Stay Informed and Stay Ahead: Market Watch, June 12th, 2024.

Mid-Week Wall Street Markets

Three Key Takeaways

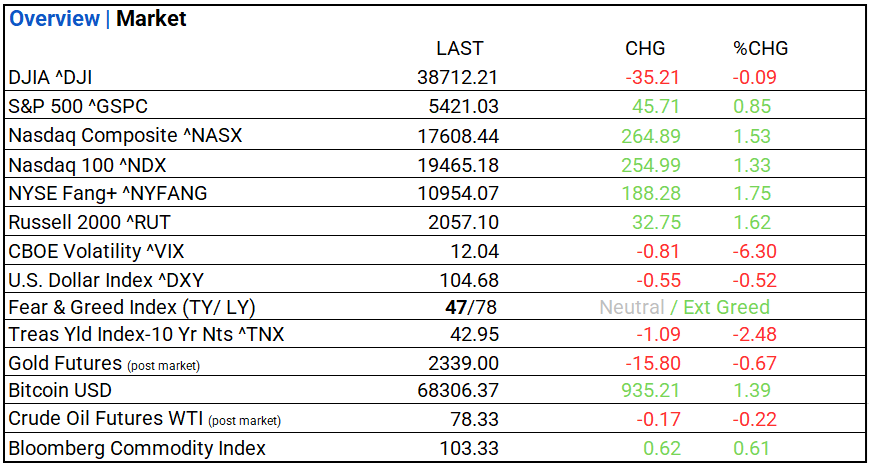

+ Major indices: NASDAQ and S&P 500 up, DJIA down. Tech leads; Energy and Consumer Staples lag. Top industry: Automobiles.

+ May CPI rose 0.1% monthly and 3.3% yearly, beating forecasts. Core CPI increased 0.2% monthly, below expectations. The Fed left the target rate unchanged.

+ Bond prices mostly fell; growth stocks outpaced value stocks.

Summary of Market Performance

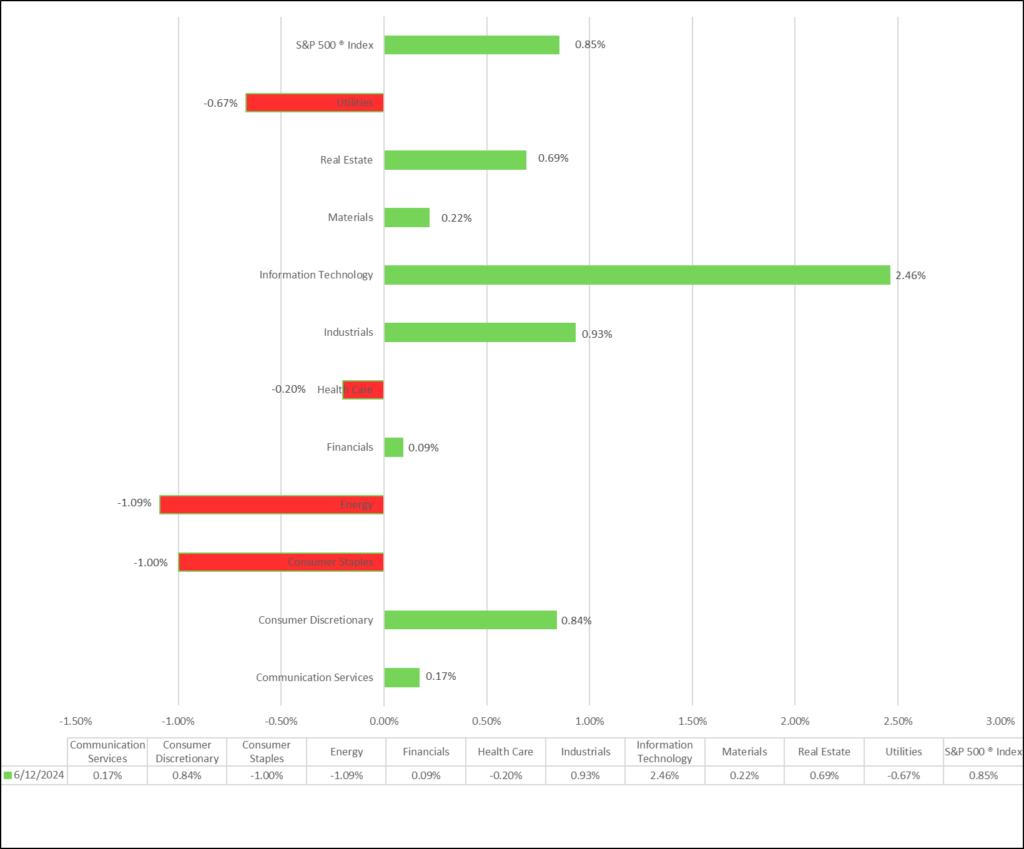

Indices & Sectors Performance:

- Major indices, NASDAQ, S&P 500 up, DJIIA down.

- 7 of 11 sectors rise: Tech outperforms, Energy/ Consumer Staples lag. Top Industries: Automobiles Industry, Semiconductor & Semiconductor Equipment Industry, Technology Hardware, Storage & Peripherals.

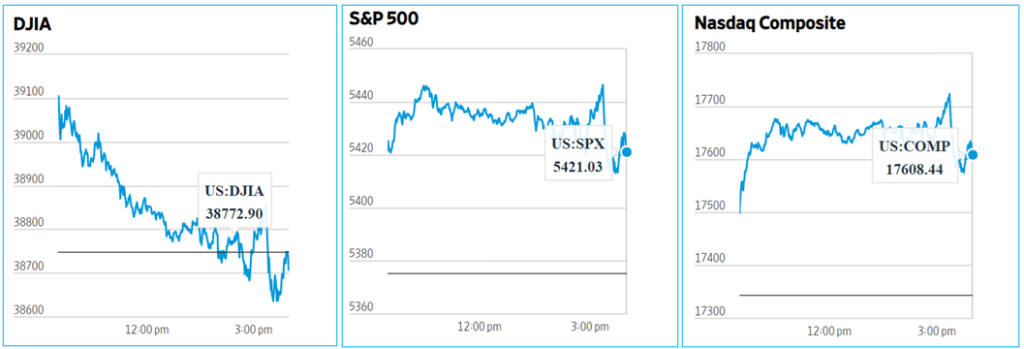

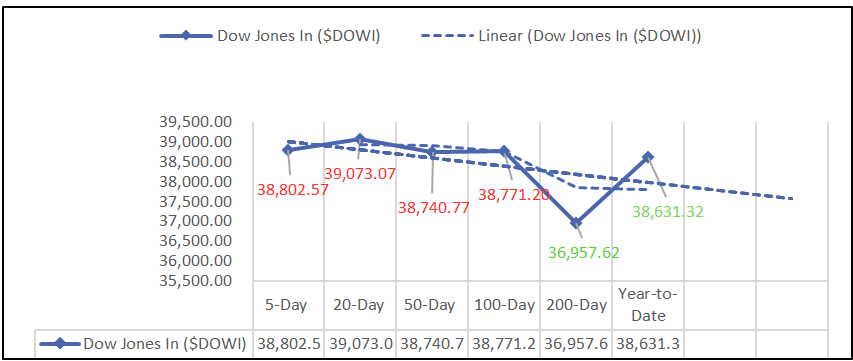

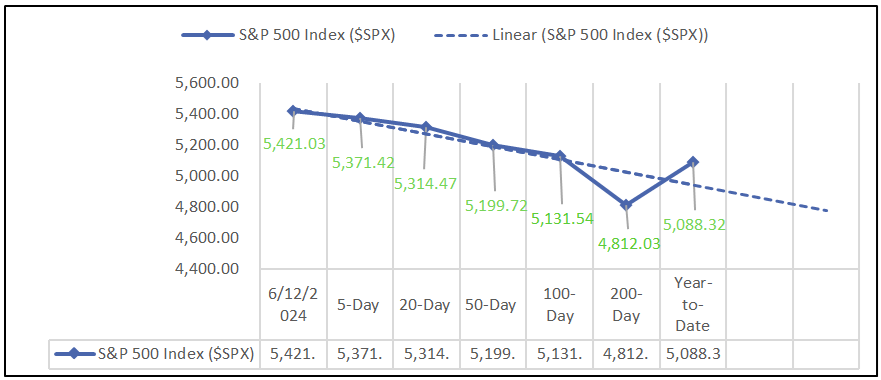

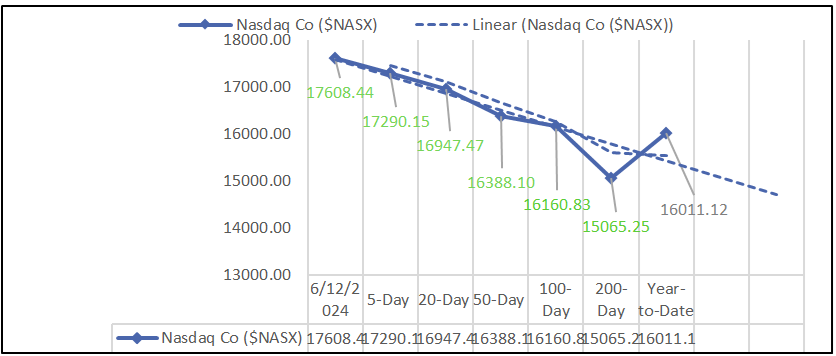

Chart: Performance of Major Indices

Moving Average Analysis:

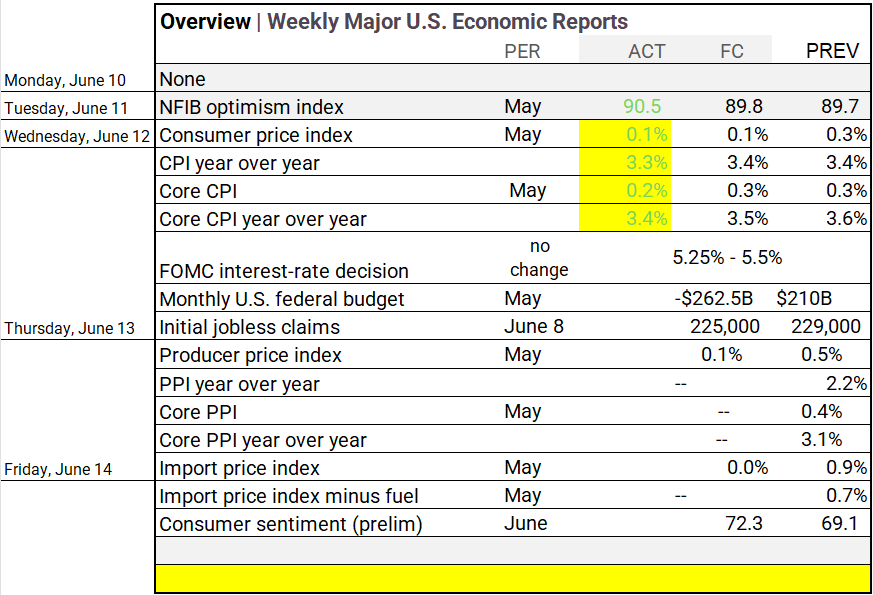

Economic Highlights:

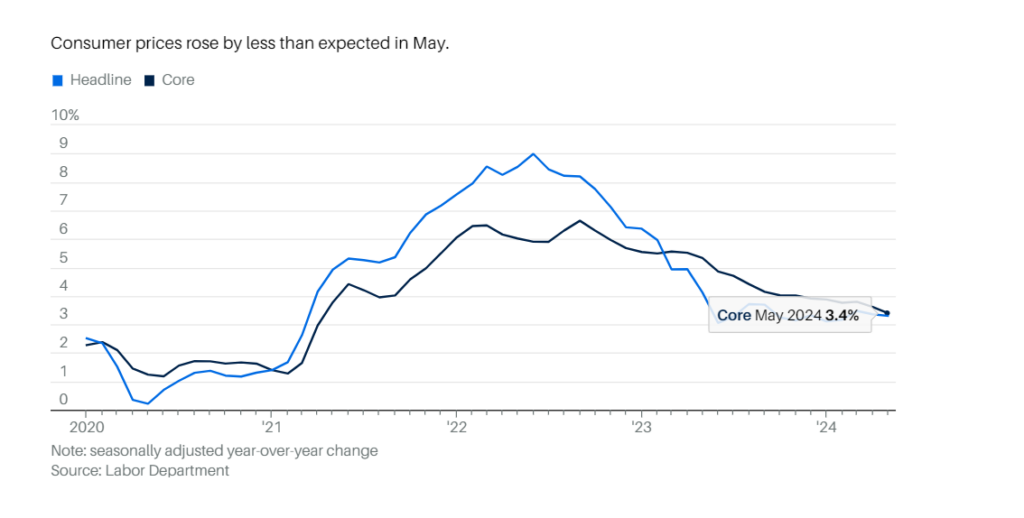

- The May Consumer Price Index (CPI) met expectations with a 0.1% monthly increase, down from 0.3%. The yearly CPI at 3.3% beat the 3.4% forecast, and Core CPI rose 0.2% monthly, also below the 0.3% forecast, with a yearly rate of 3.4%, better than the predicted 3.5%.

NASDAQ Global Market Update:

- Today’s Nasdaq data shows bullish sentiment with advancers to decliners at a 1.748 ratio.

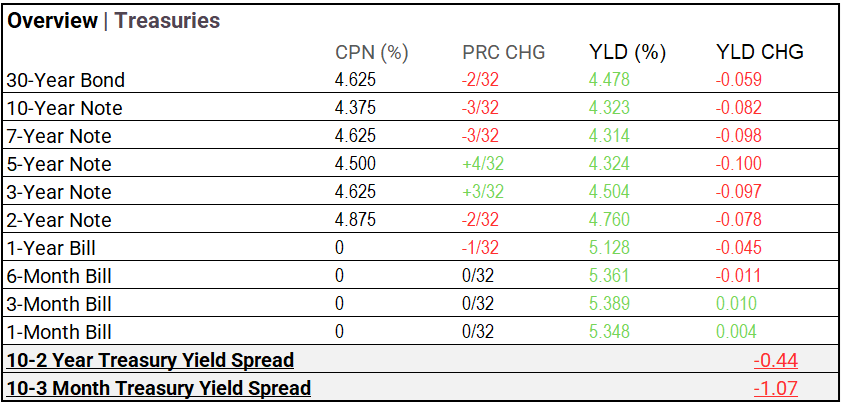

Treasury Markets:

- Bond prices mostly fell, decreasing yields and signaling higher demand for longer-term bonds. However, the 5-Year Note’s price increase suggests specific demand in that segment.

Market Trends:

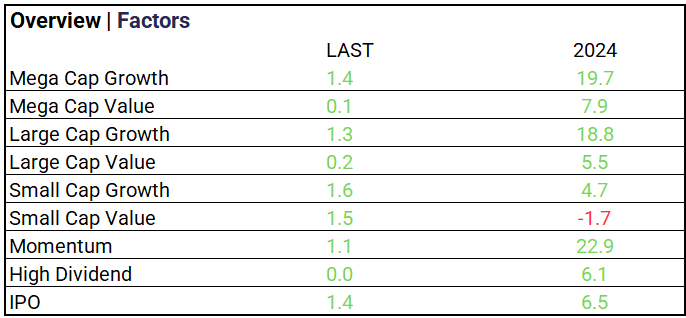

- Growth stocks outpaced value on the day: Mega Cap Growth rose 1.4% and Momentum gained 1.1%, contrasting with Mega Cap Value’s modest 0.1% increase.

Currency & Volatility:

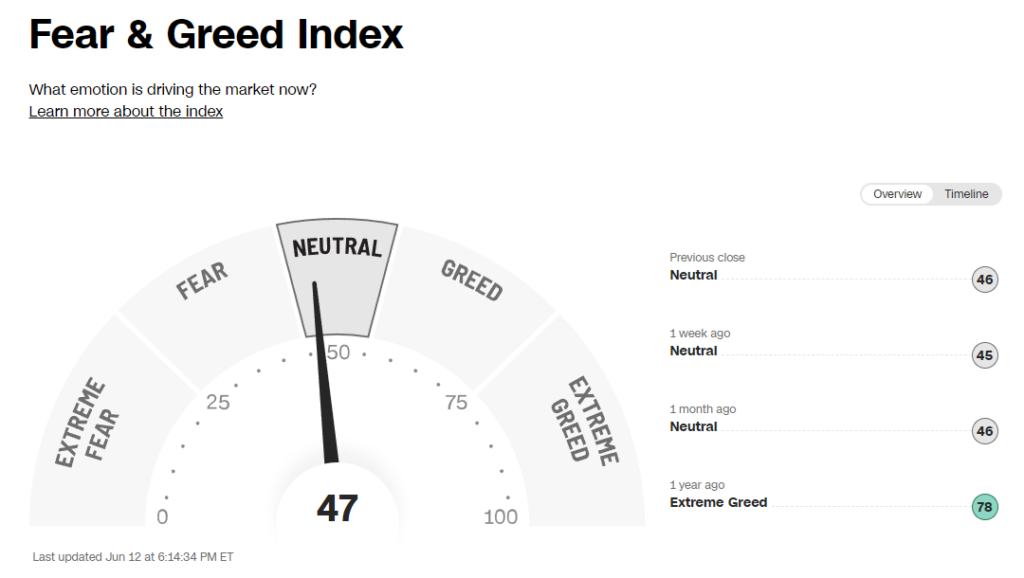

- The CBOE Volatility Index dropped 6.30% to 12.04, the U.S. Dollar Index declined 0.52%, and the Fear & Greed Index is neutral at 47.

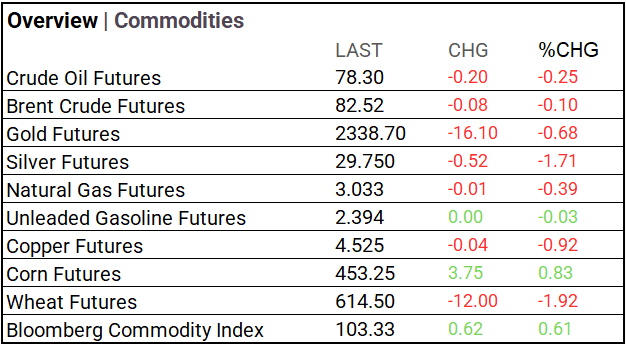

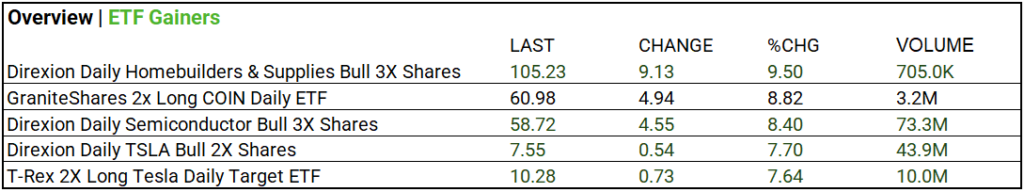

Commodities & ETFs:

- Commodities: Overall, commodities saw mixed movement: Crude oil and Brent crude prices dipped, while gold and silver futures declined notably. Agricultural futures mixed as corn rose, but wheat prices fell sharply. The Bloomberg Commodity Index increased modestly.

- ETF’s: Direxion Daily Semiconductor Bull 3X Shares jumped 8.40% with high volume at 73.3M shares. Direxion Daily TSLA Bull 2X Shares rose 7.70% on significant trading volume of 43.9M shares.

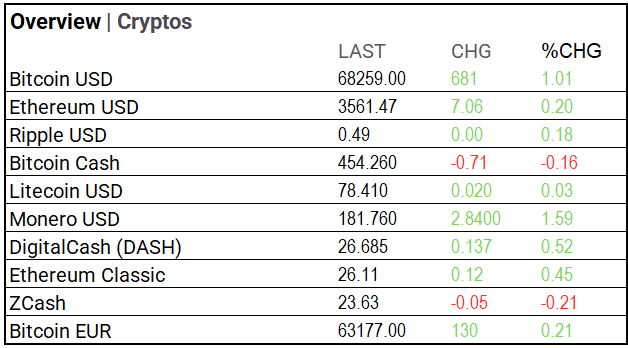

Cryptocurrency Update:

- Bitcoin closed at $68,259, gaining $681 (1.01%). Monero also saw an increase, rising to $181.76, up $2.84 (1.59%), while other cryptocurrencies showed minimal change.

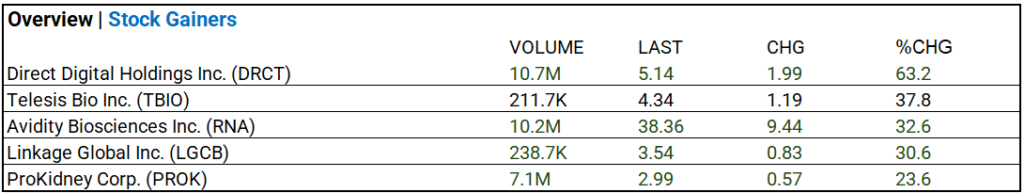

Stocks:

- Direct Digital Holdings Inc. (DRCT) traded 10.7M shares at $5.14, up 63.2%, and Avidity Biosciences Inc. (RNA) traded 10.2M shares at $38.36, rising 32.6%.

Notable Earnings:

- Broadcom (AVGO) with BIG beat.

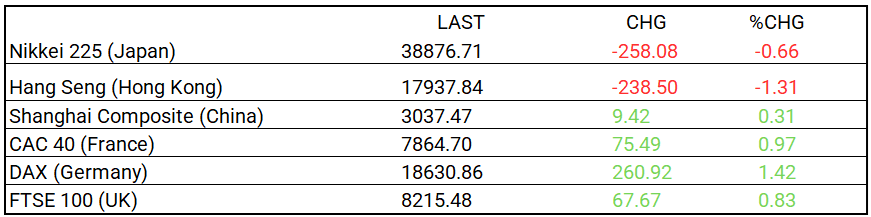

Global Markets Summary:

- Hang Seng led declines, dropping 1.31%, while DAX topped gains, rising 1.42%. Shanghai Composite showed a modest increase of 0.31%.

In the NEWS:

Central Banking and Monetary Policy:

- Fed Projects Just One Cut This Year Despite Mild Inflation Report – Wall Street Journal

- US Deficit Grows From a Year Ago Fueled by High Borrowing Costs – Bloomberg

Business:

- Broadcom to Carry Out 10-for-1 Stock Split – Wall Street Journal

- Bank Leaders Say Real Estate Pain Is Still Confined to Office – Bloomberg

China:

- Chinese EV makers’ price wars in overseas markets will sow doubts over quality: Bain – South China Morning Post