“Empowering Your Financial Success”

Daily Market Insights: November 22nd, 2023

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): -0.09%

- Hang Seng (Hong Kong): -0.12%

- Shanghai Composite (China): +0.08%

- CAC 40 (France): closed.

- DAX (Germany): +0.36%

- FTSE 100: closed.

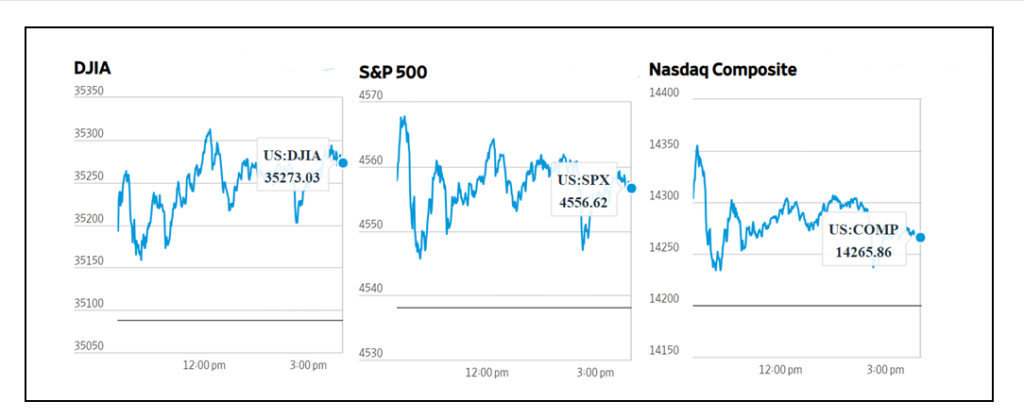

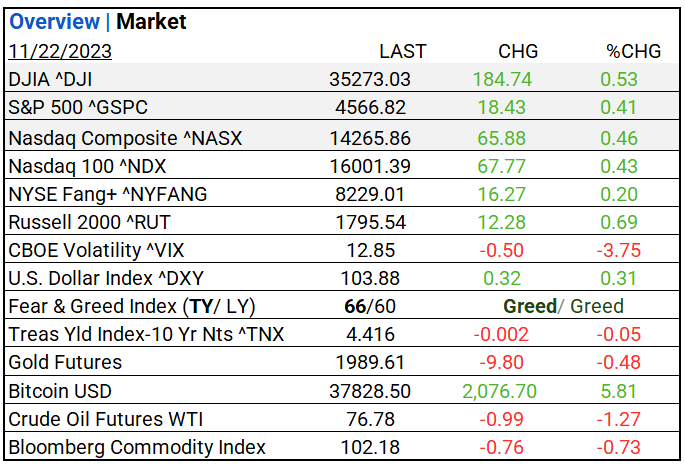

US Market Snapshot: Key Stock Market Indices:

- S&P Futures: opened@ 4533.04 (+0.33%)

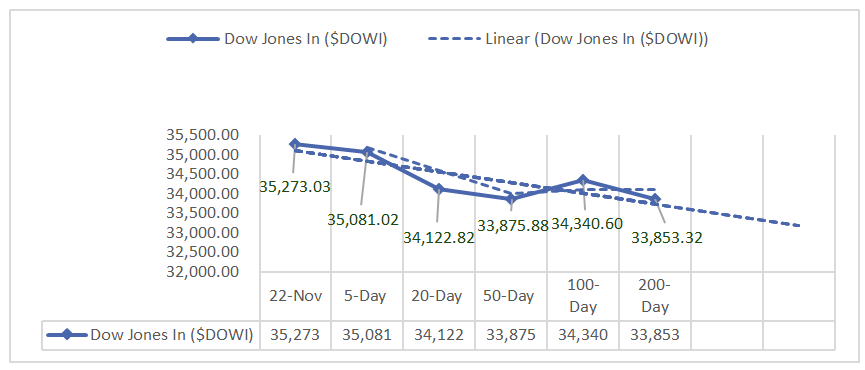

- DJIA ^DJI: 35,273.03 (184.74, 0.53%)

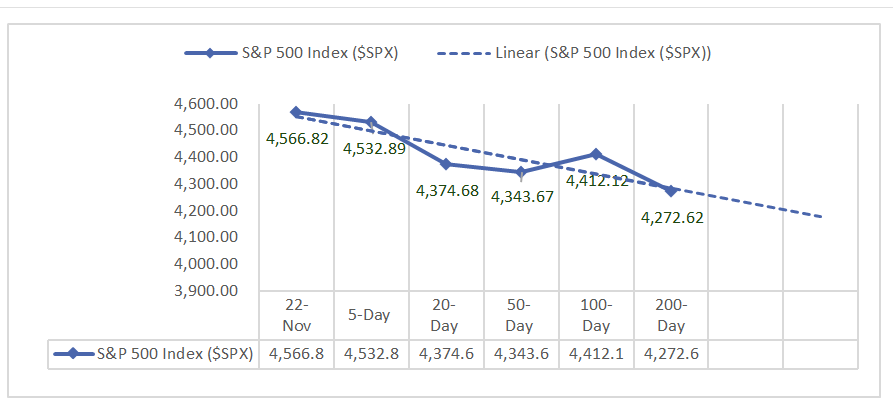

- S&P 500 ^GSPC: 4,566.82 (18.43, 0.41%)

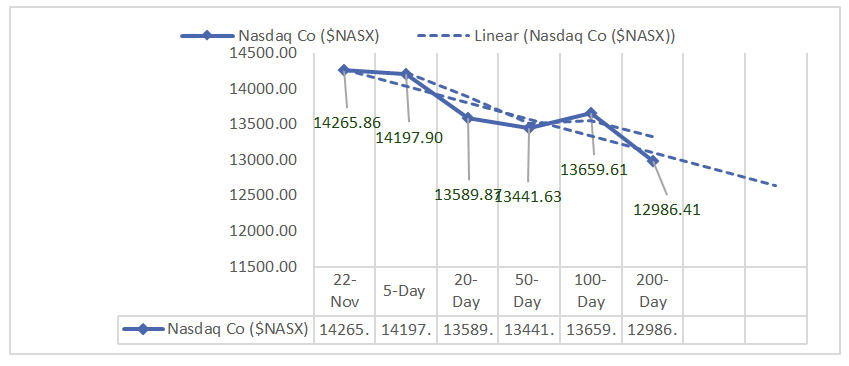

- Nasdaq Composite ^NASX: 14,265.86 (65.88, 0.46%)

- Nasdaq 100 ^NDX: 16,001.39 (67.77, 0.43%)

- NYSE Fang+ ^NYFANG: 8,229.01 (16.27, 0.20%)

- Russell 2000 ^RUT: 1,795.54 (12.28, 0.69%)

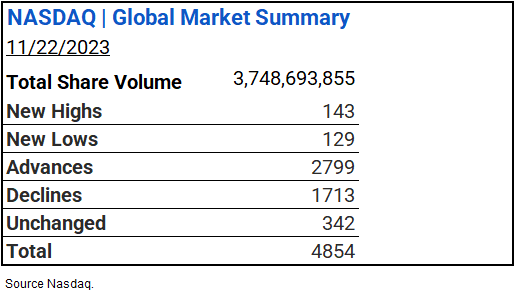

NASDAQ Global Market Summary:

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Nov. 18 jobless claims: 209K (Forecast: 233K), Oct. durable goods orders: -5.4% (Forecast: 4.0%), Nov. consumer sentiment: 61.3 (Forecast: 60.4).

- Market Indices: DJIA (+0.53%), S&P 500 (+0.41%), Nasdaq Composite (+0.46%).

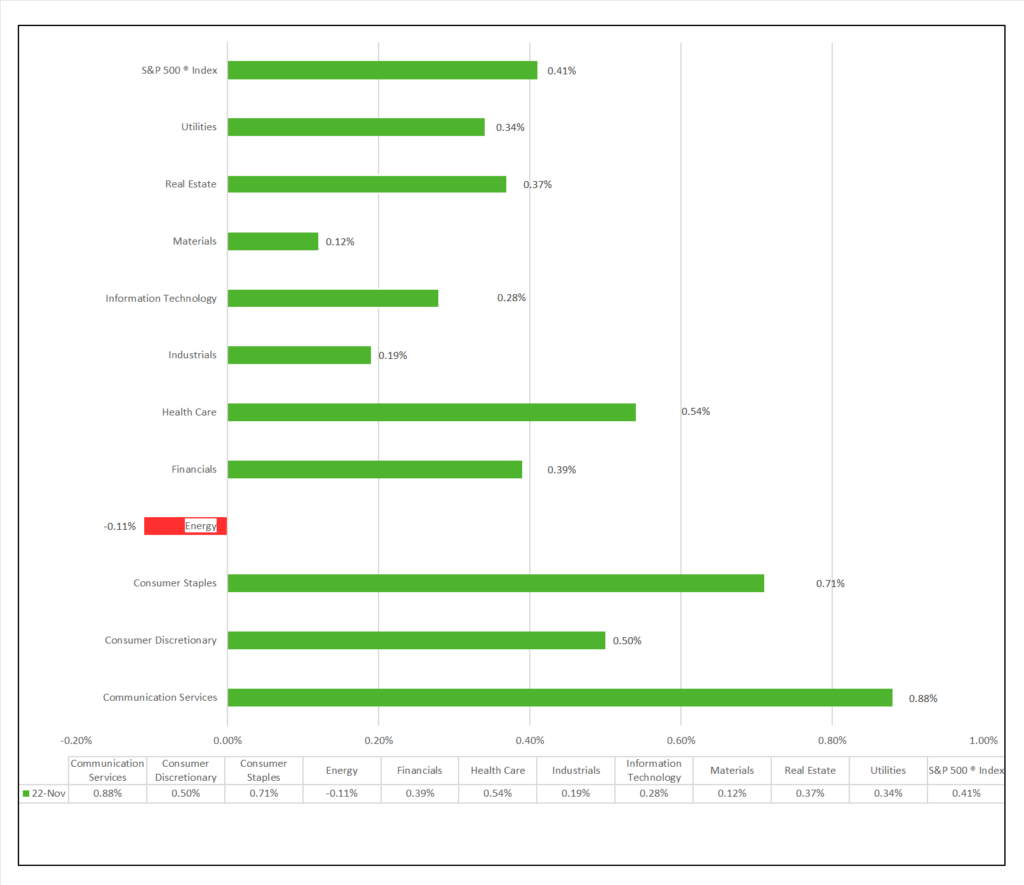

- Sector Performance: 10 of 11 sectors higher; Communication Services (+0.88%) leading, Energy (-0.11%) lagging. Top industry: Broadline Retail (+1.97%).

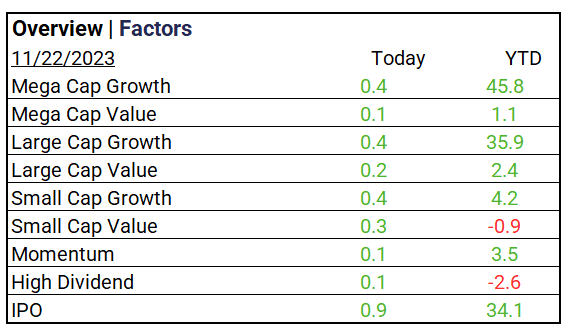

- Factors: Growth outperforms Value. IPO’s lead +0.9%.

- Top Volume ETF’s: SPDR S&P 500 ETF Trust ^SPY+0.39%, Invesco QQQ Trust ^QQQ, +0.41%, and iShares Russell 2000 ETF ^IWM +0.63%.

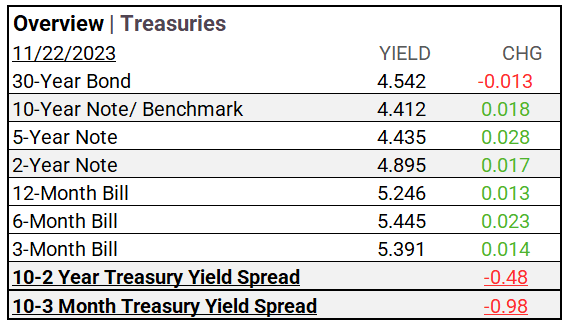

Treasury Markets:

- Treasury yields mostly gained across the curve: the 30-Year Bond decreased by -0.013, while the 10- Year and 2-Year Note increased by, +0.018 +0.017 respectively.

Currency and Volatility:

- U.S. Dollar Index gained, CBOE Volatility fell 3.75%, Fear & Greed reading reflects Greed.

source: CNN Fear and Greed Index

Commodity Markets:

- Bitcoin with solid gains, Crude Oil futures and the Bloomberg Commodity Index gained; Gold futures declined.

- Gold Futures: 1,989.61 (-9.80, -0.48%)

- Bitcoin USD: 37,828.50 (2,076.70, 5.81%)

- Crude Oil Futures WTI: 76.78 (-0.99, -1.27%)

- Bloomberg Commodity Index: 102.18 (-0.76, -0.73%)

Sectors:

- 10 of 11 sectors higher; Communication Services (+0.88%) leading, Energy (-0.11%) lagging. Top industries: Broadline Retail (+1.97%), Personal Care Products (+1.31%), and Gas Utilities(+1.30%).

Factors:

- Growth outperforms Value. IPO’s lead +0.9%.

ETF Performance:

Top Volume:

- SPDR S&P 500 ETF Trust ^SPY ($455.02, +0.4%)

- Invesco QQQ Trust ^QQQ ($390.06, +0.4%)

- Shares Russell 2000 ETF ^ IWM ($178.13, +0.6%)

Noteworthy:

- ProShares Bitcoin Strategy ETF ^BITO ($18.99, +2.3%)

US Economic Data:

- Initial Jobless Claims (Nov. 18): 209,000 (Previous: 229,000, Forecast: 233,000)

- Durable Goods Orders (Oct.): -5.4% (Previous: -3.4%, Forecast: 4.0%)

- Durable Goods Excluding Transportation (Oct.): 0.0% (Previous: Not available, Forecast: 0.2%)

- Consumer Sentiment (Final, Nov.): 61.3 (Previous: 60.6, Forecast: 60.4)

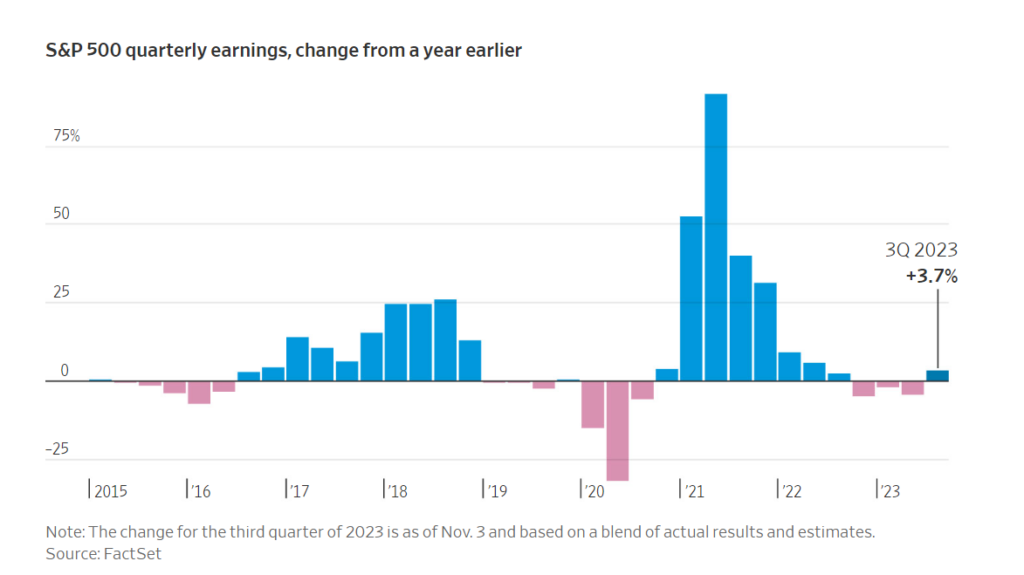

Earnings:

- Q3 Forecast: 64% of S&P 500 companies issue negative EPS guidance for Q3 2023. Communication Services and Consumer Discretionary lead in expected YoY earnings growth.

Notable Earnings Today:

- BEAT: Deere&Company (DE), Johnson Controls (JCI), GDS Holdings (GDS).

- MISSED: Thyssenkrupp ADR (TKAMY).

Central Banking and Monetary Policy:

- Home Sales Fell to a New 13-Year Low in October – WSJ

- US Mortgage Rates Fall to 7.29%, Lowest Since September – Bloomberg

Energy:

- U.S. Crude Oil Inventories Rise by 8.7 Million Barrels in Week – WSJ

- Japan Urges LNG Buyers to Sign Long-Term Deals for Fuel Security – Bloomberg

China:

- Who’s on China’s new Central Financial Commission, and what will the Communist Party watchdog do? – SCMP