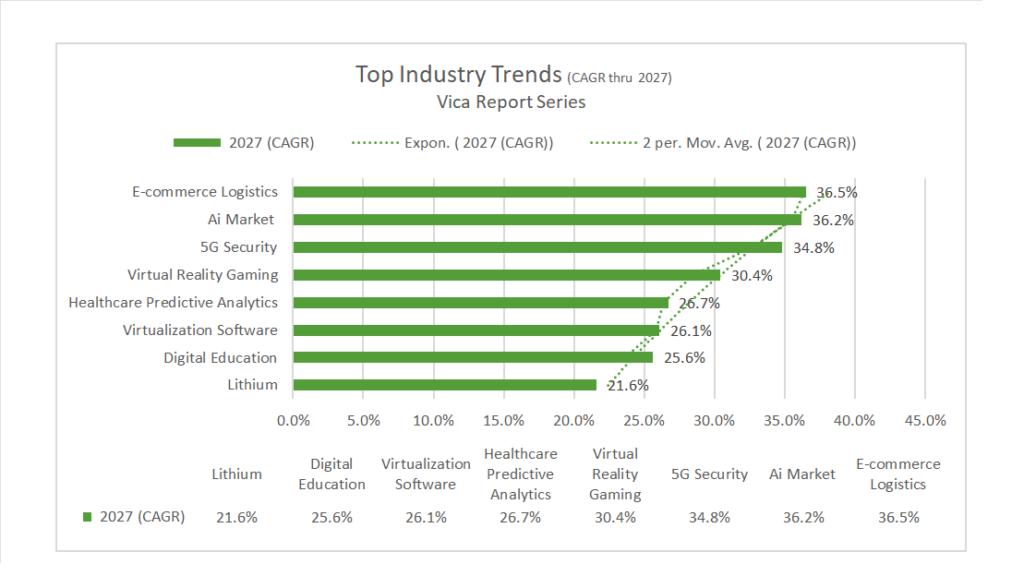

- Longer Term, Nasdaq 100^NDX companies will continue to outperform in the longer term along with Semiconductor Equipment. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

News

Company News/ Other

- Tesla Looks Abroad to Keep Growth Going as US Revenue Plateaus – Bloomberg

- ASML Investors Eye Long Term as Stock Wavers on Chip-Sector Slump – Bloomberg

Energy/ Materials

- China Dominates Solar. Does the U.S. Stand a Chance? – WSJ video

- Russia Defies Sanctions by Selling Oil Above Price Cap – WSJ

Central Banks/Inflation/Labor Market

- Bank Regulators Urge Flexibility in Commercial Real-Estate Loan Workouts as Defaults Grow – WSJ

- One Year After Liftoff, ECB Grapples With Endgame for Rate Hike – Bloomberg

Asia/ China

- How Janet Yellen’s women’s power lunch exposed China’s divide over women’s rights – South China Post

- China’s economic chiefs open new doors to private investors to bring sector back to life – South China Post