MARKETS TODAY July 19th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 gained 1.24%, China’s Shanghai Composite rose 0.03%, while Hong Kong’s Hang Seng ended lower 0.33%.

European markets finished mixed, London’s FTSE 100 gained 1.80%, France’s CAC 40 gained rose 0.38% and Germany’s DAX declined 0.35%. S&P futures opened trading at 0.02% above fair value.

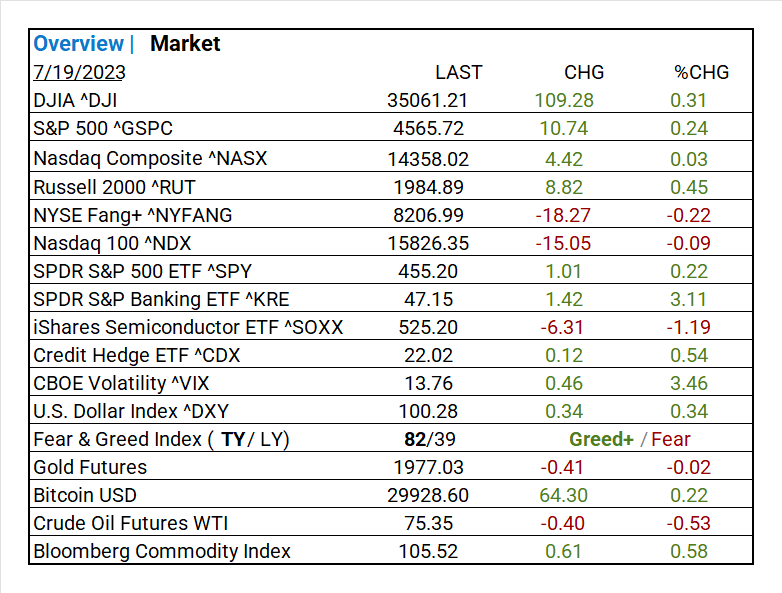

Today US Markets finished higher, DOW gained 0.31%, S&P 500 and the NASDAQ rose 0.24% and 0.03% respectively. 8 of 11 S&P 500 sectors advancing: Real Estate 1.26% outperforms/ Materials -0.52% lags. On the upside, SPDR S&P Banking ETF ^KRE, Mega Cap Value, REITs, USD Index, Credit Hedge ETF ^CDX, Bitcoin and the Bloomberg Commodity Index.

In economic news, Housing Starts and Building Permits came in below estimates, against last month positive trend.

Takeaways

- Housing Starts and Building Permits came in below estimates

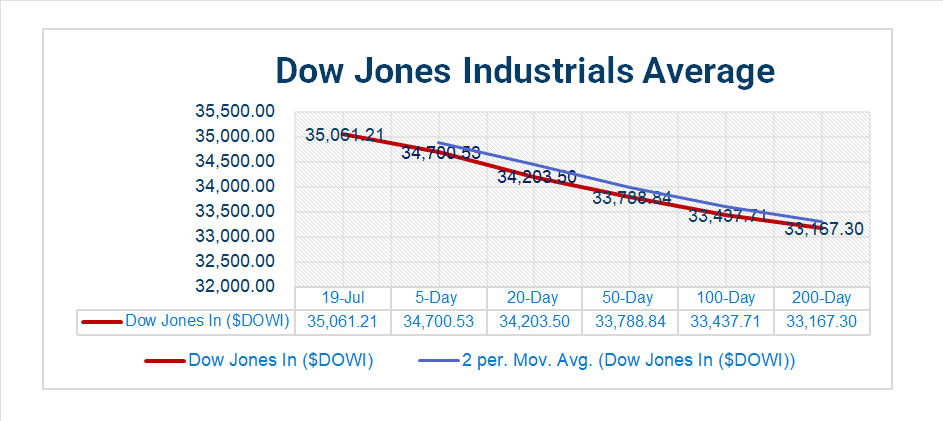

- DOW +0.31% leads majors

- 8 of 11 S&P 500 sectors advancing: Real Estate 1.26% outperforms/ Materials -0.52% lags

- Office REITs+2.64%, Health Care REITs +2.06%, Leisure Products +2.24%

- SPDR S&P Banking ETF ^KRE +3.11%

- USD Index and Bitcoin gain

- Bloomberg Commodity Index +0.58%

- Tesla (TSLA), S. Bancorp (USB) earnings beat

- Netflix (NFLX), Goldman Sachs (GS) earnings miss

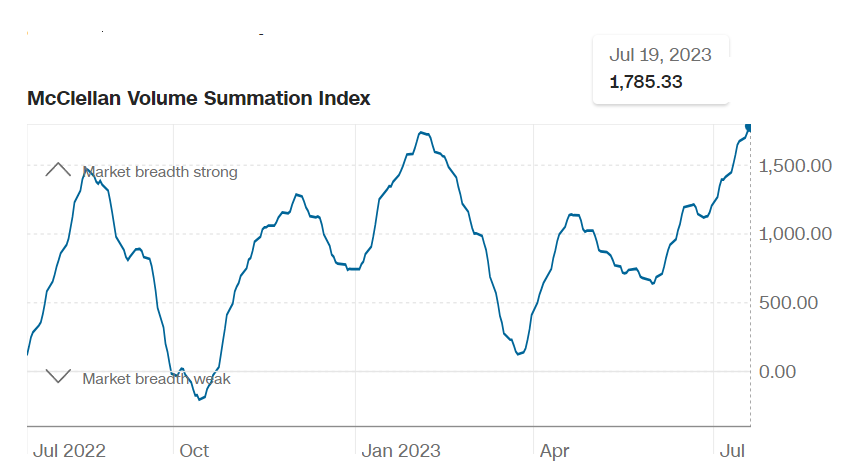

Pro Tip: the McClellan Volume Summation Index measures the amount, or volume, of shares on the NYSE that are rising compared to the number of shares that are falling. A higher number is an optimistic metric.

Sectors/ Commodities/ Treasuries

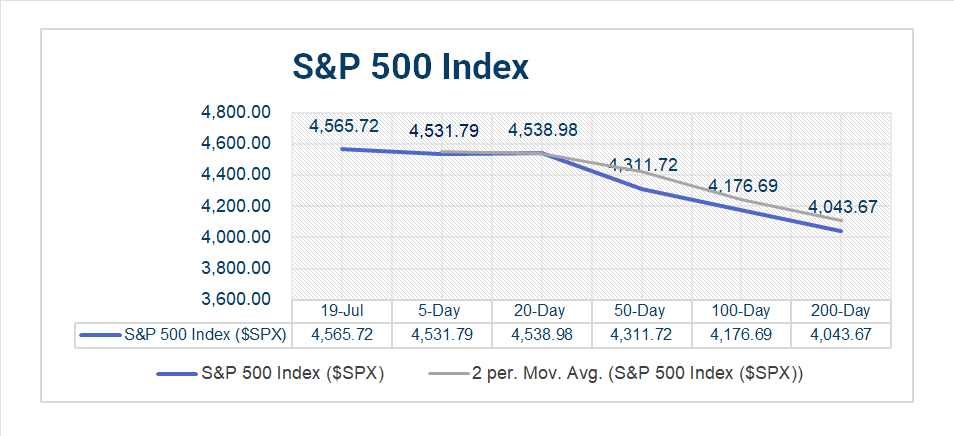

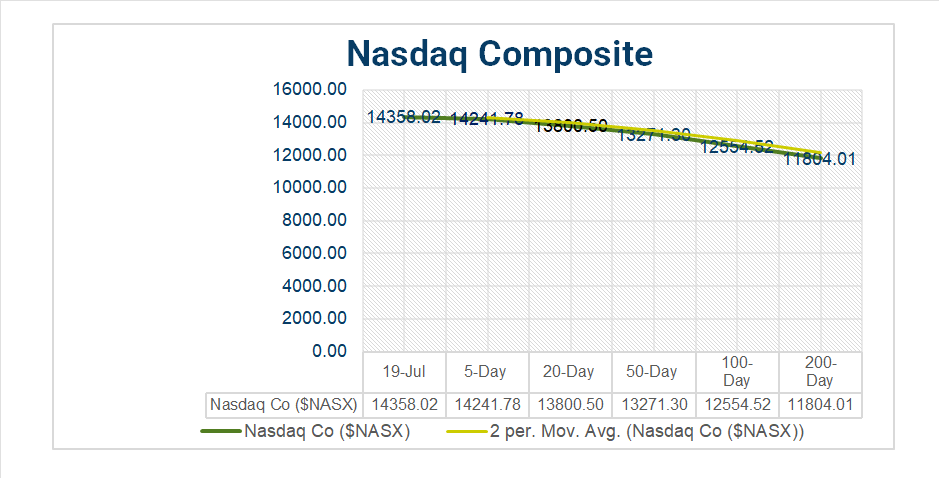

Key Indexes (5d, 20d, 50d, 100d, 200d)

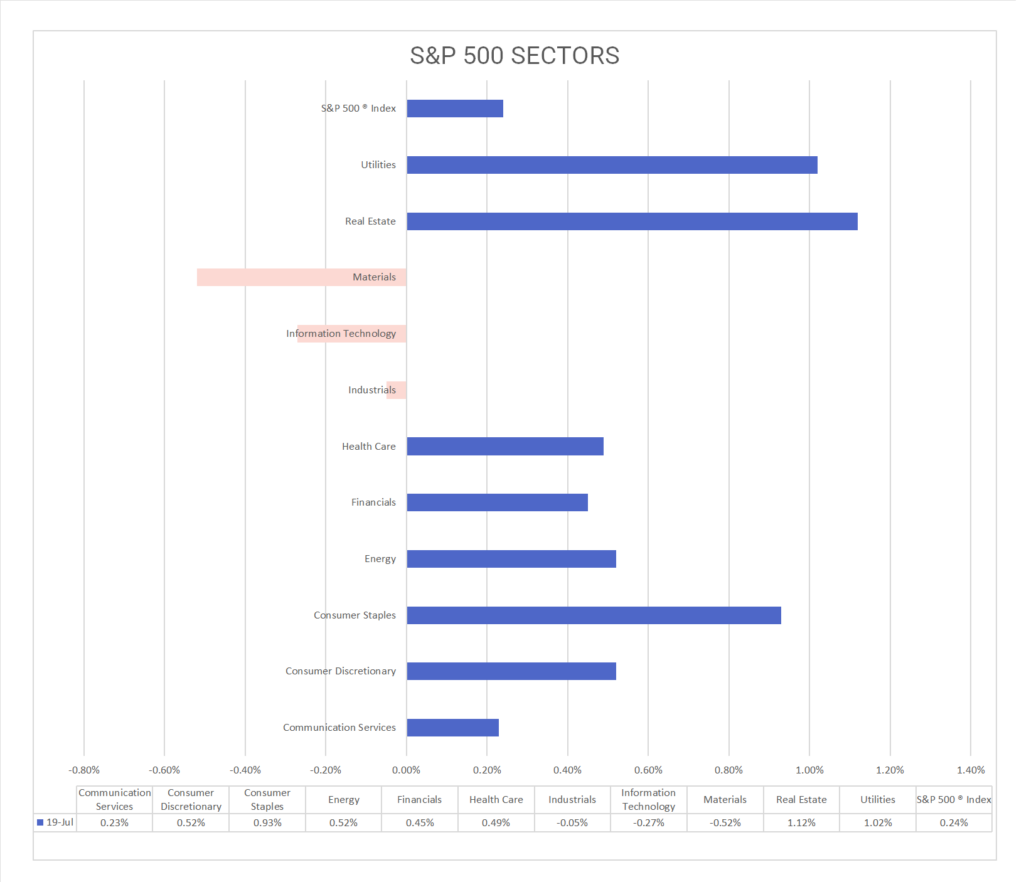

S&P Sectors

- 8 of 11 S&P 500 sectors advancing: Real Estate 26% outperforms/ Materials -0.52% lags.

- Real Estate/ Sub Office REITs+2.64%, Health Care REITs +2.06%. Others/ Leisure Products +2.24%, Communications Equipment +1.85%, Life Sciences Tools & Services +1.77%, Banks +1.70%.

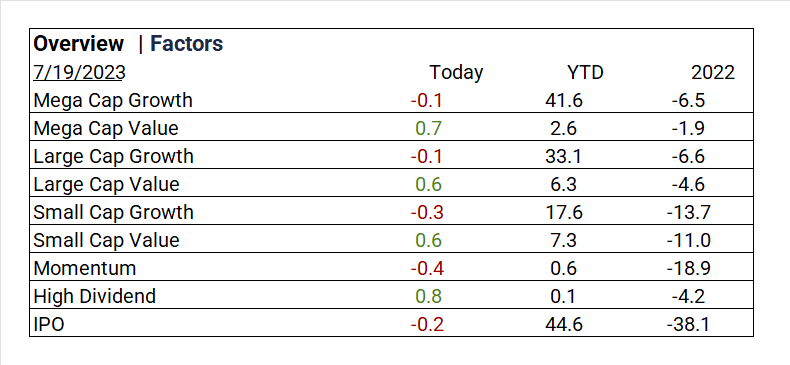

Factors

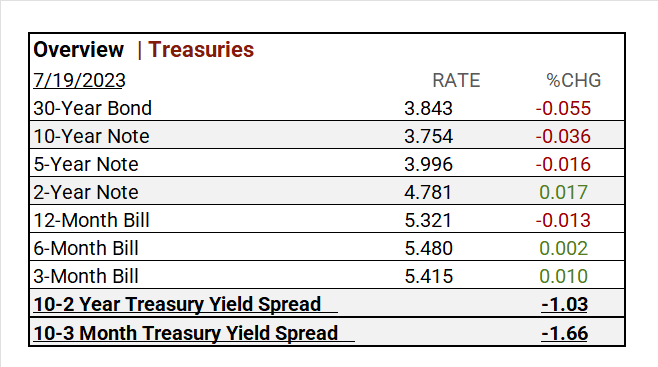

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: Tesla (TSLA), ASML ADR (ASML), Elevance Health (ELV), Activision Blizzard (ATVI), U.S. Bancorp (USB), Las Vegas Sands (LVS), Baker Hughes (BKR), Nasdaq Inc (NDAQ), M&T Bank (MTB), United Airlines Holdings (UAL), Carvana (CVNA)

- – Miss: Netflix (NFLX), IBM (IBM), Goldman Sachs (GS), Woodside Energy (WDS), Kinder Morgan (KMI)Volvo ADR (VLVLY), Halliburton (HAL), Discover (DFS), Steel Dynamics (STLD), Equifax (EFX), Northern Trust (NTRS), Citizens Financial Group Inc (CFG), Ally Financial Inc (ALLY), First Horizon National (FHN), Commerce Bancshares (CBSH)

Economic Data

US

- Housing Starts: period June, act 1.34m, fc 1.48m, prior 1.63m

- Building permits: period June, act 1.44m, fc 1.48m, prior 1.49m

Vica Partner Guidance July ‘23

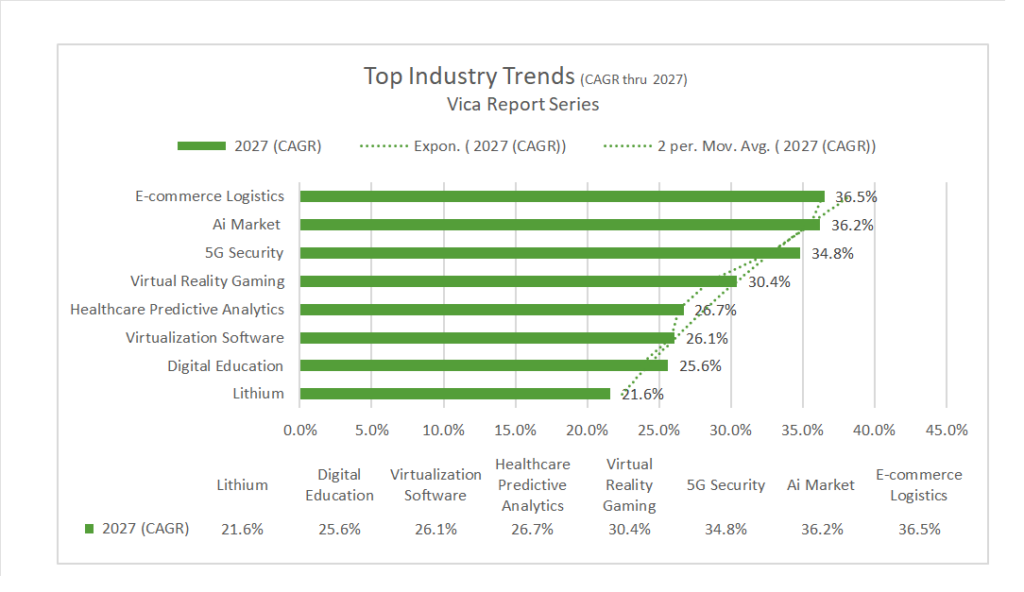

- Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Metals & Mining, Semiconductor & Semiconductor Equipment, Construction Materials, Energy Services. Nasdaq 100^NDX <15,000 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO), Sociedad Quimica y Minera (SQM).

News

Company News/ Other

- Carvana Soars On Debt-Restructuring Deal, Launches Stock Offering – WSJ

- Real Estate Woes Drive Billion-Dollar Hit for Goldman Sachs – Bloomberg

Energy/ Materials

- The Smoke and Mirrors of Western Oil Sanctions – Bloomberg

- US Oil Reserve Sales to China Could Be Blocked in Defense Bill – Bloomberg

Central Banks/Inflation/Labor Market

- US. Rate Rises Hit the Yen Hard, but Now It’s Staging a Comeback – WSJ

- Biden Gets Little Credit on Economy as He Touts ‘Bidenomics’ – Bloomberg

- Homeowners Don’t Want to Sell, So Home Builders Are Booming – WSJ

Asia/ China