Stay Informed and Stay Ahead: Market Watch, July 25th, 2024.

Late-Week Wall Street Markets

Key Takeaways

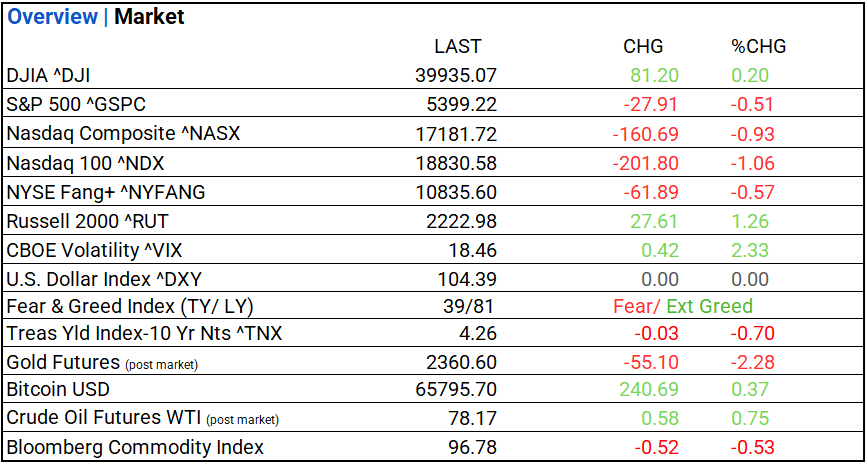

- DOW rose while the S&P 500 and NASDAQ declined. Cyclicals strong with Energy leading and Communication Services trailing. The top industry was Real Estate Management & Development.

- The economy remains resilient with Q2 GDP rising to 2.8%, exceeding the 2.1% forecast, though June durable-goods orders fell 6.6%, largely due to a sharp decline in new transportation equipment orders.

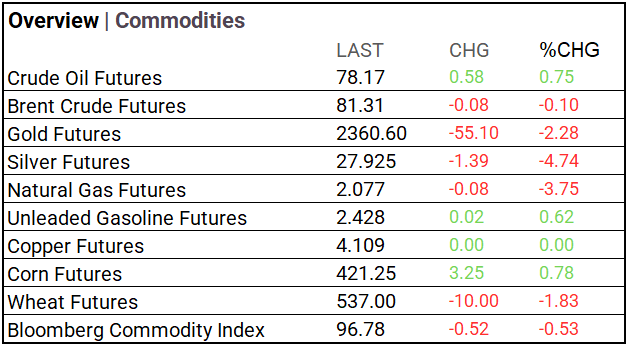

- Treasury yields fell, small caps outperformed, crude oil and corn rose, while Brent crude, gold, silver, natural gas, and wheat declined. Bitcoin edged up while other major cryptocurrencies fell. Gold and silver shorts gained, with RTX Corp and Northrop Grumman reporting strong earnings.

Summary of Market Performance

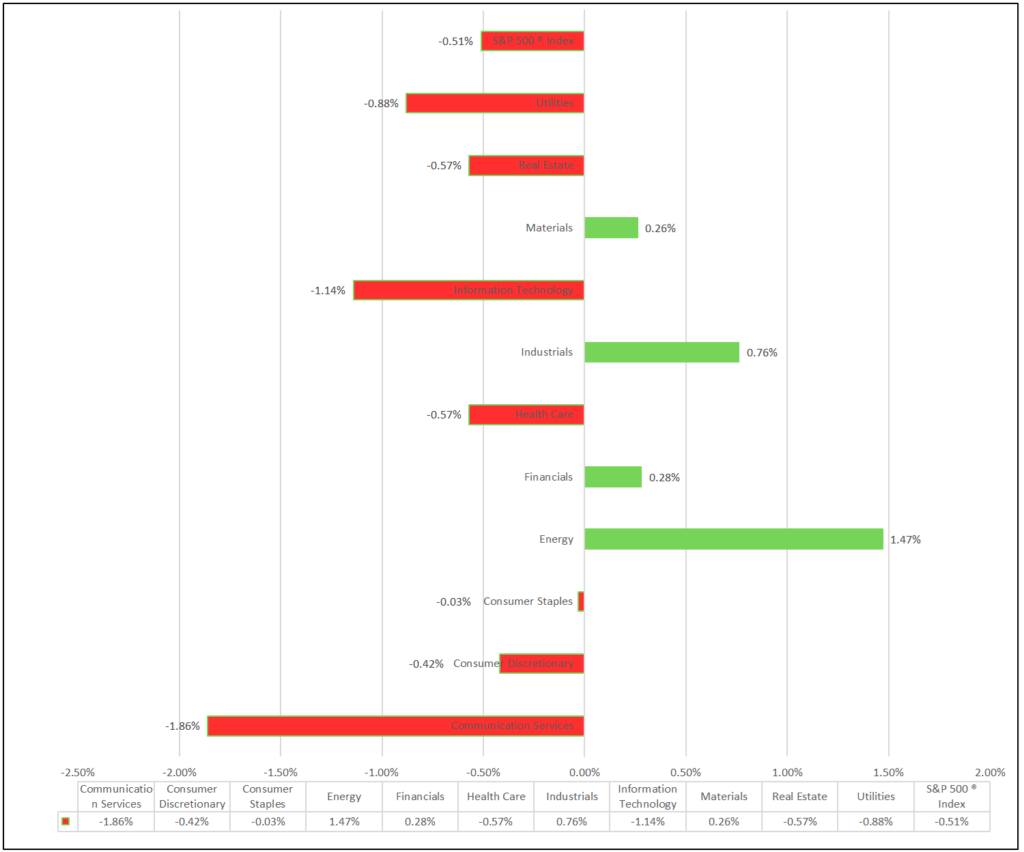

Indices & Sectors Performance:

- DOW rose while the S&P 500 and NASDAQ declined, with Energy leading and Communication Services trailing among sectors, and top industries including Real Estate Management & Development (+5.53%), Trading Companies & Distributors (+3.55%), and Leisure Products (+3.53%).

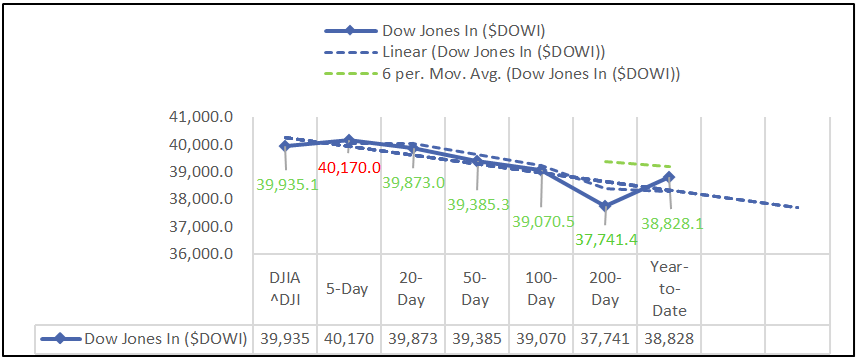

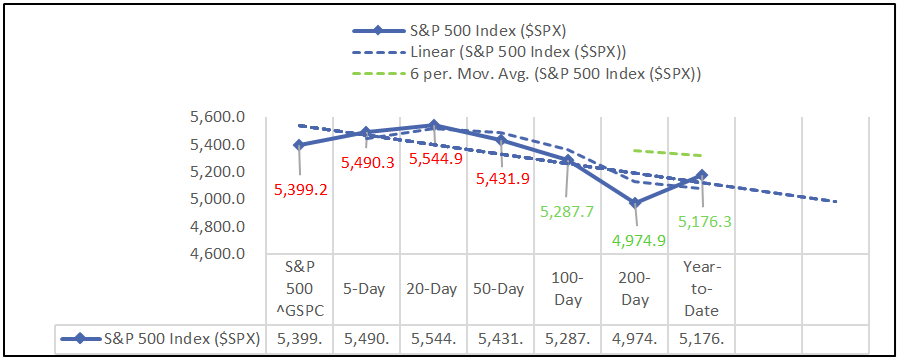

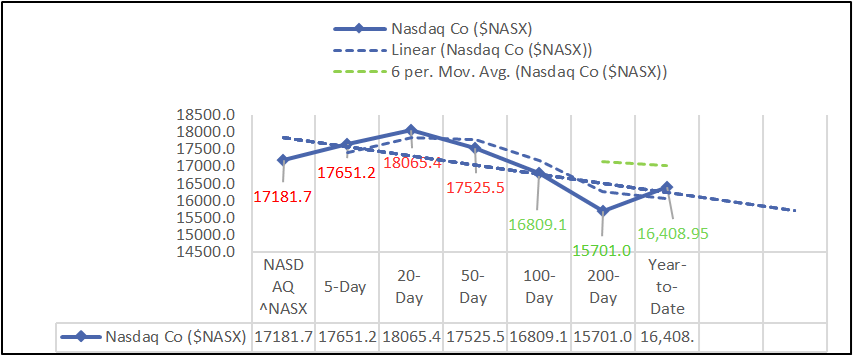

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, seven decline. Energy leading and Communication Services trailing.

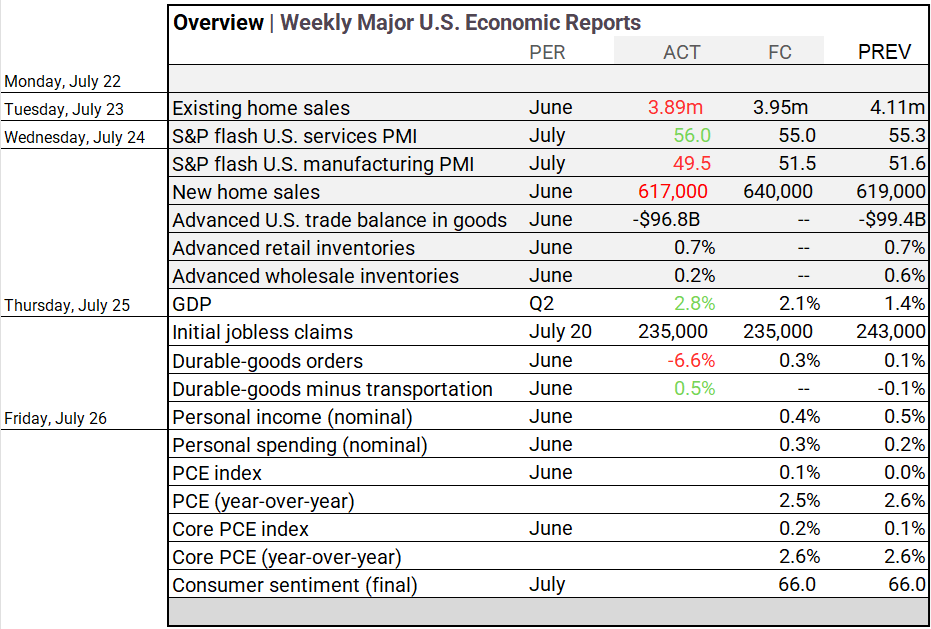

Economic Highlights:

- Q2 GDP rose to 2.8%, initial jobless claims remained at 235,000, June durable-goods orders fell 6.6%, excluding transportation up 0.5%

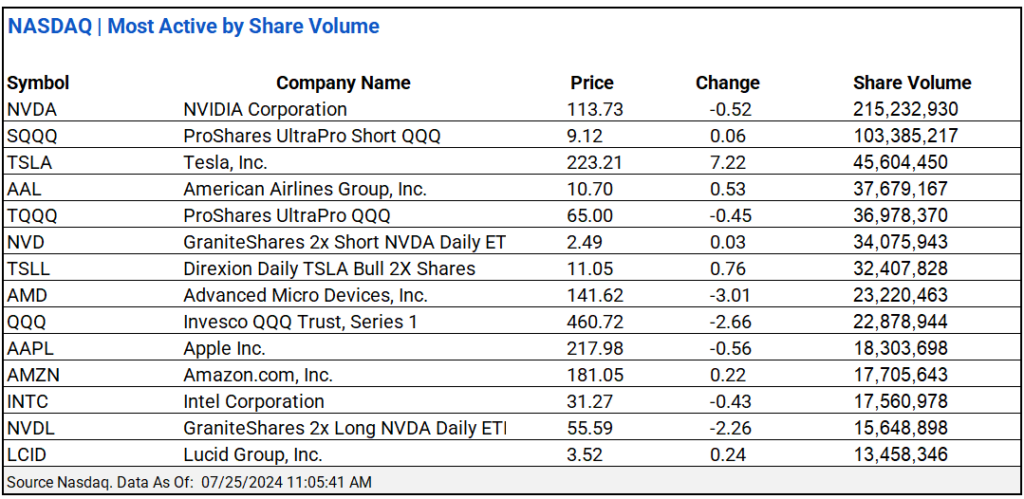

NASDAQ Global Market Update:

- NASDAQ total share volume was 5.58 billion, with an advance/decline ratio of 1.44, NVIDIA Corporation and ProShares UltraPro Short QQQ led active trading.

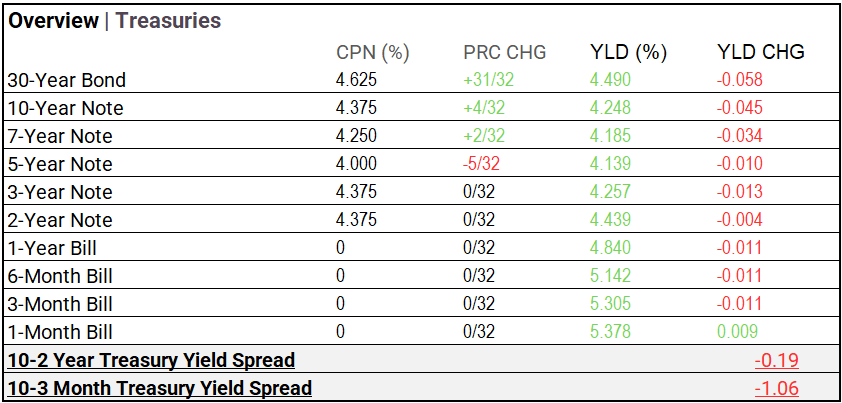

Treasury Markets:

- The 30-Year Bond, 10-Year, 7-Year, 5-Year, 3-Year, 2-Year, 1-Year, 6-Month, and 3-Month Notes all declined, indicating decreasing costs across the yield curve, except for a slight increase in the 1-Month Bill yield.

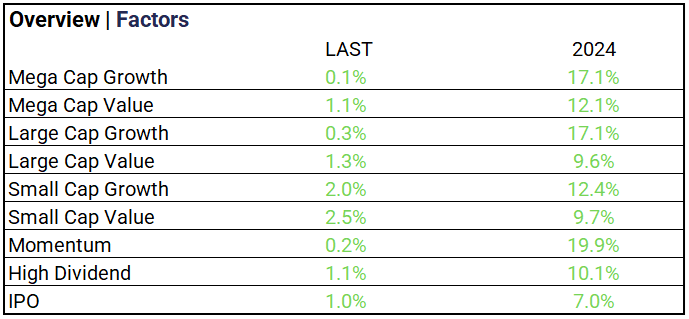

Market Factors:

- Small-cap stocks are gaining, with value up 2.5% and growth up 2%, while mega-cap growth lags at 0.1%.

Currency & Volatility:

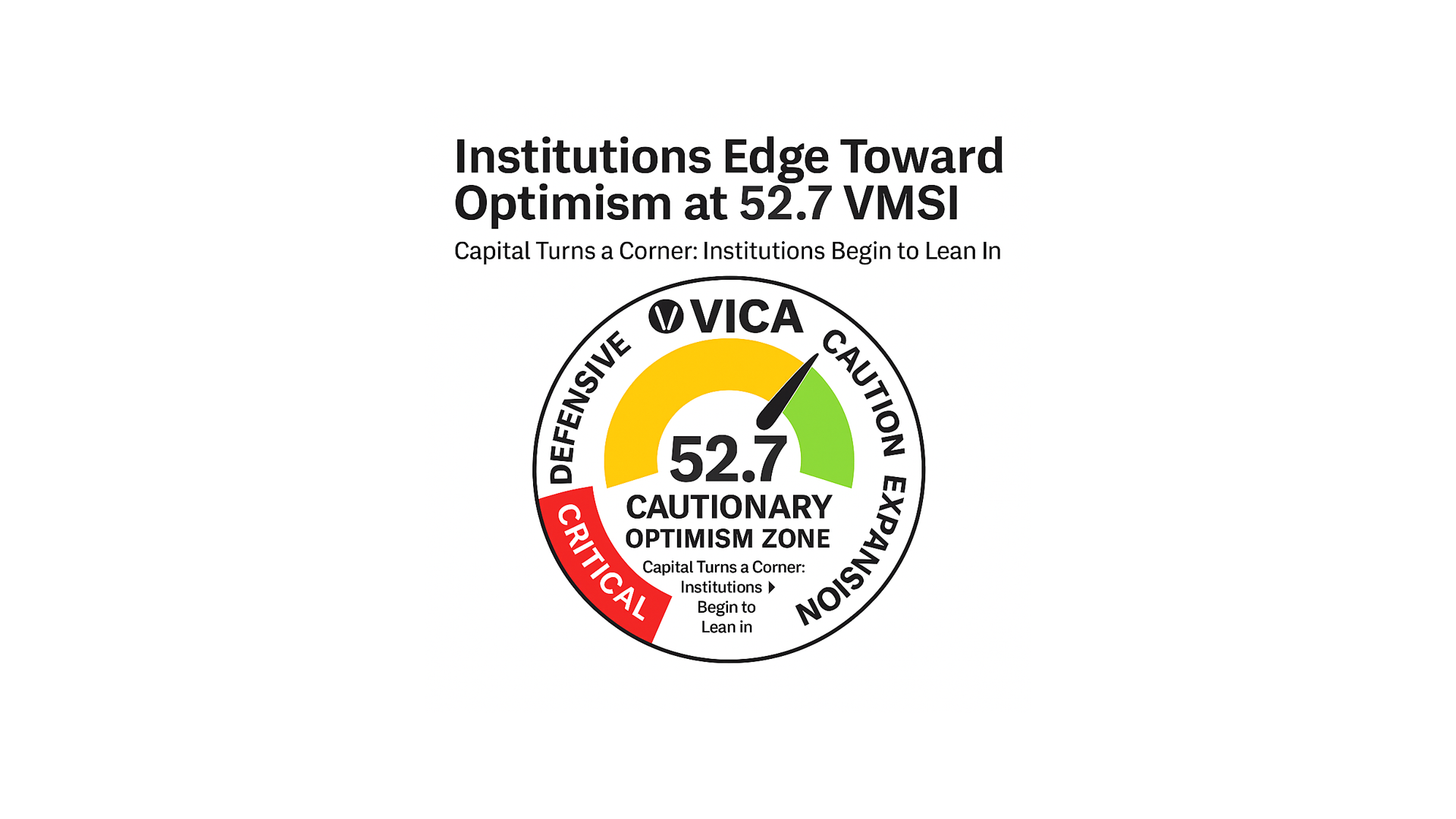

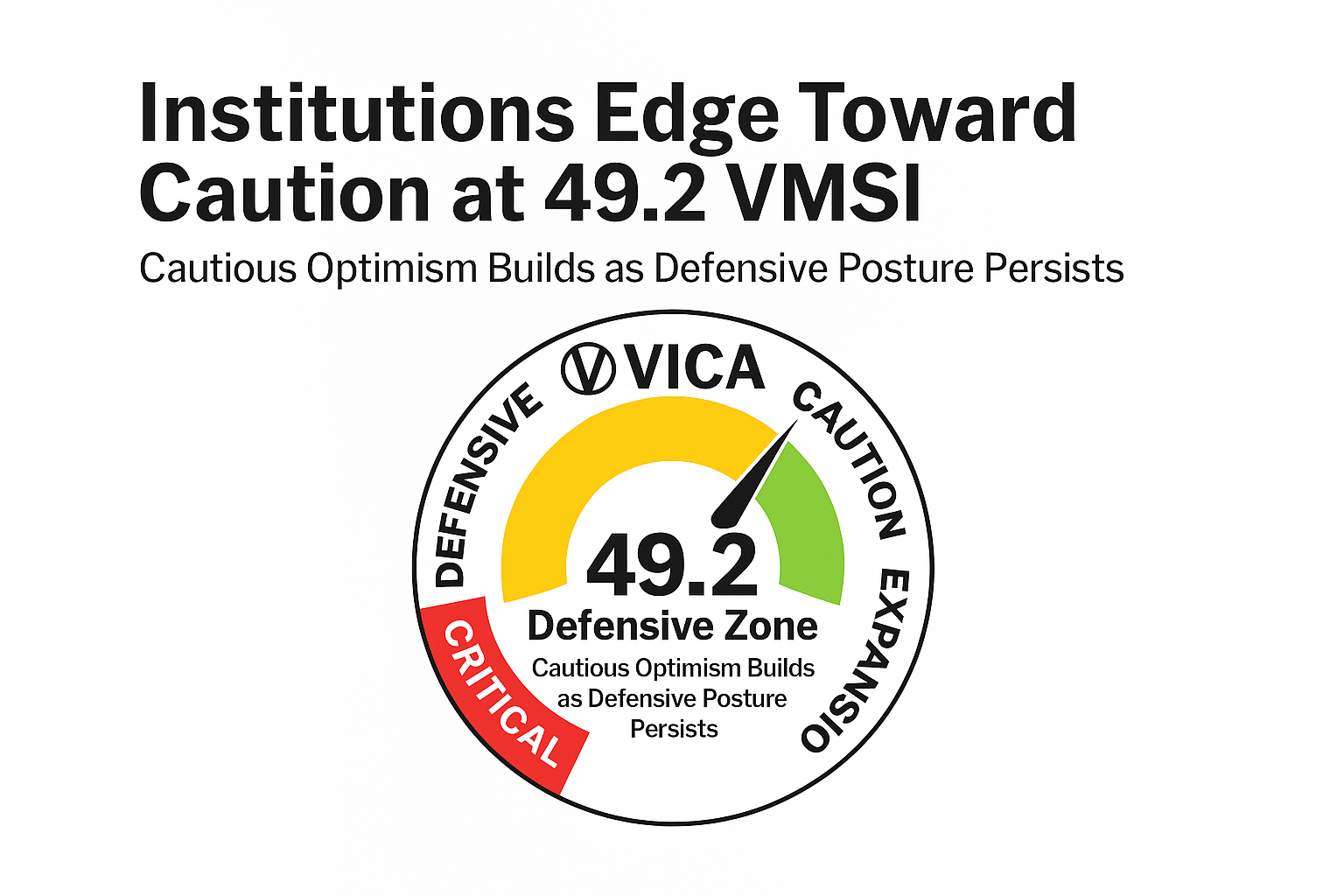

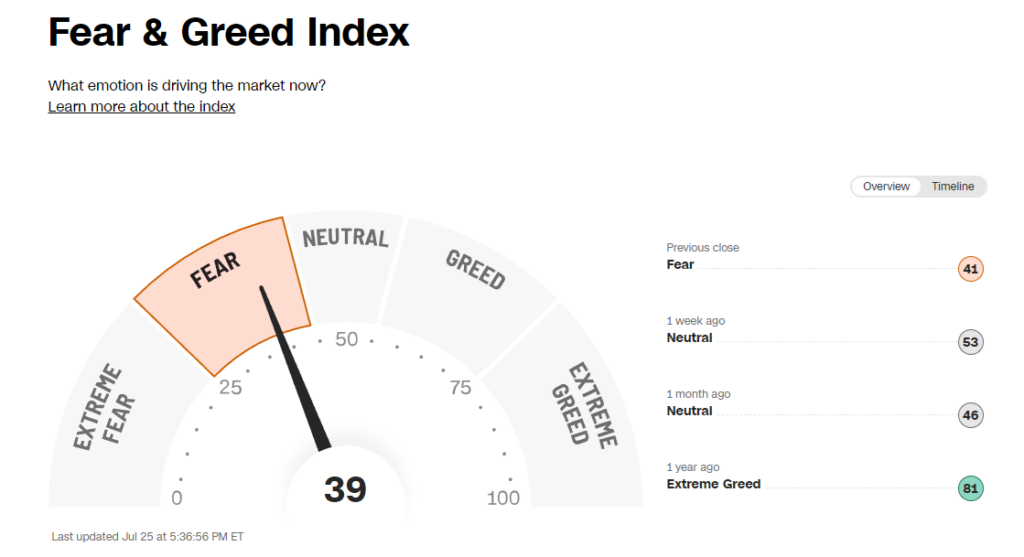

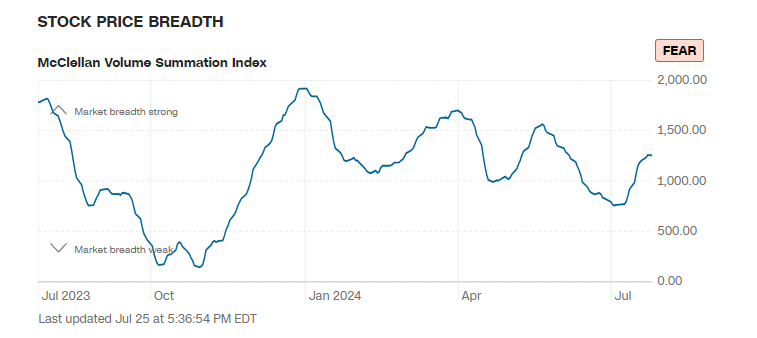

- The VIX rose to 18.46 (+2.33%), and the Fear & Greed Index shifted to “Fear” from last year’s “Extreme Greed.”

Commodities & ETFs:

- Commodity markets were mixed: crude oil and corn rose, while Brent crude, gold, silver, natural gas, and wheat fell. The Bloomberg Commodity Index decreased.

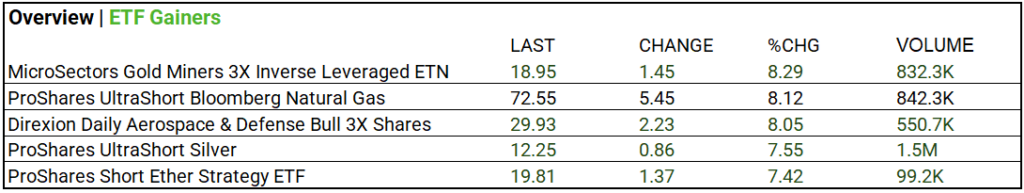

- ETFs: MicroSectors Gold Miners 3X Inverse Leveraged ETN +8.29% while ProShares UltraShort Silver was up +7.55%.

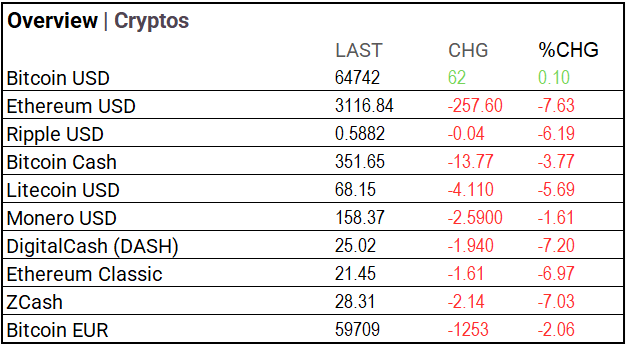

Cryptocurrency Update:

- Bitcoin rose slightly, while other major cryptocurrencies like Ethereum, Ripple, and Litecoin experienced declines.

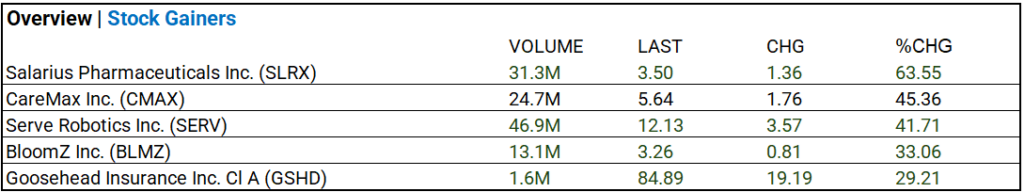

Stocks:

- Serve Robotics Inc. (SERV) surged 41.71% on a 46.9M volume.

Notable Earnings:

- AstraZeneca ADR (AZN), Rtx Corp (RTX), Northrop Grumman (NOC) beat, AbbVie (ABBV), TotalEnergies SE ADR (TTE) and Sanofi ADR (SNY) miss.

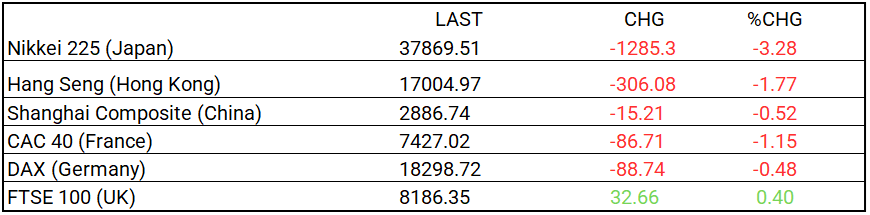

Global Markets Summary:

- Asia was down, with the Nikkei suffering a large loss of 3.28% and the Hang Seng dropping due to the US tech selloff, while Europe fell except for a slight gain in the FTSE 100.

Strategic Investment Adjustments and Historical Market Trends:

- Focus on long-duration bonds, which benefit from rate cuts due to their inverse relationship with interest rates. As the Fed eases rates, their value rises since fixed payments become more attractive compared to new, lower-rate bonds.

- Invest in Information Technology and semiconductors for long-term growth, while diversifying with small-cap and bank index ETFs to manage risk.

- Historically, election years support market growth due to increased fiscal stimulus and investor optimism.

In the NEWS

Central Banking, Monetary Policy & Economics:

- Economic Growth Quickens, Rising at 2.8% Rate in Second Quarter – WSJ

- Expectations High for Japan’s Bank Results to Spur Stock Rally – Bloomberg

Business:

- RTX Sets Aside $1.24 Billion to Resolve Government Probes – WSJ

- NBA Picks Amazon for Long-Term TV Deal – Bloomberg

China:

- China drives Asia’s venture capital market with 6 of the top 10 quarterly deals: KPMG – SCMP