MARKETS TODAY May 12th, 2023 (Vica Partners)

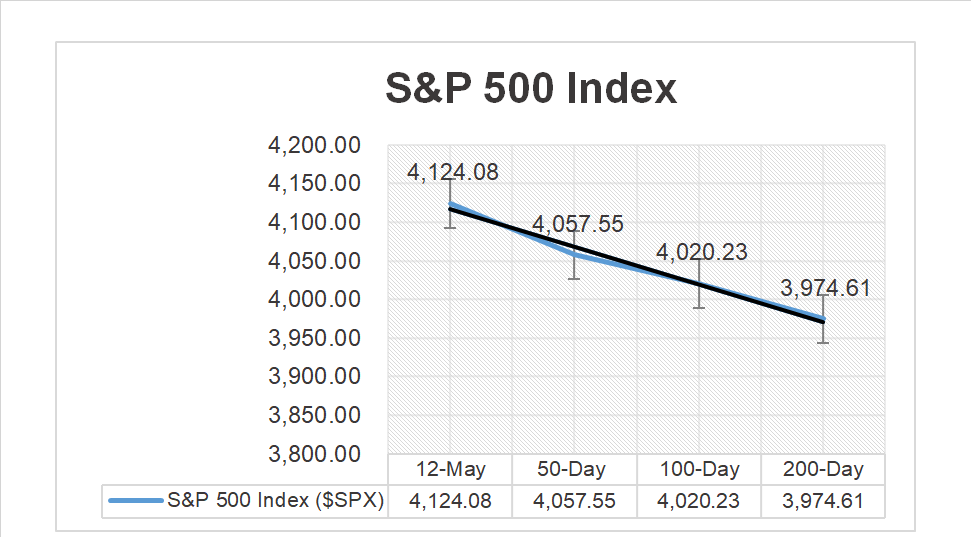

Yesterday, US Markets finished mixed S&P 500 -0.17%, DOW -0.66% and the Nasdaq +0.18%. 8 of 11 of the S&P 500 sectors lower: Materials and Energy underperformed/ Communication Services outperformed. Mega cap growth tech continued to gain with NY FANG+ 0.90%. Treasury Yields, Gold, Bitcoin and Oil all declined. In economic news, wholesale prices rose less than estimate, weekly unemployment claims came in higher.

Overnight/Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.90%, Shanghai Composite -1.12% and Hong Kong’s Hang Seng -0.70%. European markets finished higher, Germany’s DAX +0.46%, London’s FTSE 100 +0.42% and France’s CAC 40 +0.40%. US futures were trading at 0.3% above fair-value.

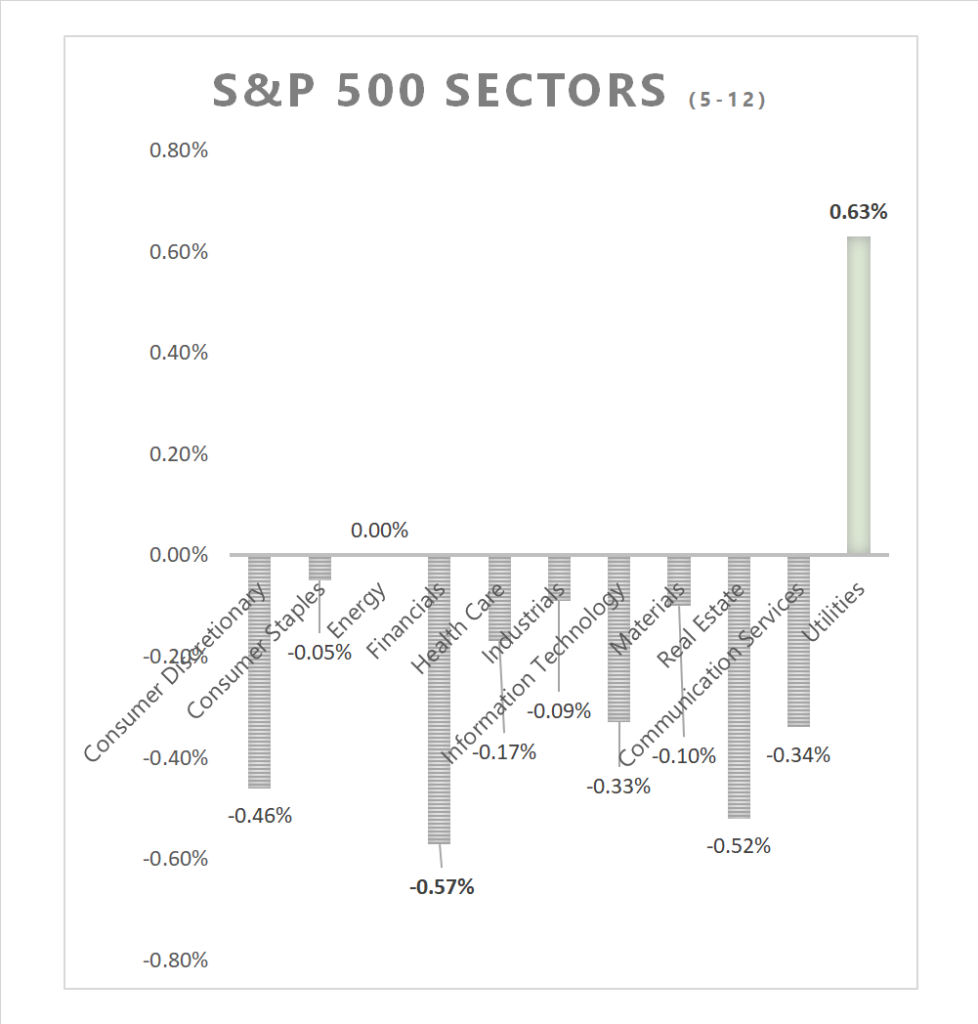

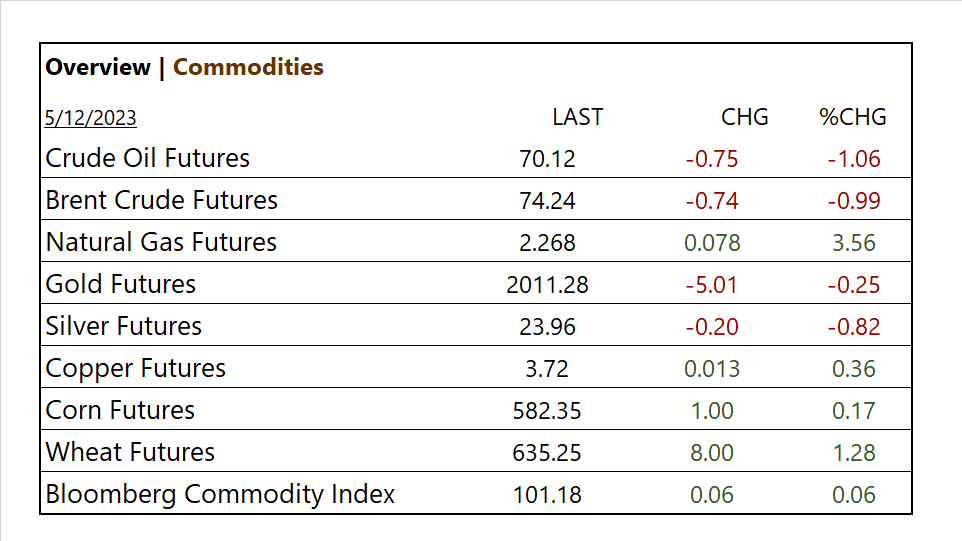

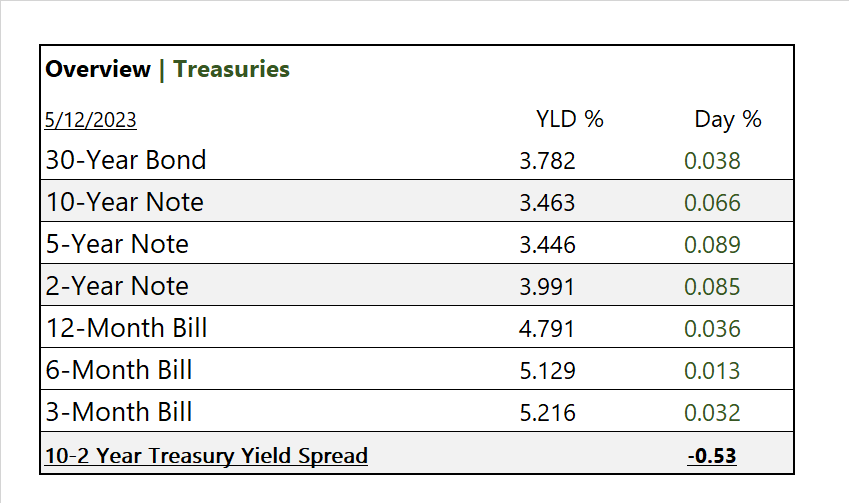

Today, US Markets finished marginally lower S&P 500 -0.16%, DOW -0.03% and the Nasdaq -0.35%. 9 of 11 of the S&P 500 sectors lower: Utilities +0.63% outperforms/ Financials -0.57% and Real Estate -0.52% lag. On the upside, Treasury Yields and the USD Index gained. Gold, Bitcoin and Oil all declined. In economic news, US Import Prices for April beat estimates while Export Prices in-line. Michigan Survey showed declining consumer sentiment.

Takeaways

- Michigan Consumer Survey weighs on market

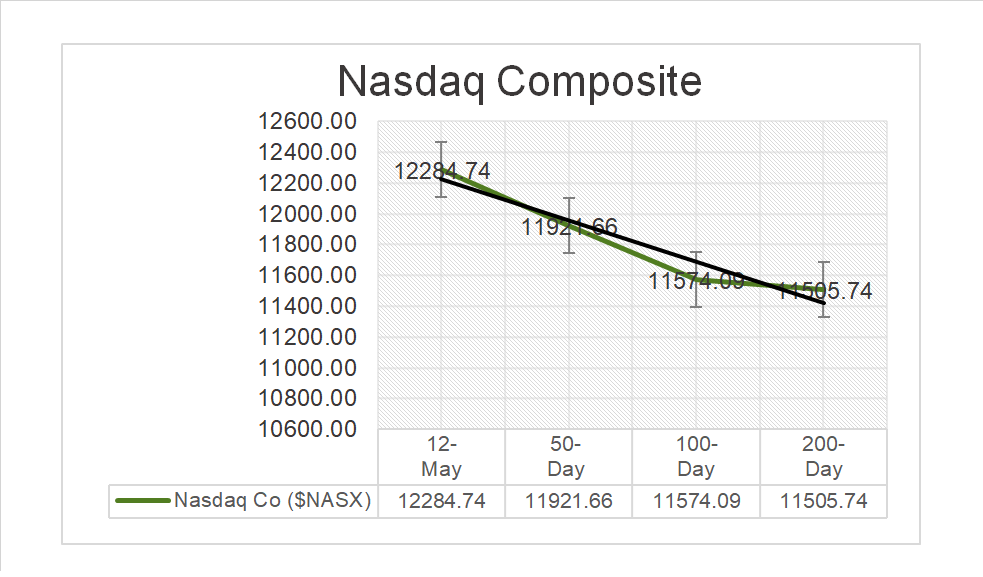

- Weekly performance, S&P 500 -0.31%, DOW -1.23% and the Nasdaq +0.43%

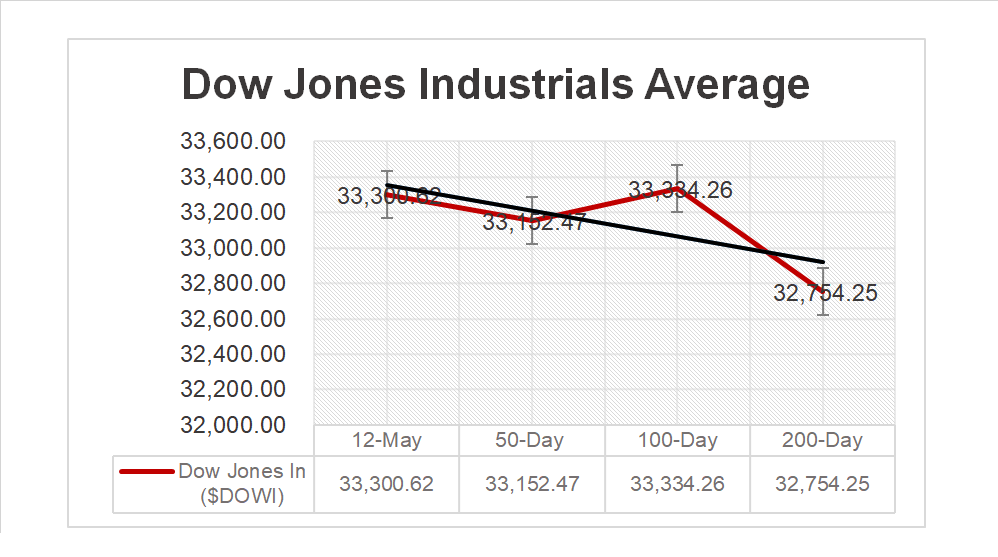

- DOW slips under 100 moving average

- 9 of 11 of the S&P 500 sectors finished lower: Financials underperform/ Utilities outperforms

- Mega cap growth declines

- Regional Banking SPDR S&P Banking ETF (KR) moderates +0.64%

- Nippon ADR (NTTYY) misses, Kubota ADR (KUBTY) beats earnings

- Debt ceiling is headline banter!

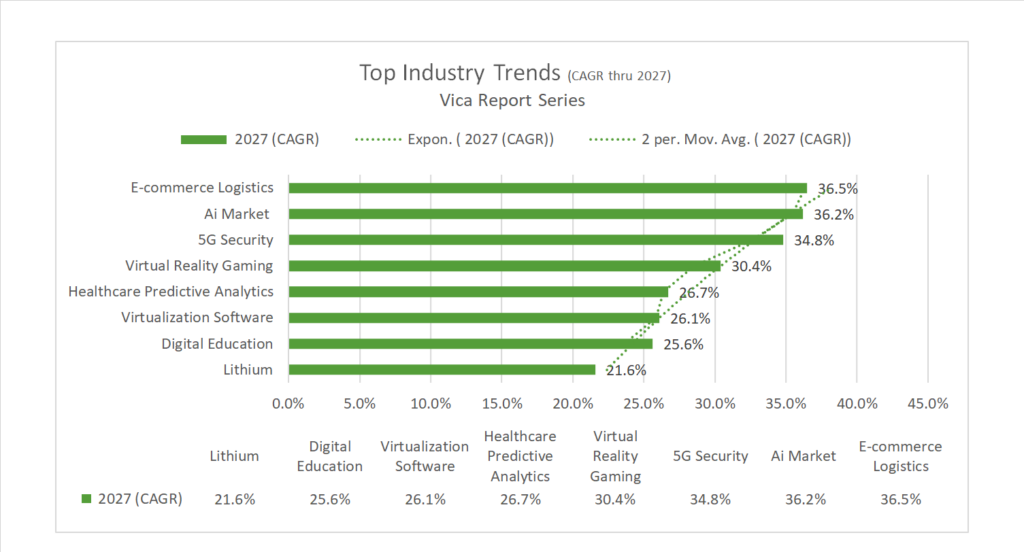

Pro Tip: The artificial intelligence market size is expected to grow from >US$89 billion in 2022 to >US$407 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 36.2% during the forecast period. Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%. More details in link above.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finish lower: Utilities +0.63% outperforms/ Financials -0.57% and Real Estate -0.52% lag.

Commodities

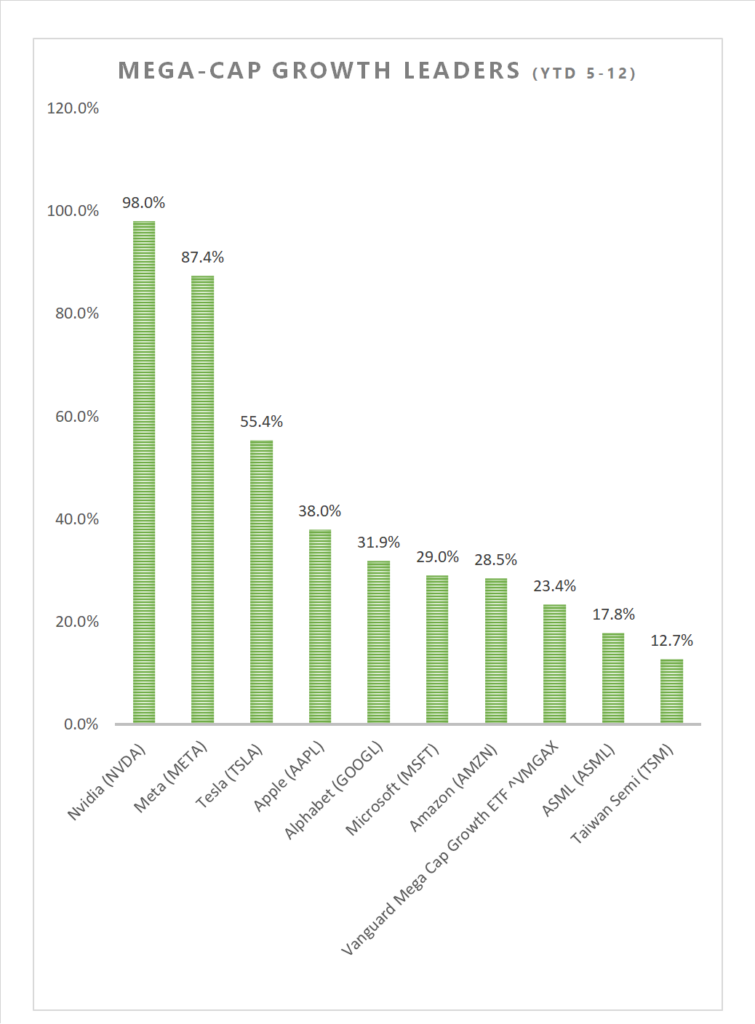

Factors/Mega Cap Growth (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Shiseido Company (SSDOY), Kubota ADR (KUBTY)

- – Miss: Nippon ADR (NTTYY), AngloGold Ashanti ADR (AU), Allianz ADR (ALIZY), Isuzu Motors (ISUZY), Rakuten ADR (RKUNY)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML),

Economic Data

US

- Import price index; period April, act 0.4%, fc 0.3%, prev. -0.6%

- Import price index minus fuel; period April, act 0. prev. -0.5%

- Consumer sentiment (preliminary); period May, act 57.7, fc 63.0, prev. 63.5

News

Company News/ Other

- Netflix Plans to Cut Spending by $300 Million in 2023 – WSJ

- Chinese tech giant Baidu embeds ChatGPT-like service on flagship search engine as global race to bring similar tools to market heats up – SCMP

Central Banks/Inflation/Labor Market

- Jim Bullard’s Speeches, Presentations and Commentary – SaintLouis Fed

- Surveys of Consumers Michigan – U Mich

- G7 finance chiefs debate reducing supply chain reliance on China – Reuters

China