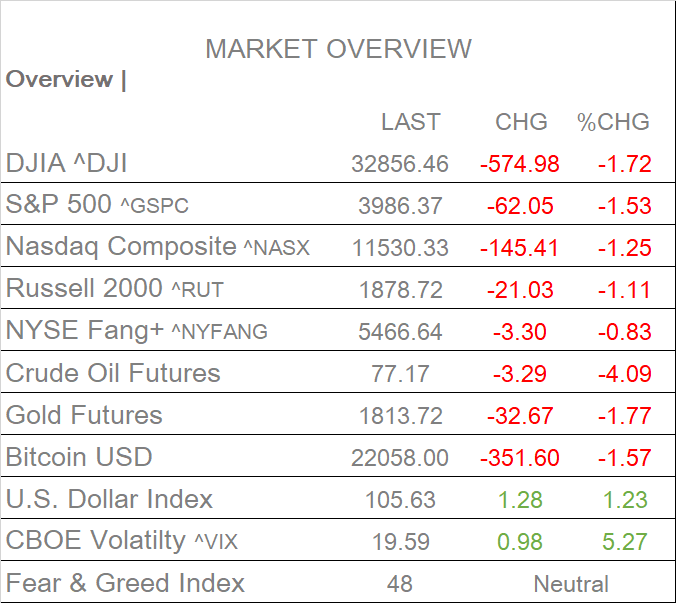

MARKETS TODAY March 7 (Vica Partners)

Overview

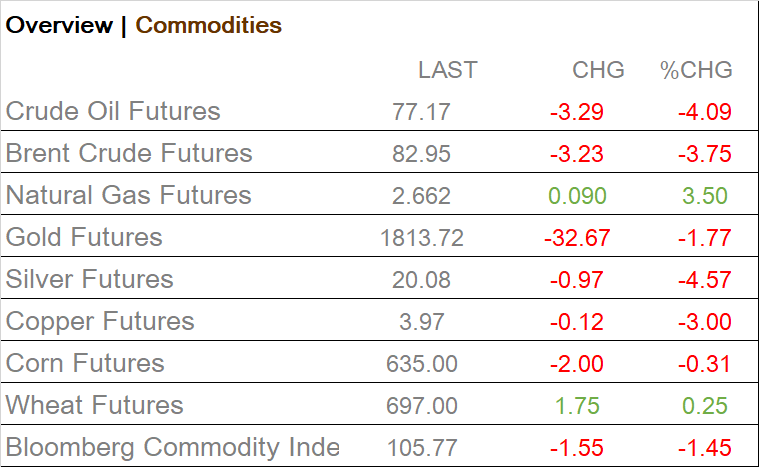

Happy Tuesday! S&P futures premarket were unchanged with Asian markets mixed overnight. Crude and Metals markets were down following a China import data miss, where imports declined Jan-Feb by 10.2% on a 5.1% forecast.

In economic news today, US wholesale inventories in January declined by 0.4% from a month earlier but in line with preliminary estimates. U.S. consumer credit also picked up slightly in January as borrowing reached $14.8b and below forecast of $25b.

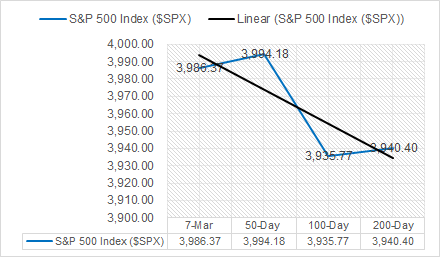

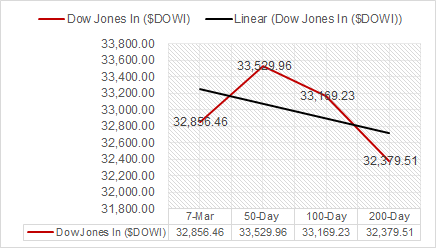

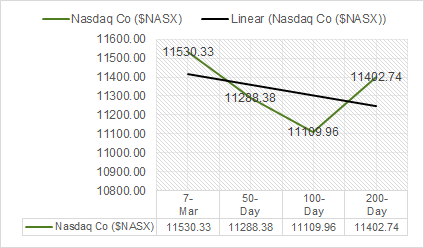

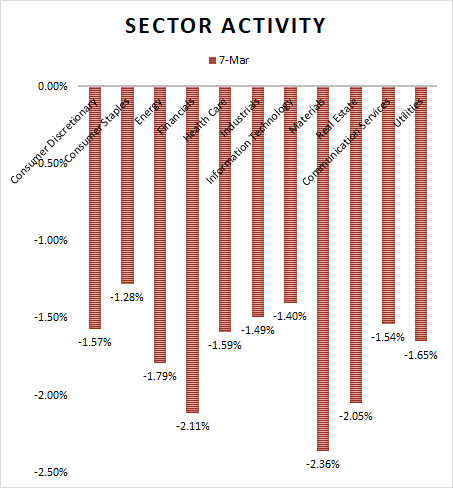

Going into Session today indexes were muted. Following Powell’s hawkish testimony the market indexes pulled-back setting on the possibility of an accelerated 50bps hike. The S&P 500 closed below its 20d moving average and all 11 S&P sectors were lower as Materials lead decliners, down 2.36%.

- The Markets moves lower following Powell’s testimony

- Indexes fall, DOW drops 575 points

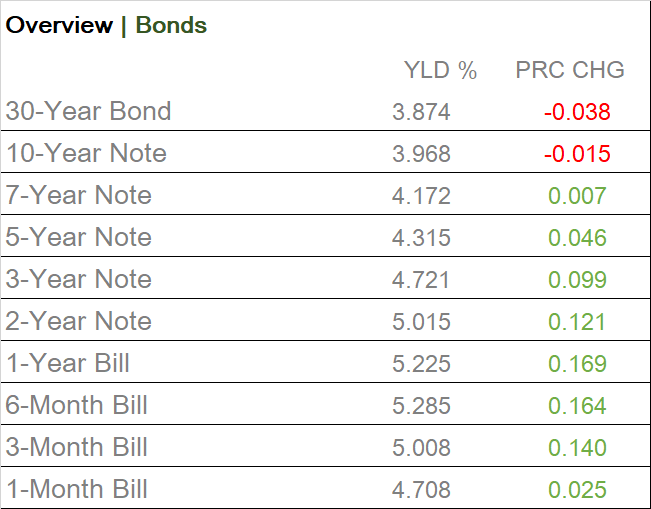

- Shorter term Yields rise

- All 11 S&P sectors lower: Materials, Financials and Real Estate underperform/ Tech outperforms

- Crude Oil Futures drop >3%

- USD Index, +up

Later this Week, on Wednesday employment data, JOLTS. On Thursday, President Biden will outline his budget proposal for the upcoming fiscal year to Congress. On Friday, February jobs reports and keep in mind that better than expected February employment numbers could setback Indexes on future hike worries.

Sectors/ Commodities/ Treasuries

- All 11 S&P sectors lower: Materials, -2.36% and Financials, -2.11% underperformed/ Information Technology, -1.40% outperformed

Commodities

US Treasuries

Economic Data

US

- Jobless claims: period March 3,act TBA, fc 193,000, prev. 190,000

- Wholesale inventories in the United States: declined by 0.4% from a month earlier to $929 billion in January 2023, in line with preliminary estimates and after a 0.1% increase in the prior month.

- Chair Powell Testimony: renews fears that that rates could go up, with the possibility of an accelerated 50bps hike.

- US wholesale inventories in Jan declined by 0.4% from a month earlier and in line with preliminary estimates.

- U.S. consumer credit picks up slightly in January from the prior month as borrowing reached $14.8b, below forecast of $25b.10:00 Wholesale inventories

Business News

- S&P cuts Nissan credit rating to junk status- Reuters

- Musk says Twitter could be cash flow-positive next quarter – Reuters

Central Banks/Inflation/Labor Market

- RBA interest rates: Reserve Bank increases official cash rate to 3.6% in record 10th consecutive rise – The Guardian

- Bank of America CEO sees U.S. technical recession in 3rd qtr – Reuters

Energy

- Oil lower after disappointing China import data – Morningstar

China

- Germany planning to ban Huawei, ZTE from parts of 5G networks –paper – Reuters

Market Outlook and updates posted at vicapartners.com