MARKETS TODAY July 14th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng +0.33%, China’s Shanghai Composite +0.04%, Japan’s Nikkei 225 -0.09%,. European markets finished mixed, France’s CAC 40 +0.06%, Germany’s DAX -0.22%, London’s FTSE 100 -0.08%. S&P futures were trading at +0.1% above fair value.

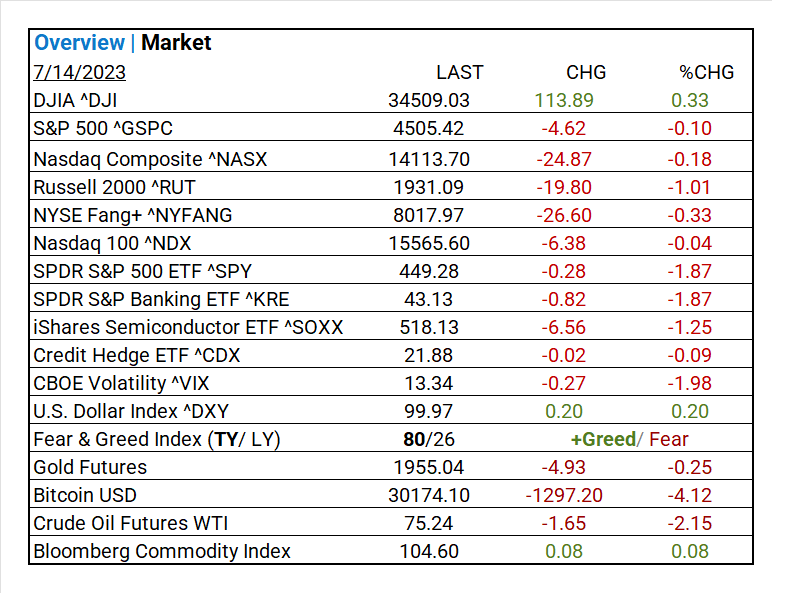

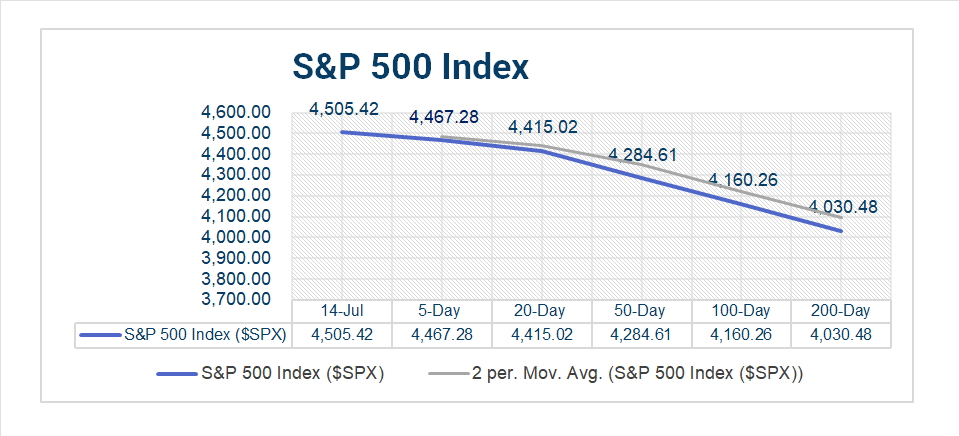

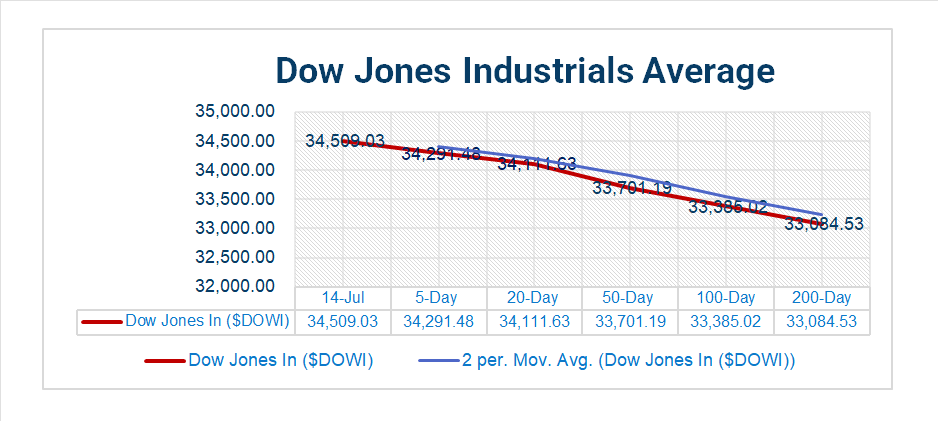

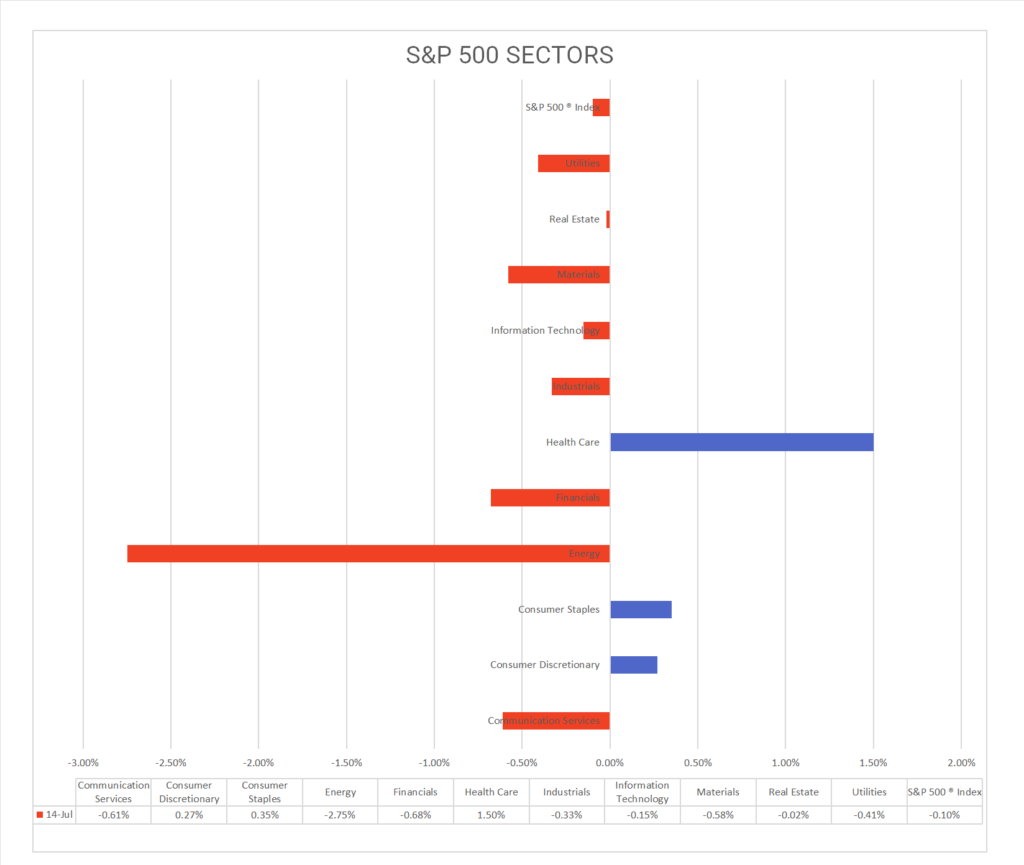

Today US Markets finished mixed, S&P 500 -0.10%, DOW +0.33%, NASDAQ -0.18%. 8 of 11 S&P 500 sectors declining: Health Care +1.50% outperforms/ Energy -2.75% lags. On the upside, DOW, Health Care Providers & Services, Treasury Yields, U.S. Dollar Index, Bloomberg Commodity Index. In economic news, U.S. import prices fell for a second consecutive month in June, Consumer sentiment reached its best reading since September 2021.

Takeaways

- Consumer sentiment reached its best reading since September 2021.

- Import, export prices beat consensus for June … welcome deflationary news

- DOW +0.33% only advancing major

- 8 of 11 S&P 500 sectors declining: Health Care +1.50% outperforms/ Energy -2.75% lags

- Health Care/ Sub Health Care Providers & Services +4.10

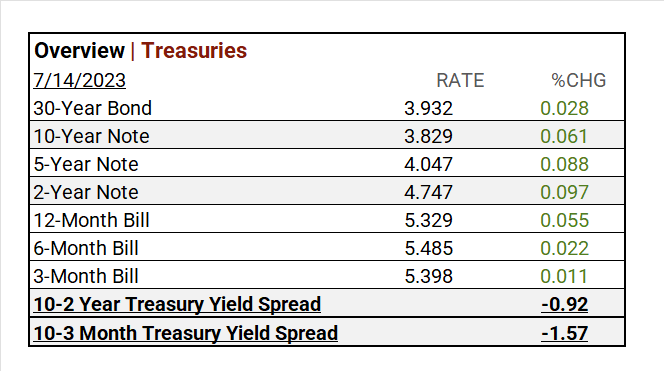

- Treasury Yields up across the curve

- USD Index and Bloomberg Commodity Index gain

- UnitedHealth (UNH) beats earnings sparks Health Care sector rally

- BIG Bank earning beats JPMorgan (JPM), Wells Fargo&Co (WFC), Citigroup (C)

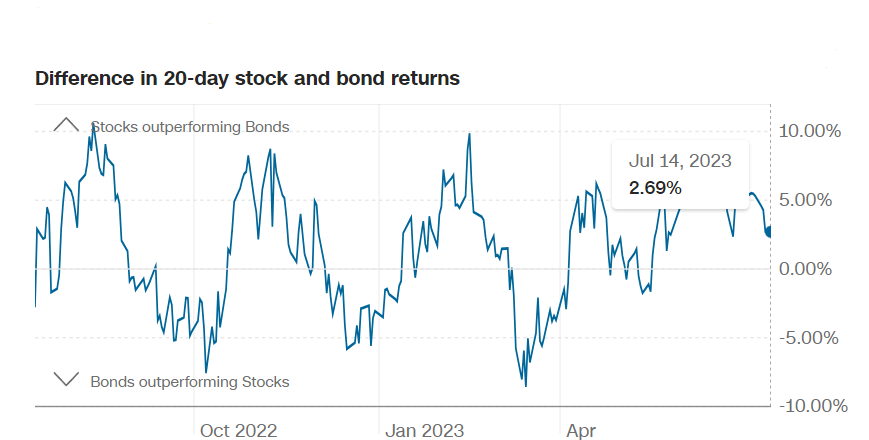

Pro Tip: Safe Haven Demand shows the difference between Treasury bond and stock returns over the past 20 trading days.

Sectors/ Commodities/ Treasuries

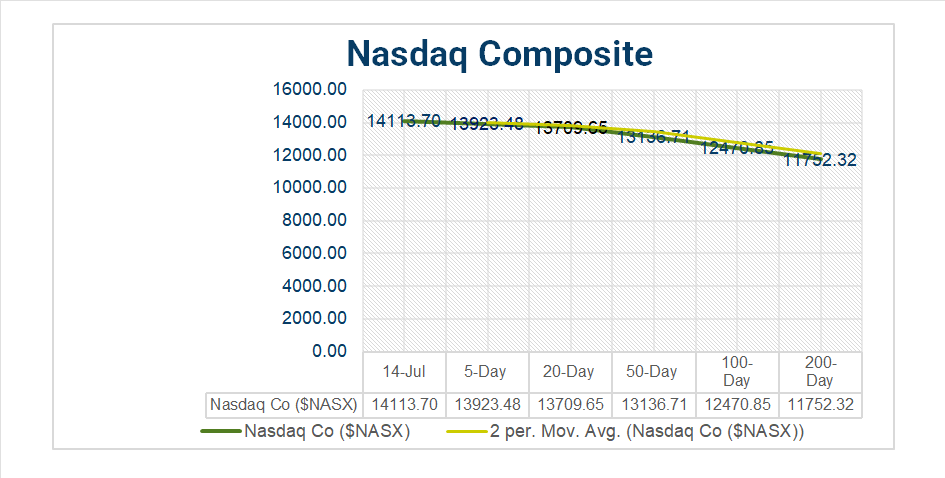

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 8 of 11 S&P 500 sectors declining: Health Care +1.50% outperforms/ Energy -2.75% lags.

- Health Care/ Sub Health Care Providers & Services +4.10

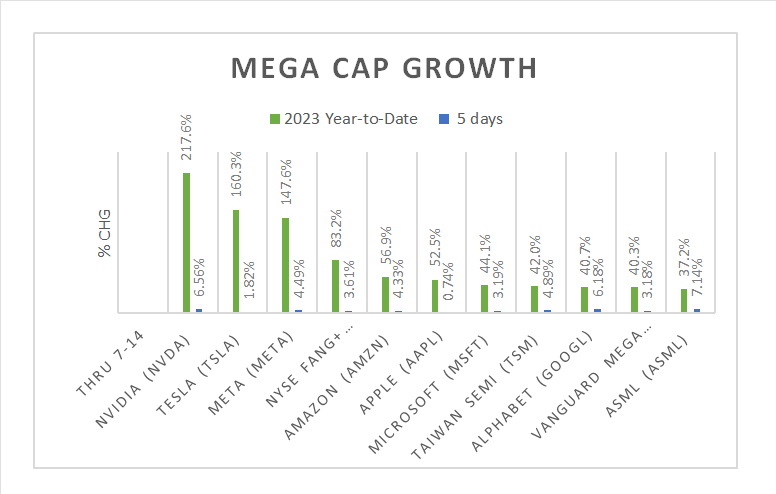

Factors/ Mega Caps

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: UnitedHealth (UNH), JPMorgan (JPM), Wells Fargo&Co (WFC), Citigroup, (C), Orkla ASA ADR (ORKLY), Castellum ADR (CWQXY)

- – Miss: BlackRock (BLK), State Street (STT),

Economic Data

US

- Import price index; period June, act -0.2%, fc -0.1%, prior -0.6%

- Import price index minus fuel; period June, act -0.4%, prior -0.1%

- University of Michigan’s consumer sentiment index; period July, act 72.6. fc 65.5, prior 64.4

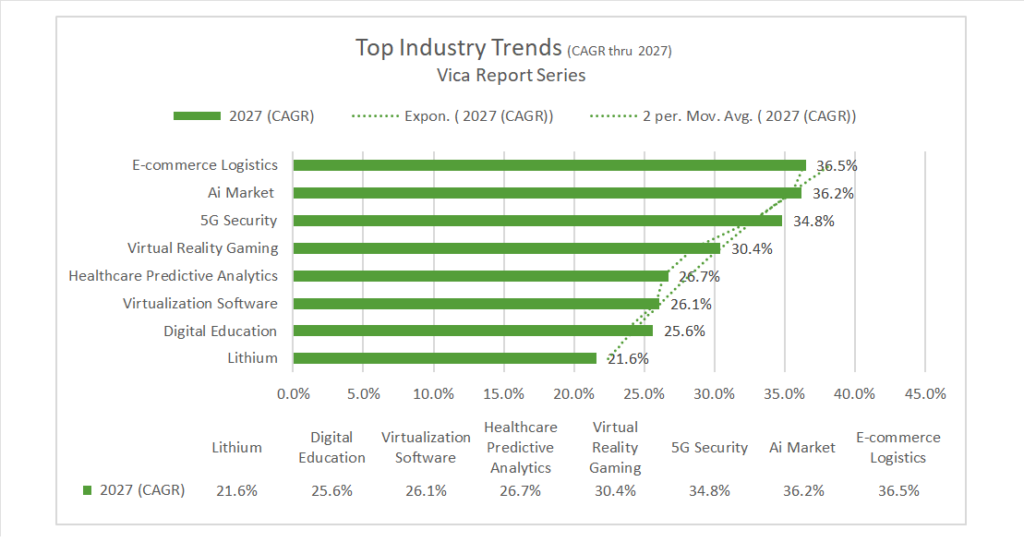

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Metals & Mining, Semiconductor & Semiconductor Equipment, Construction Materials, Energy Services. Nasdaq 100^NDX 14,500 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. Important CAGR growth below.

We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO), Sociedad Quimica y Minera (SQM).

News

Company News/ Other

- Jamie Dimon Says Some Rivals Are ‘Dancing in the Streets’ – Bloomberg

- More Americans Seek Mental-Health Care, UnitedHealth Says – WSJ

- Eli Lilly Is Buying Another Potential Obesity Treatment in Deal Worth Up to $2 Billion – WSJ

Energy/ Materials

- EU Working on E-Bus for Lithium Deal With Latin American Nations – Bloomberg

- Saudi Arabia to Lose Top Spot in OPEC+ – WSJ

Central Banks/Inflation/Labor Market

- US Bank Earnings Poke Holes in Popular Recession Theory – Bloomberg

- The Real Fed Debate This Month: What Would Prompt a Rate Hike This Fall – WSJ

Asia/ China