MARKETS TODAY April 11th, 2023 (Vica Partners)

Good Tuesday Evening,

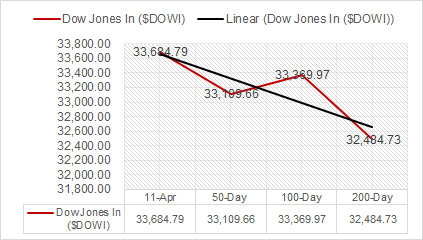

Yesterday, Key Indices were mixed but closed moderately higher, Dow and Russell 2000 led. Cyclicals are beginning to trend! 6 of 11 of the S&P 500 sectors were higher/ Energy and Materials outperform, Communication lagged. Bitcoin looking to break $30k and Gold at 2K. In economic news, Wholesale Inventories rose less than expected in February.

Overnight, Asian markets finished mixed as the Nikkei 225 gained 1.05% and the Hang Seng rose 0.57%. The Shanghai Composite lost 0.05%. Premarket, European markets finished higher with shares in France leading the region. The CAC 40 was up 0.89%, London’s FTSE 100 up 0.57% and Germany’s DAX up 0.37%. S&P 500 US futures were trading in line with fair-value at US market opening.

US Markets today, Key Indices closed mostly lower, Dow and Russell 2000 finished up for a 2nd consecutive day. 9 of 11 of the S&P 500 sectors were higher/ Materials and Energy, Information Technology lags. Bitcoin >$30K and Gold >2K. In economic news, (NFIB) Small Business Optimism Index the headline number for March came in at 90.1, down 0.8 from the previous month as small business optimism slightly declines.

Takeaways

- Markets muted, await bank earnings/ inflation data this week

- Dow and Russell 2000 lead for 2nd consecutive day

- NY FANG+ drops 1.45%

- Materials and Energy outperform

- iShares Semiconductor ETF ^SOXX declines

- Bitcoin Rallies Above $30,000

- Gold holds $2K

Pro Tip: Never sell a dull one, and when it goes quiet in tight ranges, don’t be short!

Sectors/ Commodities/ Treasuries

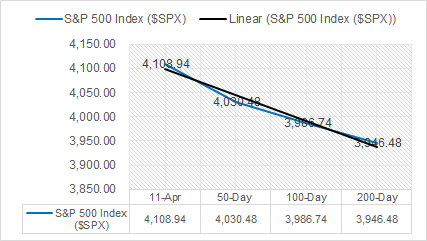

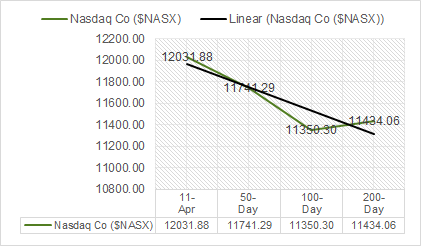

Key Indexes (50d, 100d, 200d)

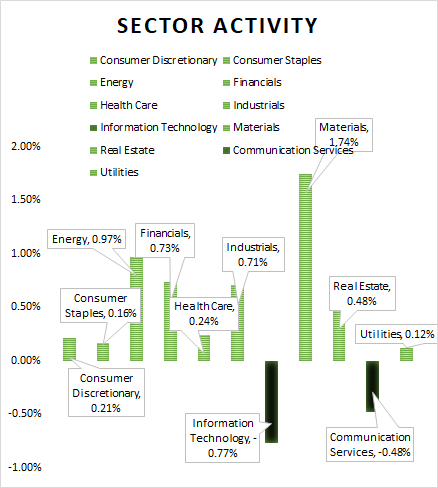

S&P Sectors

- 9 of 11 of the S&P 500 sectors were higher / Materials +1.74%, Energy + 0.97%, outperform, Information Technolgy -0.77%, Communication Services -0.48% underperform.

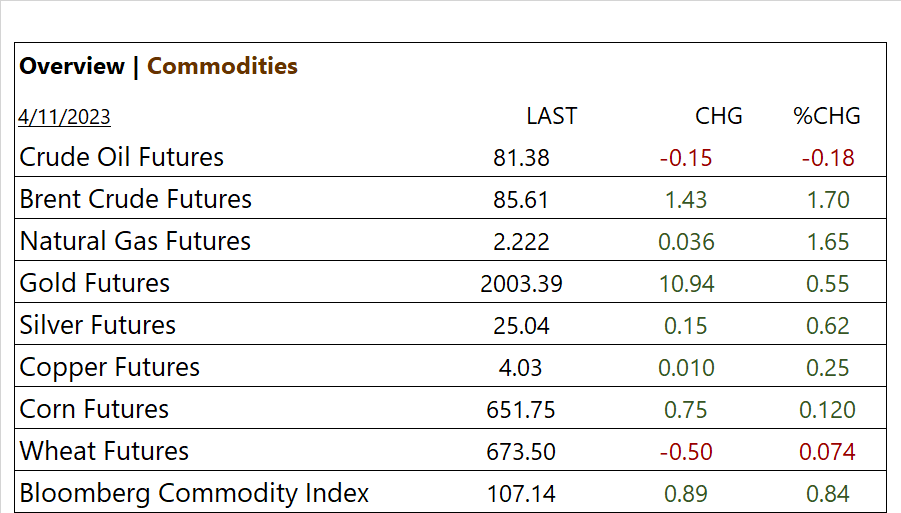

Commodities

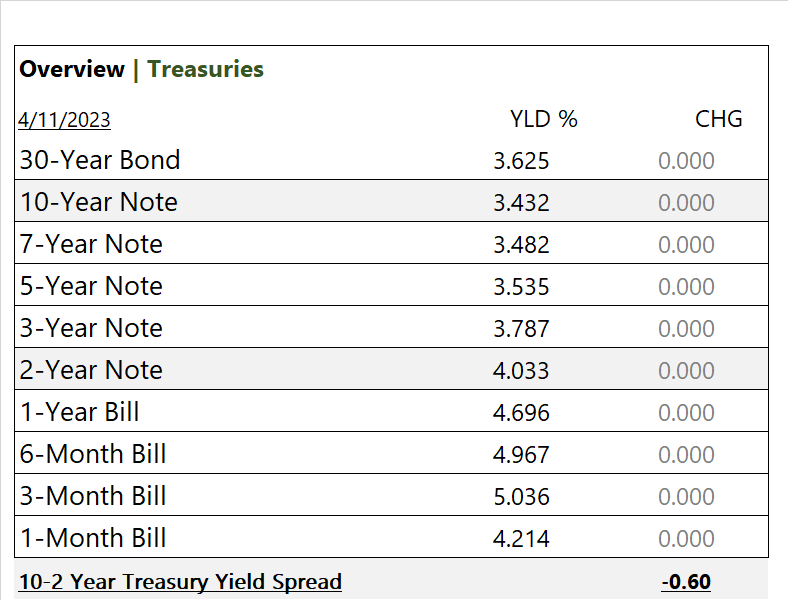

US Treasuries

Notable Earnings This Week (+beat/ – miss and bold denotes today)

- + PriceSmart (PSMT), Greenbrier (GBX), Albertsons (ACI), Royal Gold (RGLD)

- – Tilray (TLRY), CarMax (KMX)

- * Strong support – Qualcomm (QCOM), Vale (VALE), Rio Tinto (RIO), Analog Devices (ADI), Occidental Petroleum (OXY), United Health Care (UNH), Humana (HUM), Centene (CNC), Merck (MRK), OC (Owens Corning), Micron (MU). Halliburton (HAL)

Economic Data

US

- NFIB optimism index; period March, act 90.1, fc 89.0, prev. 90.9

Summary – NFIB’s Small Business Optimism Index decreased 0.8 points in March to 90.1, marking the 15th consecutive month below the 49-year average of 98. Twenty-four percent of owners reported inflation as their single most important business problem. Forty-three percent of owners reported job openings that were hard to fill, down four points from February and remaining historically very high.

News

Company News/ Other

- Exxon Deal Hunt Signals Possible Shale M&A Wave – WSJ

- Exclusive: General Motors moves deeper into mining with EnergyX lithium investment – Reuters

- AI: China tech giant Alibaba to roll out ChatGPT rival – BBC

Central Banks/Inflation/Labor Market

- Ueda, Kishida Agree No Need to Revise Government-BOJ Accord for Now – Bloomberg

- Fed Officials Signal Divide Over Whether to Hike Rates Again – Bloomberg

China

- Morgan Stanley plans China futures business – Funds Global Asia