“Empowering Your Financial Success”

Daily Market Insights: September 28th, 2023

Global Markets Summary:

Asian Markets:

- China’s Shanghai Composite: +0.13%

- Hong Kong’s Hang Seng: -1.41%

- Japan’s Nikkei 225: -1.54%

US Futures:

- S&P Futures: opened @ 4269.65 (+0.11%)

European Markets:

- Germany’s DAX: +0.70%

- France’s CAC 40: +0.63%

- London’s FTSE 100: +0.13%

US Market Snapshot:

Key Stock Market Indices:

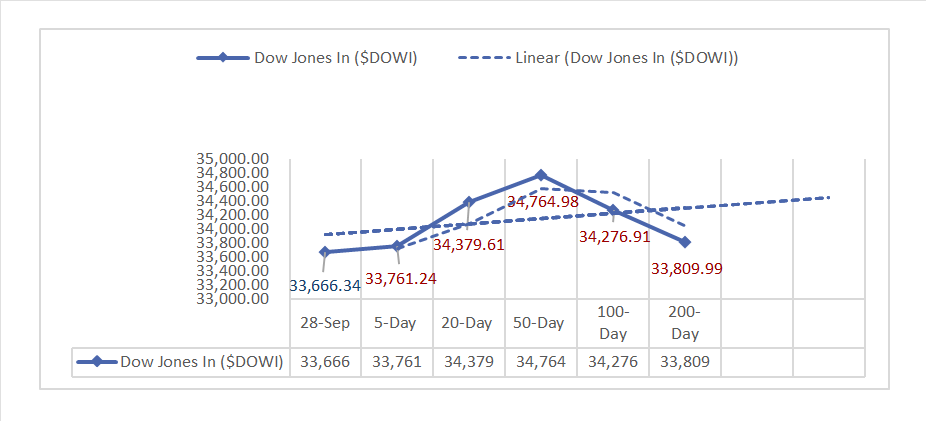

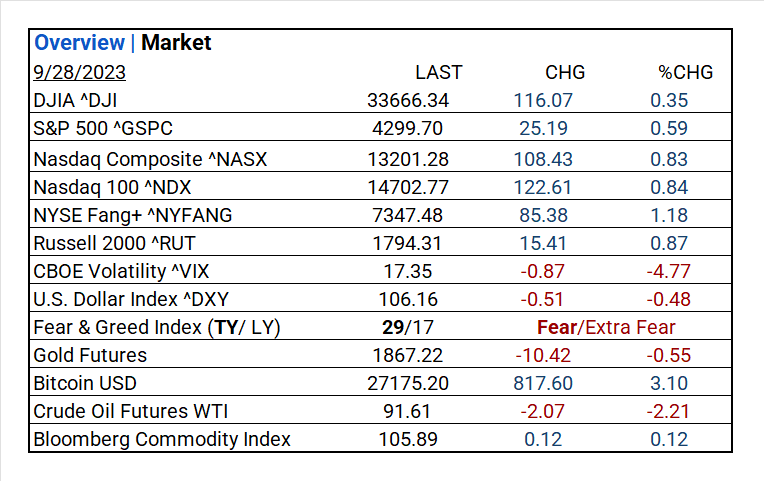

- DJIA ^DJI: 33,666.34 (116.07, 0.35%)

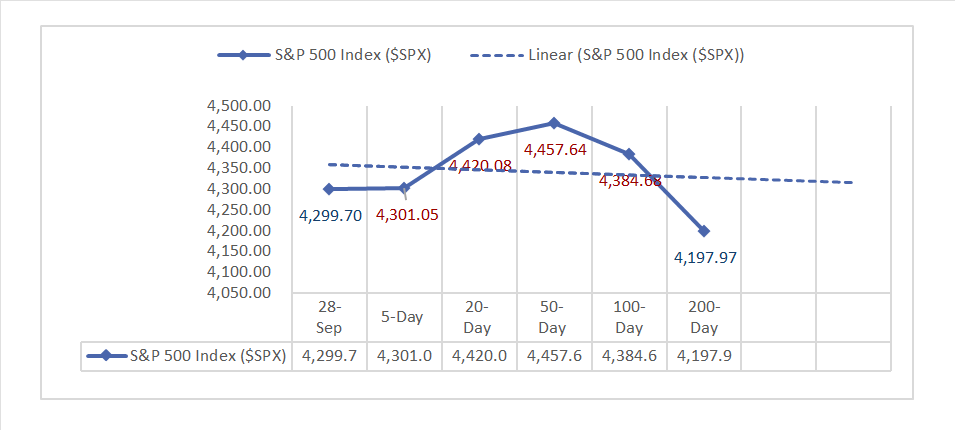

- S&P 500 ^GSPC: 4,299.70 (25.19, 0.59%)

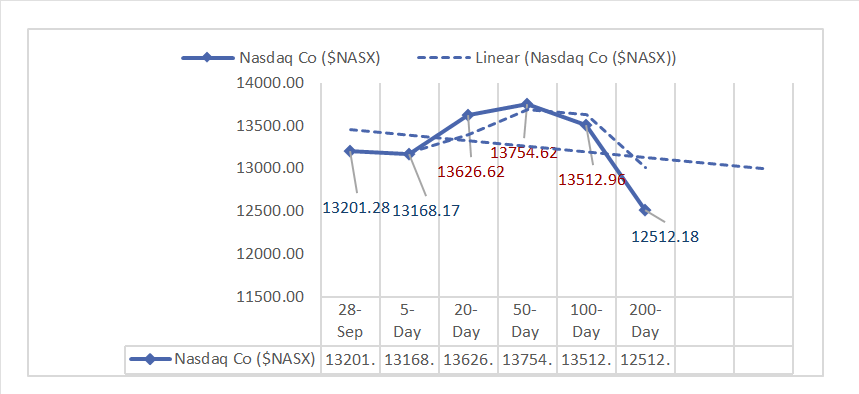

- Nasdaq Composite ^NASX: 13,201.28 (108.43, 0.83%)

- Nasdaq 100 ^NDX: 14,702.77 (122.61, 0.84%)

- NYSE Fang+ ^NYFANG: 7,347.48 (85.38, 1.18%)

- Russell 2000 ^RUT: 1,794.31 (15.41, 0.87%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Initial Claims: 204k (beat 215k consensus, up from 201k last week). Continuing Claims: 1.67 million (below 1.675 million consensus). Q2 GDP (final): 2.1% (slightly under 2.2% consensus, in line with prior figure). Q2 PCE (final): 3.7%. Data suggests a stable economy with jobless claims and GDP performance surprises.

- Market Indices: The Nasdaq Composite (^NASX) led the majors with gains, followed by the S&P 500 (^GSPC) and DJIA (^DJI). The NYSE Fang+ (^NYFANG) saw the greatest increase on the day, followed by Russell 2000 (^RUT) and Nasdaq 100 (^NDX).

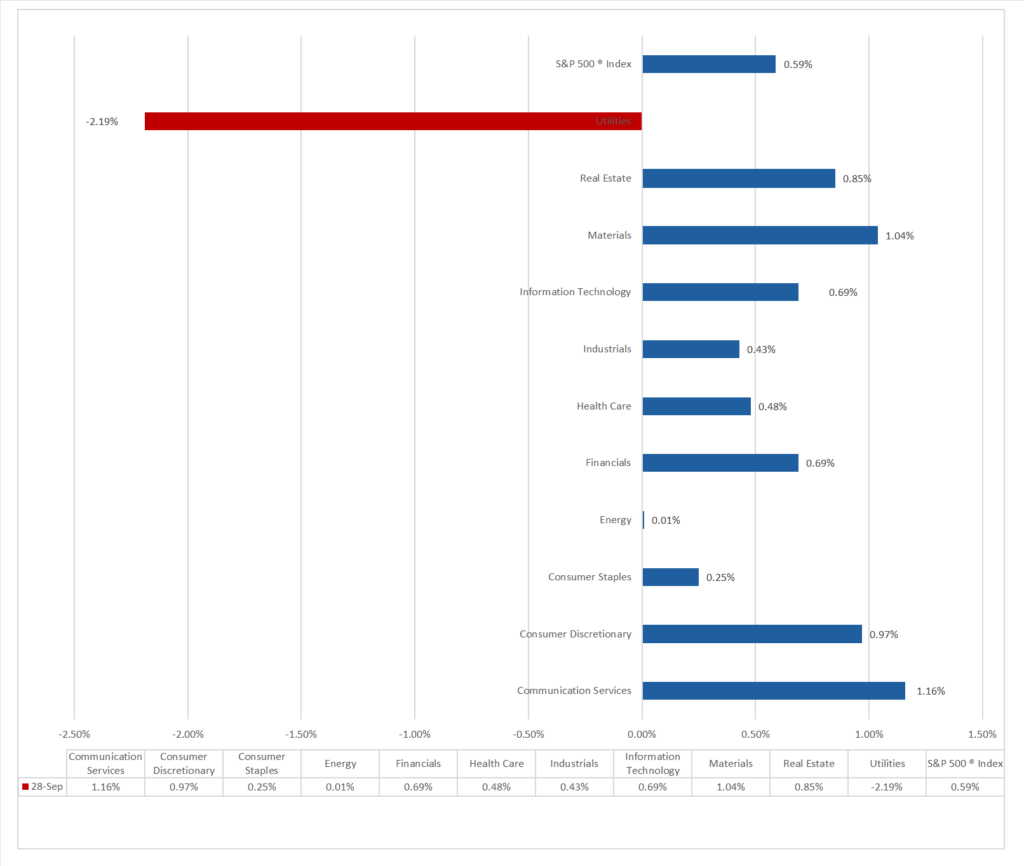

- Sector Performance: 10 of 11 sectors rose, led by Communication Services (+1.16%), while Utilities (-2.19%) lagged. Top Industries: Automobile Components (+3.12%), Automobiles (+2.38%).

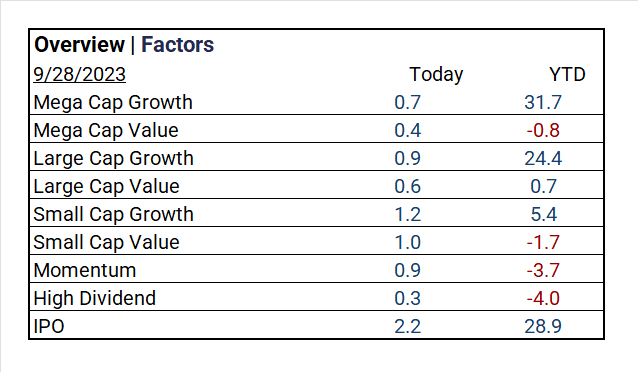

- Factors: IPOs and Small Caps outperformed.

- Top ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL gained +5.43%

- Worst ETF: ProShares Ultra VIX Short Term Futures ^UVXY declined by -7.09%..

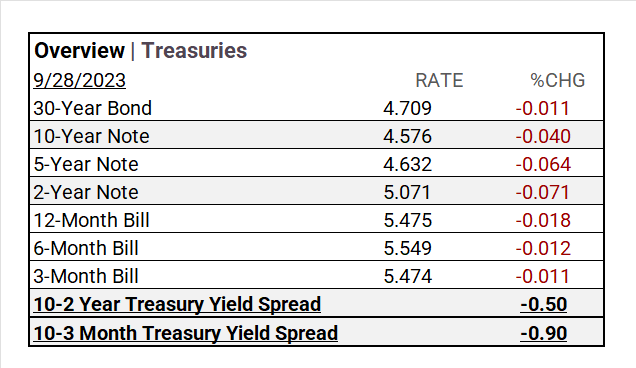

- Treasury Markets: 30-Year Bond yields were 4.709% (-0.011%), 10-Year Note at 4.576% (-0.040%), and 5-Year Note at 4.632% (-0.064%). Short-term bills fluctuated, and yield spreads tightened.

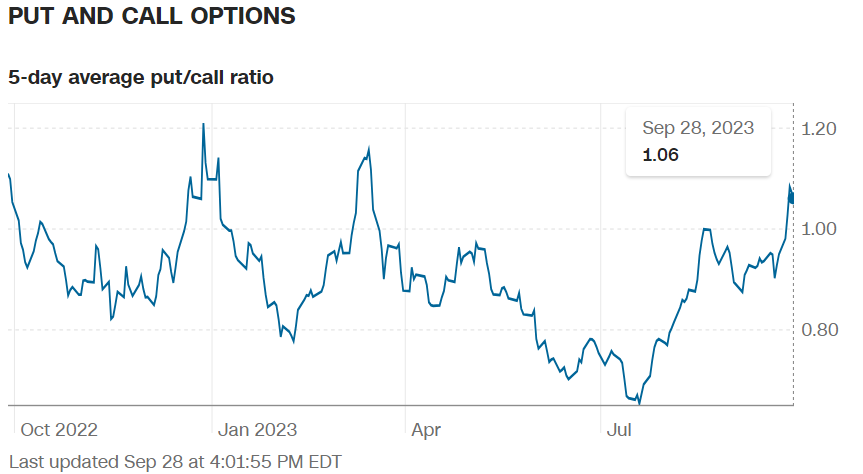

- Currency and Volatility: The U.S. Dollar Index declined, CBOE Volatility decreased, and the Fear & Greed Index showed a slight improvement but still signaled fear.

- Commodity Markets: Gold Futures declined, Bitcoin rebounded, Crude Oil Futures WTI retreated, and the Bloomberg Commodity Index rose. Gold Futures fell, Bitcoin bounced nicely,

Sectors:

- 10 of 11 sectors rose, with Communication Services (+1.16%) outperforming while Utilities (-2.19%) lagged. Industry Leads: Automobile Components (+3.12%), Automobiles (+2.38%), Hotel & Resort REITs (+2.37%).

Treasury Yields and Currency:

- In Treasury markets, long-term bonds, like the 30-Year Bond, had higher yields at 4.709%, down 0.011%. The 10-Year Note was at 4.576%, down 0.040%, and the 5-Year Note stood at 4.632%, down 0.064%. Short-term bills saw slight changes, and yield spreads narrowed.

- The U.S. Dollar Index ^DXY: 106.16 (-0.51, -0.48%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 17.35 (-0.87, -4.77%)

- Fear & Greed Index (TY/LY): 29/17 (Fear/Extreme Fear).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1867.22 (-10.42, -0.55%)

- Bitcoin USD: 27175.20 (+817.60, 3.10%)

- Crude Oil Futures WTI: 91.61 (-2.07, -2.21%)

- Bloomberg Commodity Index: 105.89 (0.12, 0.12%)

Factors:

- IPOs led (+2.2%) followed by Small Cap Growth (+1.2%)

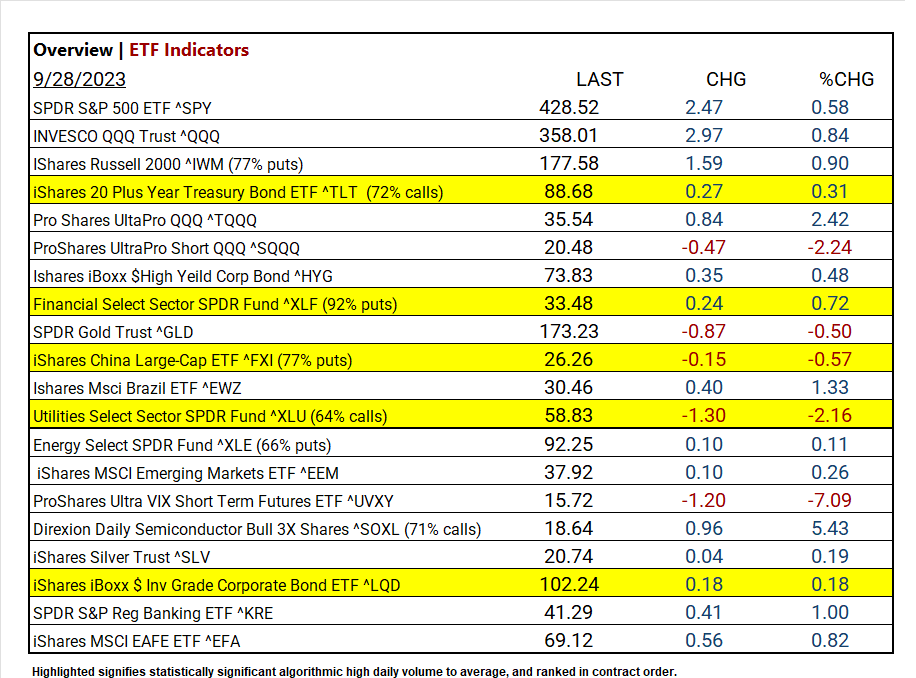

ETF Performance:

Top 3 Best Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL +5.43%

- Pro Shares UltaPro QQQ ^TQQQ +2.42%

- Ishares Msci Brazil ETF ^EWZ +1.33%

Top 3 Worst Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -7.09%

- ProShares UltraPro Short QQQ ^SQQQ -2.24%

- Utilities Select Sector SPDR Fund ^XLU -2.16%

US Economic Data

- Initial Claims: 204k (vs. consensus 215k, prior 201k)

- Continuing Claims: 1.67 million (vs. consensus 1.675 million, prior 1.662 million)

- Q2 GDP (final): 2.1% (vs. consensus 2.2%, prior 2.1%)

- Q2 PCE (final): 3.7% (prior 3.7%)

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023 results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: S&P 500 to see -0.2% YoY earnings decline, marking 4th consecutive drop. S&P 500’s 12-month P/E ratio is 18.0, below 5-year (18.7%) average but above 10-year (17.5%) average. 74 S&P 500 firms gave negative EPS guidance, 42 exceeded expectations with positive guidance.

Notable Earnings Today:

- Beat: n/a

- Miss: Accenture (ACN), Nike (NKE), Jabil Circuit (JBL), CarMax (KMX), Vail Resorts (MTN) BlackBerry (BB)

Resources:

News

Investment and Growth News

- UPS to Acquire MNX in Bid to Bolster Healthcare Business – WSJ

- X CEO Linda Yaccarino Says Platform Should Turn Profit in 2024 – WSJ

- This Year’s Hottest Tech IPO May Be a Transportation Firm – Bloomberg

- Character.AI in Early Talks for Funding at More Than $5 Billion Valuation – Bloomberg

Infrastructure and Energy

- Biden to Offer Smallest-Ever Offshore Oil Rights Sale Plan – Bloomberg

- China’s Grip on Critical Minerals Draws Warnings at IEA Gathering – Bloomberg

Real Estate Market Updates

- About Four in Ten US Homeowners Are Mortgage Free. Are You One of Them? – Bloomberg

Central Banking and Monetary Policy

- Powell Says Public’s Understanding Key to Fed Impact on Economy – Bloomberg

- Why America Has a Long-Term Labor Crisis, in Six Charts – WSJ

International Market Analysis (China)

- China’s ‘golden week’ spending and travel surge seen as economic boon – SCMP