MARKETS TODAY July 5th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, Hong Kong’s Hang Seng -1.62%, China’s Shanghai Composite -0.69%, Japan’s Nikkei 225 -0.25%. European markets finished lower, London’s FTSE 100 -1.03%, France’s CAC 40 -0.80%, Germany’s DAX -0.63%. S&P futures were trading at -0.5% below fair-value.

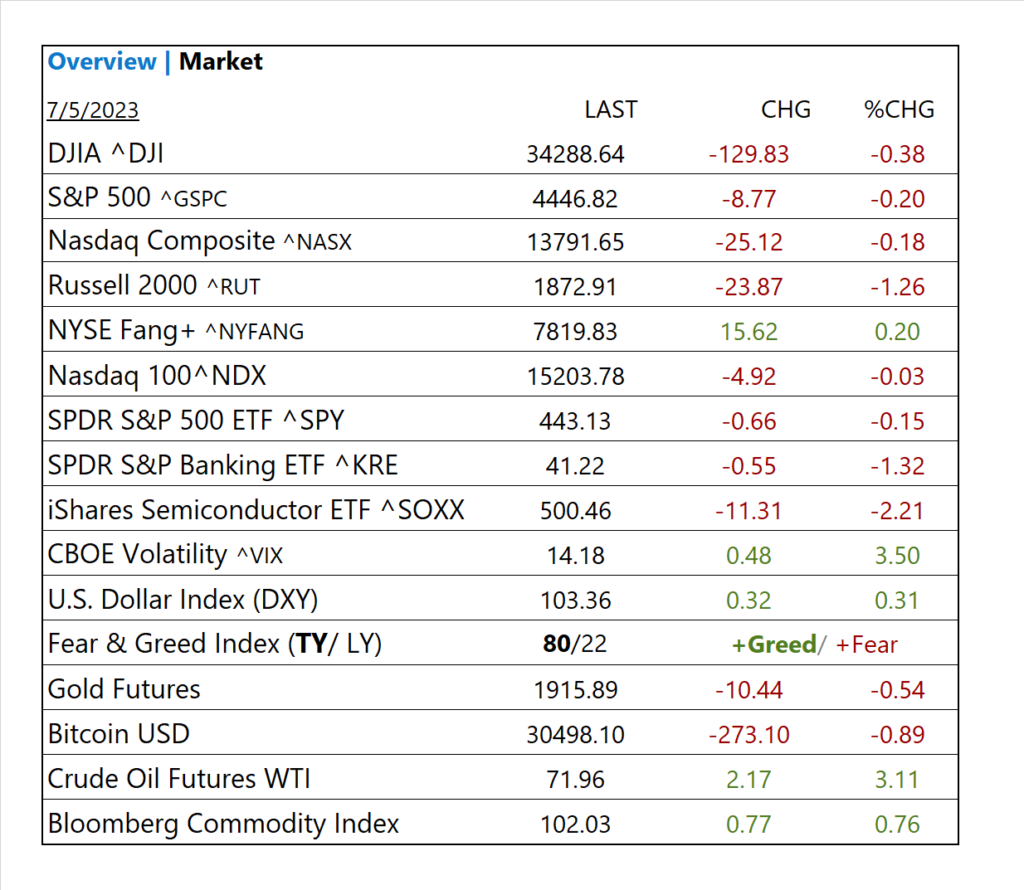

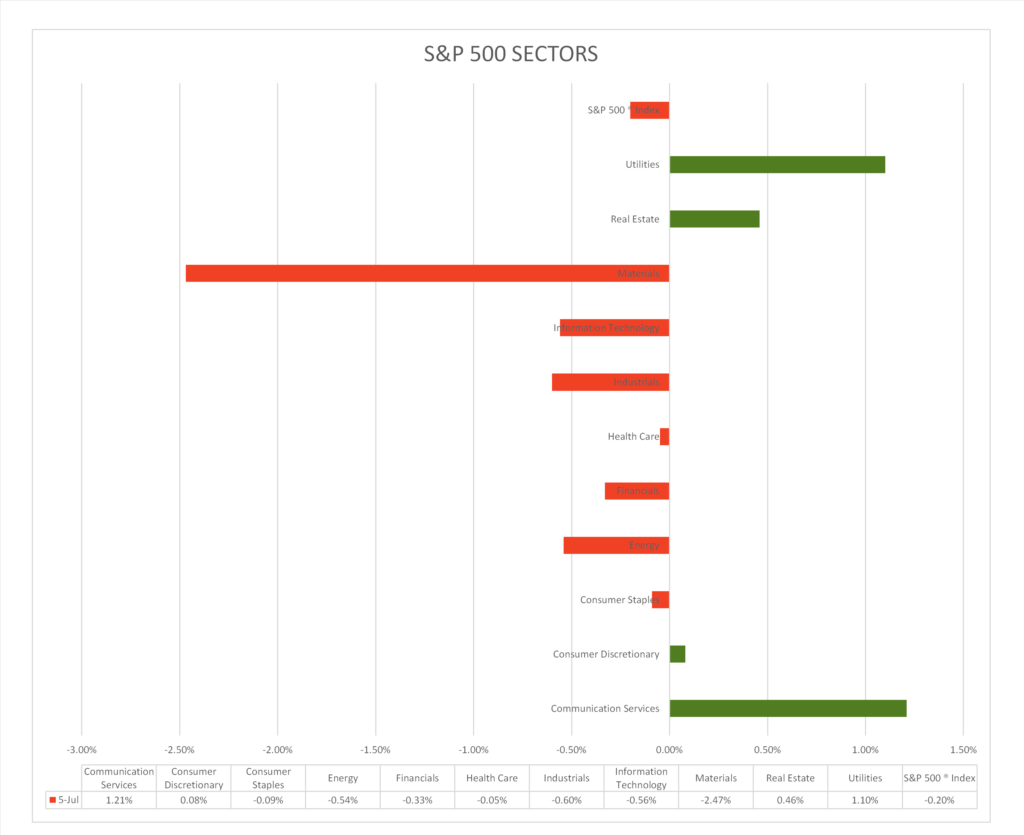

Today US Markets finished lower, S&P 500 -0.38%, DOW -0.20%, NASDAQ -0.18%. 9 of 7 of 11 S&P 500 sectors declining: Communication Services +1.21% outperforms/ Materials -2.47% lags. On the upside, FANG+, Mega Cap Growth, Utilities, Treasury Yields,, USD Index, Oil, Bloomberg Commodity Index. In economic news, May factory orders soft/ miss consensus. The release of the June FOMC minutes had little to no effect on the market.

Takeaways

- June FOMC minutes not a factor

- FNYSE Fang+ ^NYFANG +0.20%

- META +2.92%. GOOGL +1.54%, TSLA +0.95%

- 7 of 11 S&P 500 sectors declining: Communication Services +1.21% outperforms/ Materials -2.47% lags.

- Materials sector gets hammered on softer China services data

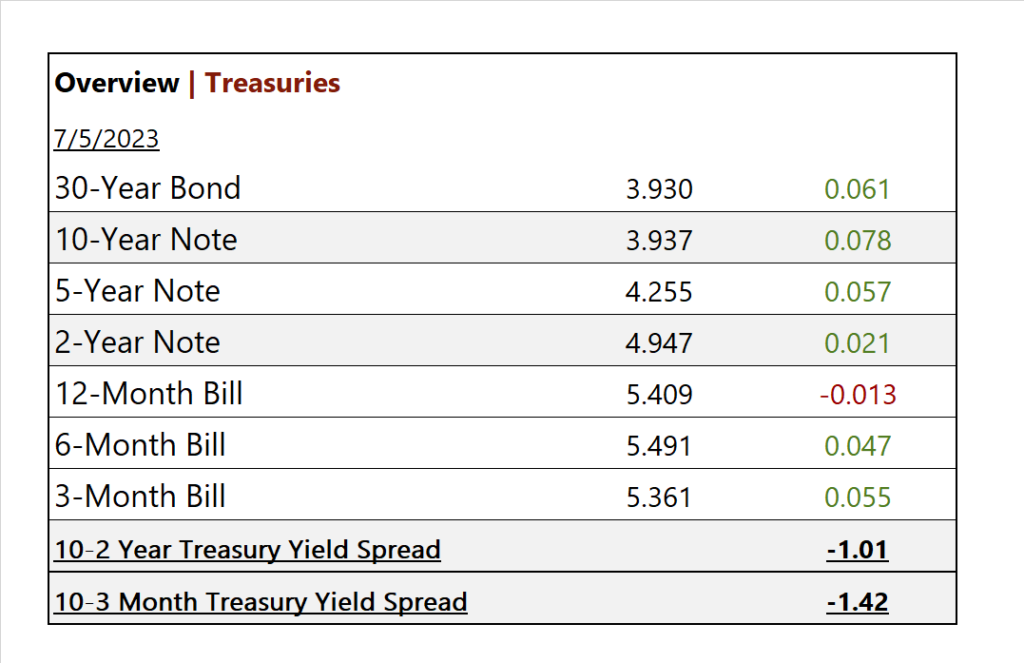

- US. Treasury yields higher

- USD Index gains

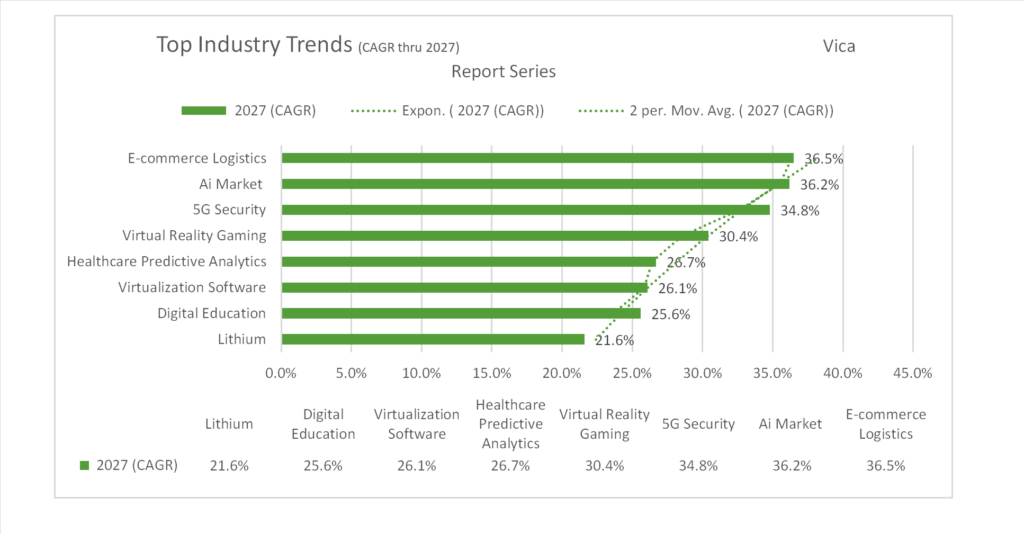

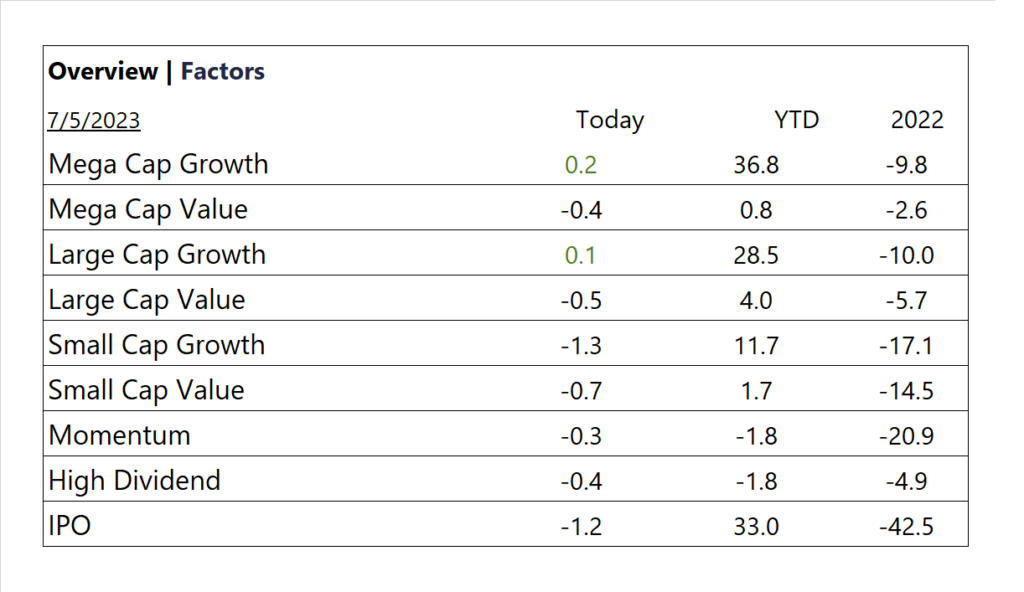

Vica Partner Guidance: Mega and Large Cap Growth continue to look attractive in early Q3. Highlighting Lithium Miners. Nasdaq 100^NDX 14,500 level is buying opportunity. Q3 2023/ credit default swap (CDS) will pick-up. Q1 2024/ expect economy pullback.

* Lithium 21.6% CAGR growth through 2027

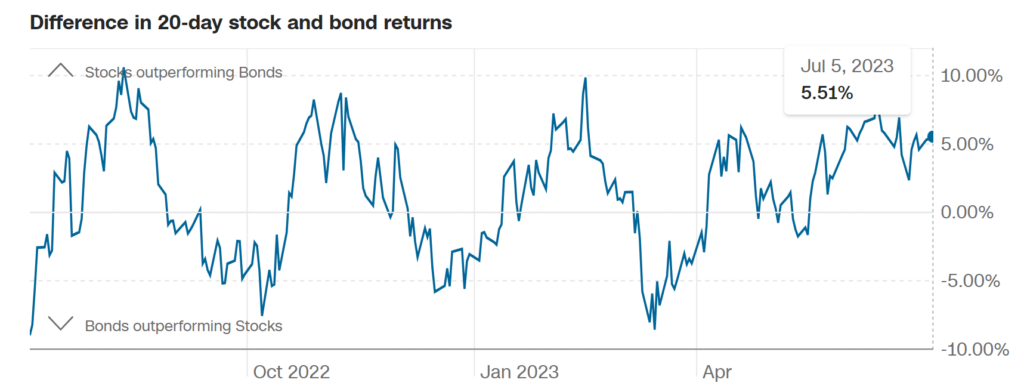

Pro Tip: Safe Haven Demand shows the difference between Treasury bond and stock returns over the past 20 trading days. Bonds perform better in bearish/ slowing markets.

Difference in 20-day stock and bond returns

Sectors/ Commodities/ Treasuries

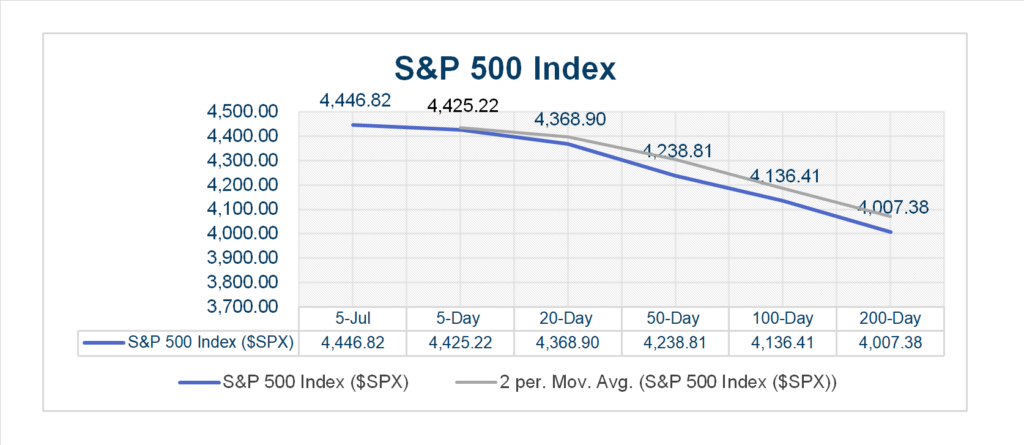

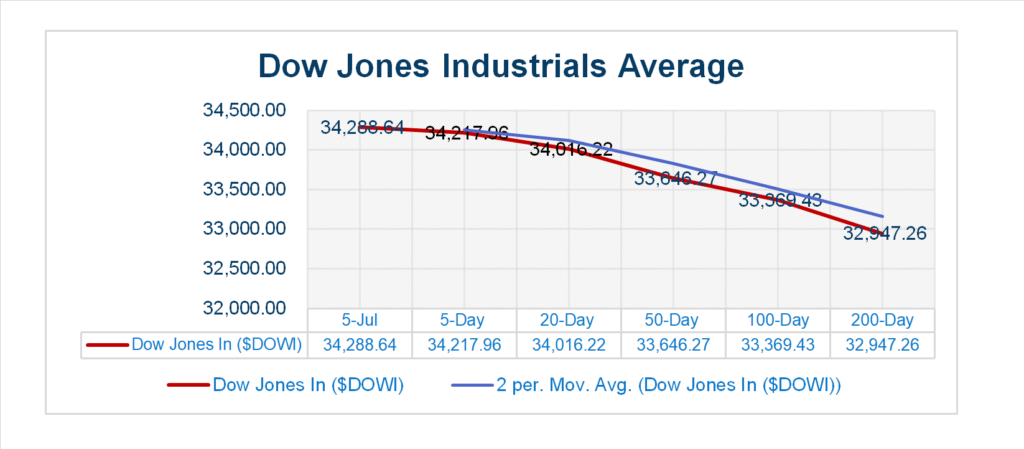

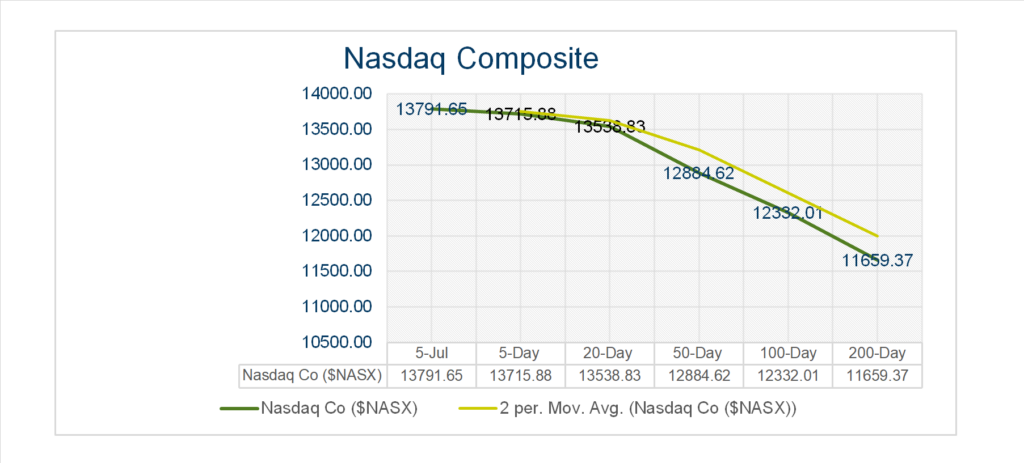

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 7 of 11 S&P 500 sectors declining: Communication Services +1.21%, Utilities +1.10% outperform/ Materials -2.47% lags.

Factors

US Treasuries

Notable Earnings Today

- +Beat: no notable activity today

- – Miss: no notable activity today

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Sociedad Quimica y Minera (SQM)

Economic Data

US

- Factory orders; period May, act 0.3%, fc 0.6%, prior 0.4%

- FOMC Minutes Officials said that, “leaving the target range unchanged at this meeting would allow them more time to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability.“

News

Company News/ Other

- TikTok Emerges as Threat to Amazon With $20 Billion Shopping Pilot – Bloomberg

- Auto Sales Defy Gloomy Forecasts – WSJ

- Commercial Property Fears Create Opportunities, Blackstone Real Estate Co-Head Says – Bloomberg

Energy/ Materials

- How China Came to Dominate the World’s Largest Nickel Source for Electric Cars – WSJ

- Why World’s Post-Cold War Energy Treaty Is Crumbling – Bloomberg

Central Banks/Inflation/Labor Market

- A New Fed Indicator Suggests Higher Rates Taking Hold—Despite Stock Market Rally – WSJ

- Global Central Banks Set to Diverge on Rates as Stubborn Inflation Stalks Fed, ECB – Bloomberg

- Subprime Auto Bondholders Face Possible First Hit in Decades – Bloomberg

China/ International

- Taiwan’s Impossible Choice: Be Ukraine or Hong Kong – WSJ