MARKETS TODAY March 13, 2023 (Vica Partners)

A ‘good Monday to all,

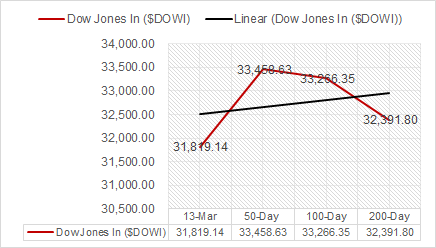

Over the past 5 trading sessions major indexes fell 4.5% on SVB Bank failure and including Powell’s Congressional testimony. The 2yr Treasury has also declined nearly 100bps since last Thursday, the largest 3-day drop in over 40 years. Sunday night SBNY became the third bank failure in the last week which was followed by a press releases from the Treasury, Federal Reserve, and FDIC allowing regulators to guarantee all deposits. Federal Reserve also has set up a new facility, Bank Term Funding Program (BTFP), which will offer loans of up to one year for eligible financial institutions; (read supplemental below).

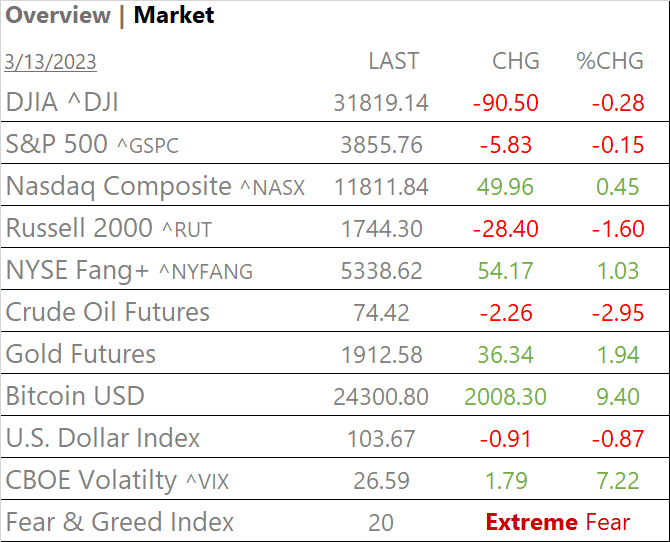

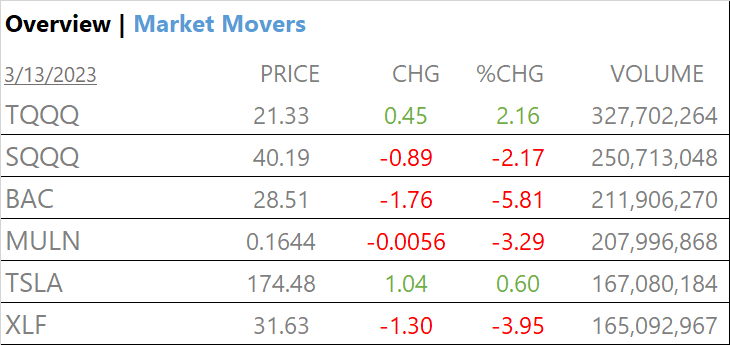

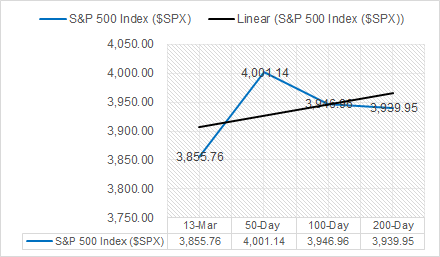

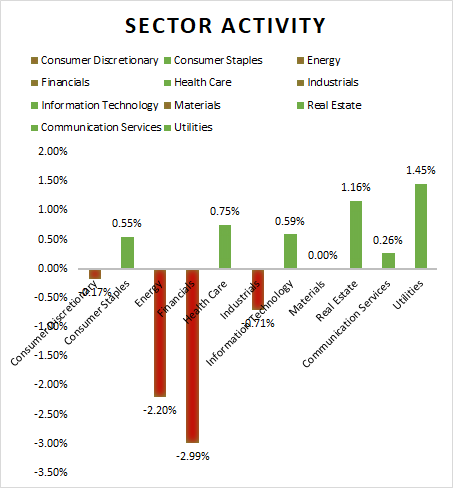

Overnight Asian markets were mixed overnight with China/Hong Kong up, with European indices down about 2.5%. Ahead of opening the financial sector weighed on pre-market, however major indices recovered firmly by midday. Today’s NY Fed Survey of Consumer Expectations also saw drop in the 1yr inflation expectations from 5% to 4.2%. Indexes finished mixed with Nasdaq +0.45% and NYSE FANG+1.03%, leading. Within the S&P 500, 7 of 11 sectors higher, Defensives/ Utilities, Health Care and Consumer Staples. Yields all declining!

Takeaways

- Futures are now pricing in a 1 in 3 chance of no hike next week

- Americans’ expectations for inflation hit a 23 month low in February

- Indexes finished mixed, Nasdaq and NYSE FANG lead

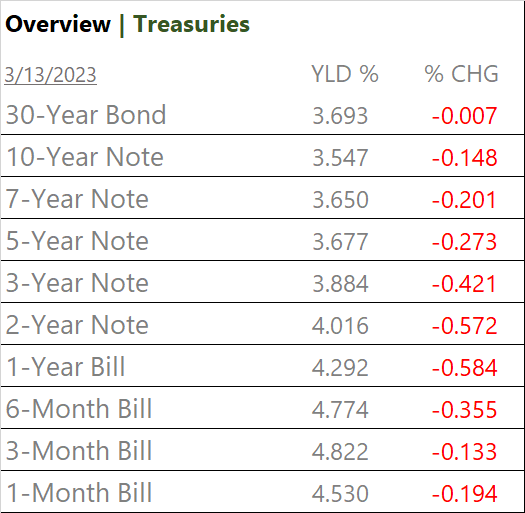

- Yields declining with Treasury market reset

- 7 of 11 sectors higher, Defensives/ Utilities, Health Care, Consumer Staples all up

- Financial Sector underperforms, declines 2.99%

- Fear & Greed index rating, Extreme Fear

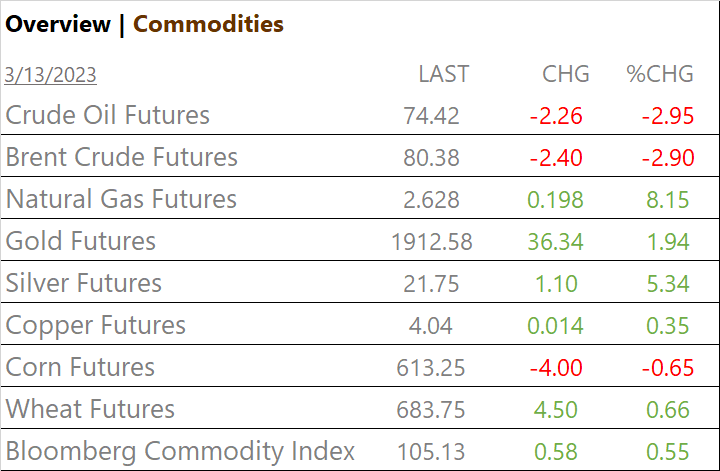

- Bloomberg Commodity Index, +up

- Crude Oil Futures, -down

- Gold, Silver, Copper +up

- Bitcoin, up +9%

- USD Index, -down

Last word; tomorrow’s CPI should have little no market impact as the market is pricing in a 1 in 3 chance of no hike next week with rate cuts once being priced into the market in the back half of the year. Expect more Financial Sector weakness- MK

Sectors/ Commodities/ Treasuries

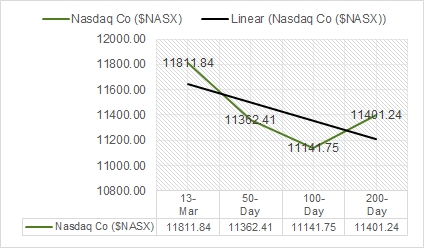

Key Indexes (50d, 100d, 200d

S&P Sectors

- 7 of 11 S&P 500 Sectors higher: Utilities 1.45%, Real Estate 1.16% and Health Care 0.75% outperform/ Financials -2.99% and Energy -2.20% underperform.

Commodities

US Treasuries

Economic Data

US

- NY Fed Survey; Median one-year-ahead inflation expectations declined by 0.8 percentage point to 4.2% in February, the lowest reading since May 2021. Expectations for inflation three years ahead were unchanged at 2.7%.

Tomorrow; Consumer price index and CPI

News

Company News

- First Republic shares dive on contagion fear, dragging U.S. regional banks – Reuters

- Signature Bank becomes next casualty of banking turmoil after SVB – Reuters

- Rivian, Amazon in talks to end exclusivity part of electric van deal – Reuters

- Pfizer looks past COVID with $43 bln deal for cancer drug maker Seagen – Reuters

Central Banks/Inflation/Labor Market

- Biden promises ‘whatever needed’ for U.S. bank system as SVB shock hammers stocks – Reuters

- US bank collapse sparks fresh oversight fight in divided Congress – Reuters

Energy

- Saudi Aramco reports record profit of $161.1 billion in 2022 – Reuters

China

- China’s new premier seeks to reassure private sector as parliament wraps up – Reuters

Supplemental

This weekend the Government set new regulations for unlimited deposit insurance. What this means is that Federal Reserve allows banks to pledge assets valued at par, so they delay a capital loss should they need to raise funds to meet deposit withdrawals as it relates to bank deposits and portfolio losses.

The new regulations have 3 intended purposes a) short term they stabilize the financial markets b) improve regulatory review c) work to increase industry/ bank deposit ratios and longer term they will tighten lending standards.

Market Outlook and updates posted at vicapartners.com