Stay Informed and Stay Ahead: Market Watch, September 16th, 2024.

Navigating Low Interest Rates: Strategic Investment Moves

As interest rates decline, traditional savings options like CDs and high-yield savings accounts yield less. To maximize returns and adapt to the changing economic environment, consider diversifying your investments.

Key Takeaways

- Reevaluate Savings Strategies: With lower interest rates, returns on CDs and high-yield savings accounts decrease. Explore other investment options to enhance returns.

- Growth Stocks in Low-Rate Environments: Invest in companies with strong earnings potential, focusing on sectors like technology and healthcare.

- Dividend Stocks for Income Stability: Dividend-paying stocks offer a steady income stream and potential for capital growth in a low-rate setting.

- Real Estate Opportunities: Lower borrowing costs make real estate, especially through REITs, a viable option for income and long-term growth.

- Diversify for Long-Term Success: Spread investments across stocks, bonds, real estate, and alternative assets to balance growth and manage risk.

Curious about how to implement these strategies effectively? Keep reading to discover specific investment options with returns along with practical advice to optimize your portfolio in a low-rate environment.

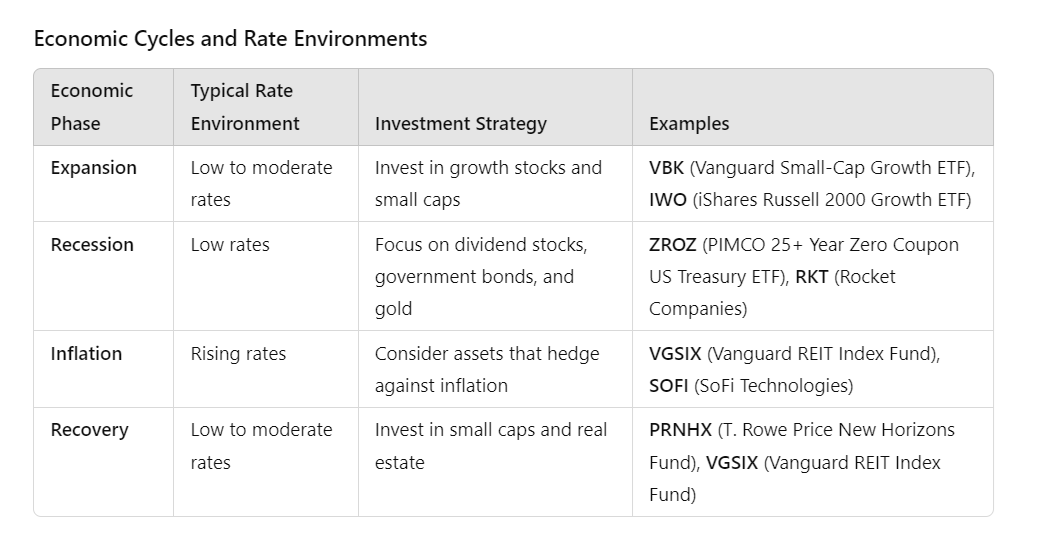

Economic Cycles and Rate Environments

Understanding economic cycles helps in making informed investment decisions. When rates are low, the economy may be in a growth or recovery phase, affecting investment performance.

- Expansion: In growth phases, stocks, particularly growth stocks, often perform well. Look for companies with strong fundamentals and resilience.

- Recession: During downturns, dividend stocks, government bonds, and gold can offer more protection. Essential goods and services remain stable investments.

- Inflation: If inflation rises, consider assets like real estate or commodities that hedge against price increases.

Actionable Investment Strategies

- Reevaluate Savings Strategies: With shrinking returns on CDs and savings accounts—currently averaging around 0.5% APY—explore higher-growth options. ETFs like TLT (iShares 20+ Year Treasury Bond ETF) offer a current yield of about 2.8%, with a compound annual growth rate (CAGR) of approximately 5% over the past decade. EDV (Vanguard Extended Duration Treasury ETF) provides a yield of around 2.9%, with a CAGR of about 6% over the same period, offering better returns compared to traditional savings methods.

- Long-Term Bonds for Stability: ZROZ (PIMCO 25+ Year Zero Coupon US Treasury ETF) offers a yield of around 3.1% and a CAGR of approximately 7% due to its exposure to long-duration Treasury bonds. This can provide a stable income source and potential for capital gains in a low-rate environment.

- Small-Cap Stocks for Growth: Small-cap stocks, such as those in VBK (Vanguard Small-Cap Growth ETF) and IWO (iShares Russell 2000 Growth ETF), have historically outperformed during economic recoveries. VBK has delivered an average annual return of about 12% over the past decade, with a CAGR of around 11%. IWO has averaged approximately 11% annually, with a CAGR of about 10% over the same period.

- Dividend and Growth Stocks: Combine income and growth with stocks like NVDA (NVIDIA), which has a five-year average return of approximately 30% per year and a CAGR of around 25%, and RKT (Rocket Companies), which provides a dividend yield of about 3.5% and has seen a CAGR of around 7% over the past five years. Both stocks are positioned to benefit from a low-rate environment.

- Diversify Across Assets: Use PRNHX (T. Rowe Price New Horizons Fund) for small caps, offering an annual return of around 10% with a CAGR of approximately 9% over the past decade. VGSIX (Vanguard REIT Index Fund) provides a yield of about 4.0% and a CAGR of roughly 8% in real estate exposure. SOFI (SoFi Technologies) has experienced significant appreciation with a CAGR of around 20% since its IPO. This diversified approach can help maintain a balanced portfolio and capitalize on different market conditions.

In Conclusion

As interest rates continue to decline, adapting your investment strategy is crucial. The key to navigating this environment effectively lies in reevaluating your approach to savings, embracing growth opportunities, and diversifying your portfolio. Explore strategies such as investing in long-term bonds, small-cap stocks, dividend-paying equities, and real estate to better position your portfolio for growth and stability. These approaches offer real potential for returns and stability compared to traditional savings options.

Next Steps: For a more comprehensive understanding and practical advice, avoid the noise from entertainment-based financial media and hedge fund promotions. Focus on proven strategies and insights from experienced investors. Stick to investments you understand and hold for the long term—time and compounding are your allies. Discover actionable steps tailored to your financial goals in our full article, coming at the end of September.