Stay Informed and Stay Ahead: Market Watch, May 24th, 2024.

Wall Street, Late-Week Market Recap Edition

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Goods orders rise, May sentiment beats forecasts.

- Market Indices: DJIA up 0.01%, S&P 500 up 0.70%, Nasdaq up 1.10%.

- Sector Performance: 10/11 sectors up; Communication Services lead, Energy, Health Care lag. Top: Power, Renewables.

- Factors: Weekly gains driven by IPOs/ Mega, Large, Small-Cap Growth.

- Treasury Markets: Yields drop, except short-term Notes, Bills, slightly rise.

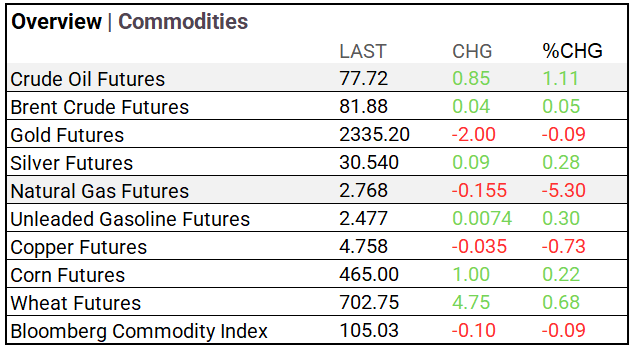

- Commodities: Oil, Silver, Gasoline, Wheat up; Natural Gas, Gold down.

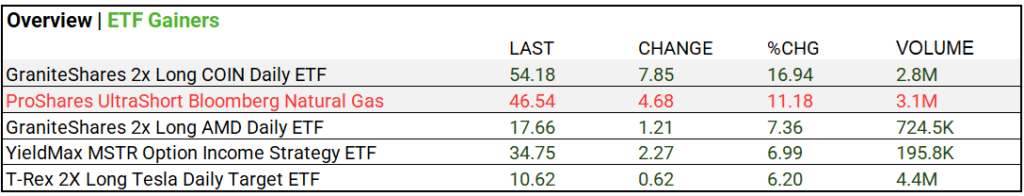

- ETFs: GraniteShares COIN and ProShares UltraShort Natural Gas ETFs gain on high volume.

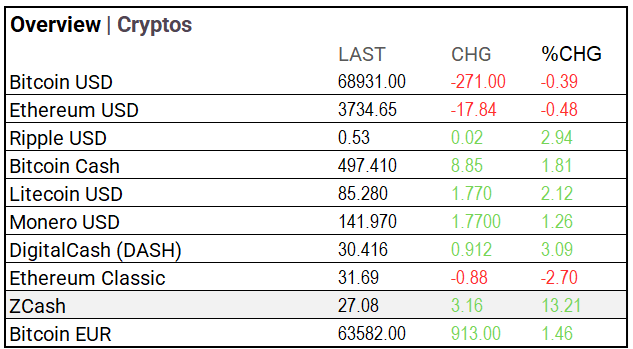

- Cryptos: ZCash and Ripple gain; Bitcoin and Ethereum dip.

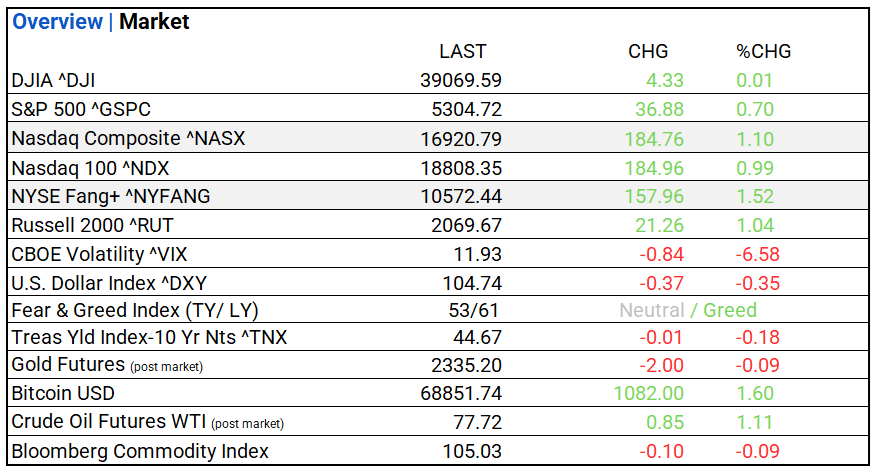

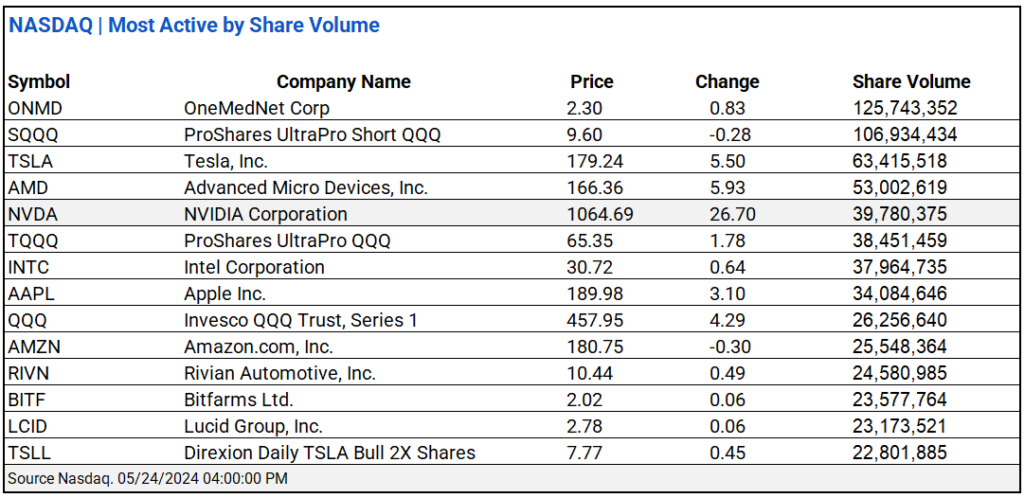

US Market Snapshot: Key Metrics:

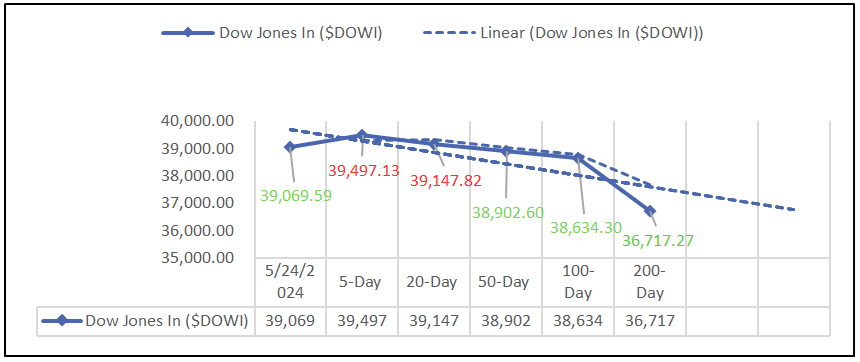

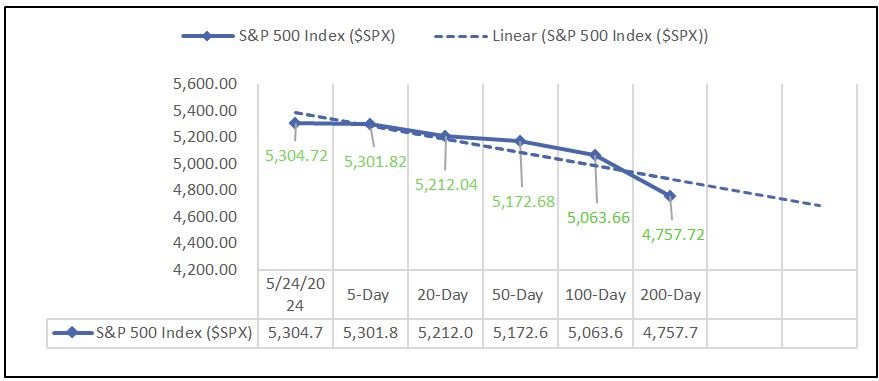

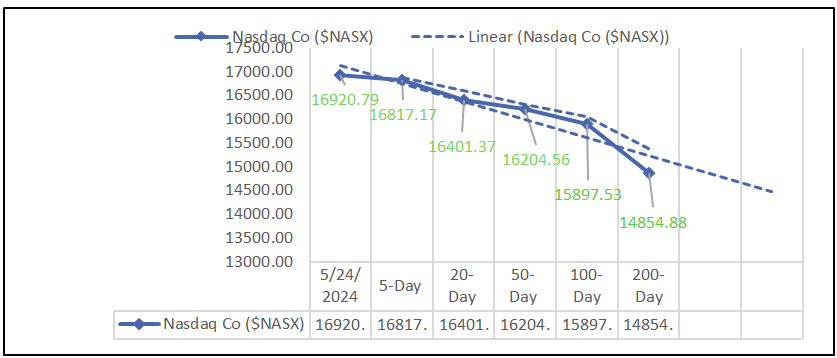

Moving Averages: DOW, S&P 500, NASDAQ:

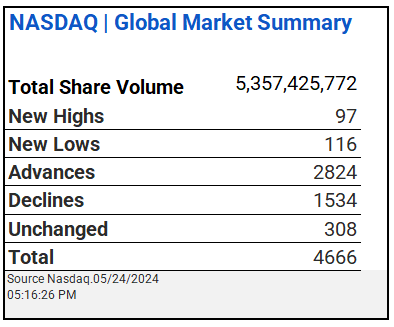

NASDAQ Global Market Summary:

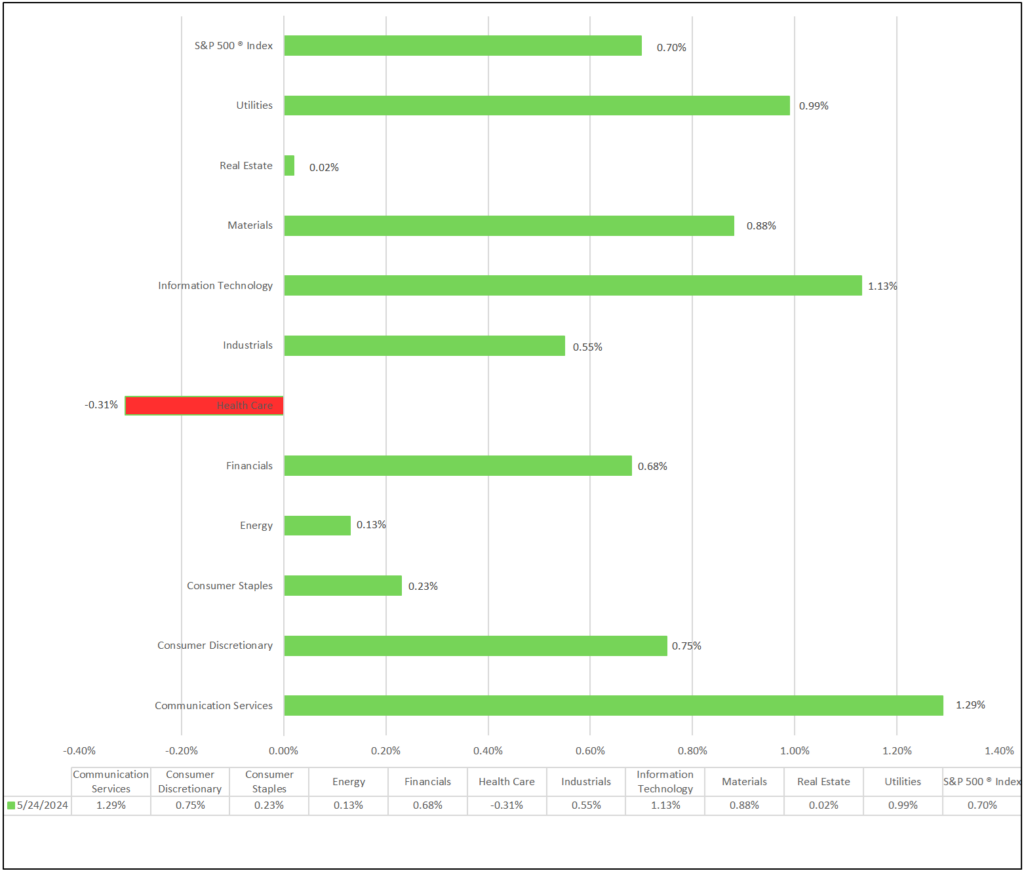

Sectors:

- 10 of 11 sectors higher; Communication Services (+1.29%) leading, Energy Health Care (-0.31%) lagging. Top industries: Independent Power and Renewable Electricity Producers (+4.86%), Automobiles (+2.73%), Automobile Components (+2.54%), and Construction & Engineering (+2.49%).

Factors:

- Broad-based weekly gains led by IPOs and Mega, Large and Small – Cap Growth.

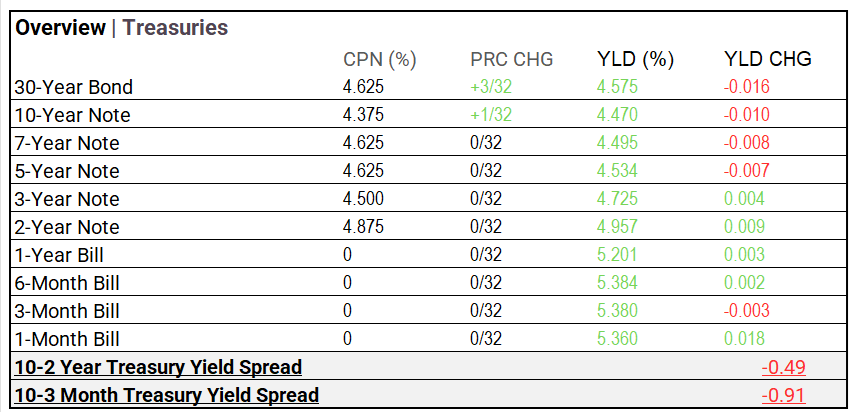

Treasury Markets:

- Treasury yields mostly declined, except for shorter-term notes and bills, which saw slight increases.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 104.74 (-0.37, -0.35%)

- CBOE Volatility ^VIX: 11.93 (-0.84, -6.58%)

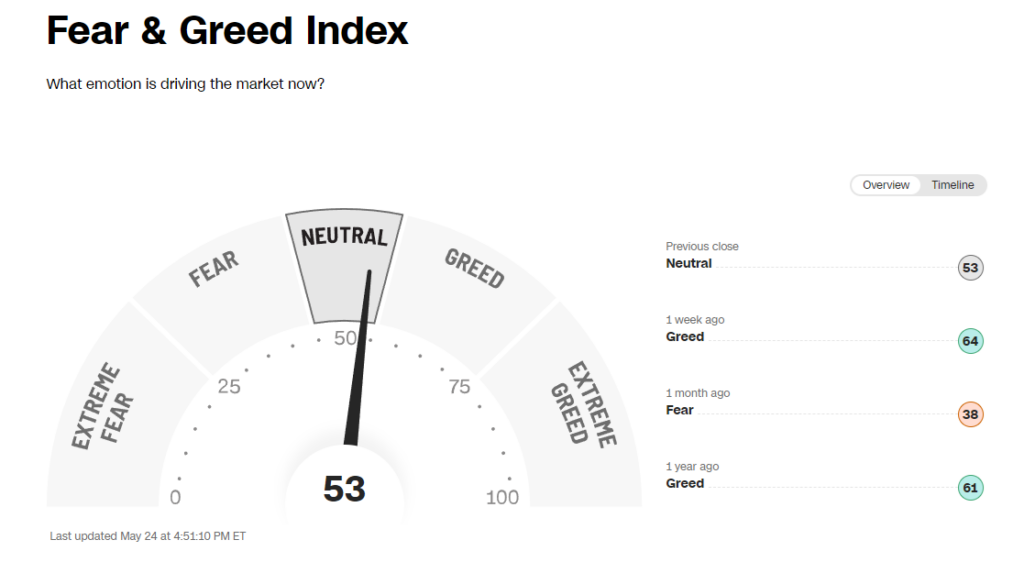

- Fear & Greed Index: 53/TY 61/LY (Neutral/ Greed)

Commodity Markets:

- Crude Oil, Silver, Gasoline, and Wheat futures rose, while Natural Gas and Gold futures fell.

ETF’s:

- GraniteShares COIN and ProShares UltraShort Natural Gas ETFs led gains, both showing significant increases on larger volume.

Cryptos:

- ZCash and Ripple led gains, while Bitcoin and Ethereum saw minor declines.

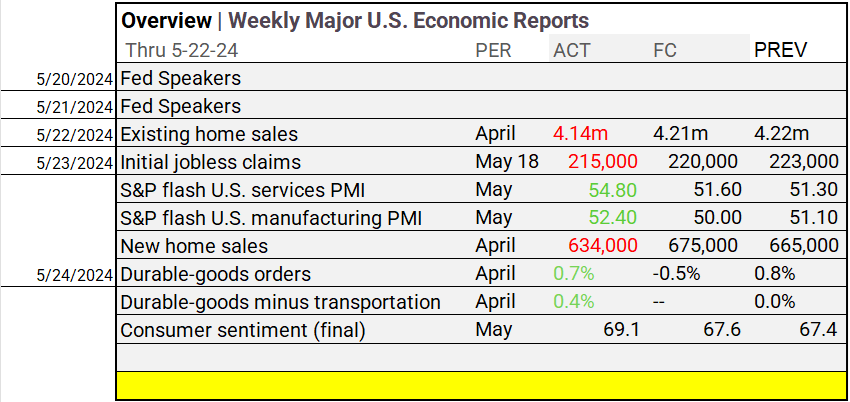

US Economic Data:

- Durable goods orders increased, consumer sentiment improved in May, exceeding previous and forecasted values.

Notable Earnings Today:

- BEAT: Booz Allen Hamilton (BAH).

- MISSED: Industrias Penoles (IPOAF), Buckle (BKE).

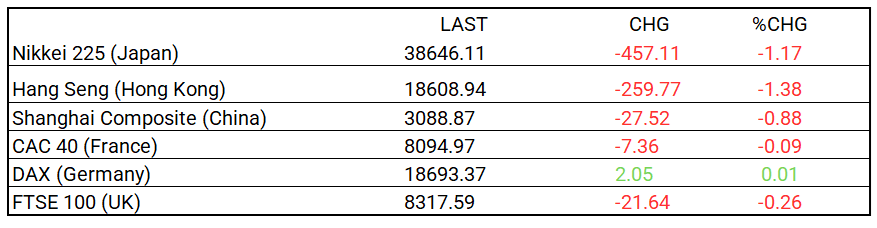

Global Markets Summary: Asian & European Markets:

- Asian markets declined, while European markets were mixed with minimal change.

Central Banking and Monetary Policy, Noteworthy:

- UK. Consumer Confidence Improves as Inflation Cools Further – Wall Street Journal

- Biden to End Tariff Exclusions on Hundreds of Chinese Products – Bloomberg

Business:

- Norway’s Oil Fund to Vote Against Exxon Mobil Amid Shareholder Rights Concern – Wall Street Journal

- Lucid to Cut 400 Jobs in Latest Sign of Stress for EV Market – Bloomberg

China:

- 13 of China’s biggest fiscal manoeuvres to boost economy since the pandemic years – South China Morning Post