Stay Informed and Stay Ahead: Market Watch, December 22nd, 2023.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Core PCE (YoY) outperforms at 3.2%, exceeding the forecast, while PCE (YoY) declines notably to 2.6%.

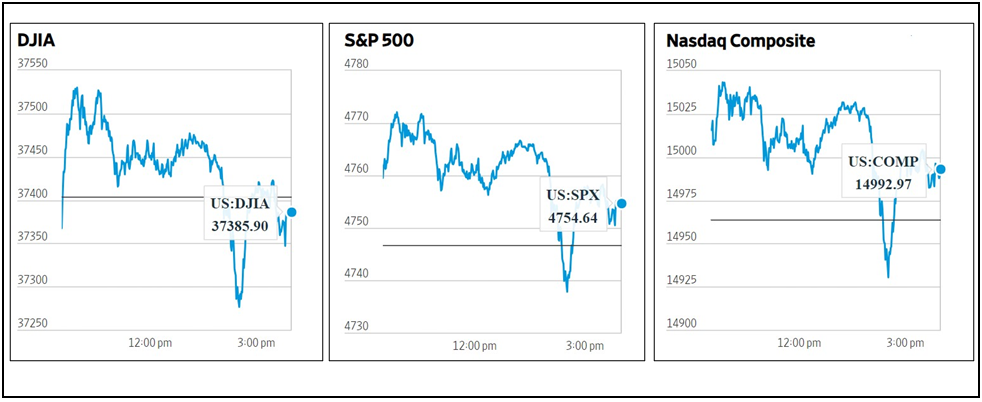

- Market Indices: DJIA (-0.05%), S&P 500 (+0.17%), Nasdaq Composite (+0.19%).

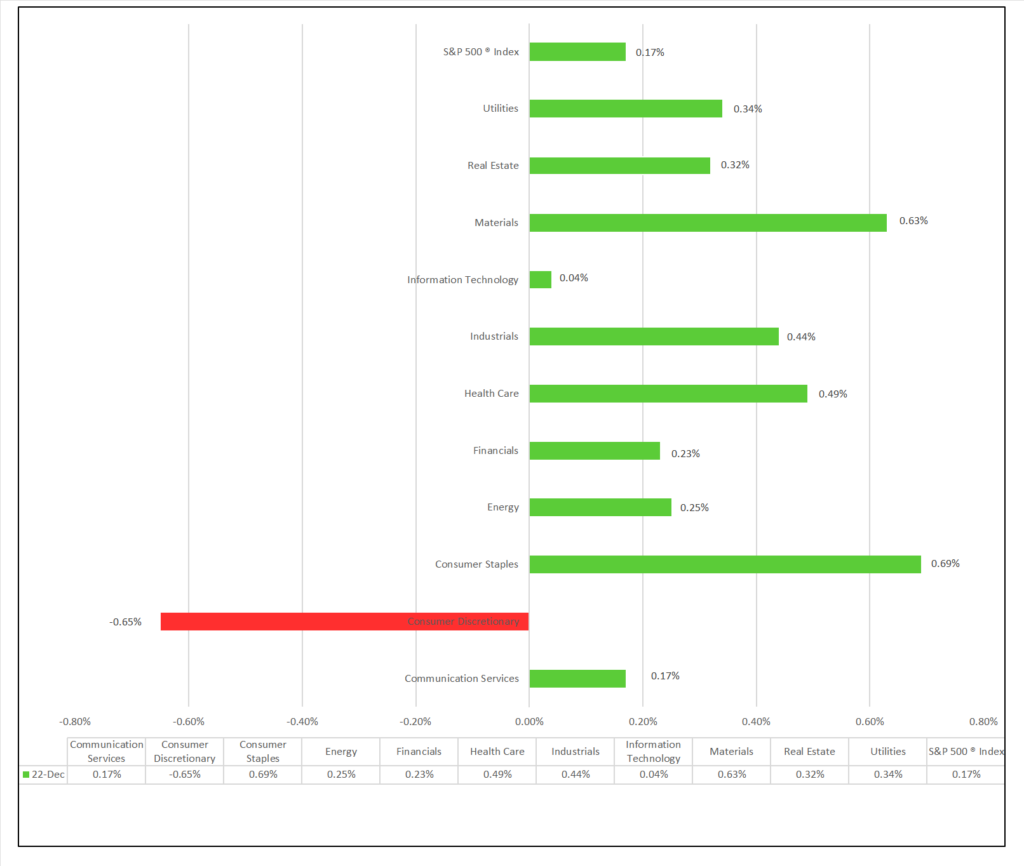

- Sector Performance: 10 of 11 sectors higher; Consumer Staples (+0.69%) leading, Consumer Discretionary (-0.65%) lagging. Top industry: Biotechnology (+1.44%).

- Factors: Small Cap Growth increased by 1.1%, while Small Cap Value posted a notable gain of 0.9%.

- Treasury Markets: Mixed yields with the 30-Year Bond showing the highest gain at +0.022%.

- Commodities: Bitcoin and Gold rise moderately, Crude Oil futures fall, and the Bloomberg Commodity Index increases.

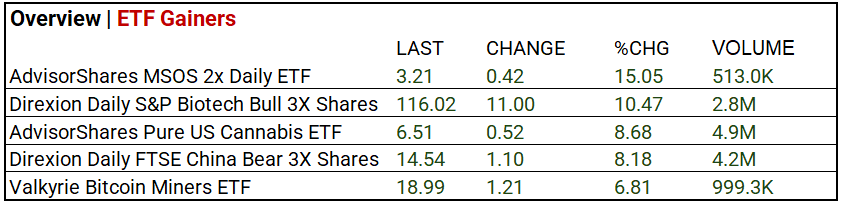

- ETFs: AdvisorShares Pure US Cannabis ETF rose 8.68% on 4.9 million volume, and Direxion Daily FTSE China Bear 3X Shares gained 8.18% on 4.2 million dominated.

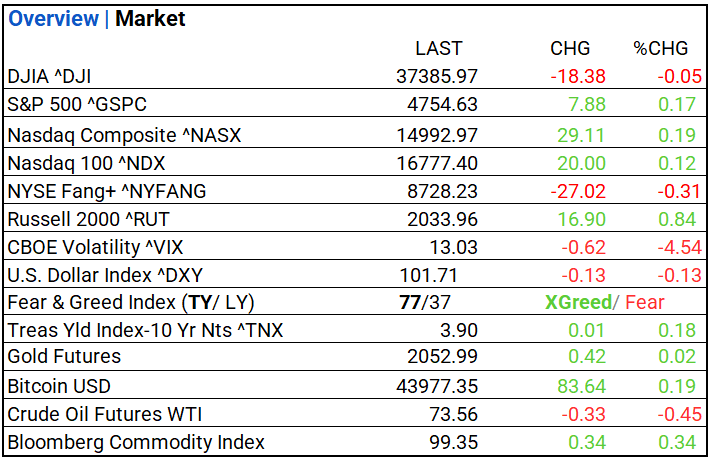

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,385.97 (-18.38, -0.05%)

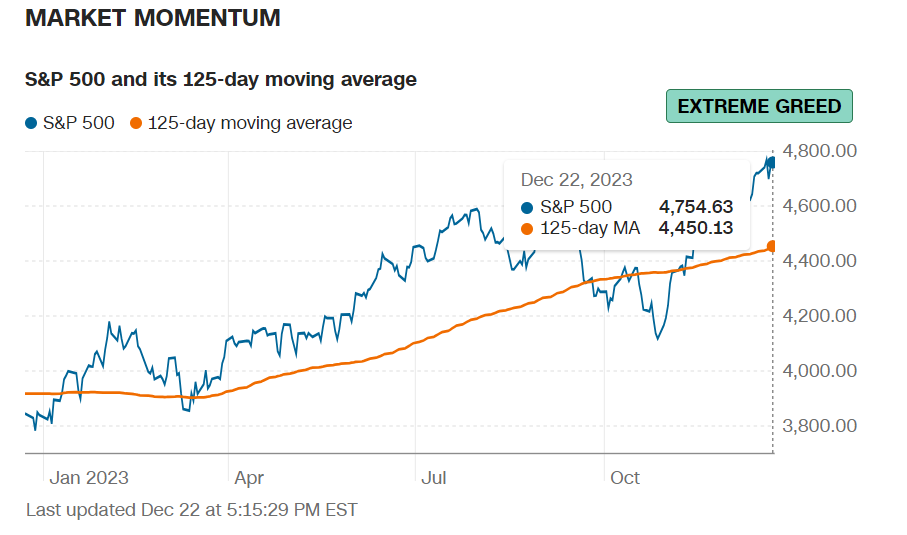

- S&P 500 ^GSPC: 4,754.63 (+7.88, +0.17%)

- Nasdaq Composite ^NASX: 14,992.97 (+29.11, +0.19%)

- Nasdaq 100 ^NDX: 16,777.40 (+20.00, +0.12%)

- NYSE Fang+ ^NYFANG: 8,728.23 (-27.02, -0.31%)

- Russell 2000 ^RUT: 2,033.96 (+16.90, +0.84%)

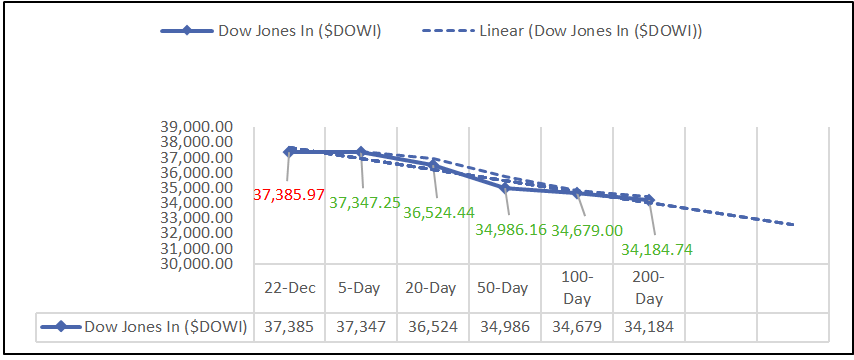

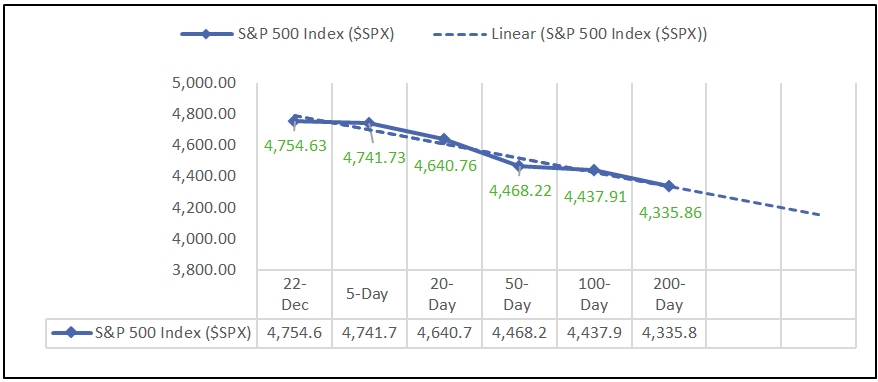

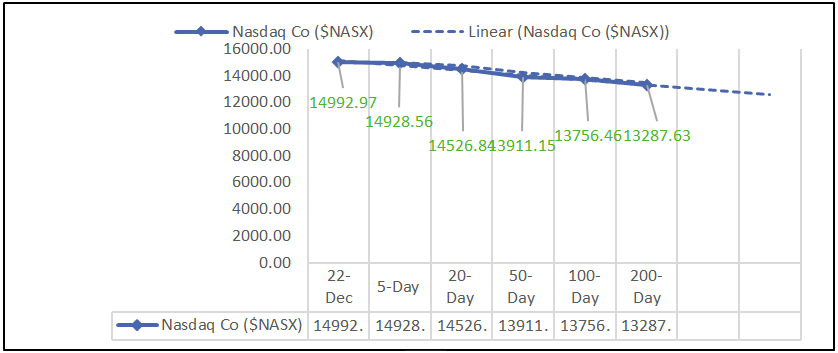

Moving Averages: DOW, S&P 500, NASDAQ:

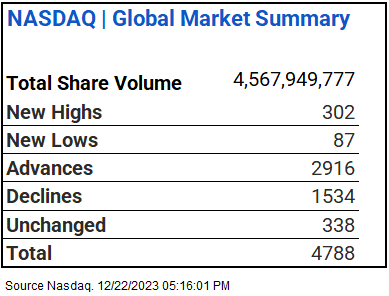

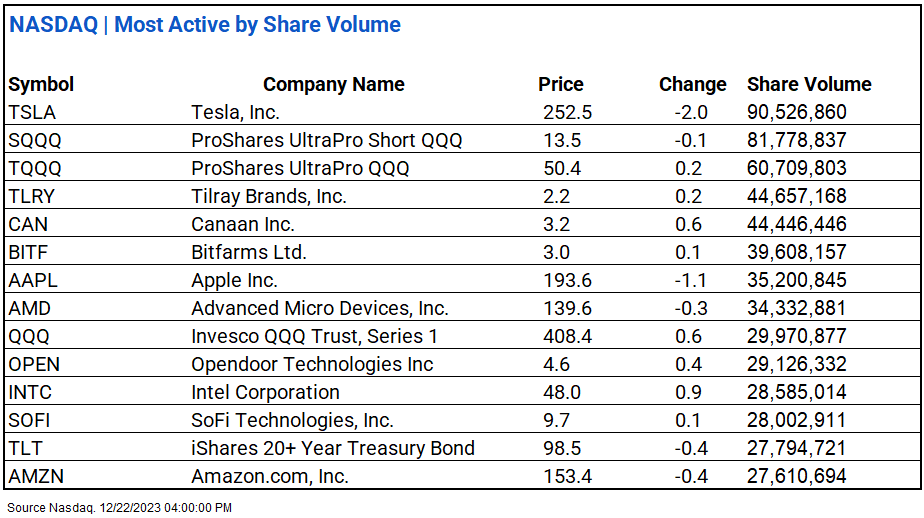

NASDAQ Global Market Summary:

Sectors:

- 10 of 11 sectors higher; Consumer Staples (+0.69%) leading, Consumer Discretionary (-0.65%) lagging. Top industries: Biotechnology (+1.44%), Independent Power and Renewable Electricity Producers (+1.33%), and IT Services (+1.20%).

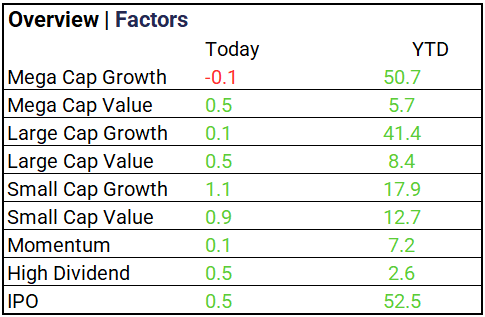

Factors:

- Small Cap Growth increased by 1.1%, while Small Cap Value posted a notable gain of 0.9%.

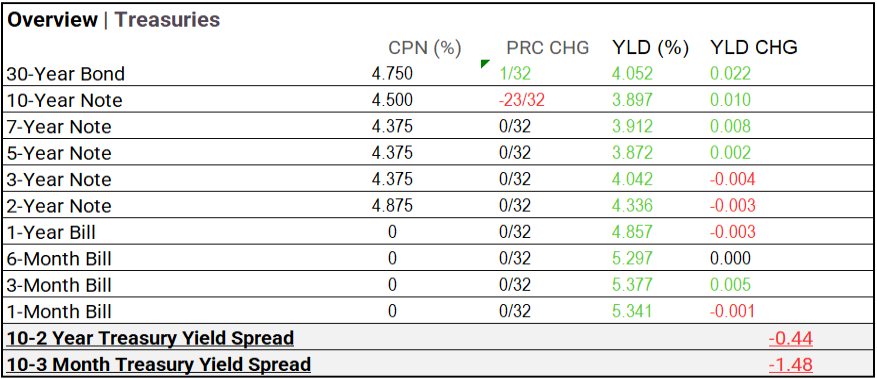

Treasury Markets:

- Mixed yields with the 30-Year Bond showing the highest gain at +0.022%.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 101.71 (-0.13, -0.13%)

- CBOE Volatility ^VIX: 13.03 (-0.62, -4.54%)

- Fear & Greed Index: 77/LY 37 (Extreme Greed/ Fear)

Commodity Markets:

- Gold Futures: $2,052.99 (+$0.42, +0.02%)

- Bitcoin USD: $43,977.35 (+$83.64, +0.19%)

- Crude Oil Futures WTI: $73.56 (-$0.33, -0.45%)

- Bloomberg Commodity Index: 99.35 (+$0.34, +0.34%)

ETF’s:

- Direxion Daily FTSE China Bear 3X Shares surged 8.18% on significant volume following breaking news about Chinese government-imposed gambling restrictions.

US Economic Data:

- Durable Goods Orders (Nov.): 5.4% (Forecast: 2.0%, Previous: -5.1%)

- Durable Goods Minus Transportation (Nov.): 0.5% (Forecast: –, Previous: -0.3%)

- Personal Income (Nov.): 0.4% (Forecast: 0.4%, Previous: 0.2%)

- Personal Spending (Nov.): 0.2% (Forecast: 0.3%, Previous: 0.2%)

- PCE Index (Nov.): -0.1% (Forecast: –, Previous: 0.0%)

- Core PCE Index (Nov.): 0.1% (Forecast: 0.1%, Previous: 0.2%)

- PCE (Year-Over-Year): 2.6% (Forecast: –, Previous: 2.9%)

- Core PCE (Year-Over-Year): 3.2% (Forecast: 3.3%, Previous: 3.4%)

- New Home Sales (Nov.): 590,000 (Forecast: 688,000, Previous: 672,000)

- Consumer Sentiment (Final, Dec.): 69.7 (Forecast: 69.4, Previous: 69.4)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT:

- MISSED:

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 0.086%

- Hang Seng (Hong Kong): -1.69%

- Shanghai Composite (China): -0.13%

- CAC 40 (France): -0.034%

- DAX (Germany): 0.11%

- FTSE 100 (UK): 0.036%

Central Banking and Monetary Policy, Noteworthy:

- Prices Fell in November for the First Time Since 2020. Inflation Is Approaching Fed Target. – WSJ

- Fed Rate Cuts Pit Economists Versus Markets on Timing, Depth – Bloomberg

Energy:

- OPEC Is Losing Its Mojo on Wall Street – WSJ

- China’s Ailing Clean Energy Industry Eyes Remedy in Saudi Arabia – Bloomberg

China:

- China targets ‘future industries’ in 2024, humanoid robots and biomedicines to drive high-quality economic growth – SCMP