MARKETS TODAY July 7th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, Japan’s Nikkei 225 -1.17%, Hong Kong’s Hang Seng -0.90%, China’s Shanghai Composite -0.28%. European markets finished mixed, Germany’s DAX +0.48%, France’s CAC 40 +0.42%, London’s FTSE 100 -0.32%. S&P futures were trading at -0.2% below fair value.

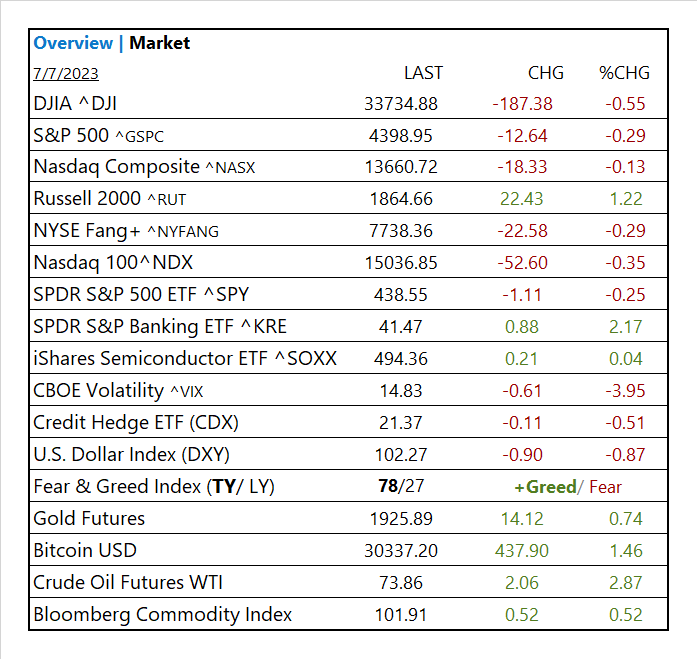

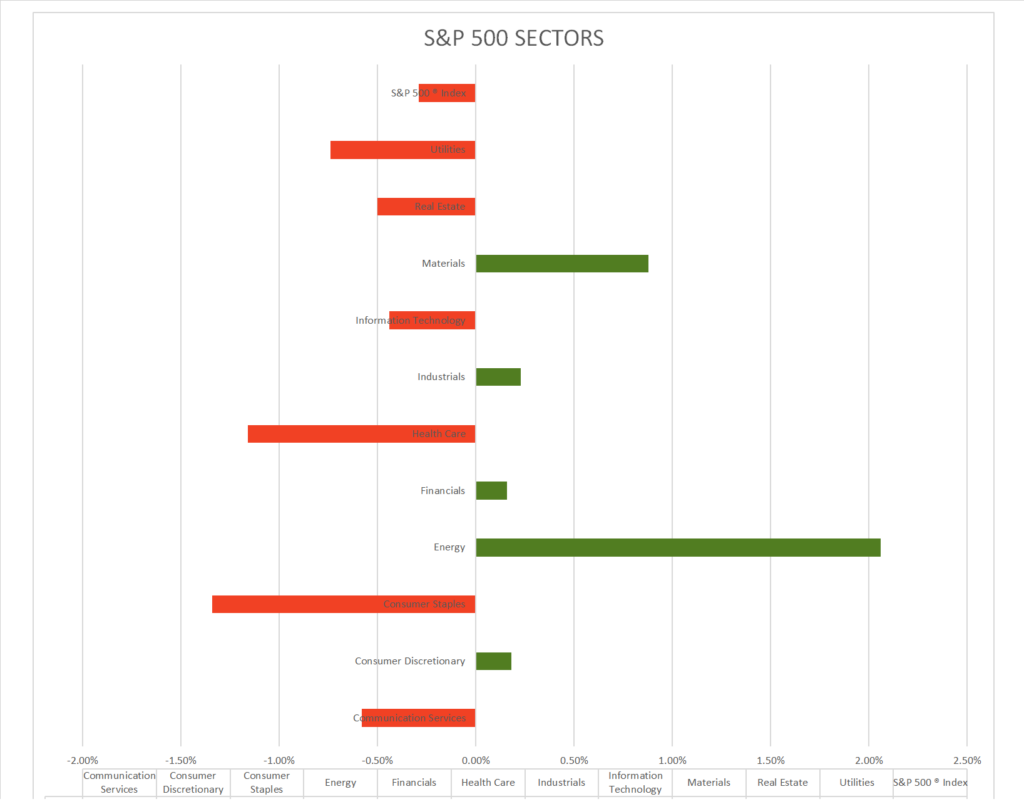

Today US Markets finished lower, S&P 500 -0.29%, DOW -0.55%, NASDAQ -0.13%. 6 of 11 S&P 500 sectors declining: Energy +2.06% outperforms/ Consumer Staples -1.34% lags. On the upside, Russell 2k, SPDR S&P Banking ETF (KRE), Large/ Small Cap Value, Gold, Bitcoin, Oil, Bloomberg Commodity Index. In economic news, Headline nonfarm payrolls soft, unemployment rate inline, wages came in a higher than consensus.

Takeaways

- Unemployment rate and wages mostly in line with consensus

- Russell 2k, up 1.22%

- 6 of 11 S&P 500 sectors declining: Energy +2.06% outperforms/ Consumer Staples -1.34% lags.

- SPDR S&P Banking ETF (KRE), +2.17%

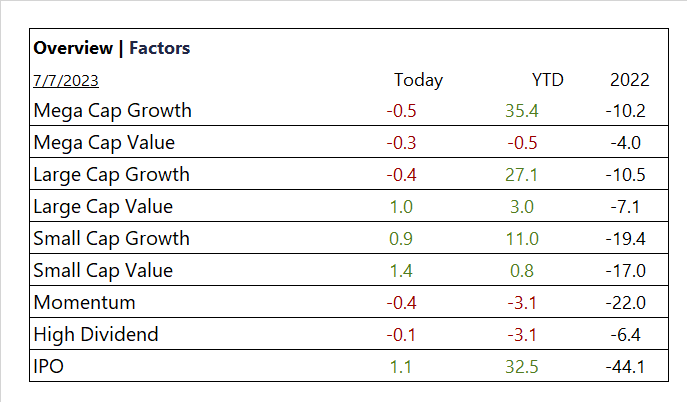

- Large/ Small Cap Value gain

- Gold, Bitcoin, Oil and Bloomberg Commodity Index rise

BIG picture stuff this Week

- Economic Data: surveys were mostly positive, employment components mixed with weakening in manufacturing and strength in services. Headline ADP big beat set the Market back this week.

- US/ China tensions, Semiconductor ETF ^SOXX 5 day <2.1%>

- Japan Equities trending

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Lithium Miners. Nasdaq 100^NDX 14,500 level is a buying opportunity. Undervaluation of Japanese equities and upside for Chinese Mega Cap tech. Q3/4 2023/ credit default swap (CDS) will pick-up and expect Q1 2024 economy pullback.

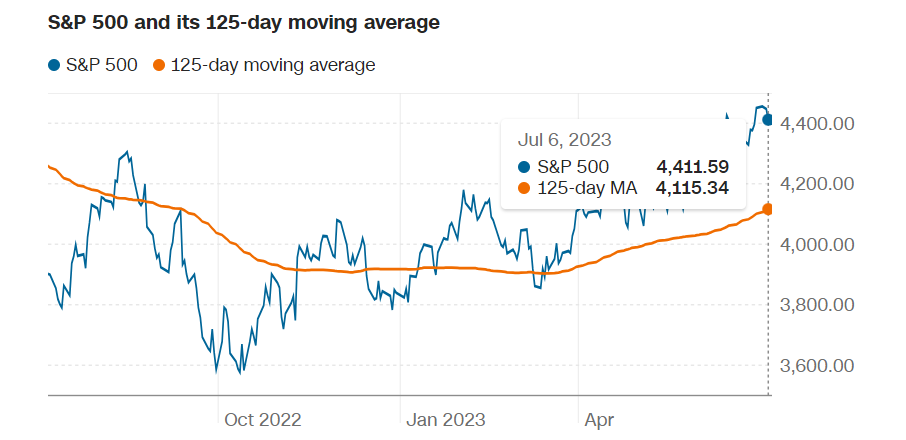

Pro Tip: S&P 500 Index above its 125-day moving average as a signal for growing momentum and opportunity.

Sectors/ Commodities/ Treasuries

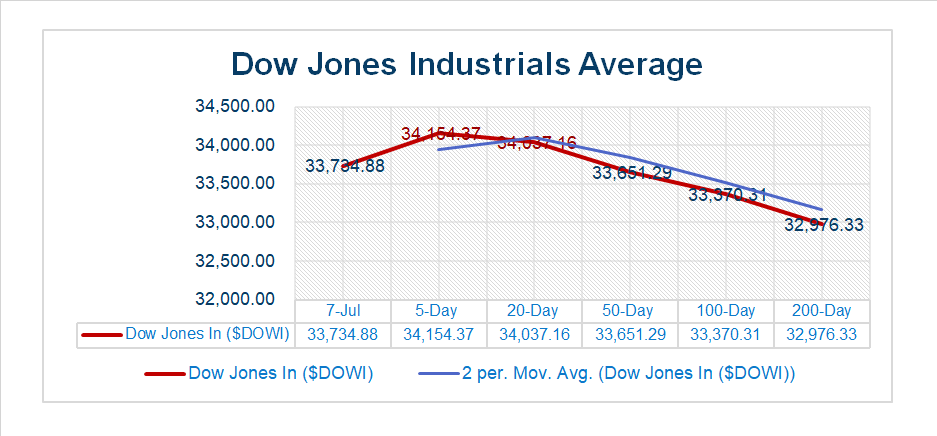

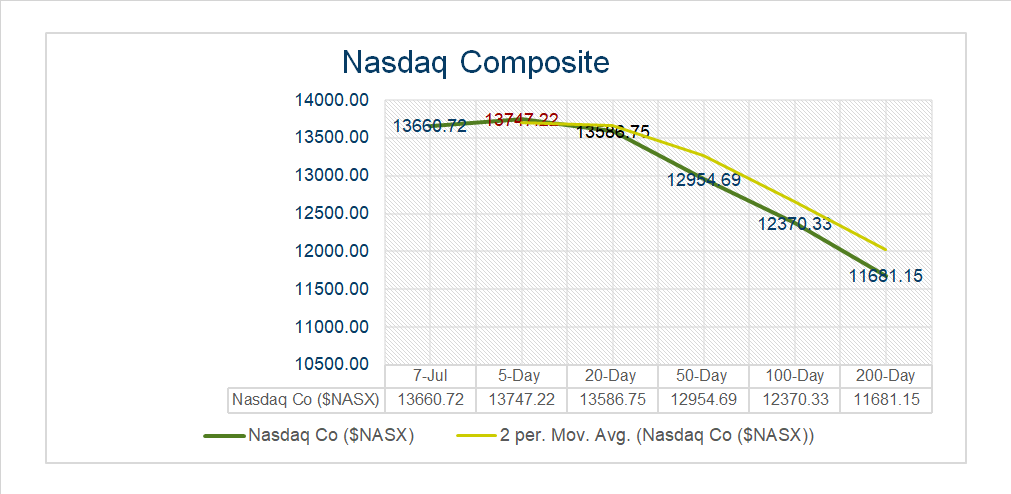

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 6 of 11 S&P 500 sectors declining: Energy +2.06%, Materials +0.88% outperform/ Consumer Staples -1.34%, Utilities -0.74% lag.

Factors

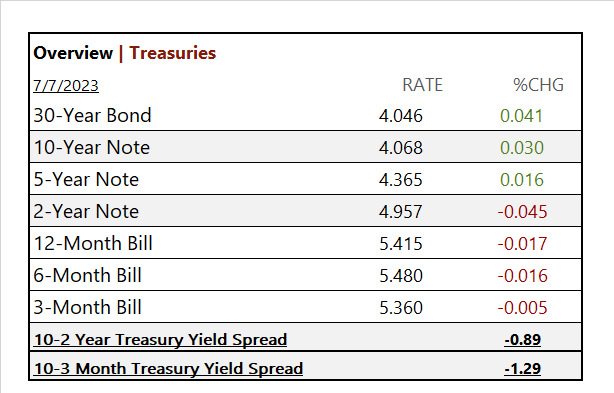

US Treasuries

Notable Earnings Today

- +Beat: No notable release today

- – Miss: Ryohin Keikaku Co (RYKKY)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Sociedad Quimica y Minera (SQM)

Economic Data

US

- US. nonfarm payroll; period June, act 209,000, fc 240,000, prior 306,000

- US. unemployment rate; period June, act 3.6%, fc 3.6%, prior 3.7%

- US. hourly wages; period June, act 0.4%, fc 0.3%. prior 0.4%

- Hourly wages year over year; act 4.4%, fc 4.2%. prior 4.4%

News

Company News/ Other

- China’s Ant Group Slapped With Nearly $1 Billion Fine – WSJ

- In Remaking Twitter, Elon Musk Created an Opening for Rivals – WSJ

Energy/ Materials

- Coal’s No Stranded Asset. It’s a Security Blanket – Bloomberg

- US. Oil Boom Blunts OPEC’s Pricing Power – WSJ

- In California, a lithium gold rush at the edge of a dying sea – SCMP

Central Banks/Inflation/Labor Market

- BOJ deputy chief urges ‘balanced decision’ on yield curve control – Nikkei

- The Job Market vs. Inflation – WSJ

Asia/ China

- China’s Central Bank Boosts Gold Reserves for Eighth Month – Bloomberg

- Huawei taps into computing power shortage in China, touts self-developed AI tech amid ChatGPT craze – SCMP