MARKETS TODAY March 29th, 2023 (Vica Partners)

Good Wednesday Afternoon,

Yesterday, major indices ended lower as the Nasdaq/FANG+ lead decliners. Energy, Materials outperform while Information Technology lagged.

Overnight, Asian markets finished mixed as the Hang Seng gained 2.06%, the Nikkei 225 rose 1.33% and the Shanghai Composite lost 0.16%. Premarket, European markets closed higher today with shares in France leading the region. The CAC 40 up 1.39%, Germany’s DAX up 1.23% and London’s FTSE 100 up 1.07%. S&P futures were trading near session highs at 0.8% above fair-value.

US markets, Key Indices closed higher with Nasdaq/FANG+ leading advancers. All 11 of the S&P 500 sectors were higher/ Information Technology and Real Estate out preformed, Health Care lagged. Bitcoin up >4% while Bloomberg Commodity Index, Oil futures, and Gold declined. In economic news, pending U.S. home sales beat estimates and mortgage apps gained for a third consecutive week. US crude oil inventories for the week fell the most since Nov ’22 along with gasoline stocks.

Takeaways

- Banking sector fears soften

- Nasdaq/FANG+ mega cap growth lead rally

- Tech outperforms while Defensives lag

- Yields rise across the curve (10-2 yield spread rising -0.54)

- Fear & Greed Index rating moderating = 40/ Mild Fear

- Bitcoin regains $28K, up >4%

Pro Tip, 5G security control is designed to connect everyone and everything. A scalable combination of product, price, and services that target midmarket segments will lead a $1.5 trillion to $2.0 trillion addressable market. Look to patent and product/ chip leaders to score big!

Sectors/ Commodities/ Treasuries

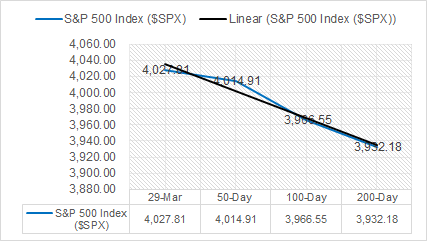

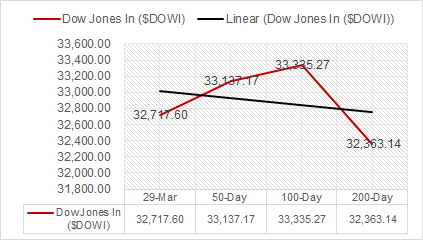

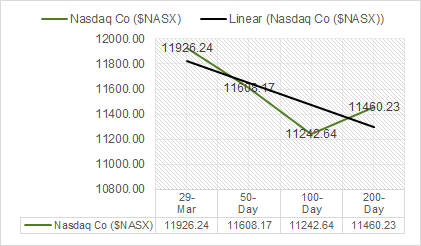

Key Indexes (50d, 100d, 200d)

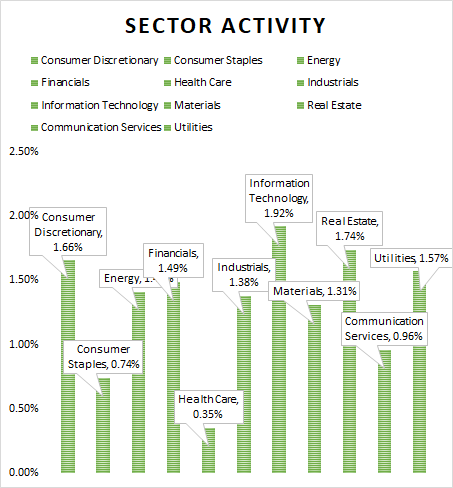

S&P Sectors

- All 11 of the S&P 500 sectors were higher. Information Technology +1.92%, Real Estate +1.74% outperform/ Health Care +0.35%, Consumer Staples +.74% underperform.

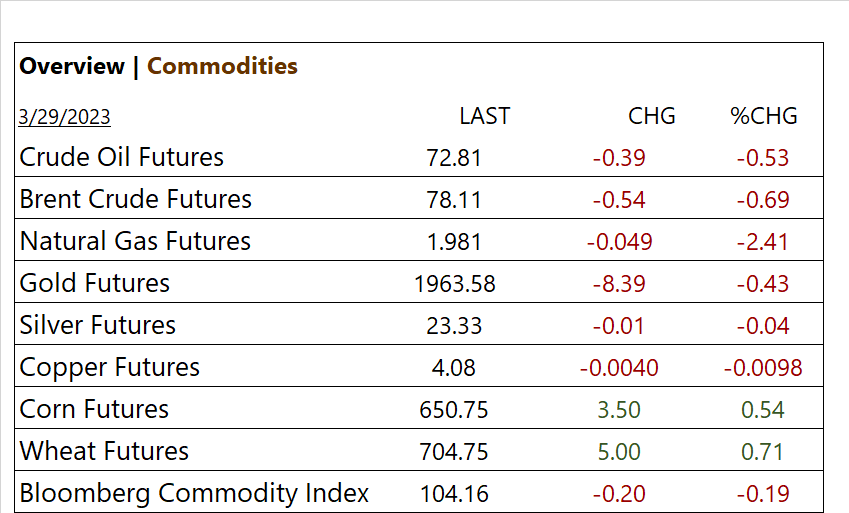

Commodities

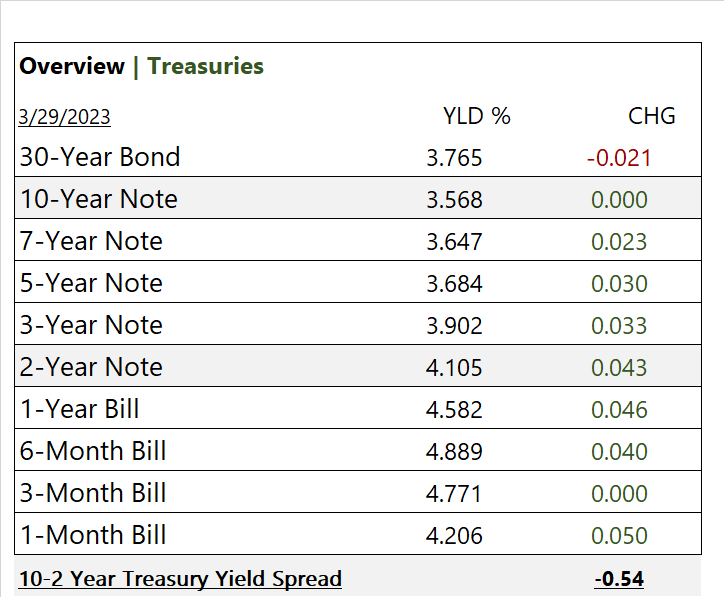

US Treasuries

Notable Earnings This Week (bold denotes today)

- + BioNTech (BNTX), Walgreens Boots (WBA), McCormick&Co (MKC), Carnival Corp (CCL), PVH (PVH), Cintas (CTAS), Lululemon Athletica (LULU), Paychex (PAYX)

- – Anhui Conch Cement Co (AHCHY), Huazhu (HTHT), Micron (MU), Constellation Software (CNSWF), Concentrix (CNXC)

- * Strong support – Baidu Inc (BIDU), Sociedad Quimica y Minera de Chile (SQM), Alibaba Group Holdings (BABA), Qualcomm (QCOM), Vale (VALE)

Economic Data

US

- Pending U.S. home sales; period Feb., act 0.8%, fc -3.0%, prev. 8.1%

- MBA Mortgage apps: period March, act +3.0%, <36%> same week one year ago.

- US crude oil inventories; declined by 7.489 million barrels in the week ended March 24, the most since November last year and against market expectations of a 0.092 million barrel increase. Gasoline stocks declined by 2.904 million, above expectations of a 1.617 million draw.

- Tomorrow; Jobless Claims, Fed President Speakers

News

Company News/ Other

- Elon Musk, Other AI Experts Call for Pause in Technology’s Development – WSJ

- Apple launches ‘buy now, pay later’ service in US – Reuters

- Exclusive: ICU Medical to compete against GE Healthcare for Medtronic units –sources – Reuters

Central Banks/Inflation/Labor Market

- Biden says White House response to banking stress is ‘not over yet’ – Reuters

- SVB Mess Festered Under Fed’s Bureaucracy and Feel-Good Culture – Bloomberg

- Privacy and Central Bank Digital Currency – Ripple

China

- Mainland EV makers like BYD have potential to establish foothold in Southeast Asian markets, panel at Post’s China Conference hears – South China Morn Post

- China’s green loans exceed $3.2 trln, central bank chief says – Reuters

- Meet the Xi Jinping Loyalist Now Overseeing China’s Economy – NY Times