MARKETS TODAY August 8th, 2023 (Vica Partners)

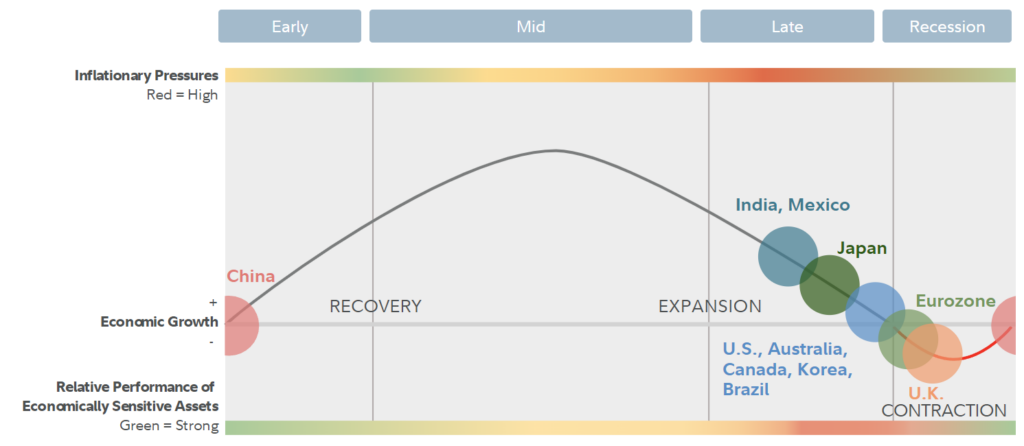

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 gained 0.38%. Hong Kong’s Hang Seng Shanghai Composite down 1.81% and China’s Shanghai Composite down 0.25%. S&P futures opened trading at 0.45% below fair value..

European markets finished lower, Germany’s DAX lost 1.10%, France’s CAC 40 down 0.69% and London’s FTSE 100 down 0.36%.

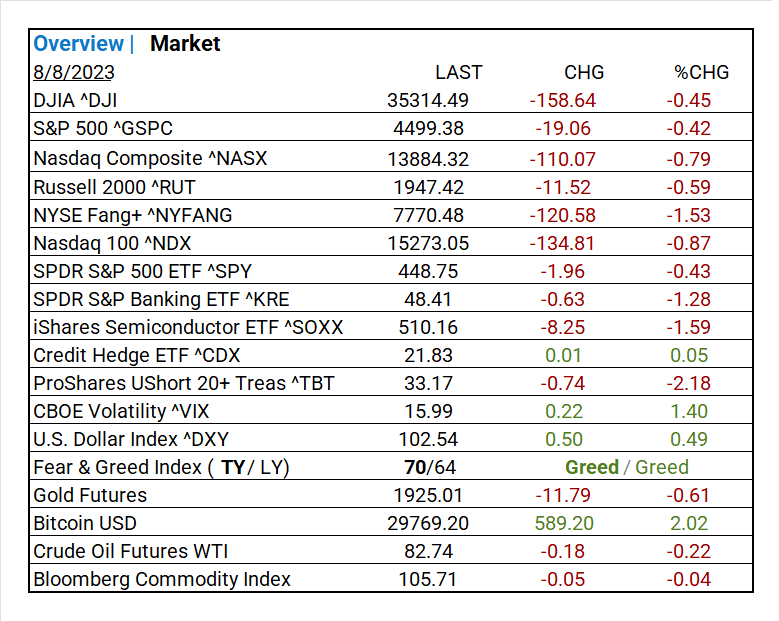

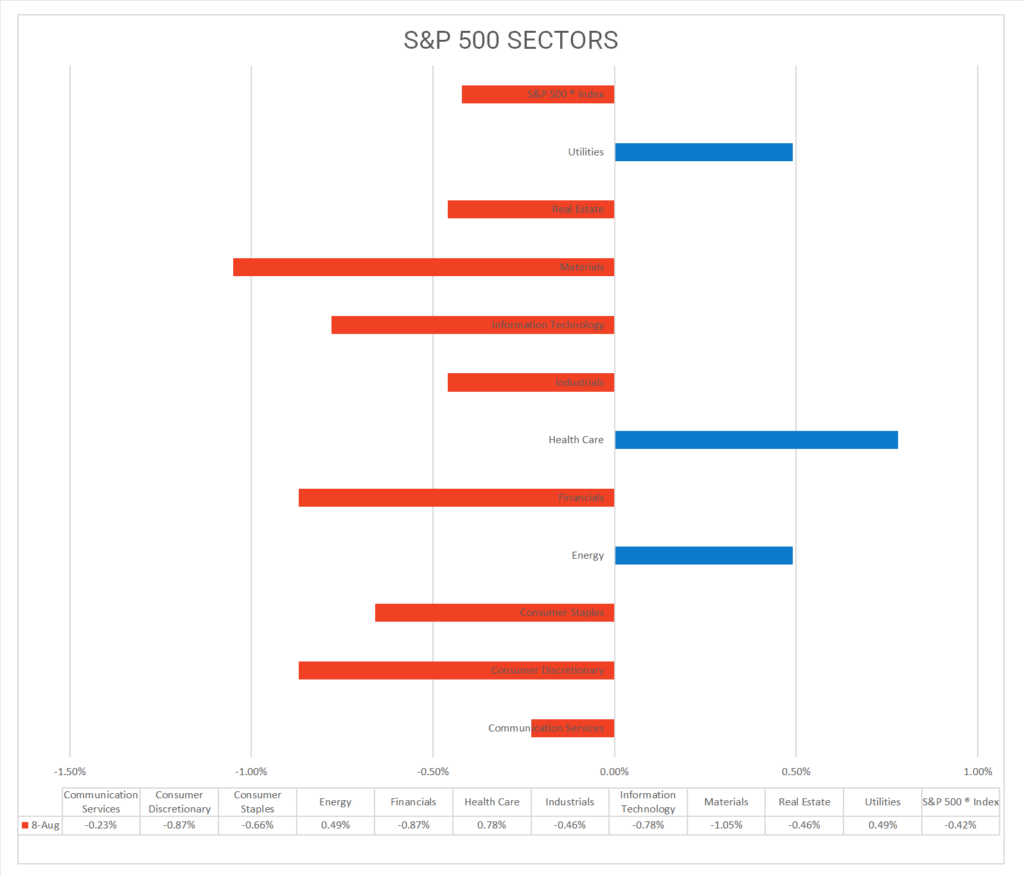

Today US Markets finished lower, the S&P 500 was off 0.42%, the DOW down 0.45% and the NASDAQ lost 0.79%. 8 of 11 S&P 500 sectors declining: Health Care +0.78% outperforms/ Materials -1.05% lags. On the upside, Credit Hedge ETF ^CDX, Trending Industries: Pharmaceuticals, Passenger Airlines, Leisure Product, Life Sciences Tools & Services,USD Index and Bitcoin.

In US economic news, the Small Business Optimism Index beat consensus for July increasing for a third consecutive month. Q2 Household Credit report had credit card balances rising historic high of >$1T.

Takeaways

- China trade data import, export falling >10% y/y, largest declines since Feb ‘20.

- Household debt rose to $17.06 trillion led by credit card balances

- 8 of 11 S&P 500 sectors declining: Health Care +0.78% outperforms/ Materials -1.05% lags

- Industries: Pharmaceuticals +3.85%, Passenger Airlines +1.66%, Leisure Products +1.39%, Life Sciences Tools & Services +1.08%

- USD Index and Bitcoin gain

- Eli Lilly (LLY) up >10% today with w/ solid pre-market earnings beat

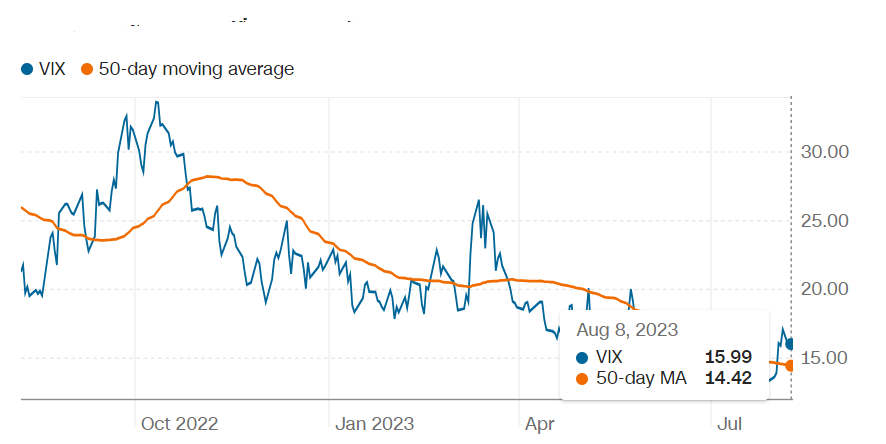

Pro Tip: the CBOE Volatility Index, or VIX measures expected price fluctuations or volatility in the S&P 500 Index options over the next 30 days. Today’s reading is above the 50-day moving average and more of a neutral metric.

Sectors/ Commodities/ Treasuries

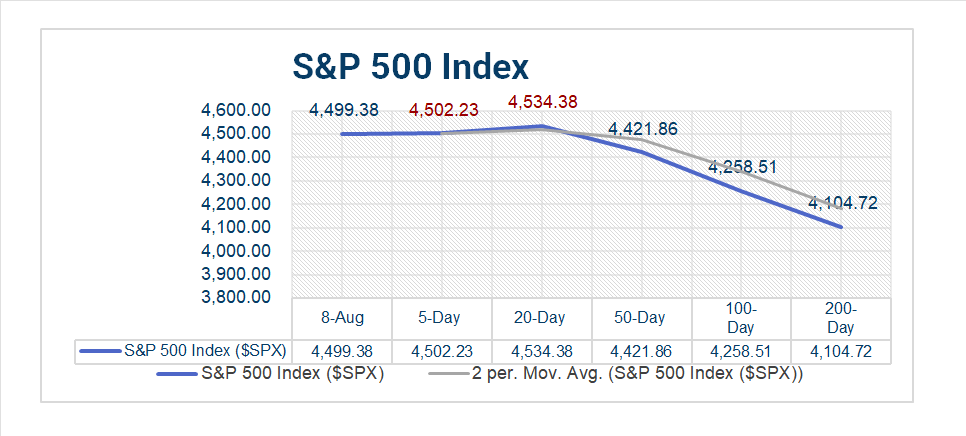

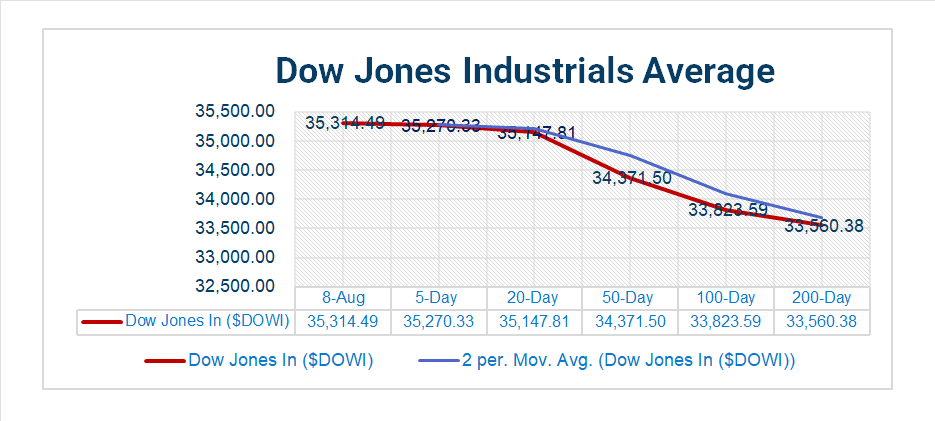

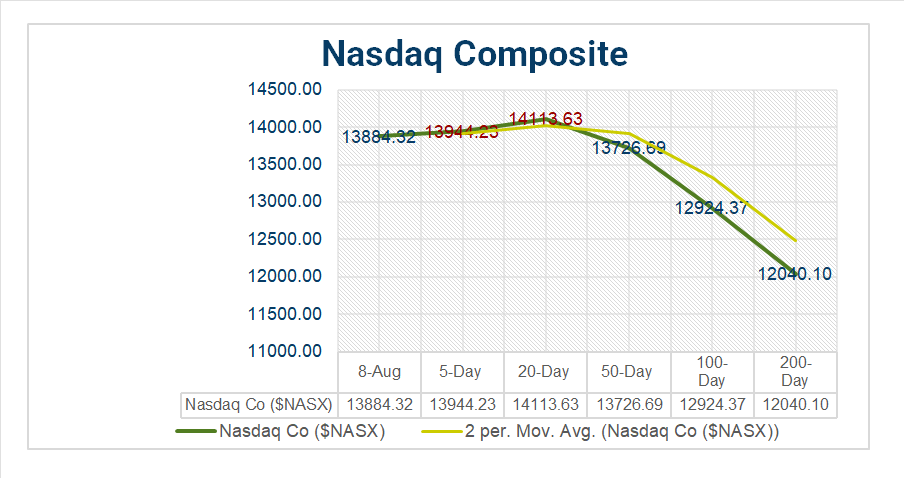

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 8 of 11 S&P 500 sectors declining: Health Care +0.78% outperforms/ Materials -1.05% lags.

- Industries: Pharmaceuticals +3.85%, Passenger Airlines +1.66%, Leisure Products +1.39%, Life Sciences Tools & Services +1.08% Energy Equipment & Services +0.65%, Electric Utilities +0.64%, Diversified Telecommunication Services+0.58%

- YTD Leaders: %, Communication Services +43.28%, Information Technology +39.96%, Consumer Discretionary +35.93%

- S&P 500 +17.68%

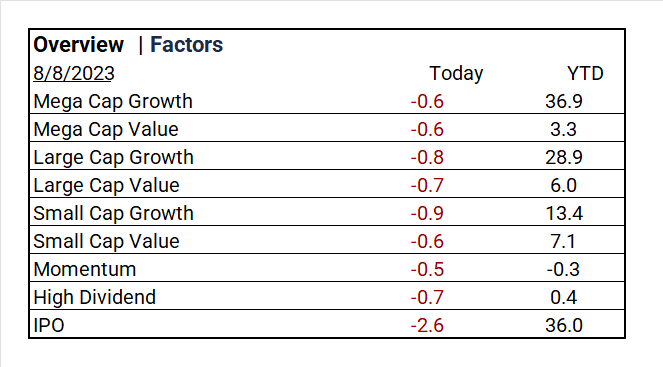

Factors

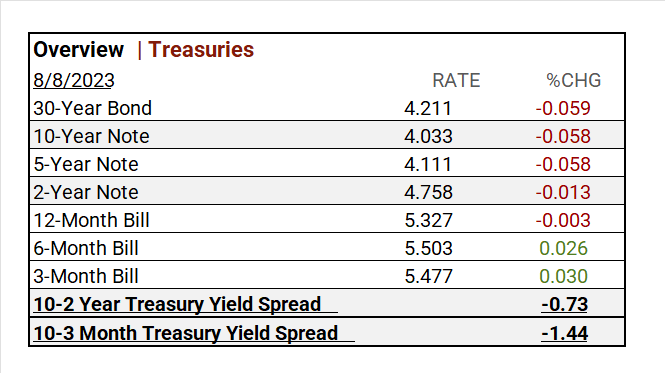

US Treasuries

US Treasuries

Earnings

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Actual (thru 8/04)

- 84% of the S&P 500 have reported results for the second quarter of 2023

- Companies represented in the Morningstar US Market Index are expected to see their earnings decline by about 5.27% from a year ago.

- Based on earnings consensus estimates, consumer cyclical companies are forecast to see the most growth, followed by energy, industrials, and financial services.

Notable Earnings Today

- +Beat: Eli Lilly (LLY), Zoetis Inc (ZTS), Itau Unibanco (ITUB),Transdigm (TDG), Li Auto (LI), Datadog (DDOG),Restaurant Brands Int (QSR), Globalfoundries (GFS), Coupang LLC (CPNG), Franco-Nevada (FNV), Horizon Therapeutics (HZNP), Rivian Automotive (RIVN), Super Micro Computer (SMCI), FleetCor (FLT), Warner Music (WMG), Insulet (PODD), Bentley (BSY), Akamai (AKAM), Twilio (TWLO), LYFT (LYFT)

- – Miss: United Parcel Service (UPS), SoftBank Group (SFTBY), Duke Energy (DUK), Bayer AG PK (BAYRY), Daikin Industries ADR (DKILY), Barrick Gold (GOLD), Broadridge (BR), Royalty Pharma (RPRX), Expeditors Washington (EXPD), Shiseido Company (SSDOY), Sysmex Corp (SSMXY), Bio-Techne (TECH), Toast (TOST)

Economic Data

US

- NFIB optimism index: period July, act 91.9, fc 90.8, prior 91

- S. trade balance: period June, act-65.5B, fc -$65.0B, prior -$68.98B

- S. wholesale inventories: period June. act -0.5%, fc -0.3%. prior 0.0%

- Fed’s Harker, Core PCE may decline below 4% by end of ’23. Rates may stay on hold assuming no major data changes though mid Sept.

Vica Partner Guidance August ’23, (updated 8-04)

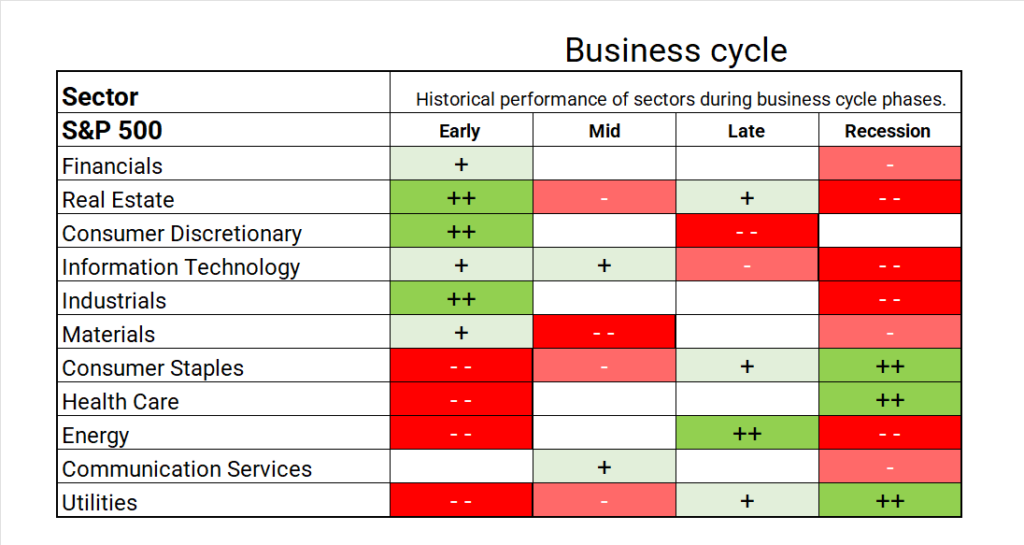

- Q3/4 highlighting, Industries: Interactive Media & Services, Household Durables, Broadline Retail, Consumer Finance, Automobiles, Construction & Engineering, Semiconductor & Semiconductor Equipment, Construction Materials, Specialized REITs, Gas Utilities. Other: Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US. Look for continued strength in Mega and Large Cap Growth “the new defensives” Expect Energy Sector rally!

- Cautionary, Banks shortly may be overpricing. Current indicators are mixed. Credit default swap (CDS) to pick-up through Q4/Q1. >20 Year Treasuries price erosion.

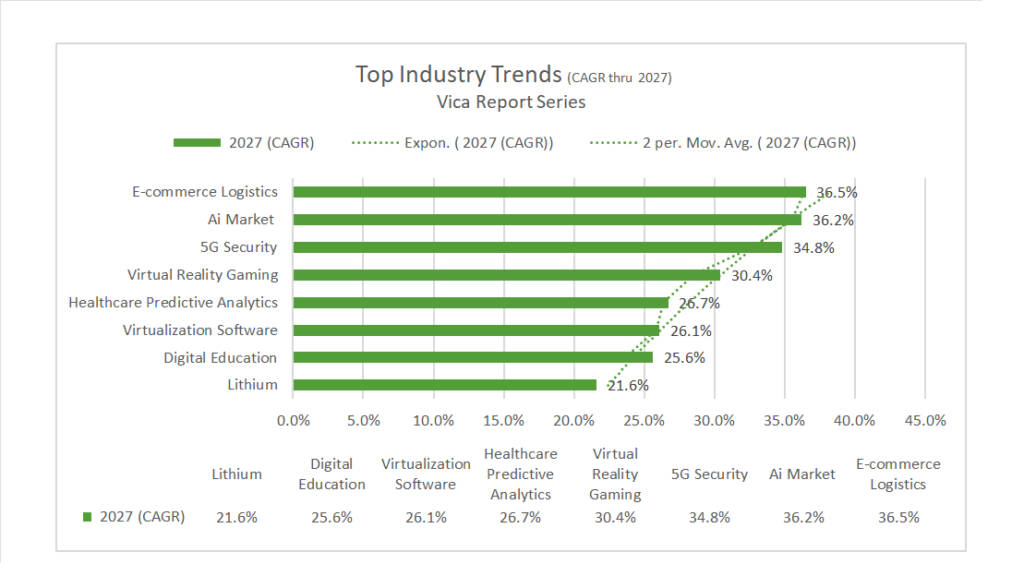

- Longer Term, NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment, Key Material like Lithium. Forward looking CAGR growth below:

- Company, we continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

- BIG Picture: Market bottoms are made on bad news and with deflationary signals the current market rally should come as no surprise. The combination of current Fed tightening, higher oil prices and a strong dollar should have given us a final bottom in ’23?

- Our biggest concern with the current rally is that the Government is not as effective as Free Markets in managing capital. Stock repurchases are just another way to deploy Capital. Consider that about 63% of the typical business cost is labor. I wholeheartedly trust the Free Market to better spend on CAPEX, R&D, and other.

- As for Bonds as an alternative investment for Stocks, a >10-year bond should have a return that exceeds nominal GDP, assuming inflation remains above >3%.

- The argument for Fed further tightening has its pundits. Raising rates to counter jobs (1.6 jobs available for every job seeker) in a rapidly changing economy will NOT moderate on demands.

- The Fed would benefit by rethinking its 2% inflation target and adjusting it to 3%. This would account for more accurate wages, energy transitions and more BIG tech market-based institutions. In addition, add more protection from deflation.

News

Company News/ Other

- The Weight-Loss Drug Frenzy Is Outrunning the Company Behind It – Bloomberg

- Bank Stocks Slide After Moody’s Downgrade – WSJ

- New Lending by Mortgage REITs Has Dried Up – WSJ

Energy/ Materials

- One of Europe’s Hottest Cities Rediscovers an Old Cooling Technique – Bloomberg

- Power-Plant Owners Blast Biden’s Emissions-Cutting Plan – Bloomberg

Central Banks/Inflation/Labor Market

- Ueda’s YCC Tweak Fuels Bets That End to Negative Rates Is Near – Bloomberg

Asia/ China

- China has a 31-point plan for private sector to kick-start economy. But are bruised business owners buying it? – South China Morning Post