Stay Informed and Stay Ahead: Market Watch, January 5th, 2024.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: In December, the U.S. employment rate and hourly wages closely align with consensus expectations, while ISM services fall below expectations, and factory orders for November modestly exceed forecasts.

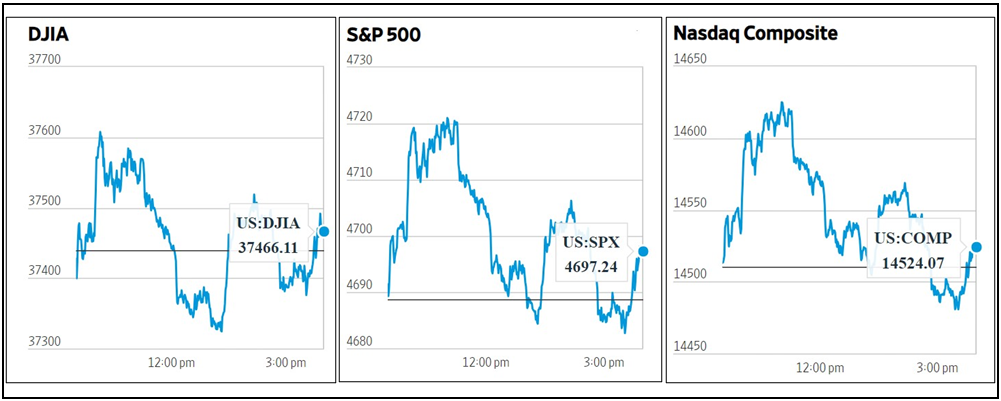

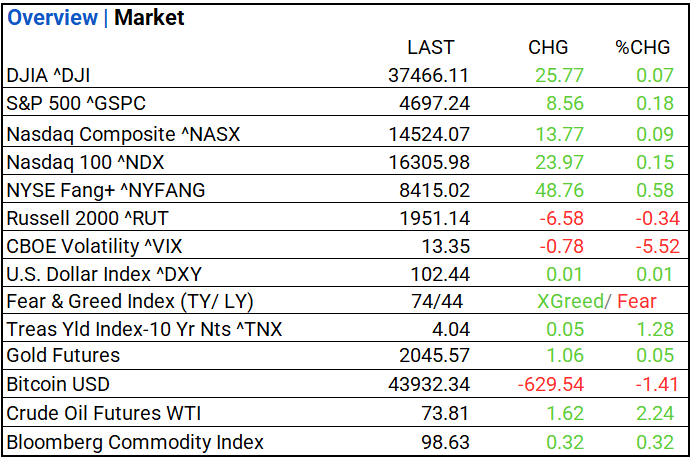

- Market Indices: DJIA (+0.07%), S&P 500 (+0.18%), Nasdaq Composite (+0.09%).

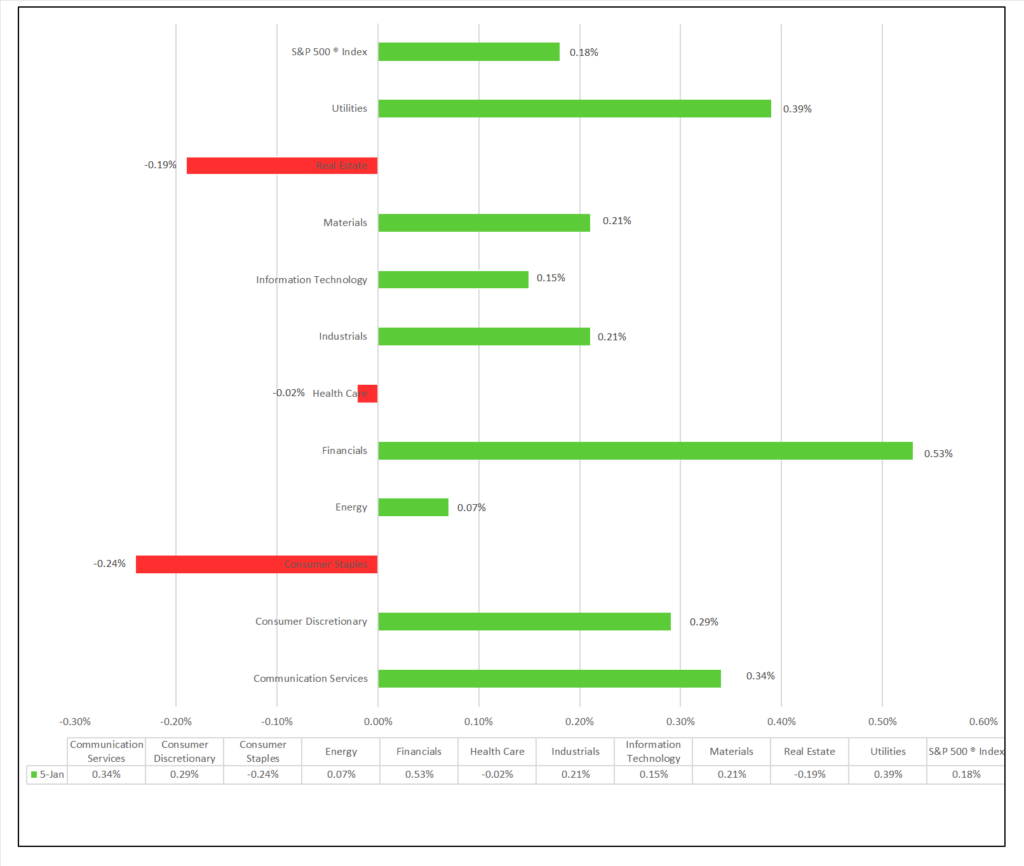

- Sector Performance: 8 of 11 sectors higher; Financials (+0.53%) leading, Consumer Staples (-0.24%) lagging. Top industry: Passenger Airlines (+3.68%).

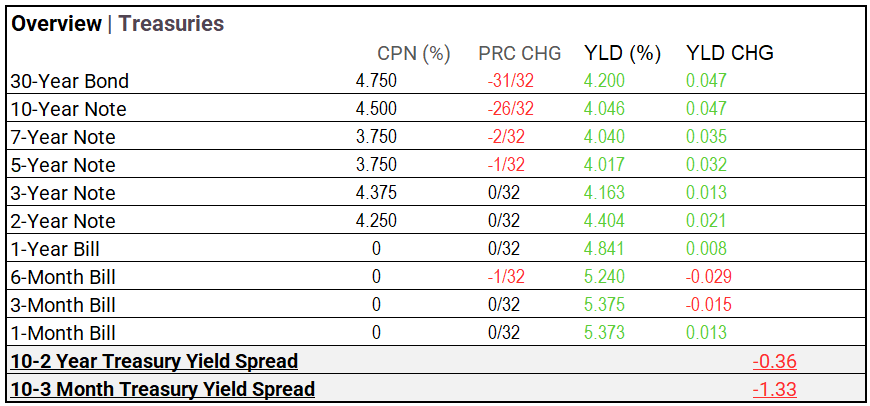

- Treasury Markets: Shorter-term bills decreased, while bond yields increased, with the 30-year and 10-year both experiencing the highest gain of +0.04.

- Commodities: Gold sees a moderate increase as Bitcoin declines, Crude Oil futures surge by 2.24%, and the Bloomberg Commodity Index rises.

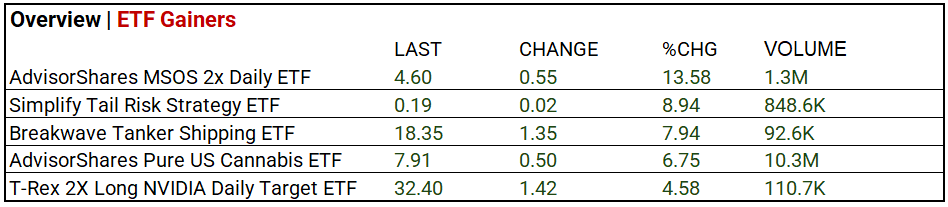

- ETFs: MSOS 2x gained 13.6%, doubling the daily total return of the AdvisorShares Pure US Cannabis ETF, which itself increased by 6.8% on substantial 10.3 million volume.

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,385.97 (-18.38, -0.05%)

- S&P 500 ^GSPC: 4,754.63 (+7.88, +0.17%)

- Nasdaq Composite ^NASX: 14,992.97 (+29.11, +0.19%)

- Nasdaq 100 ^NDX: 16,777.40 (+20.00, +0.12%)

- NYSE Fang+ ^NYFANG: 8,728.23 (-27.02, -0.31%)

- Russell 2000 ^RUT: 2,033.96 (+16.90, +0.84%)

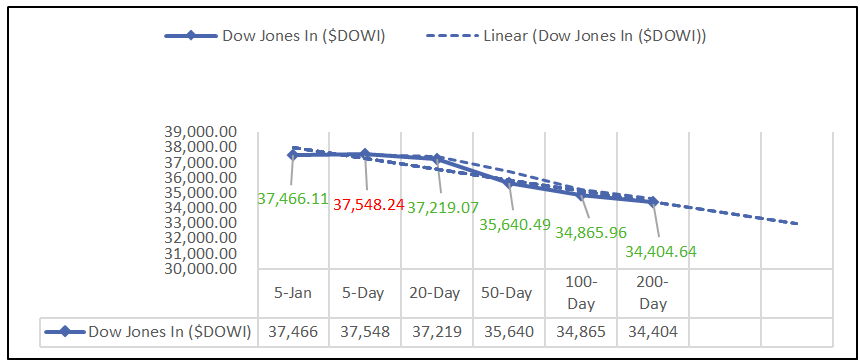

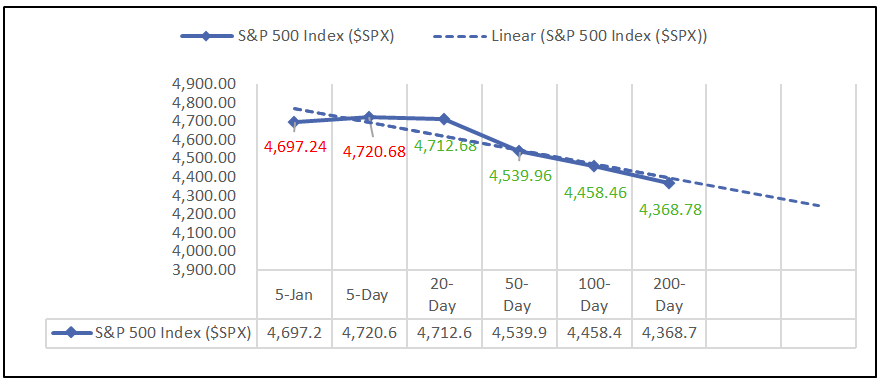

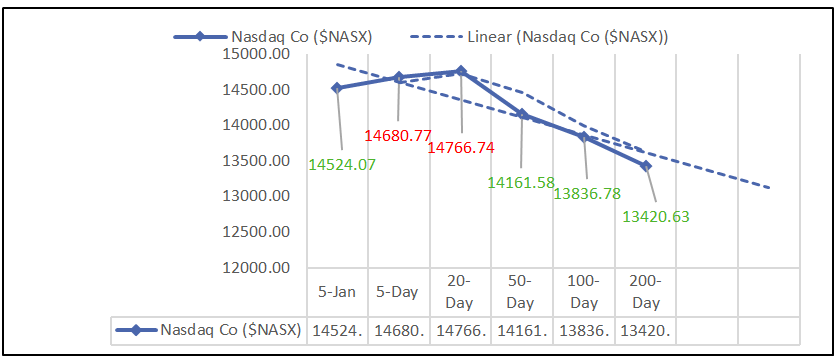

Moving Averages: DOW, S&P 500, NASDAQ:

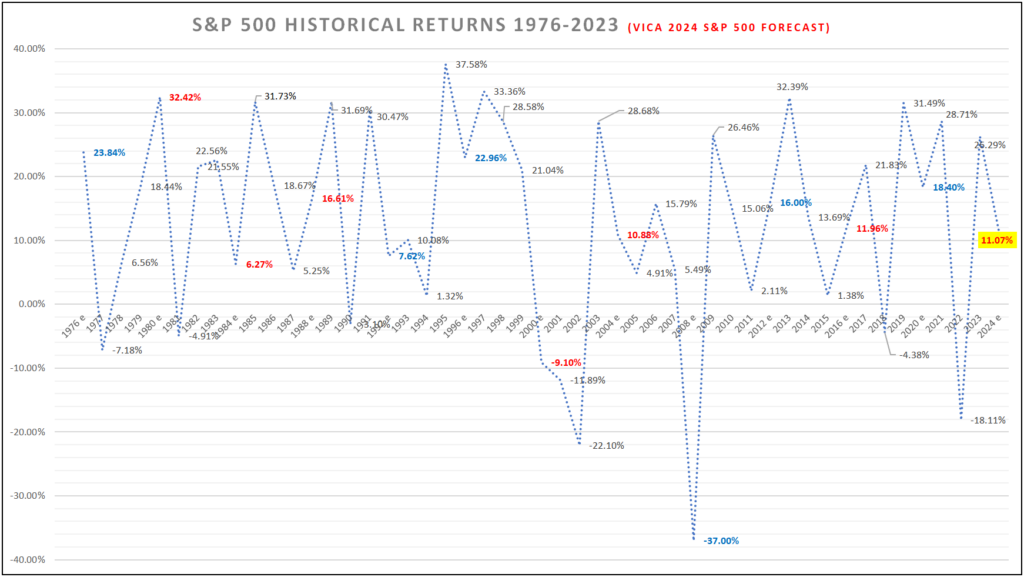

Vica S&P 500 Forecast:

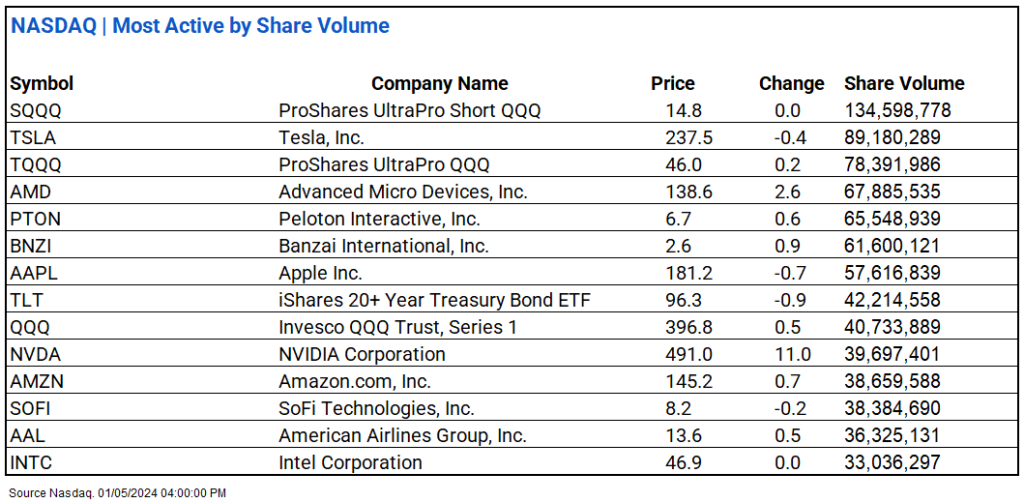

NASDAQ Global Market Summary:

Sectors:

- 8 of 11 sectors higher; Financials (+0.53%) leading, Consumer Staples (-0.24%) lagging. Top industries: Passenger Airlines (+3.68%), Diversified Telecommunication Services (+2.01%), and Consumer Finance (+1.53%).

Factors:

- Updates next week.

Treasury Markets:

- Shorter-term bills decreased, while bond yields increased, with the 30-year and 10-year both experiencing the highest gain of +0.047.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 102.44 (+0.01, +0.01%)

- CBOE Volatility ^VIX: 13.35 (-0.78, -5.52%)

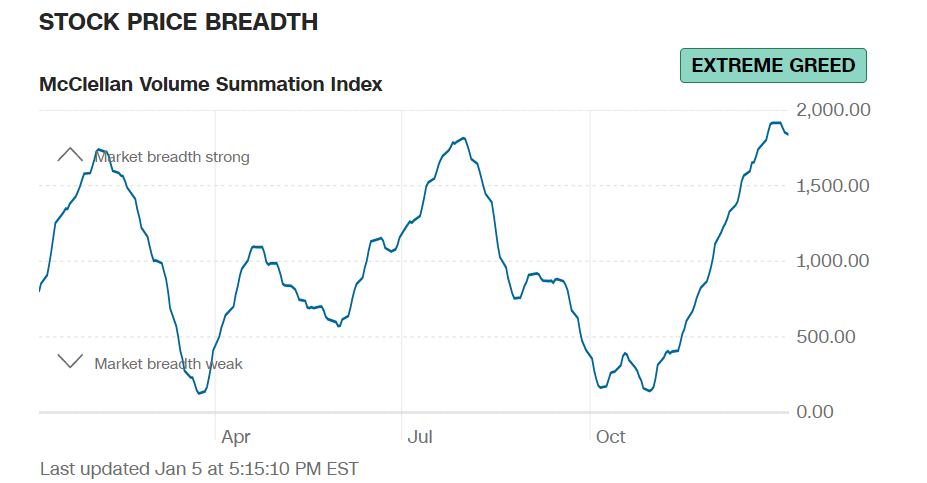

- Fear & Greed Index: 74/LY 44 (Extreme Greed/ Fear)

Commodity Markets:

- Gold Futures: $2,045.57 (+$1.06, +0.05%)

- Bitcoin USD: $43,932.34 (-$629.54, -1.41%)

- Crude Oil Futures WTI: $73.81 (+$1.62, +2.24%)

- Bloomberg Commodity Index: 98.63 (+$0.32, +0.32%)

ETF’s:

- MSOS 2x gained 13.6%, doubling the daily total return of the AdvisorShares Pure US Cannabis ETF, which itself increased by 6.8% on substantial 10.3 million volume.

US Economic Data:

- U.S. employment report for December: 216,000 (Forecast: 170,000, Previous: 173,000)

- U.S. unemployment rate for December: 3.7% (Forecast: 3.8%, Previous: 3.7%)

- U.S. hourly wages for December: 0.4% (Forecast: 0.3%, Previous: 0.4%)

- Hourly wages (year over year): 4.1% (Forecast: 3.9%, Previous: 0%)

- ISM services for December: 50.6% (Forecast: 52.5%, Previous: 52.7%)

- Factory orders for November: 2.6% (Forecast: 2.5%, Previous: -3.4%)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT:

- MISSED: Constellation Brands A (STZ), Greenbrier (GBX)

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 33,377.42 (89.13, 0.27%)

- Hang Seng (Hong Kong): 16,535.33 (-110.65, -0.66%)

- Shanghai Composite (China): 2,929.18 (-25.17, -0.85%)

- CAC 40 (France): 7,420.69 (-29.94, -0.40%)

- DAX (Germany): 16,594.21 (-23.08, -0.14%)

- FTSE 100 (UK): 7,689.61 (-33.46, -0.43%)

Central Banking and Monetary Policy, Noteworthy:

- US Payrolls, Wages Pick Up in Jobs Report Dotted With Caveats – Bloomberg

- Fed Should Lower Rates as Economy Normalizes, Barkin Says – Bloomberg

- Eurozone Inflation Rose Less Than Expected, Keeping Rate-Cut Talk on Track – WSJ

Energy:

- Southwestern, Chesapeake Near $17 Billion Energy Merger – WSJ

- Smarter Energy Use Is a New Green Bet for Big-Money Investors – Bloomberg

China:

- China steps up efforts to adapt as US-led ‘reshoring’ campaign seems set in stone – SCMP