MARKETS TODAY April 21st, 2023 (Vica Partners)

Good Friday!

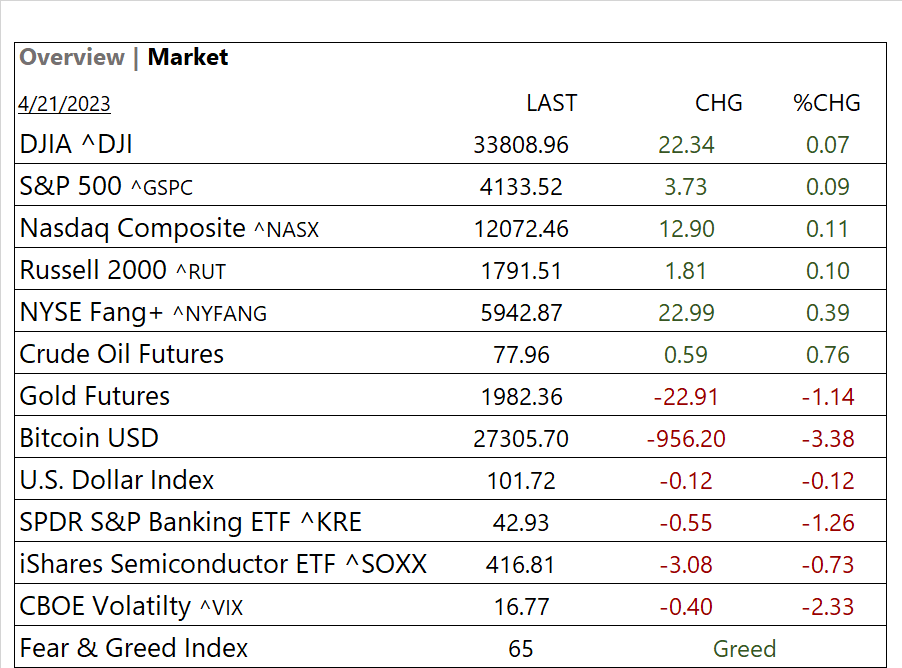

Over the past 5 days DOW, S&P 500 and Nasdaq Composite declined 0.71%, 0.40% and 0.88% respectively. Yesterday, the Cboe Volatility Index rose sharply >4% on recessionary concerns. Consumer Discretionary and Communication Services underperformed as Tesla and AT&T missed on earnings. Jobless claims and new employ apps for the week topped estimates with Philly Fed’s Mfg. activity contraction accelerated in April.

Overnight, Asian markets Asian markets finished lower with China leading the region. The Shanghai Composite -1.95%, Hong Kong’s Hang Seng -1.57% and Japan’s Nikkei 225 -0.33%. European markets finished higher with shares in Germany leading the region. The DAX +0.54%, France’s CAC 40 +0.51% and London’s FTSE 100 +0.15%. Premarket, S&P 500 US futures were trading at 0.05% above fair value.

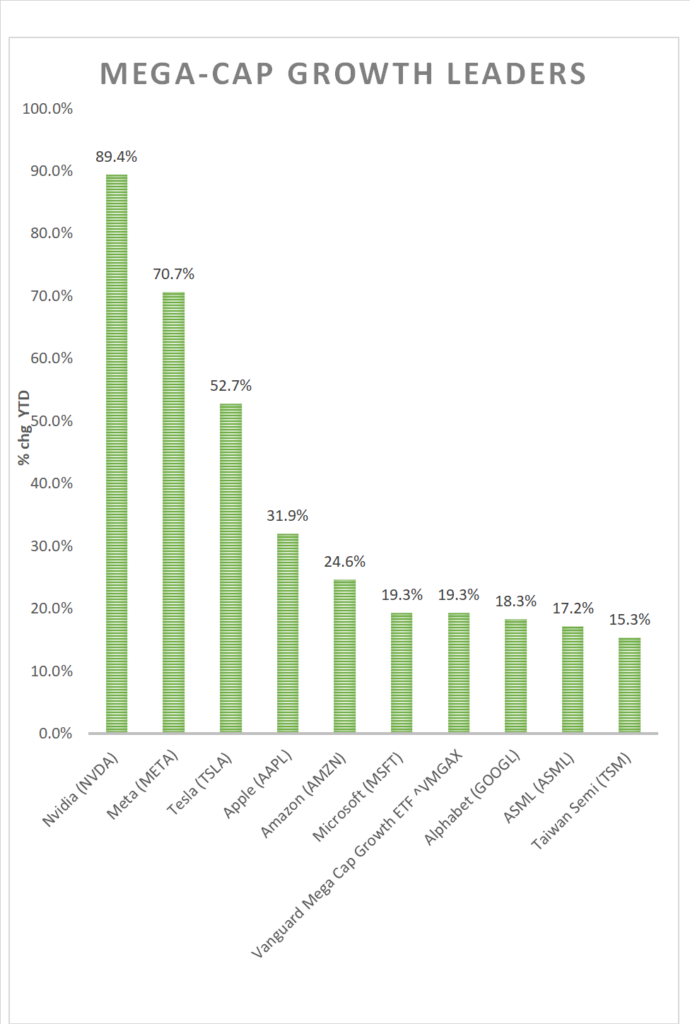

US Markets today finished moderately higher with NYFANG+ Mega Caps leading. 7 of 11 of the S&P 500 sectors finished higher, Health Care outperforms/ Materials sharply lags. Treasury yields rose across the curve and Oil was up. The Bloomberg Commodity Index, USD Index, Bitcoin and Gold all drop. In economic news, business activity in the US private sector expanded at quicker pace in April beating analysts’ forecasts.

Takeaways

- S&P Global Composite, Manufacturing and Services PMI beat forecasts

- The Cboe Volatility Index fell below 17

- NYFANG+ Mega Caps lead

- Defensive Sectors, Health Care and Consumer Staples outperform

- P&G beats on earnings

- Chile to take State control over lithium sparks sector selloff

Pro Tip: Follow the trend: “The trend is your friend” is a common saying in trading. If a stock is trending up, it’s more likely to continue going up than to suddenly reverse direction. Pay attention to the overall market trend and make your trades accordingly.

Sectors/ Commodities/ Treasuries

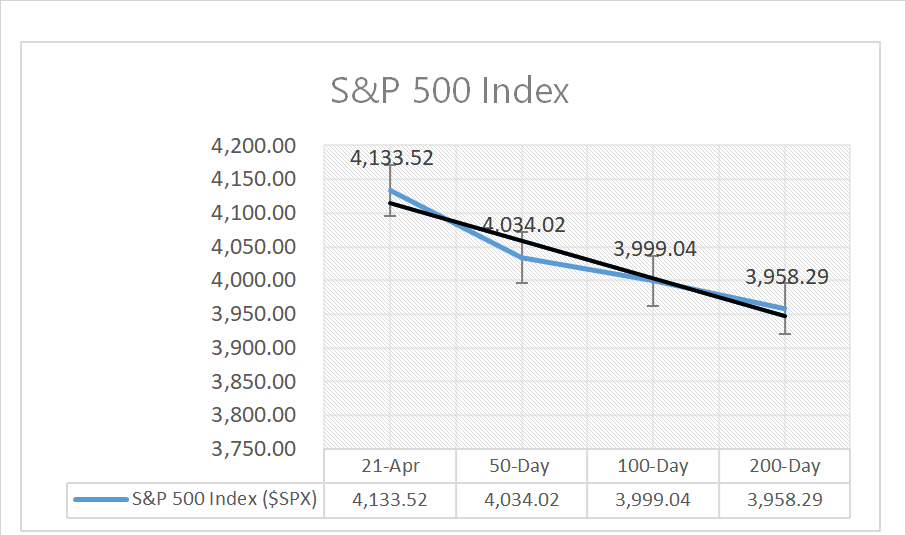

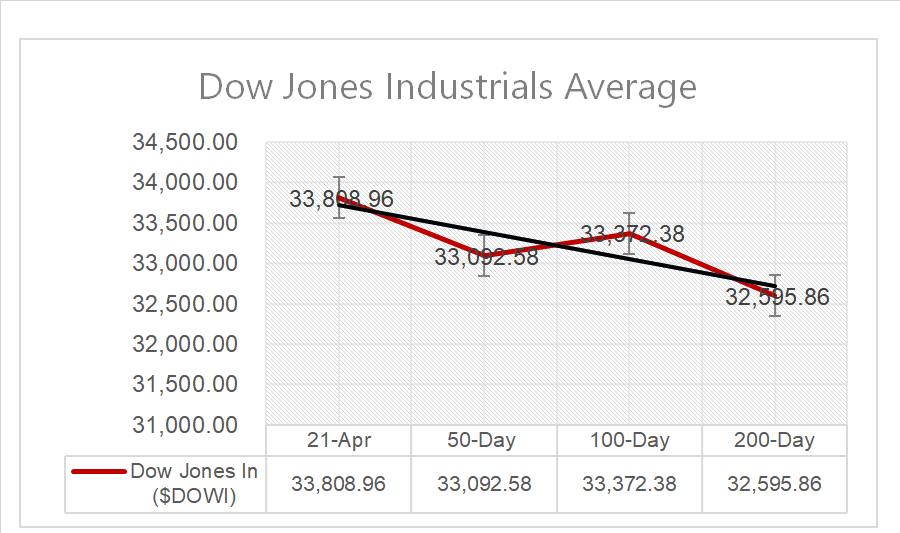

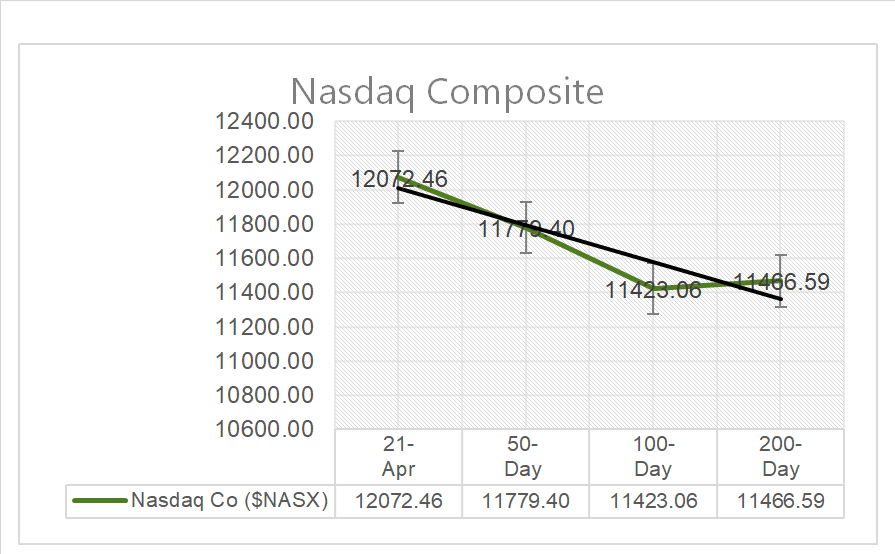

Key Indexes (50d, 100d, 200d)

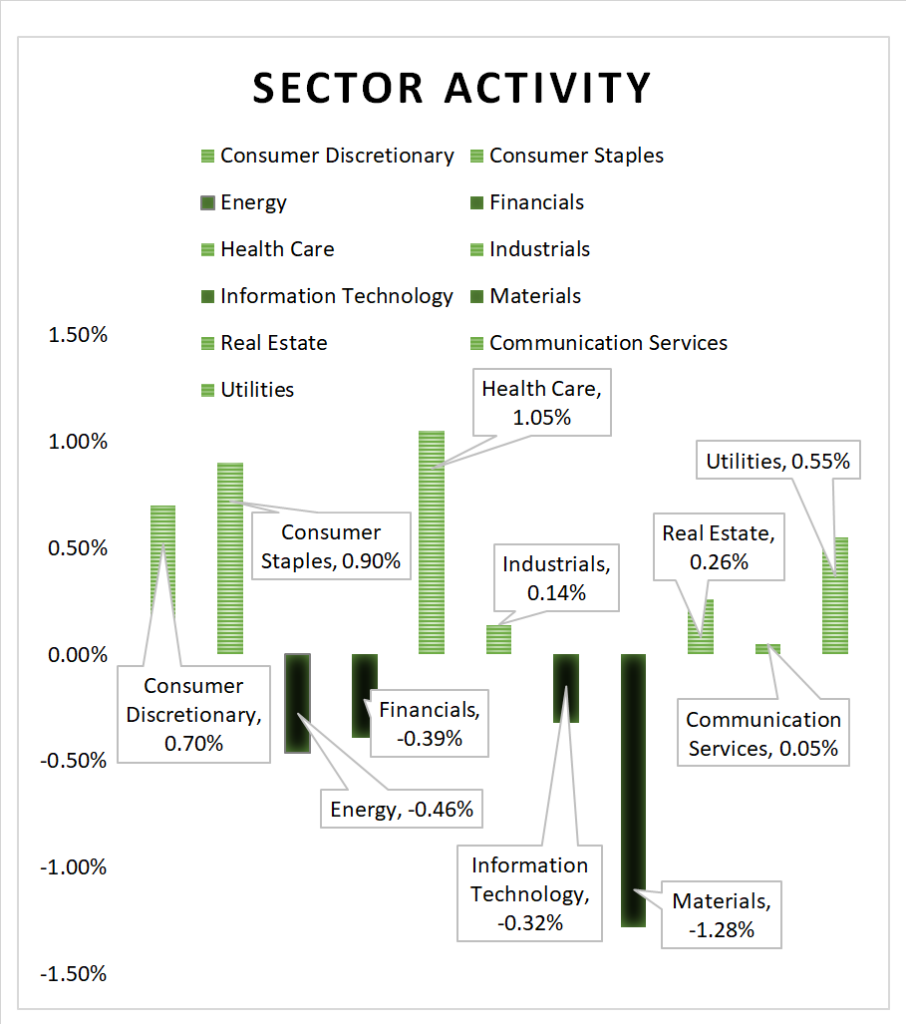

S&P Sectors

- 7 of 11 of the S&P 500 sectors finish higher, Health Care +1.05% and Consumer Staples +0.90% outperform/ Materials -1.28% underperforms

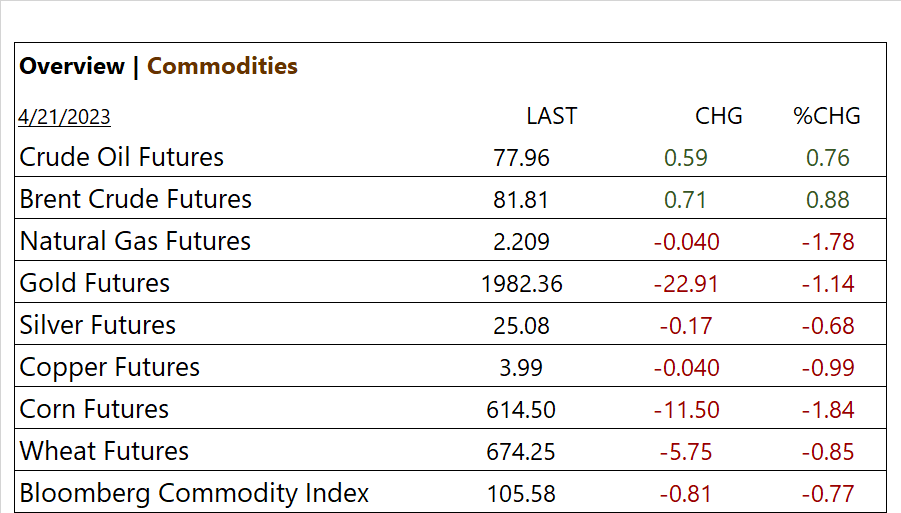

Commodities

Factor Related

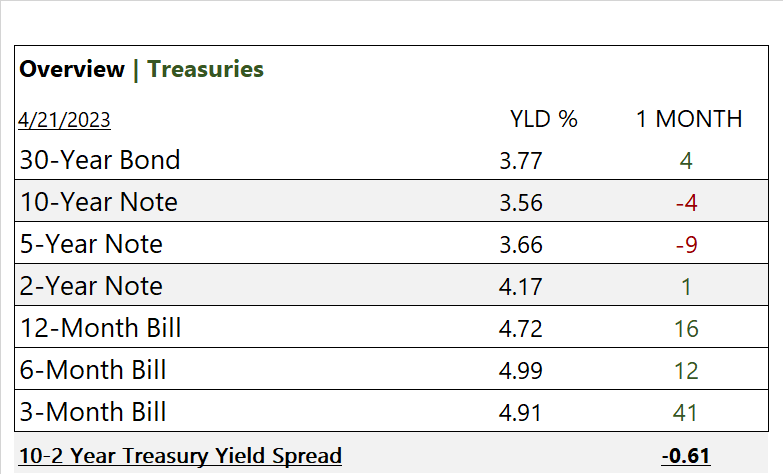

US Treasuries

Notable Earnings Today

- +Beat: Procter&Gamble (PG), HCA (HCA), Schlumberger (SLB), Freeport-McMoran (FCX), Autoliv (ALV)

- –Miss: SAP ADR (SAP), Sandvik AB ADR (SDVKY), Regions Financial (RF)

- * Strong support – NVIDIA (NVDA), QUALCOMM (QCOM), Analog Devices (ADI), Amazon (AMZN), Cintas Corp (CTAS), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP)

Economic Data

US

- S&P flash U.S. services PMI; period April, act 53.7, fc 51.5, prev. 52.6

- S&P flash U.S. manufacturing PMI; period April, act 50.4, fc 49.0, prev. 49.2

News

Company News/ Other

- Amazon rallies after research firm predicts upbeat retail sales – Reuters

- Chile leader wants state to share in any lithium extraction – AP

- Oil set for weekly loss as economic uncertainty weighs – Reuters

Central Banks/Inflation/Labor Market

- Fed tilts toward rate hike, with a possible pause in view as lending slows – Reuters

- The Inflation Reduction Act’s Bait and Switch – WSJ

China