MARKETS TODAY Dec 27 (Vica Partners)

DOW (^DJI) 33,242 (+37), S&P 500 (^GSPC) 3,829 (-16), Nasdaq (^IXIC) 10,353 (-144), Russell 2000 (^RUT) 1,750 (-11), NYSE FANG+ (^NYFANG) 4,316 (-137), Brent Crude $84.44/barrel (+$0.11), Gold $1,810/oz (+$9), Bitcoin 16.6k (-52)

Session Overview

The Dow Jones Industrial Average was up 0.11% on Tuesday, closing at 33,241.56. The best performing sectors were the Energy and Materials sectors, up 0.77% and 0.54% respectively. In energy markets, oil prices continued to rise with Brent and West Texas Intermediate Crude were up as high as 2% in today’s session. Tesla stock fell to a two-year low, closed at $109.10 on Tuesday, down $14.05, or 11.41%. It’s the lowest close since Aug. 2020.

Historically the seven-sessions from Christmas and New Year weeks typically sees stocks move higher.

Technicals/ Sector Performance/ Yields+

6 of 11 of S&P 500 Sectors higher; the best performing sectors were the Energy and Materials sectors, up 0.77% and 0.54% respectively. Information Technology and Communications were the laggards declining 0.93% and 0.33% respectively.

Yields rose today: US – 2yr to 4.349%, 5yr to 3.95%, 10yr to 3.847%, 30yr to 3.92%

Greed Index Rating 38/ Fear

U.S Economic News

- The S&P CoreLogic Case-Shiller price index; S. home prices fell 0.5% in October from September, the fourth consecutive decline month over month. All 20 cities in the index posted monthly declines. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.3% as compared with 3.05% last year.

Other Asset Classes:

- CBOE Volatility Index (^VIX): -0.78 to 21.65

- USD index: +$0.14 to $104.33

- Oil prices after hours – Brent: +0.13% to $84.44, WTI: +0.14% to $79.64,

Nat Gas: -5.36% to $5.0

- Gold: +0.49% to $1,810.55, Silver: +0.46% to $23.96, Copper: +0.59% to $3.86

- Bitcoin: -0.31% to $16.6k

In world news

- Oil prices rising on China’s reopening news. China is the source for +45% of the projected growth in daily demand in 2023.

Vica Momentum Stock Report

Consol Energy (CEIX) $CEIX. (Momentum Grade B) (Value A) (Growth A+) 50 Day Average +6.71%, 100 Day Average +18.66%, 200 Day Average +117.29%, Year to Date 218.52%

CONSOL Energy Inc. is a producer and exporter of high-Btu bituminous thermal and crossover metallurgical coal. It owns and operates productive longwall mining operations primarily in the Northern Appalachian Basin.

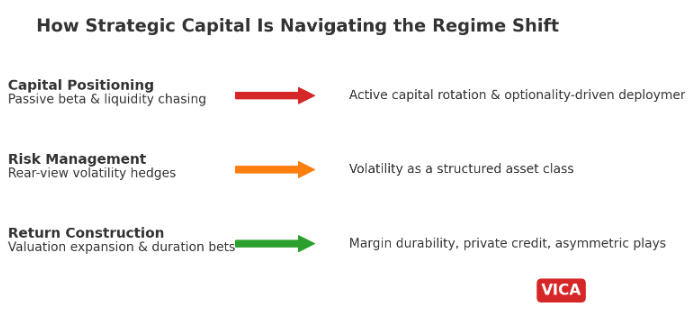

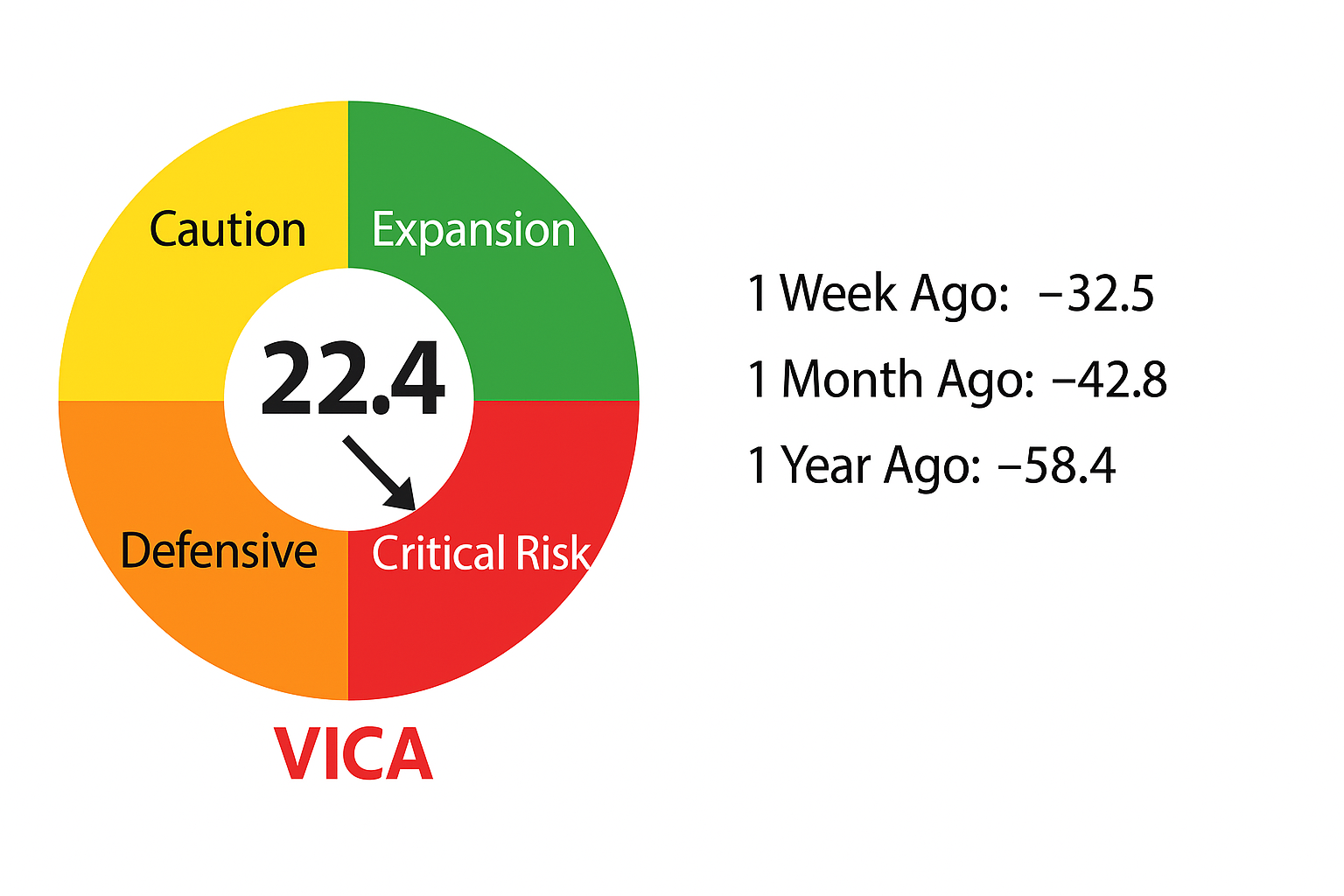

Market Outlook

Market Outlook and updates posted at vicapartners.com