“Empowering Your Financial Success”

Daily Market Insights: September 26th, 2023

Global Markets Summary:

Asian Markets:

- Hong Kong’s Hang Seng: -1.46%

- Japan’s Nikkei 225: -1.11%

- China’s Shanghai Composite: -0.37%

US Futures:

- S&P Futures: opened @4,312.88 (-0.57%)

European Markets:

- London’s FTSE 100: +0.08%

- Germany’s DAX: -0.97%

- France’s CAC 40: -0.70%

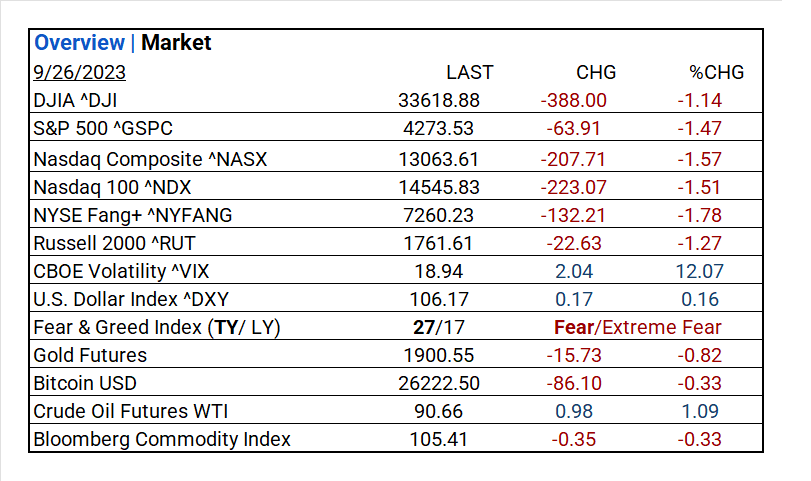

US Market Snapshot:

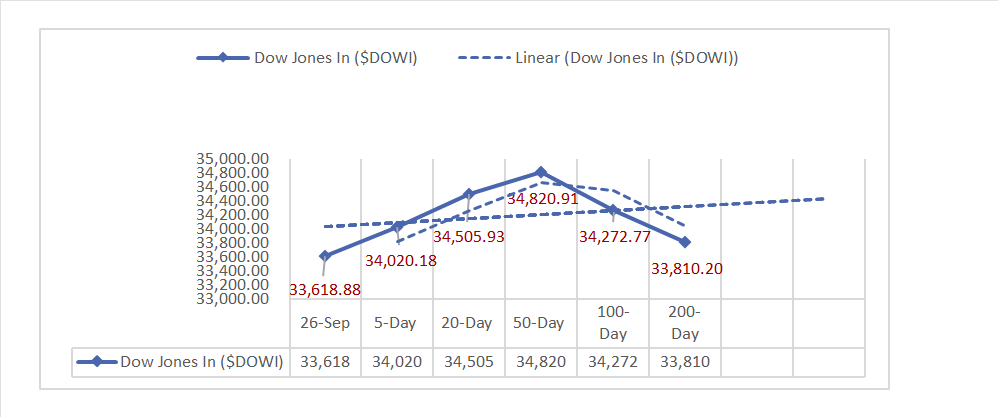

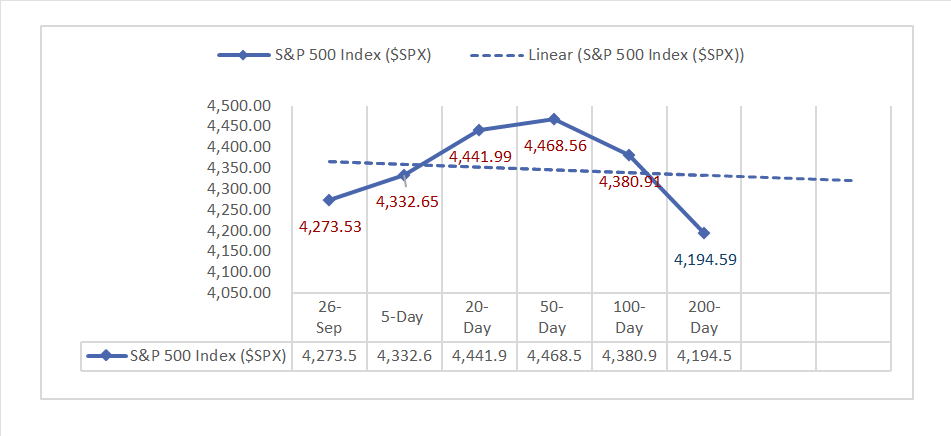

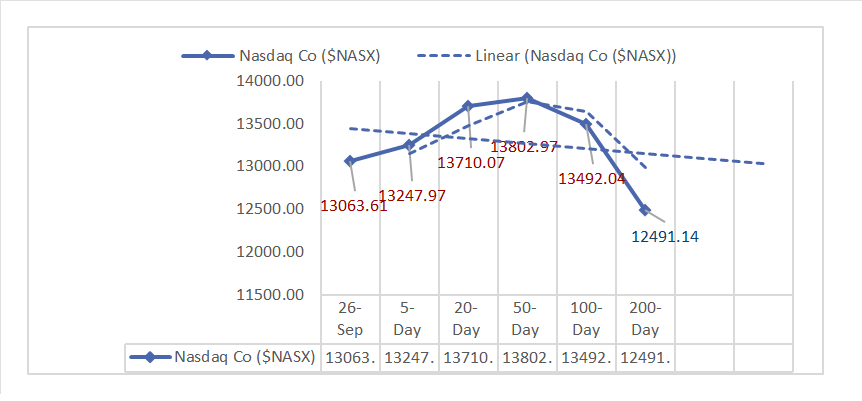

Key Stock Market Indices:

- DJIA ^DJI: 33618.88 (-388.00, -1.14%)

- S&P 500 ^GSPC: 4273.53 (-63.91, -1.47%)

- Nasdaq Composite ^NASX: 13063.61 (-207.71, -1.57%)

- Nasdaq 100 ^NDX: 14545.83 (-223.07, -1.51%)

- NYSE Fang+ ^NYFANG: 7260.23 (-132.21, -1.78%)

- Russell 2000 ^RUT: 1761.61 (-22.63, -1.27%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Improved home prices and sales amid declining consumer confidence indicate economic uncertainty.

- Market Indices: DJIA, S&P 500, and Nasdaq Composite faced pressure, with NYSE Fang+ leading the downturn.

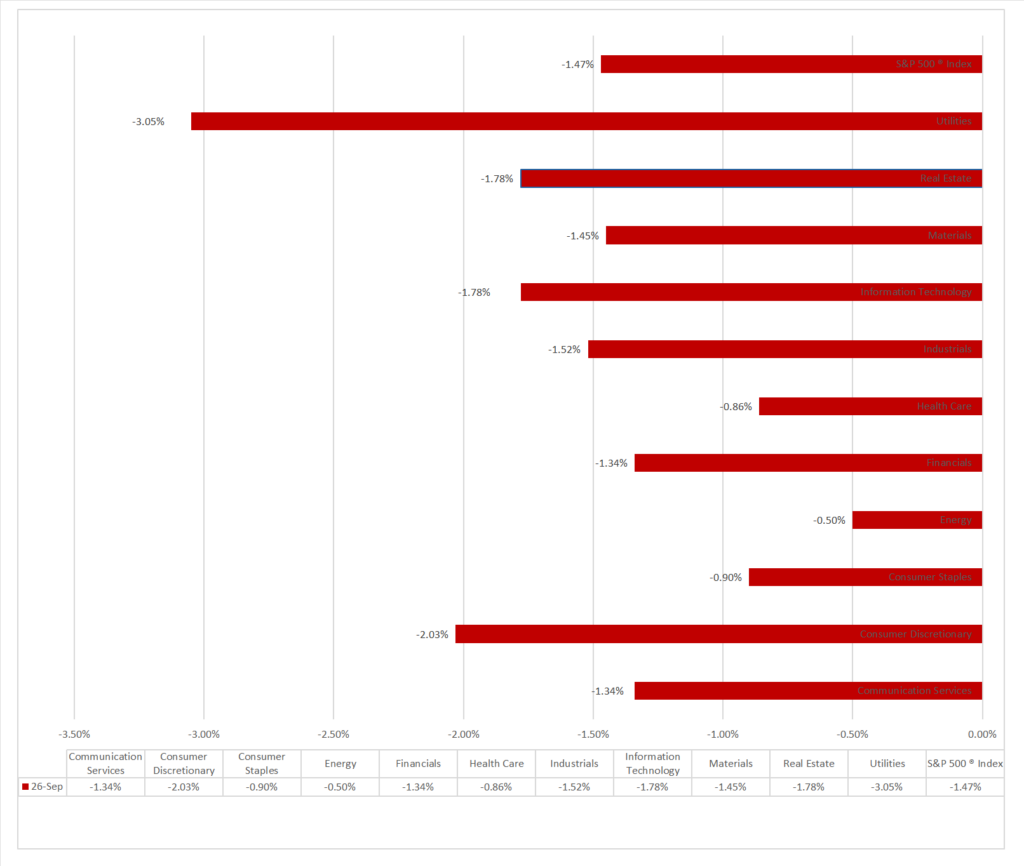

- Sector Performance: All 11 sectors declined, led by Energy (-0.50%) and lagging in Utilities (-3.05%).

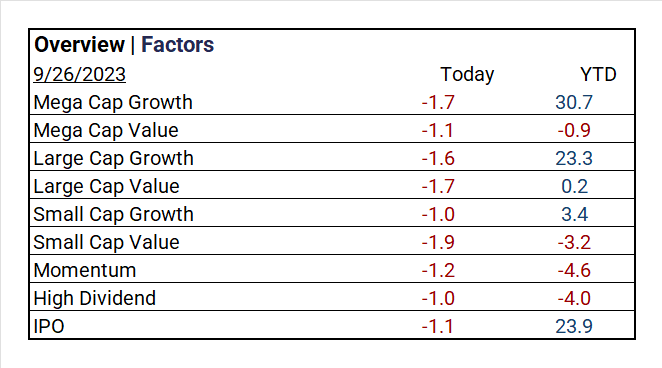

- Factors: Small Cap Growth and High Dividend outperformed (-1.0%), followed by Mega Cap Value and IPOs at (-1.1%).

- Top ETF: ProShares Ultra VIX Short Term Futures ^UVXY: +13.89%.

- Worst ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL: -5.38%.

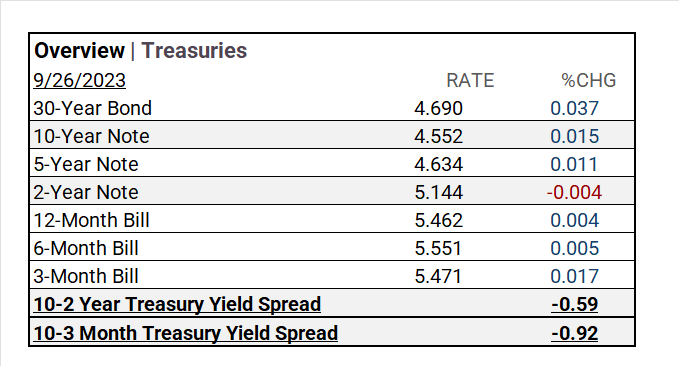

- Treasury Markets: Long-term bonds, like the 30-Year Bond, had higher yields; 10-2 Year and 10-3 Month spreads narrowed.

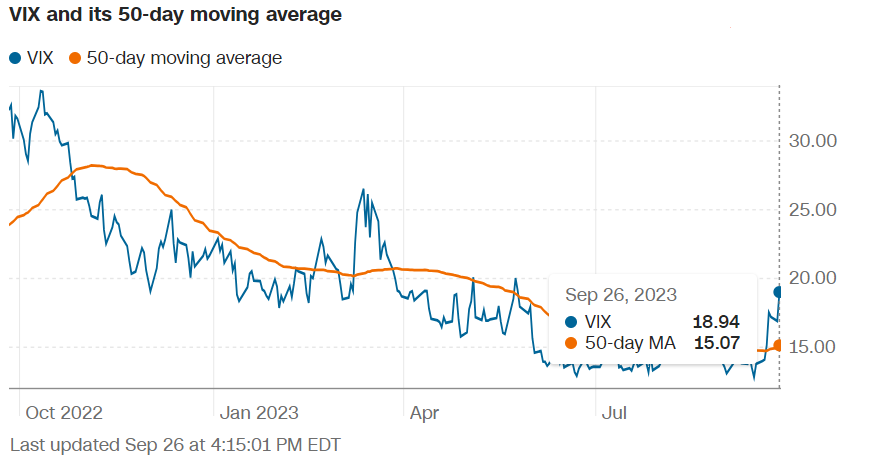

- Currency and Volatility: U.S. Dollar Index rose, CBOE Volatility increased, Fear & Greed Index indicated fear.

- Commodity Markets: Gold Futures and Bitcoin fell, Crude Oil Futures WTI rose, and Bloomberg Commodity Index declined.

Sectors:

- Sector Performance: All 11 sectors declined, led by Energy (-0.50%) and lagging in Utilities (-3.05%).

Treasury Yields and Currency:

- In Treasury markets, long-term bonds, like the 30-Year Bond, saw increased yields, while short-term bills had minor fluctuations. Additionally, yield spreads shifted, with the 10-2 Year spread narrowing and the 10-3 Month spread declining significantly.

- The U.S. Dollar Index ^DXY: 106.17 (+0.17, +0.16%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 18.94 (+2.04, +12.07%)

- Fear & Greed Index (TY/LY): 27/17 (Fear/Extreme Fear).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1900.55 (-15.73, -0.82%)

- Bitcoin USD: 26222.50 (-86.10, -0.33%)

- Crude Oil Futures WTI: 90.66 (+0.98, +1.09%)

- Bloomberg Commodity Index: 105.41 (-0.35, -0.33%)

Factors:

- Small Cap Growth and High Dividend outperformed with a drop of (-1.0%) followed by Mega Cap Value and IPO’s at (-1.1%).

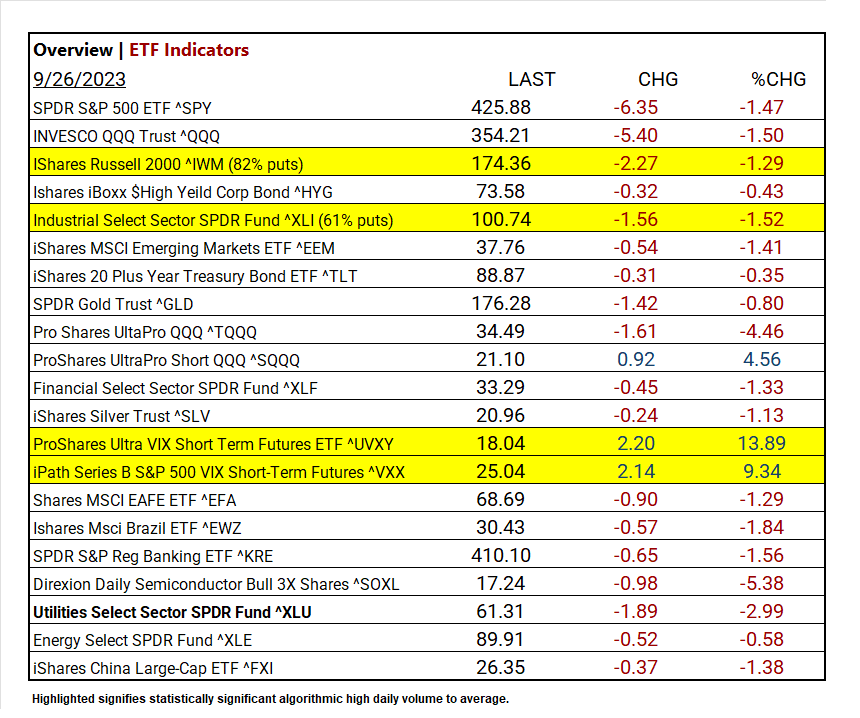

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY: +13.89%

- iPath Series B S&P 500 VIX Short-Term Futures ^VXX: +9.34%

- ProShares UltraPro Short QQQ ^SQQQ: +4.56%

Top 3 Worst Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL: -5.38%

- Pro Shares UltaPro QQQ ^TQQQ:-4.46%

- Utilities Select Sector SPDR Fund ^XLU: -2.99%

US Economic Data

- S&P/Case-Shiller Home Price YoY change: 0.1% (prev. -1.2%), MoM change: 0.6% (prev. 0.9%)

- House Price Index YoY change: 4.6% (prev. 3.2%), MoM change: 0.8% (prev. 0.4%)

- Consumer Confidence (Conference Board): 103 (prev. 108.7), below consensus (105)

- New Home Sales MoM: 675 (prev. 739k), below consensus (700k)

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023 results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: S&P 500 to see -0.2% YoY earnings decline, marking 4th consecutive drop. S&P 500’s 12-month P/E ratio is 18.0, below 5-year (18.7%) average but above 10-year (17.5%) average. 74 S&P 500 firms gave negative EPS guidance, 42 exceeded expectations with positive guidance.

Notable Earnings Today:

- Beat: Costco (COST), Cintas (CTAS), Ferguson (FERG), Progress (PRGS), AAR (AIR), MillerKnoll (MLKN)

- Miss: Synnex (SNX), United Natural Foods (UNFI)

Resources:

News

Investment and Growth News

- OpenAI Seeks New Valuation of Up to $90 Billion in Sale of Existing Shares – WSJ

- Japanese Automakers Stand to Gain From Detroit’s Labor Strike – Bloomberg

- Alibaba’s Cainiao and AliExpress start ‘5-day global delivery’ service for consumers in UK, Spain, Netherlands, Belgium and South Korea – SCMP

Infrastructure and Energy

- Lithium Boom in Argentina Hinges on Politics, Zijin Unit Says – Bloomberg

- US Energy Policy Hindering Oil Production, Chevron CEO Says – Bloomberg

Real Estate Market Updates

- Surging Insurance Costs Have Come for Office Landlord – WSJ

Central Banking and Monetary Policy

- U.S. Home Prices Increased in July – WSJ

- US Consumer Confidence Drops to a Four-Month Low on Outlook – Bloomberg

International Market Analysis (China)

- China still a key market, US businesses say, but hope dims for improved prospects – SCMP