MARKETS TODAY Jan 24 (Vica Partners)

DOW (^DJI) 33,734 (+104), S&P 500 (^GSPC) 4,017 (-3), Nasdaq (^IXIC) 11,334 (-30), Russell 2000 (^RUT) 1,886 (-5), NYSE FANG+ (^NYFANG) 5,077 (-29), Brent Crude $86.35/barrel (-$1.84), Gold $1,937/oz (+$6), Bitcoin $22.7k (-$218)

Session Overview

- DOW ends higher, S&P and Nasdaq lower

- Yields lower

- 7 of 11 S&P 500 Sectors higher: Industrials outperforms, Healthcare underperforms

- Earnings mixed, Microsoft and Johnson & Johnson beat!

- Brent and WTI Oil down >1.5%

- Flash US Business Services/ Manufacturing activity, both signaled a solid fall in sector output

Technicals/ Sector Performance/ Yields+

Index Moving Averages

S&P 500 Index ($SPX) close 4,017-/ 50 Day 3,938+/ 100 Day 3,865+/ 200 Day 3,964+

Dow Jones In ($DOWI) close 33,734+/ 50 Day 33,617+/ 100 Day 32,257+/ 200 Day 32,359+

Nasdaq Co ($NASX) close 11,334-/ 50 Day 10,944+/ 100 Day 10,991+/ 200 Day 11,540-

7 of 11 S&P 500 Sectors higher: Industrials and Utilities outperforms/ Health Care Utilities and Energy underperform

The best performing sectors were the Industrials and Utilities sectors, up 0.66% and 0.36% respectively. The Health Care sector was the biggest decliner, down 0.79%.

Yields decline: US – 2yr to 4.211%=, 5yr to 3.575%-, 10yr to 3.455%-, 30yr to 3.604%-

Greed Index Rating 63/ Greed

Notable Company Earnings

- Beats / Johnson & Johnson (JNJ), Haliburton (HAL), PACCAR Inc. (PACR), Microsoft Corp (MSFT)

- Misses / 3M Co. (MMM) Travelers (TRV)

Tomorrow/ AT&T Inc. (T) Norfolk Southern Corp. (NSC), U.S. Bancorp U.S.(USB), Kimberly-Clark Corp (KMB), Hess Corp. (HES)

U.S Economic News

- Flash US PMI Composite Output Index; at 46.6 (December: 45.0). 3-month high. The contraction in activity was solid overall, but the slowest since last October.

- Flash US Services Business Activity Index; at 46.6 (December: 44.7). 3-month high. The latest data signaled a solid fall in service sector output, but one that was the softest since last October.

- Flash US Manufacturing Output Index; at 46.7 (December: 46.2). 2-month high. It signals a solid decline in operating conditions at the start of 2023. Although softening, the rate of decline was the second-fastest since May 2020.

- Tomorrow, the only economic data in the US will be mortgage apps

- Week Ahead (key report activity) Thursday/ Initial and Continuing jobless claims, January. Friday / PCE and Core price indexes data, December

Other Asset Classes:

- CBOE Volatility Index (^VIX): -0.61 to 19.20

- USD index: -$0.22 to $101.92

- Oil prices: Brent: -2.09% to $86.35, WTI: -1.83% to $80.13, Nat Gas: -5.48% to $3.258

- Gold: +0.31% to $1,937.37, Silver: +1.13% to $23.67, Copper: +0.15% to $4.26

- Bitcoin: -0.95% to $22.7k

Business News

- U.S. targets Google’s online ad business monopoly in latest Big Tech lawsuit reuters

- J&J expects inflation, China COVID hit to carry into 2023 reuters

- U.S. business activity still soft in early 2023, but outlook perks up reuters

Vica Momentum Stock Report

PACCAR (PCAR) $PCAR. (Momentum Grade A) (Value A+) (Growth B) 20 Day Average +8.13%, 50 Day Average +8.20%, 100 Day Average +22.59%, 200 Day Average +29.30%

PACCAR Inc. is a leading manufacturer of heavy-duty trucks in the world and has substantial manufacturing exposure to light/medium trucks. It also designs and manufactures diesel engines and other powertrain components for use in its own products and for sale to third party manufacturers of trucks and buses. In addition to core business they supply aftermarket parts, and finance and leasing services.

PACCAR Engine Factory in Columbus Mississippi

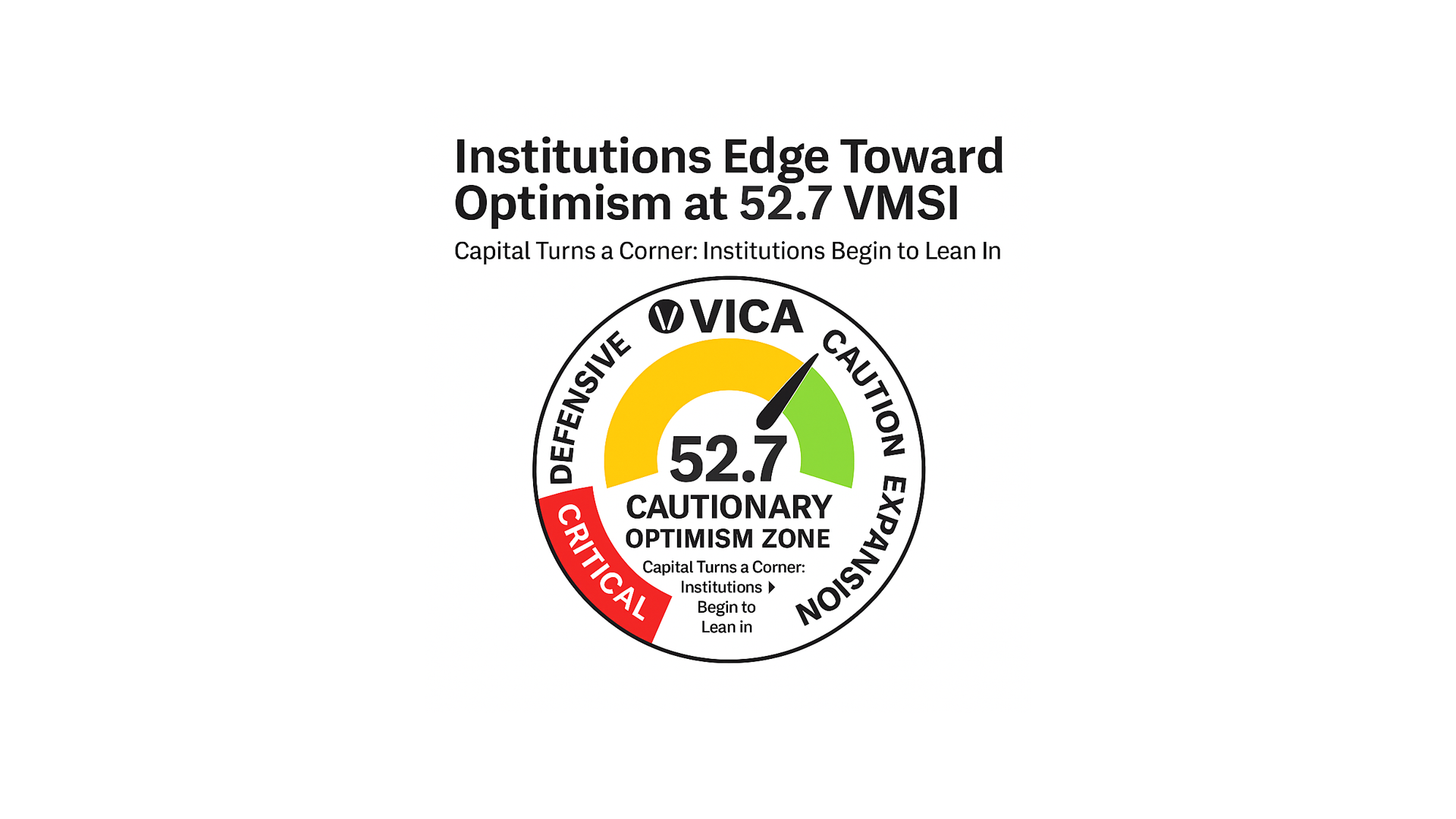

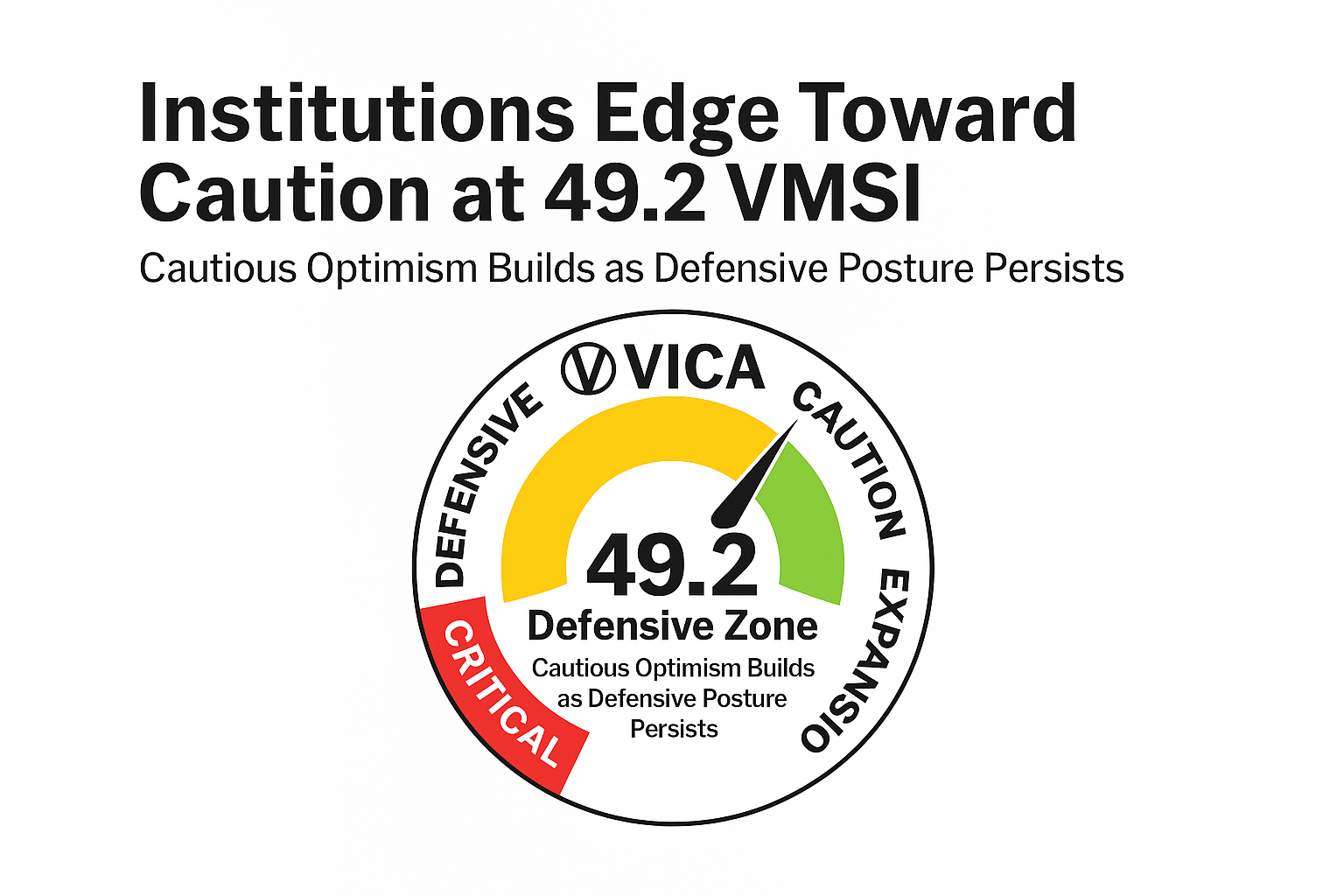

Market Outlook

Market Outlook and updates posted at vicapartners.com