MARKETS TODAY April 24th, 2023 (Vica Partners)

Last Week, Indices mostly unchanged, the S&P 500 -0.09% the smallest weekly range in 19 months. We did see broader market upsides as the Volatility Index @15 week low while greed continues to dominate buying sentiment. Earnings summary to date, 18% of S&P 500 companies reported with 75% beating estimates within 6%. S&P 500 Financials have beaten estimates 60%, Industrial and Consumer results good, Housing market remains resilient, Tech/ semiconductor helped by forward guidance.

Overnight, Asian markets finished mixed, Nikkei 225 +0.10%, Shanghai Composite -0.78% and Hang Seng -0.58%. European markets finished lower, DAX -0.11% France’s CAC 40 – 0.04%, London’s FTSE 100 – 0.02%. Premarket, S&P 500 US futures were trading unchanged.

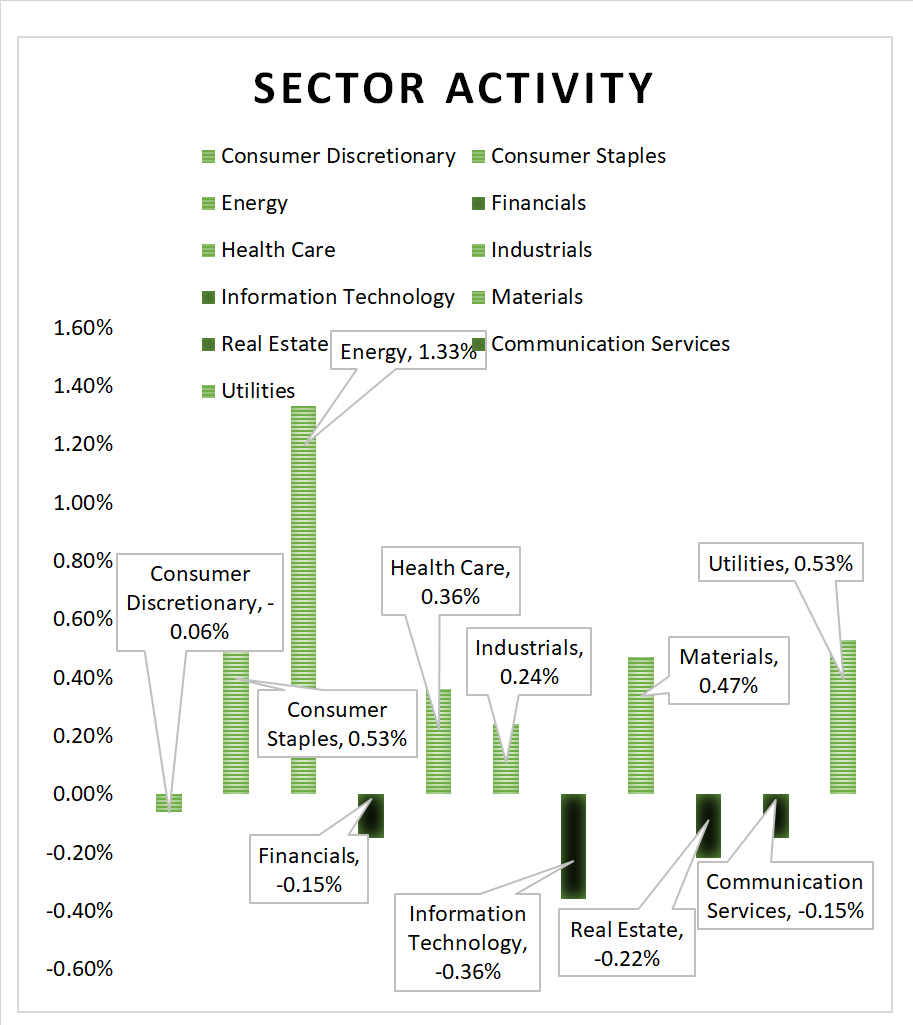

US Markets today, finished mixed with DOW leading. 6 of 11 of the S&P 500 sectors finished higher, Energy outperforms/ Information Technology lags. Treasury yields, USD Index, Bitcoin all drop. Oil, the Bloomberg Commodity Index and Gold rise. In economic news, Chicago Fed National Activity Index was unchanged in March. Dallas Fed Index declined from March to April indicating that the manufacturing segment remained under pressure and missing analyst expectations

Takeaways

- Dallas Fed Index decline, recessionary marker

- Coca-Cola (KO) earnings beat fuels DOW gain today

- Energy outperforms/ Information Technology lags

- The Cboe Volatility Index remained below 17

- SPDR S&P Regional Banking ETF ^KRE down <1%

- Investor sentiment Greed

Pro Tip: Investing in individual stocks carries more risk than investing in stock indexes. Over the past decade, the S&P 500 index, delivered an annualized return of around 15% and SPY has delivered an annualized return of approximately 16.5%. As an exception, Apple, Amazon, and Google have delivered annualized returns ranging from 20% to over 30%.

Sectors/ Commodities/ Treasuries

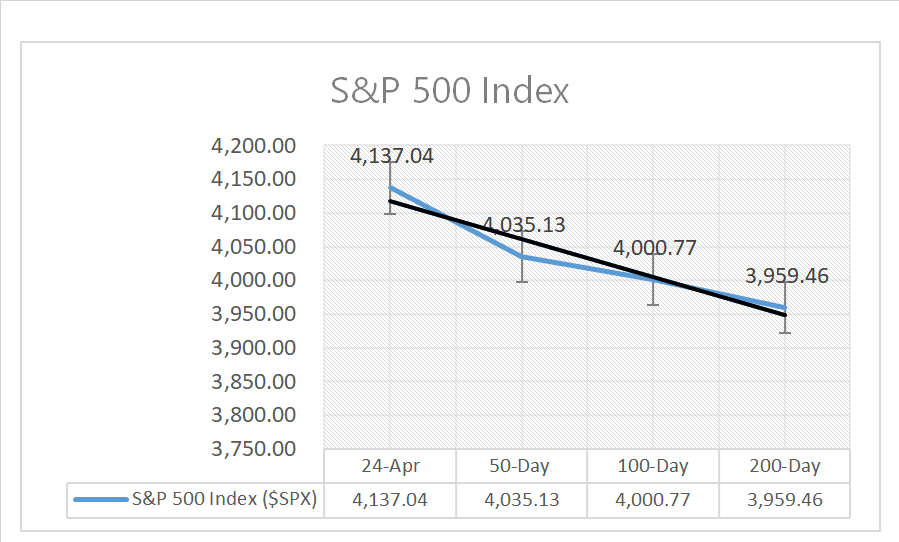

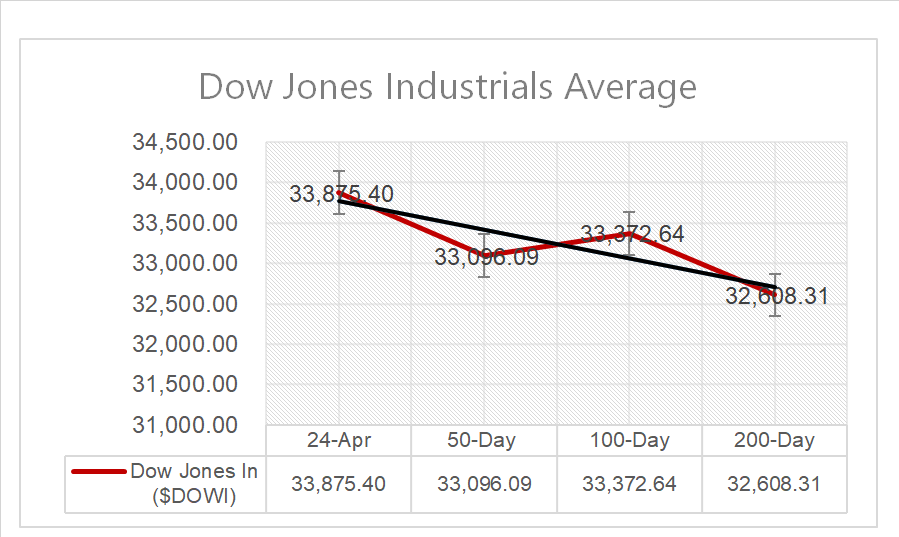

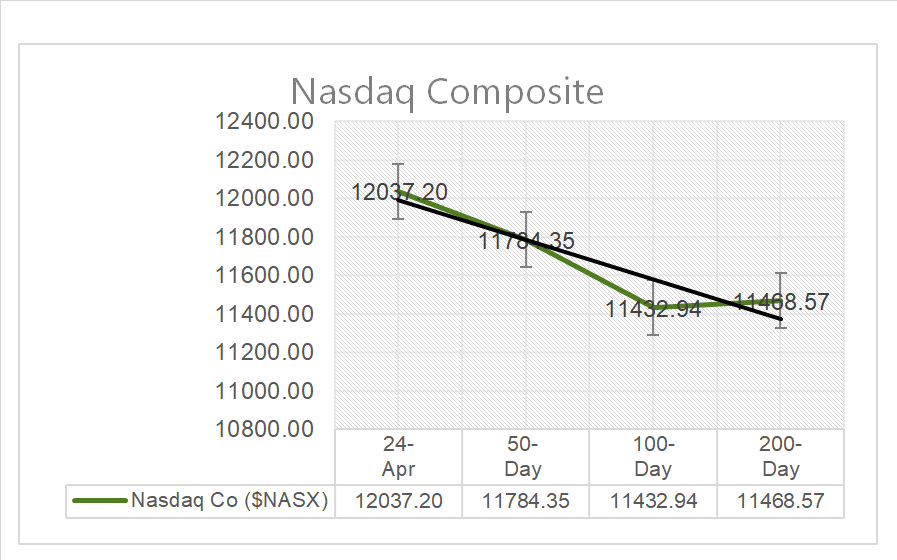

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors finish higher, Energy +1.33% outperforms/ Information Technology -0.36% underperforms

Commodities

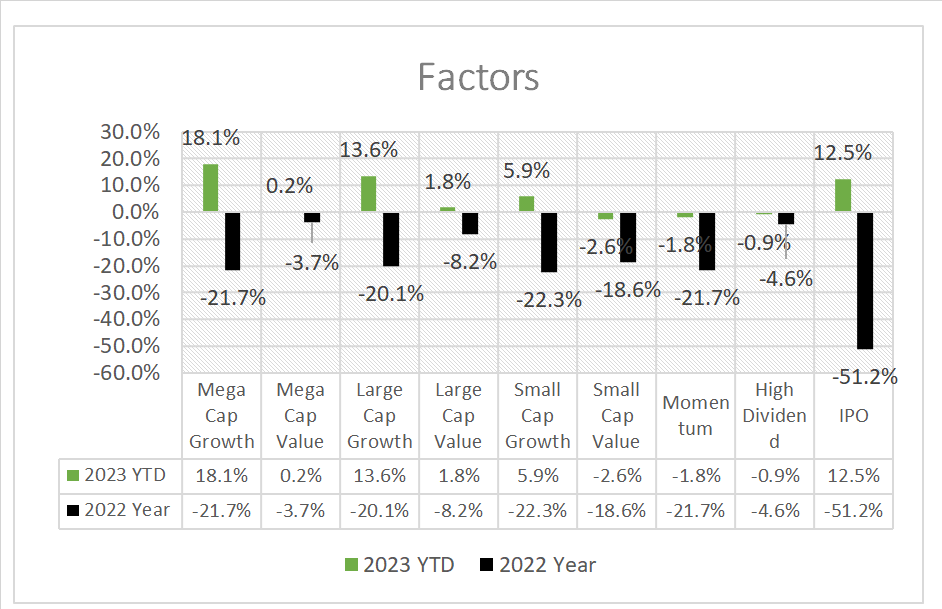

Factors

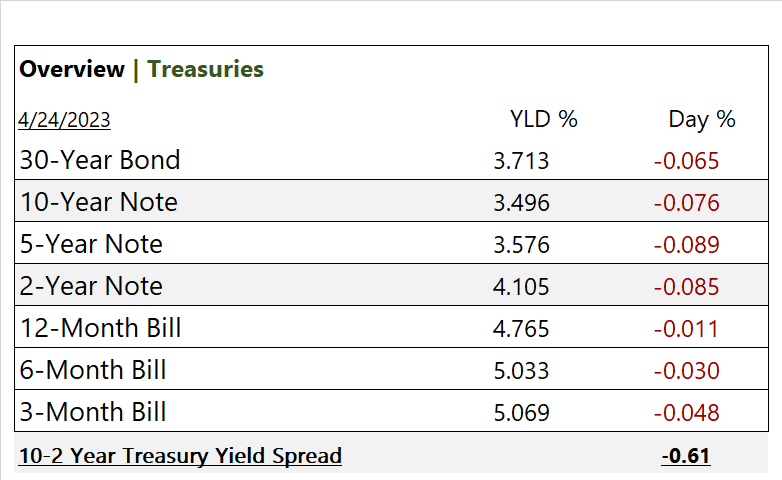

US Treasuries

Notable Earnings Today

- +Beat: Coca-Cola (KO), Canadian National Railway (CNI), Cadence Design (CDNS), Ameriprise Financial (AMP), Tsingtao Brewery Co (TSGTY) Koninklijke Philips ADR (PHG), Cleveland-Cliffs (CLF), Whirlpool (WHR)

- – Miss: Alexandria RE (ARE), Nidec (NJDCY), Packaging America (PKG), Crown (CCK), First Republic Bank (FRC), Bank of Hawaii (BOH)

- * Strong support – NVIDIA (NVDA), QUALCOMM (QCOM), Analog Devices (ADI), Amazon (AMZN), Cintas Corp (CTAS), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP), Coca-Cola (KO)

Economic Data

US

- Chicago Fed March national activity index; -0.19 vs -0.19 prior

- Dallas Fed Manufacturing; -15.7 in March to -23.4 in April, analyst consensus of -14.6

News

Company News/ Other

- Coca-Cola gets a lift from higher prices, steady demand – Reuters

- Tesla raises 2023 spending forecast as it races to ramp up output – Reuters

Central Banks/Inflation/Labor Market

- What a New Cold War Means for Central Banks – Bloomberg

China

- Exclusive: China guides banks to further cut deposit rates – sources – Reuters