MARKETS TODAY April 4th, 2023 (Vica Partners)

Good Tuesday Afternoon,

Yesterday, the S&P and DOW extended recent gains with the Nasdaq/ FANG+ declining. Of the S&P 500 sectors Energy and Healthcare outperformed/ Real Estate and Consumer Discretionary underperformed.

Overnight, Asian markets finished mixed with the Shanghai Composite up 0.49% and the Nikkei 225 up 0.35% while the Hang Seng down 0.66%. Premarket, European markets finished mixed as the DAX gained 0.14%, while the FTSE 100 led the CAC 40 lower. They fell 0.50% and 0.01% respectively. S&P futures were trading at 0.25% above fair-value.

US markets today, Key Indices closed lower except FANG+. 7 of 11 of the S&P 500 sectors were lower as Energy and Industrials underperformed, Utilities outperformed. Oil futures, Bitcoin and Gold were all up. In economic news, US Job openings fell below 10m for first time since May 2021.

Takeaways

- Equities give back opening gains

- JOLTS fall below 10m for first time since May 2021.

- FANG+ and mega cap growth lead gainers

- Utilities outperform, Energy lags

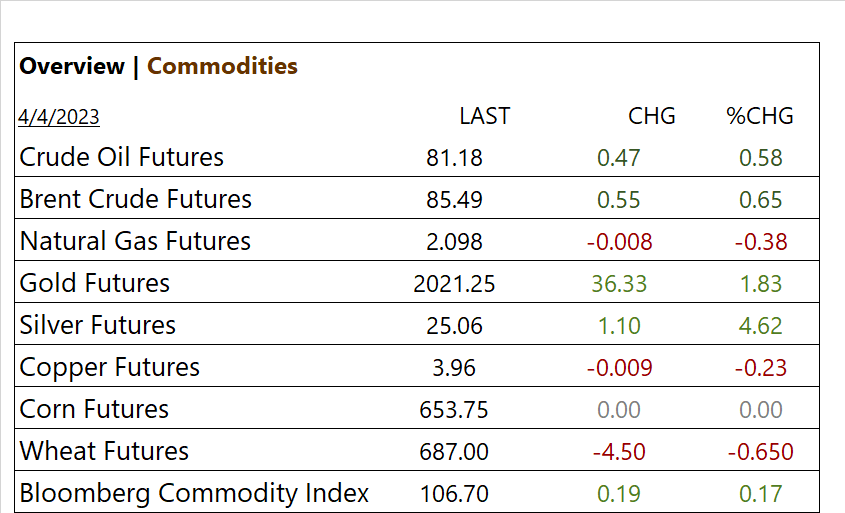

- Gold and Silver jump

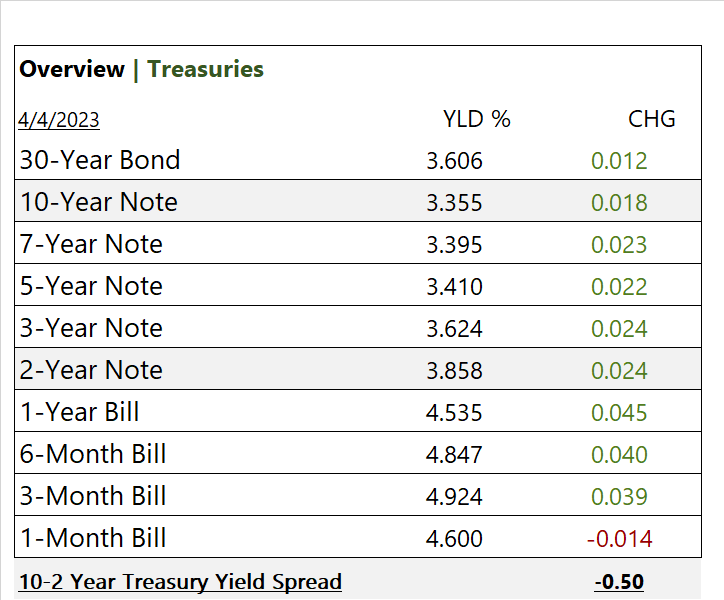

- Yields rise

- Fear & Greed Index rating moderating = 50 Neutral

- Bloomberg Commodity Index up

Sectors/ Commodities/ Treasuries

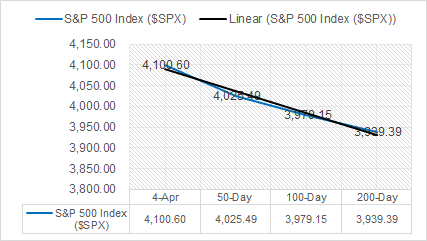

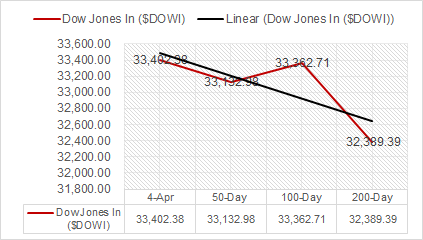

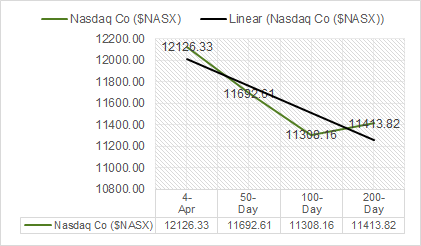

Key Indexes (50d, 100d, 200d)

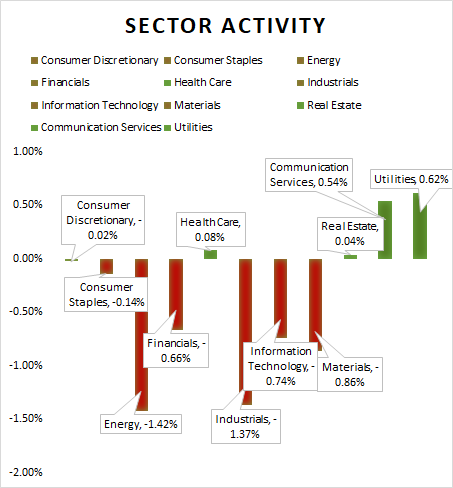

S&P Sectors

- 7 of 11 of the S&P 500 sectors were lower / Energy -1.42%, Industrials -1.37%, underperform/ Utilities outperform +0.62.

Commodities

US Treasuries

Notable Earnings This Week (bold denotes today)

- + Science Applications (SAIC), MSC Industrial Direct (MSM)

- – Acuity Brands (AYI), Lindsay (LNN)

- * Strong support – Baidu Inc (BIDU), Sociedad Quimica y Minera de Chile (SQM), Alibaba Group Holdings (BABA), Qualcomm (QCOM), Vale (VALE), Rio Tinto (RIO), Analog Devices (ADI), Palo Alto Networks (PANW), Toyota Motor Corp (TM), Occidental Petroleum (OXY)

Economic Data

US

- Factory orders; period Feb., act -0.7%, fc -0.6%, prev. -2.1%

- Job openings; period Feb., act 9.9 million, fc 10.5 million, prev. 10.6 million

News

Company News/ Other

- Why did OPEC cut oil production? Key reasons explained – Reuters

- Oil prices surge after OPEC’s surprise output cuts – Aljazeera

Central Banks/Inflation/Labor Market

- US Job Openings Fall Below 10 Million for First Time Since 2021 – Bloomberg

- JPMorgan’s Dimon says US banking turmoil not over, sees long repercussion – Reuters

- Yellen Says US Banks Are ‘Stabilizing,’ After Tumultuous March – Bloomberg

China

- Foreign cash streaming back to China after Alibaba’s plans – Reuters