Stay Informed and Stay Ahead: Exclusive Research, February 3rd, 2025

Introduction

As we enter 2025, the global economy presents a mix of opportunities and risks. Inflationary pressures, shifting central bank policies, and geopolitical uncertainties are key factors influencing market performance. Investors need to understand these dynamics to position their portfolios for success in an evolving economic environment.

This article outlines the critical drivers of the February 2025 market outlook, explores potential risks, and offers actionable strategies for institutional investors, fund managers, and individual investors.

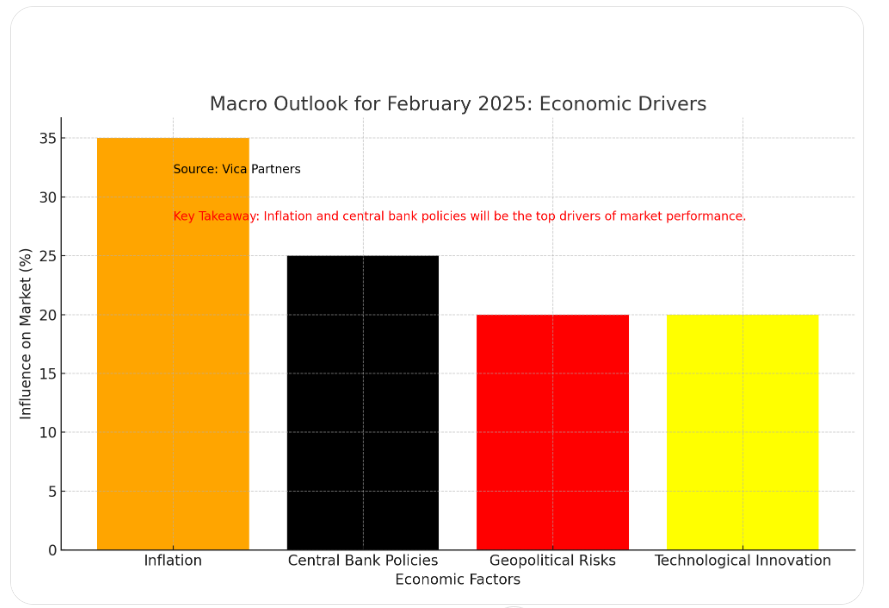

Key Drivers of the Market in February 2025

- Central Bank Policy Shifts: A Delicate Balancing Act

Central banks, especially the Federal Reserve, will be key in shaping market trends. As the Fed’s tightening cycle ends, the focus will shift to managing inflation and potential interest rate cuts. Understanding these shifts is necessary for adjusting strategies in fixed-income investments, equities, and commodities.

- Key Focus: Will the Fed implement rate cuts? How will this impact bond yields, equity markets, and investor sentiment?

Case Study: JPMorgan Chase

JPMorgan Chase is positioning its portfolios to take advantage of potential bond market fluctuations, anticipating that rate cuts may create a favorable environment for credit markets later in the year.

Macro Outlook for February 2025: Economic Drivers

- Inflation Trends: Will It Continue to Subside?

Inflation has been decreasing from the highs seen in 2022 and 2023, but sectors like housing and wages remain sensitive to inflation. Energy prices are stabilizing, and supply chains are recovering, but inflation is expected to continue its gradual decline, with key sectors still under pressure.

- Key Focus: Which sectors will continue to experience inflationary pressures, and how will this impact consumer spending and corporate margins?

Case Study: The Home Depot

Home Depot has adjusted by increasing higher-margin products, providing a buffer against inflation. Their strategy shows how companies can adapt to material cost increases while maintaining profitability.

- Geopolitical Risks and Global Trade Dynamics

Geopolitical tensions, particularly in Ukraine and the Asia-Pacific region, will influence markets. Trade relations, particularly with China, will be critical for shaping February 2025’s market performance. Monitoring these developments closely is necessary for identifying risks and opportunities.

- Key Focus: How will geopolitical developments affect global trade flows? Which regions will show growth despite risks?

Case Study: Apple Inc.

Apple has diversified its supply chain, expanding production in India and Southeast Asia to reduce exposure to geopolitical risks tied to US-China tensions. This strategy could serve as a model for other companies facing global trade uncertainty.

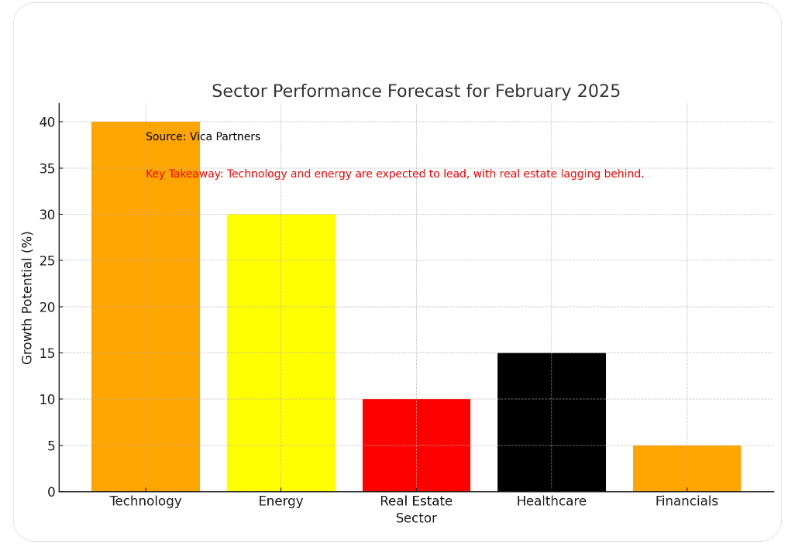

Sector Performance Forecast for February 2025

Sector-Specific Outlook for February 2025

- Technology: The Growth of AI and Automation

Technology remains a primary driver of economic growth, particularly in AI, cybersecurity, and cloud computing. February 2025 will likely see further investment in AI-driven innovations.

- Key Focus: How will AI advancements impact investment opportunities in technology? Which companies are best positioned to benefit?

Case Study: NVIDIA

NVIDIA leads in AI-driven hardware, with its GPUs critical to AI advancements. The company’s investment in AI research and development places it at the forefront of AI technology growth.

- Energy: Navigating the Transition to Renewables

The energy sector is shifting toward renewable sources, although oil and gas will remain integral to the global energy mix. February 2025 could bring renewed interest in both traditional and renewable energy sectors as market conditions evolve.

- Key Focus: How will oil and gas prices perform, and how will the transition to renewables impact energy companies?

Case Study: NextEra Energy

NextEra Energy’s investments in wind and solar energy make it a leader in renewable energy. The company stands to benefit as global demand for clean energy solutions increases.

- Real Estate: A Mixed Picture in Housing Markets

The housing market will face challenges due to higher mortgage rates. However, commercial real estate, particularly in logistics and industrial properties, is poised for growth.

- Key Focus: How will interest rates affect the housing market, and what commercial real estate opportunities are available?

Case Study: Prologis

Prologis capitalizes on e-commerce growth by investing in industrial real estate. Its focus on logistics properties has allowed it to remain resilient, even in a higher interest rate environment.

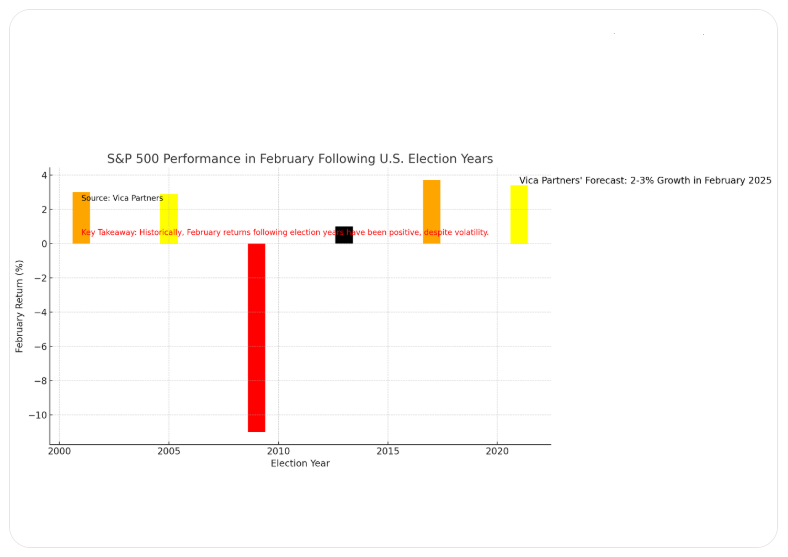

S&P 500 Performance in February Following U.S. Election Years

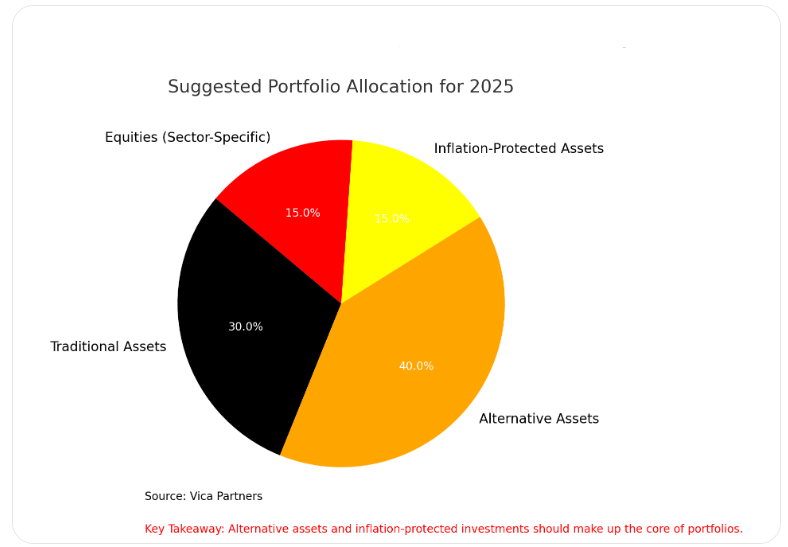

Investment Strategies for February 2025

- Diversify into Alternative Assets

With ongoing volatility in traditional asset classes, investors should allocate more capital to alternative assets like private equity and real estate. These provide diversification and offer higher return potential in a moderating growth environment.

- Key Strategy: Allocate to alternatives to hedge against volatility while benefiting from sector-specific growth.

- Focus on Inflation-Protected Securities

As inflation remains a concern, incorporating inflation-protected securities like TIPS (Treasury Inflation-Protected Securities) will help preserve purchasing power.

- Key Strategy: Use TIPS to safeguard portfolios against inflationary pressures.

- Embrace Sector-Specific Equity Strategies

Sectors like technology, energy, and financials will outperform. Focus on companies within these sectors that are positioned for growth, driven by long-term macroeconomic trends.

- Key Strategy: Target high-growth sectors using a diversified equity strategy.

Suggested Portfolio Allocation for 2025

February S&P 500 Performance: Historical Trends Following an Election Year

The S&P 500 shows patterns following U.S. presidential elections. While past performance is not indicative of future results, historical data can offer insights.

Key Trends Following Election Years:

- Post-Election Recovery: The year after an election often sees market optimism, with investors reacting positively to policy clarity and reduced uncertainty. February returns following election years are generally positive.

- Market Volatility: While there is typically positive movement, periods of market volatility also occur as new policies are tested.

Case Study: February S&P 500 Performance Post-2020 Election

In February 2021, the S&P 500 saw strong performance, driven by the new administration’s stimulus packages and a recovering economy.

- Key Focus: February 2025 may see similar volatility as investors assess the impacts of fiscal policies and geopolitical developments.

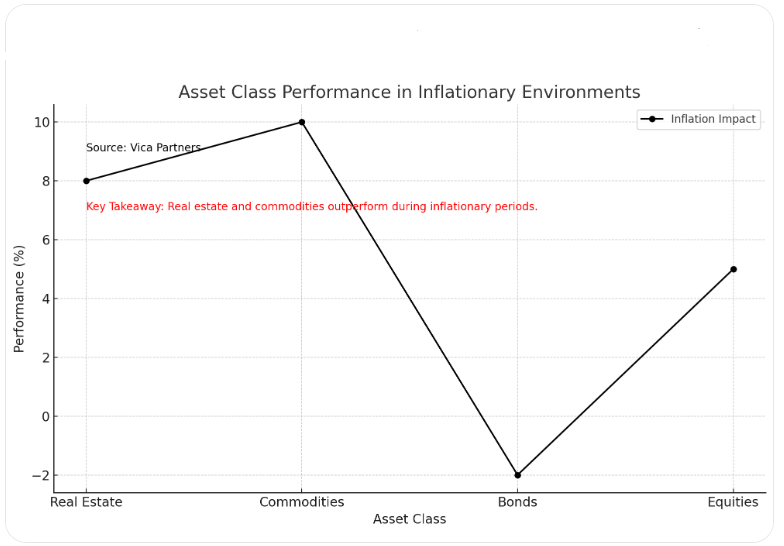

Asset Class Performance in Inflationary Environments

Conclusion

February 2025 will be a critical month for markets. Investors will need to remain agile, adapting to shifting central bank policies, evolving inflation trends, and geopolitical risks. Historical trends indicate that while volatility remains, there are opportunities for those who strategically allocate to growth sectors like technology, energy, and alternative assets.

The path to success in 2025 will rely on a data-driven approach to portfolio management. By focusing on sector-specific growth opportunities and maintaining diversification, investors can capture long-term gains while managing risk.

Key Takeaways:

- Monitor central bank actions closely for signs of rate cuts or adjustments that could impact asset valuations.

- Diversify portfolios with alternative assets and inflation-protected securities to hedge against volatility.

- Focus on high-growth sectors like AI, renewable energy, and technology for long-term growth.