Stay Informed and Stay Ahead: Market Watch, December 8th, 2023.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: In November, the U.S. experienced a job gain of 199,000, with a 0.4% increase in hourly wages, and a consumer sentiment at 69.4 in December, indicating inflation easing.

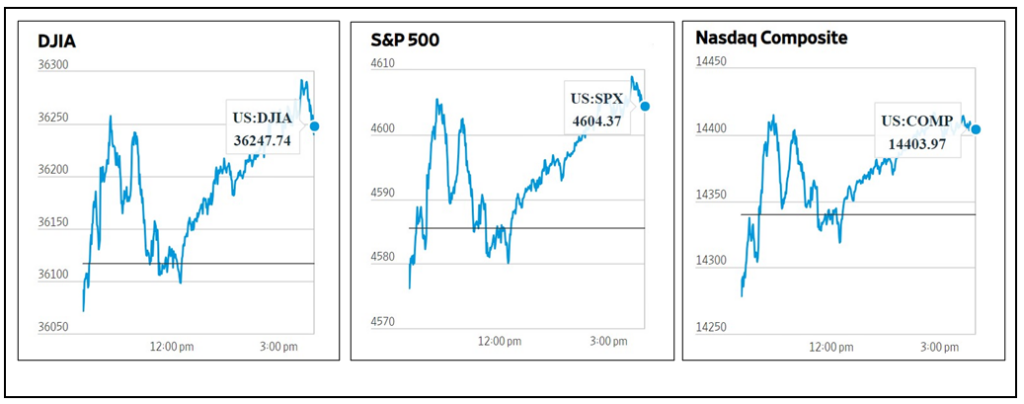

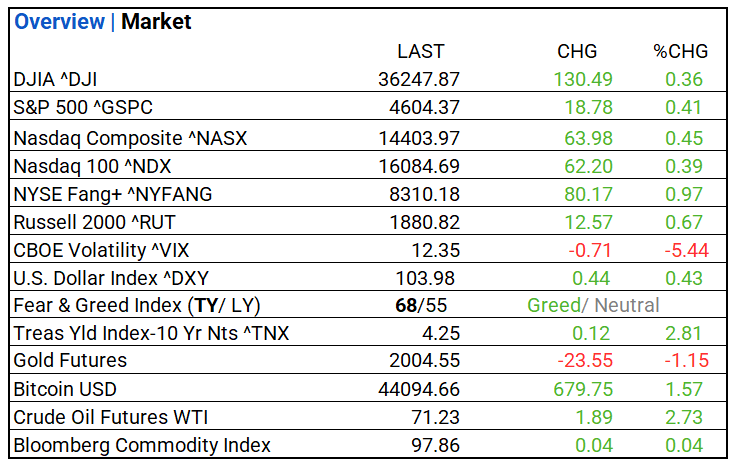

- Market Indices: DJIA (+0.36%), S&P 500 (+0.41%), Nasdaq Composite (+0.45%).

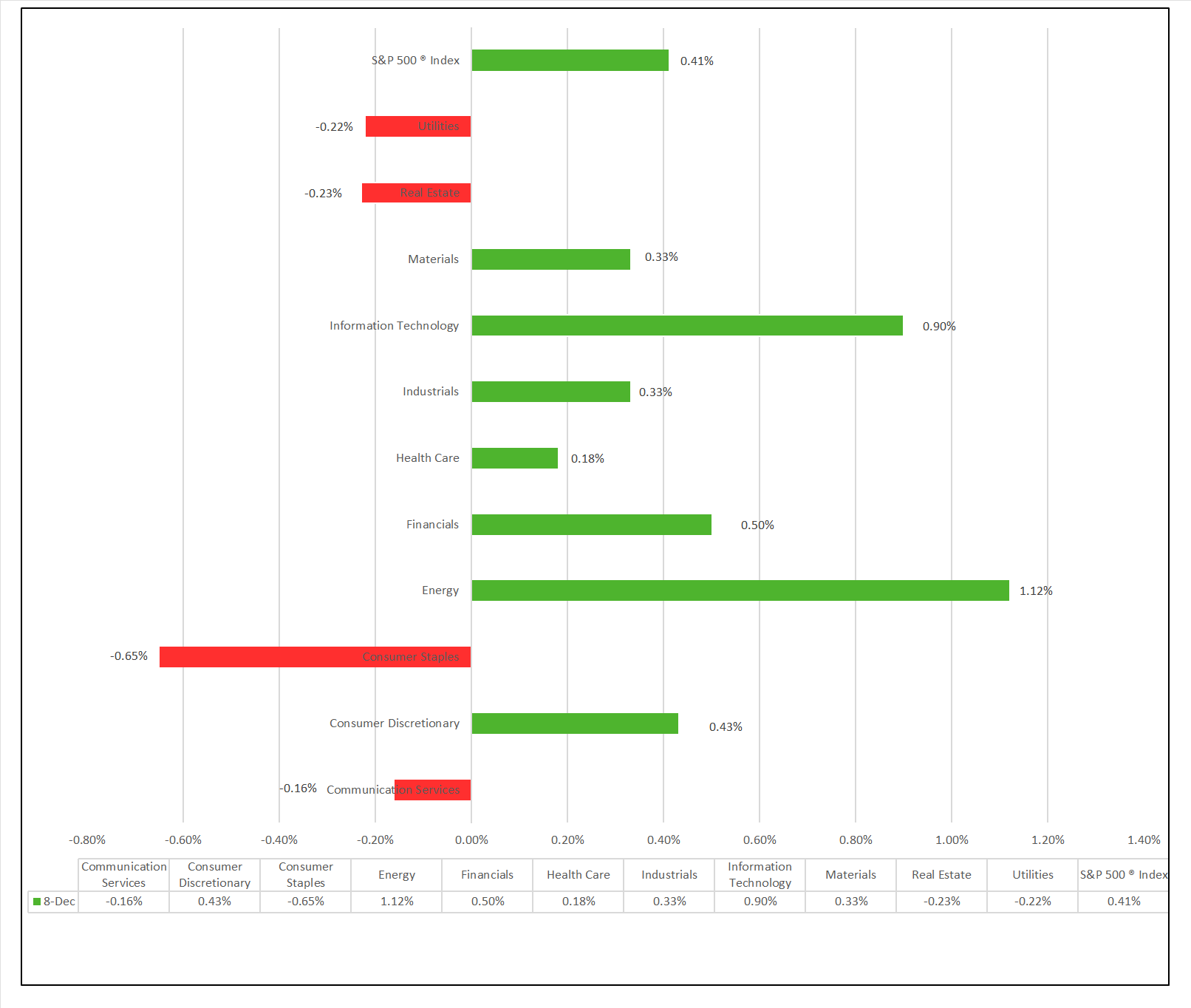

- Sector Performance: 7 of 11 sectors higher; Energy (+1.12%) leading, Consumer Staples (-0.65%) lagging. Top industries: Construction & Engineering (+2.51%).

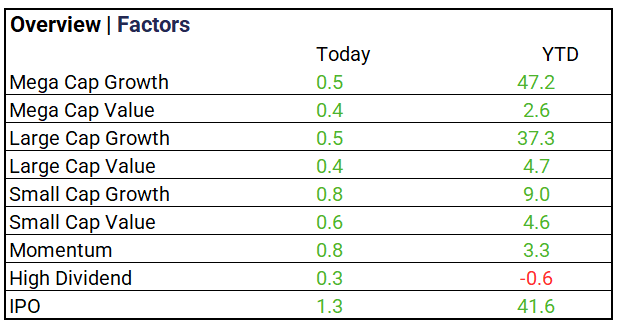

- Factors: IPOs, Momentum, Small Caps outperform.

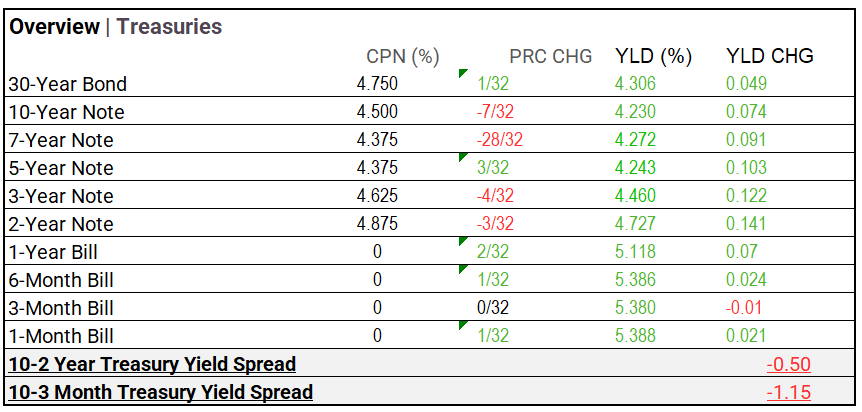

- Treasury Markets: Treasury yields rise across the curve, the 2-Year Treasury Notes leading with yield gain of 0.141.

- Commodities: Bitcoin rises as Gold falls. Crude Oil Futures surge, and the Bloomberg Commodity Index modestly increases.

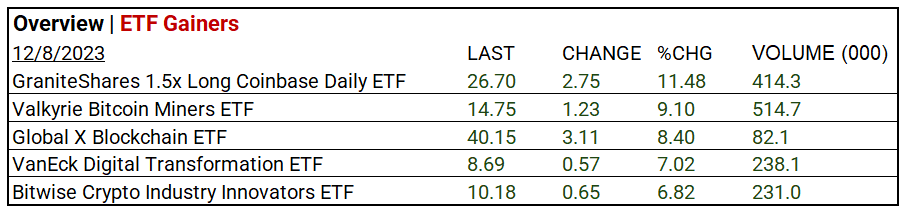

- Other/ETF: Bitcoin dominates with GraniteShares 1.5x Long Coinbase Daily ETF (+11.48%) and Valkyrie Bitcoin Miners ETF (+9.10%).

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 36,247.87 (+130.49, +0.36%)

- S&P 500 ^GSPC: 4,604.37 (+18.78, +0.41%)

- Nasdaq Composite ^NASX: 14,403.97 (+63.98, +0.45%)

- Nasdaq 100 ^NDX: 16,084.69 (+62.20, +0.39%)

- NYSE Fang+ ^NYFANG: 8,310.18 (+80.17, +0.97%)

- Russell 2000 ^RUT: 1,880.82 (+12.57, +0.67%)

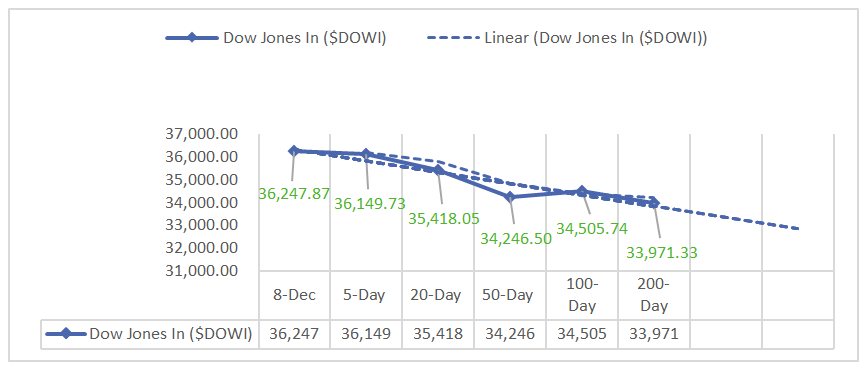

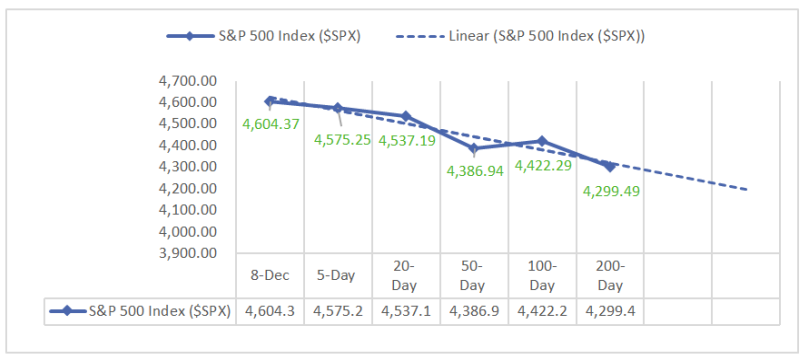

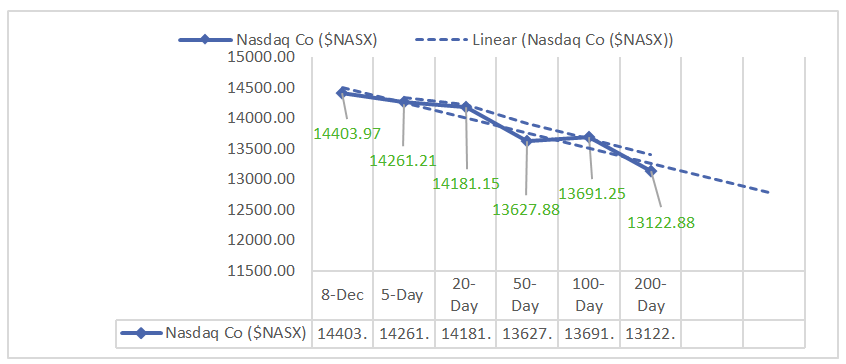

Moving Averages: DOW, S&P 500, NASDAQ:

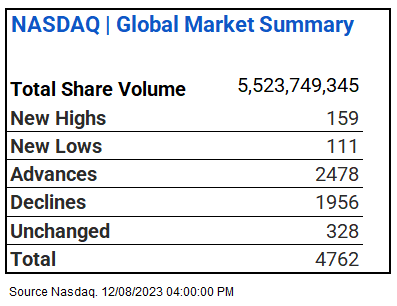

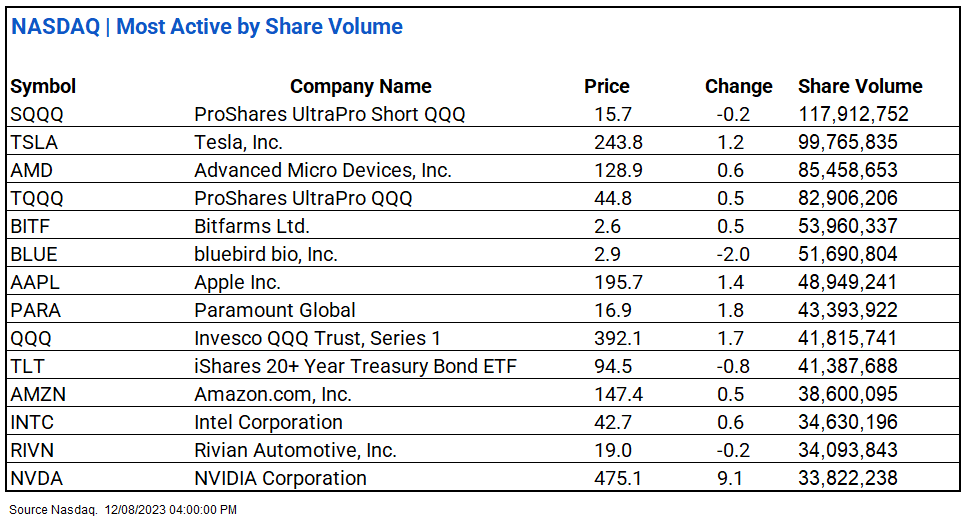

NASDAQ Global Market Summary:

Sectors:

- 7 of 11 sectors higher; Energy (+1.12%) leading, Consumer Staples (-0.65%) lagging. Top industries: Construction & Engineering (+2.51%), Building Products (+2.13%), and Textiles, Apparel & Luxury Goods (+2.03%).

Factors:

- IPOs, Momentum, Small Caps outperform.

Treasury Markets:

- Treasury yields rise across the curve, the 2-Year Treasury Notes leading with yield gain of 0.141.

Currency and Volatility:

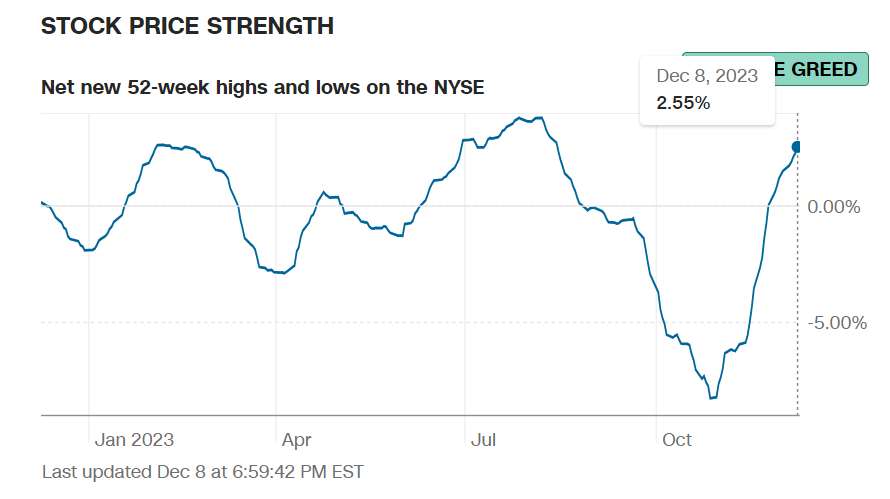

- U.S. Dollar Index and CBOE Volatility down, Fear & Greed indicates Greed.

- CBOE Volatility ^VIX: 12.35 (-0.71, -5.41%)

- Fear & Greed Index: 68/LY 55 (Greed/ Neutral).

Commodity Markets:

- Gold Futures: $2,004.55 (-23.55, -1.15%)

- Bitcoin USD: $44,094.66 (+679.75, +1.57%)

- Crude Oil Futures WTI: $71.23 (+1.89, +2.73%)

- Bloomberg Commodity Index: 97.86 (+0.04, +0.04%)

ETF’s:

US Economic Data:

- U.S. employment report Nov.: 199,000 (Previous: 190,000, Forecast: 150,000)

- U.S. unemployment rate Nov.: 3.7% (Previous: 3.9%, Forecast: 3.9%)

- U.S. hourly wages Nov.: 0.4% (Previous: 0.3%, Forecast: 0.2%)

- Hourly wages year over year Nov.: 4.0% (Previous: 4.0%, Forecast: 4.0%)

- Consumer sentiment (prelim) Dec.: 69.4 (Previous: 62.4, Forecast: 61.3)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Hello Group (MOMO).

- MISSED: Johnson Outdoors (JOUT).

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): -1.68%

- Hang Seng (Hong Kong): -0.70%

- Shanghai Composite (China): 0.11%

- CAC 40 (France): 1.32%

- DAX (Germany): 0.78%

- FTSE 100 (UK): 0.54%

Central Banking and Monetary Policy, Noteworthy:

- FDA Approves World’s First Crispr Gene-Editing Drug for Sickle-Cell Disease – WSJ

- US Unemployment Rate to Tick Up Amid Early Signs of Recession – Bloomberg

Energy:

- U.S. Crude Oil Inventories Fall by 4.6 Million Barrels in Week – WSJ

- Commodity Traders’ Mega Profits Are Here to Stay – Bloomberg

China:

- China ‘more investible than ever’ for Middle East and Latin America, but Western capital remains wary – SCMP