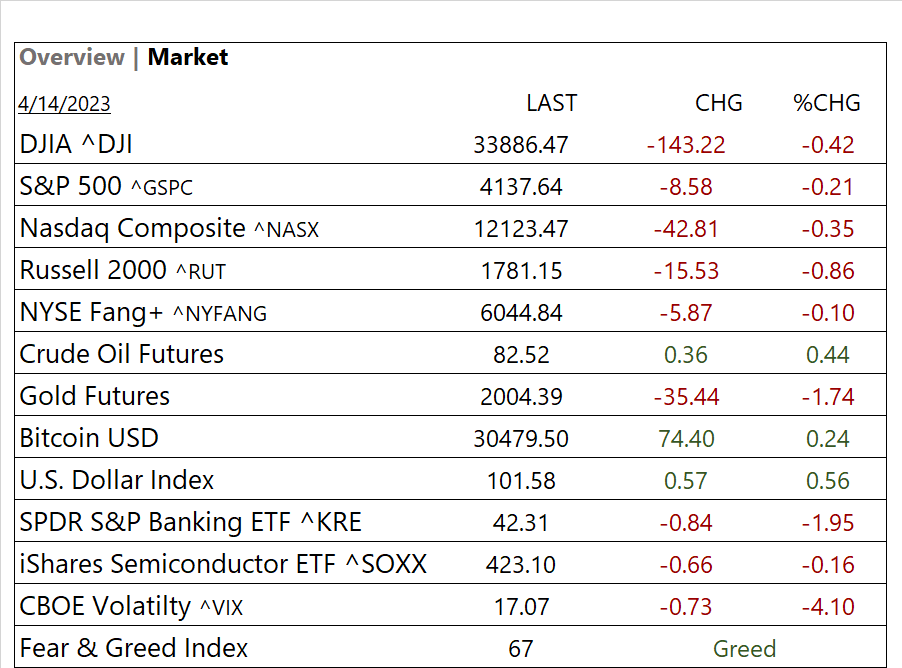

MARKETS TODAY April 14th, 2023 (Vica Partners)

Good Friday Evening!

Yesterday, key Indices closed sharply higher led by Nasdaq and FANG+. 10 of 11 of the S&P 500 sectors were higher, Communication Services and Consumer Discretionary outperform/ Real Estate lagged. Yield mostly rise while Bitcoin and Gold gained. In economic news, headline PPI/ Core PPI came in lower than expected, Jobs higher.

Overnight, Asian markets finished higher with shares in Japan leading the region. The Nikkei 225 was up 1.20%, China’s Shanghai Composite up 0.60% and Hong Kong’s Hang Seng up 0.46%. Premarket, European markets finished higher today with shares in France leading the region. The CAC 40 was up 0.52%, Germany’s DAX up 0.50% and London’s FTSE 100 up 0.36%. S&P 500 US futures were trading -0.10% below fair value.

US markets today, Key Indices close lower, DOW drops 143 point and lags. 9 of 11 of the S&P 500 sectors finish lower, Utilities and Real Estate underperform/ Financials outperform – BIG Banks JP Morgan and Citi beat on earnings. Yield rise across thew curve. Bitcoin and USD Index rise. In economic news, Retail Sales declined by 1% in March, led by lower spending on vehicles while manufacturing output fell. US consumer sentiment improved in April.

Takeaways

- BIG Banks JP Morgan and Citi beat on earnings

- Financials and Energy outperform

- BIG Banks forward recessionary warnings contribute to selloff

- Indices end higher on the Week, DOW +1.2%, S&P +0.08%, Nasdaq +0.03%

- CBOE Volatility Index ^VIX closes at 17.07, records YTD low

- Bitcoin almost breaks $31K today

- Retail Sales and manufacturing output declined in March

- OPEC forecasts rising oil demand, analysts expect higher energy prices ahead

- Markets priced in a 76% chance of a 25-basis-point rate hike in the May

Pro Tip: Estimating how much your stock-market investment will return over time then use an average annual return of 5.0%. Investing in S&P 500 is less risky than buying single stocks, as it’s diversified by sector. SPDR S&P 500 ETF Trust (SPY) is a start.

Sectors/ Commodities/ Treasuries

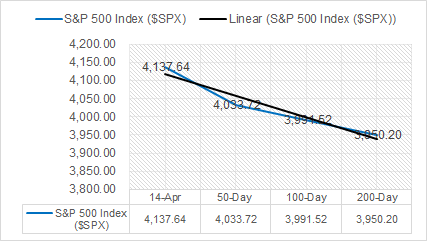

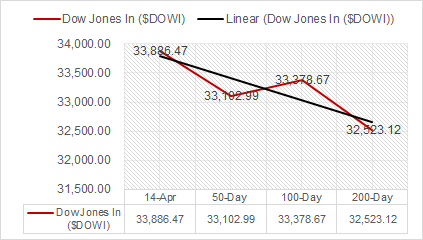

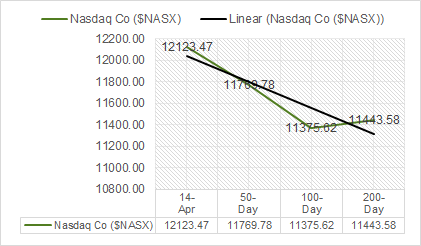

Key Indexes (50d, 100d, 200d)

S&P Sectors

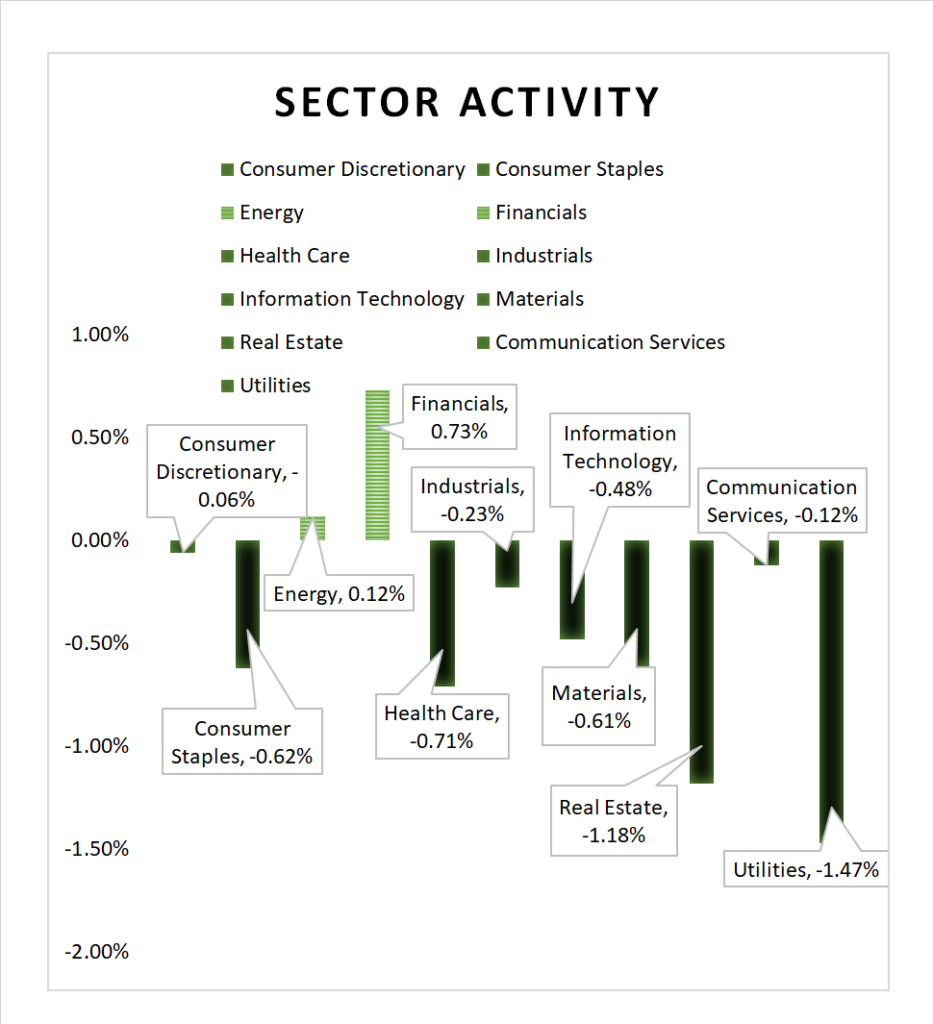

- 9 of 11 of the S&P 500 sectors finish lower, Utilities -1.47% and Real Estate -1.18% underperform/ Financials 0.73% outperforms

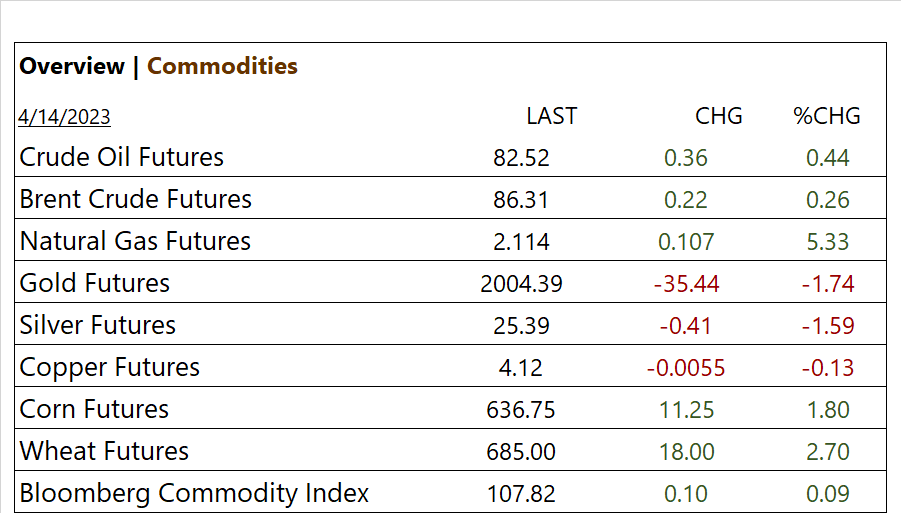

Commodities

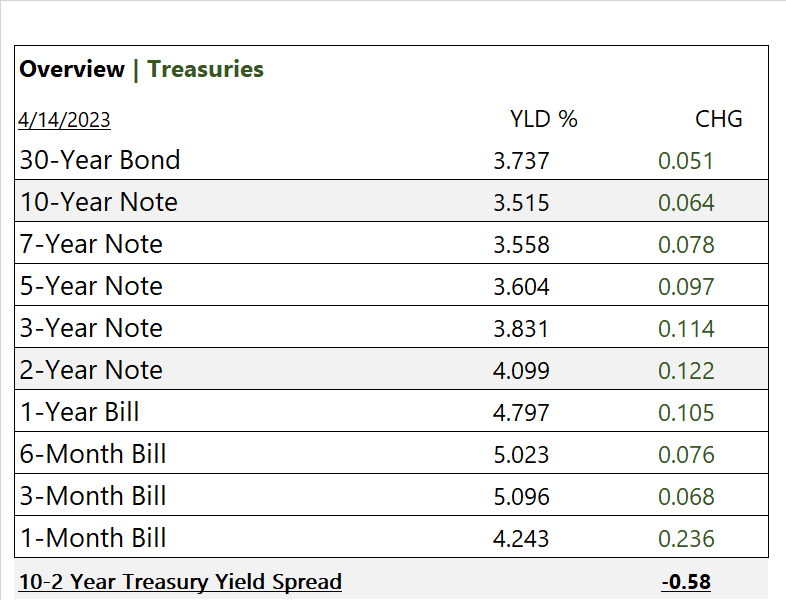

US Treasuries

Notable Earnings Today

- + UnitedHealth (UNH), JPMorgan (JPM), Wells Fargo & Co (WFC), Citigroup (C)

- – BlackRock (BLK), PNC Financial (PNC)

- * Strong support – Albermarie (ALB), Alphabet (GOOGL), NVIDIA (NVDA), Meta (META), Citigroup (C), Morgan Stanley (MS), BlackRock (BLK)

Economic Data

US

- U.S. retail sales; period March, act -1.0%, fc -0.5%. prev. -0.2%

- Retail sales minus autos, period March, act -0.8%, fc -0.4%, prev. 0%

- Import price index; period March, act -0.6% , fc -0.2%, prev. -0.1%

- Import prices minus fuel; period March, act -0.5%. prev. 0.4%

- Industrial production; period March, 0.4% 0.2% 0.2%

- Capacity utilization, period March, act 79.8%, fc 79.1%, prev. 79.6%

- Business inventories; period Feb., act 0.2%, fc 0.3%. prev. -0.2%

- Consumer sentiment; period April, act 63.5, fc 62, prev. 62

Summary – Americans cut back back on big ticket purchases as interest rates rose. Retail sales fall 1.0% in March, Core retail sales decline 0.3%, Manufacturing production falls 0.5%, Import prices fall 0.6%; drop 4.6% year-on-year. US consumer sentiment improves in April while short-term inflation expectations rise

News

Company News/ Other

- UnitedHealth First-Quarter Earnings, Revenue Up as Company Added Members – WSJ

- JPMorgan amasses deposits as customers move money to largest U.S. bank – Reuters

- OPEC Sees Oil Demand Climbing, at Odds With Saudi-Led Production Cut – WSJ

Central Banks/Inflation/Labor Market

- Unemployment Is Low. Inflation Is Falling. But What Comes Next? – NY Times

- El-Erian Terrified of Central Banks Losing Autonomy Over Errors – Bloomberg

- World’s Most Influential Central Banks’ Balance Sheets Look to Have Troughed – Coindesk

China