Sources: National Association of REALTORS®, BLS, VMSI

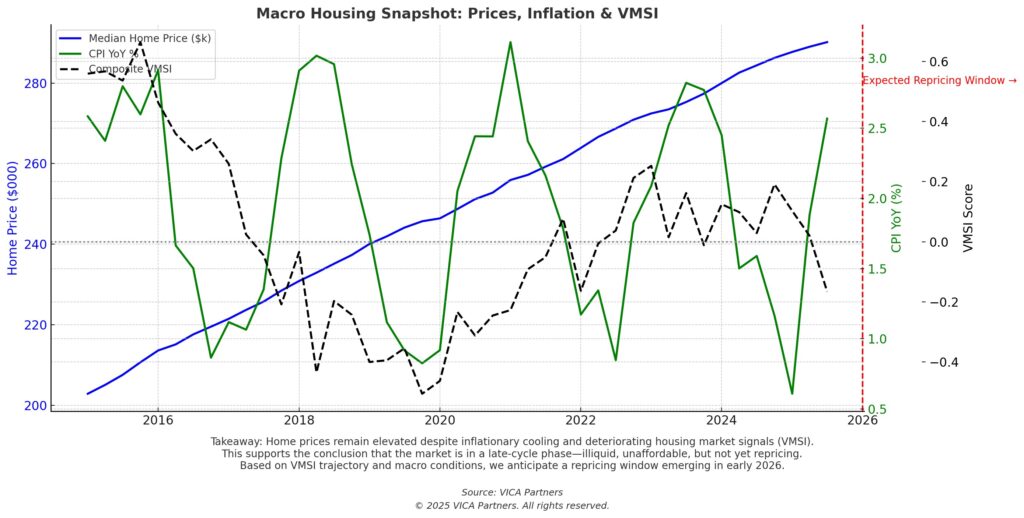

The U.S. housing market is showing clear late-cycle characteristics. Prices remain elevated, yet affordability and liquidity are deteriorating. Buyer sentiment is weak, transaction volume is sliding, and institutional participation is light. Our internal VMSI framework shows sustained stress in market internals. Based on these trends and broader macro dynamics, we expect meaningful repricing to emerge in early 2026.

June 2025 Snapshot: High Prices, Low Velocity

According to the National Association of REALTORS®, the median existing-home price reached a record $435,300 in June, up 2% year-over-year. Meanwhile, sales volume dropped 2.7% to 3.93M units (SAAR)—a 10-month low. Despite higher inventory (+16% YoY), transaction flow remains subdued as elevated mortgage rates (~6.5%+) continue to choke affordability.

Investor demand is also thinning. While 30% of transactions were all-cash, much of that came from equity-rich repeat buyers, not institutional capital. First-time buyer share remains well below long-term averages at 30%.

VMSI Signals Weakness Beneath Price Resilience

The VMSI Index (Valuation, Momentum, Sentiment, Inventory) captures structural softening:

- Valuation remains firm due to chronic undersupply

- Momentum is slowing as volume decays in seasonally strong months

- Sentiment has turned cautious, especially in rate-sensitive segments

- Inventory gains have not meaningfully eased pressure on price

Composite VMSI readings have stayed negative for two straight quarters—historically associated with late-cycle stall-outs and eventual repricing.

Macro Housing Snapshot Chart

Chart shows late-cycle tension: high prices, cooling inflation, and weakening housing signals.

Outlook: A Repricing Window Ahead

We don’t expect a sharp correction this year, but pressure is building beneath the surface. If rates ease and inventory continues rising, we see a window for price reset and improved institutional entry by early 2026. Markets with stretched valuation-to-income ratios or capital rollover risks will likely lead the adjustment.

Prepared by VICA Partners. For institutional use only.

Copyright: © 2025 VICA Partners. All rights reserved.

Disclaimer: This material is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell securities. All views are as of the date of publication and subject to change without notice