Stay Informed and Stay Ahead: Market Watch, August 1st, 2024.

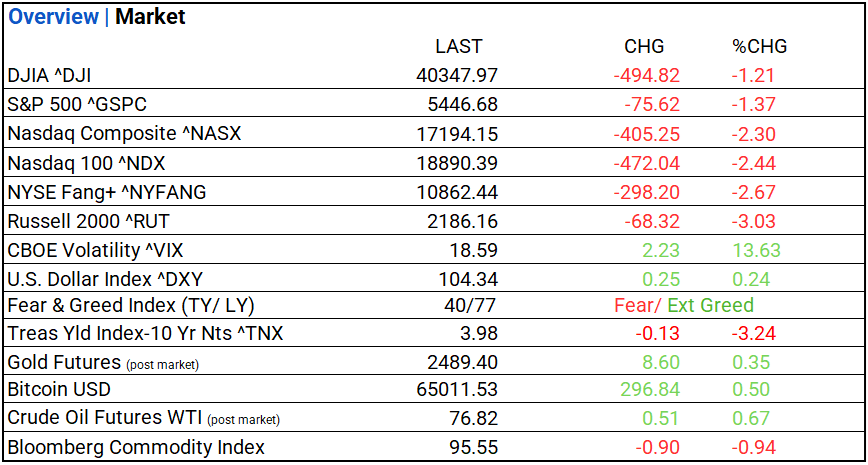

Late-Week Wall Street Markets

Key Takeaways

- DOW, S&P 500 and NASDAQ declined. Utilities/Real Estate higher, Tech and Energy Lower. The top industry was Household Products.

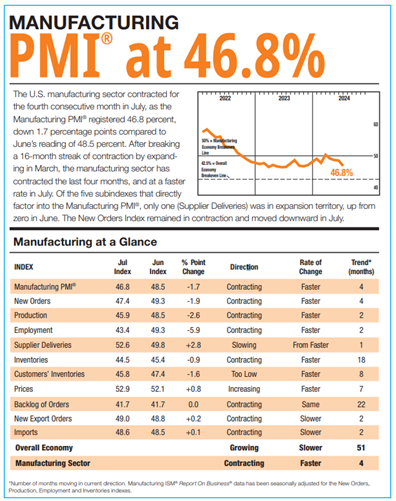

- S&P U.S. Manufacturing PMI shows negative growth, ISM reports showed broad-based weakness in July.

- Treasury yields fell, high dividend stocks rose, commodities mostly higher, and cryptos outperformed. Semiconductor shorts were top ETF winners, while Amazon missed earnings in the aftermarket.

Summary of Market Performance

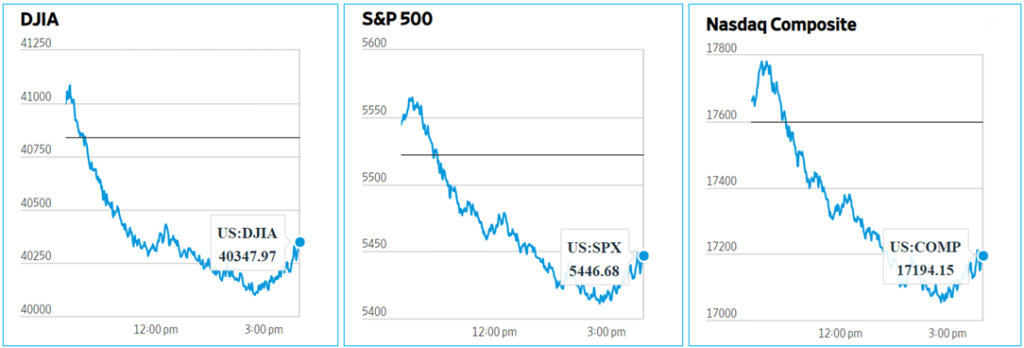

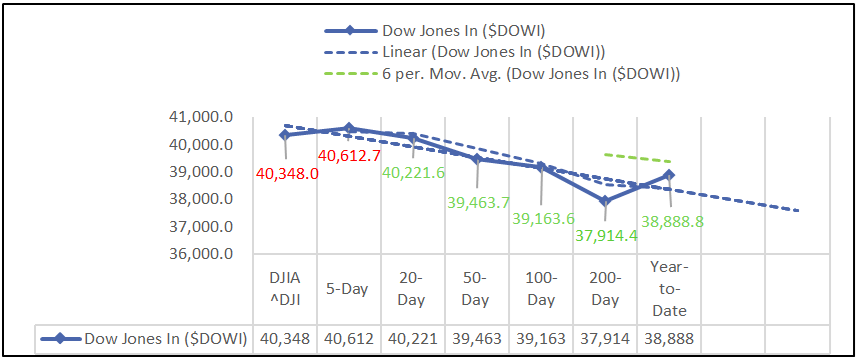

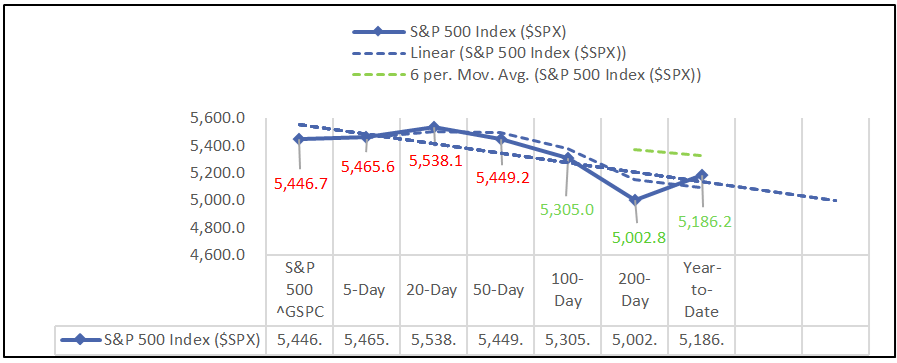

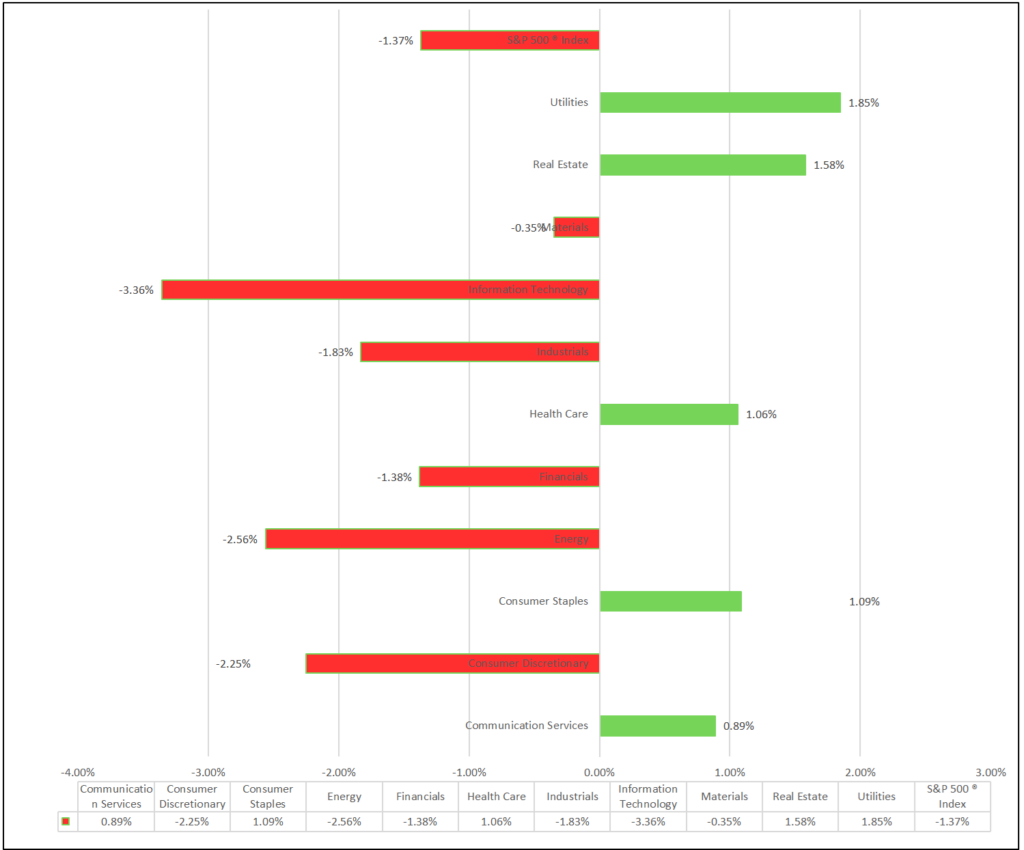

Indices & Sectors Performance:

- DOW, S&P 500 and NASDAQ declined, 6 of 11 S&P 500 sectors lower: Utilities/Real Estate higher, Tech and Energy Lower. Top industries included Household Products (+2.74%), Residential REITs (+2.71%), and Automobile Components (+2.70%).

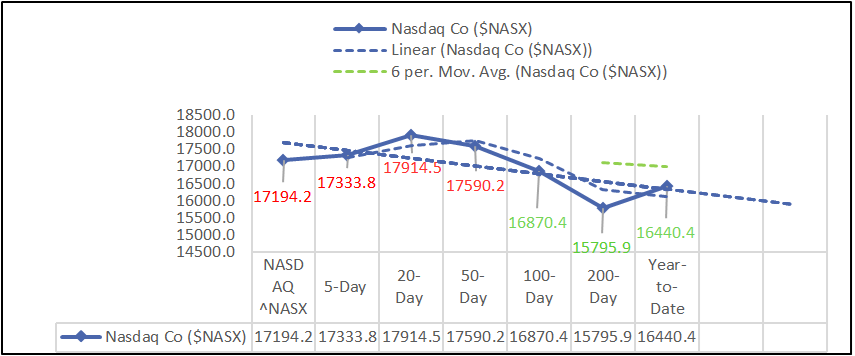

Chart: Performance of Major Indices

Moving Average Analysis:

S&P 500 Sectors:

- Among eleven sectors, six fell. Utilities leading and Tech trailing.

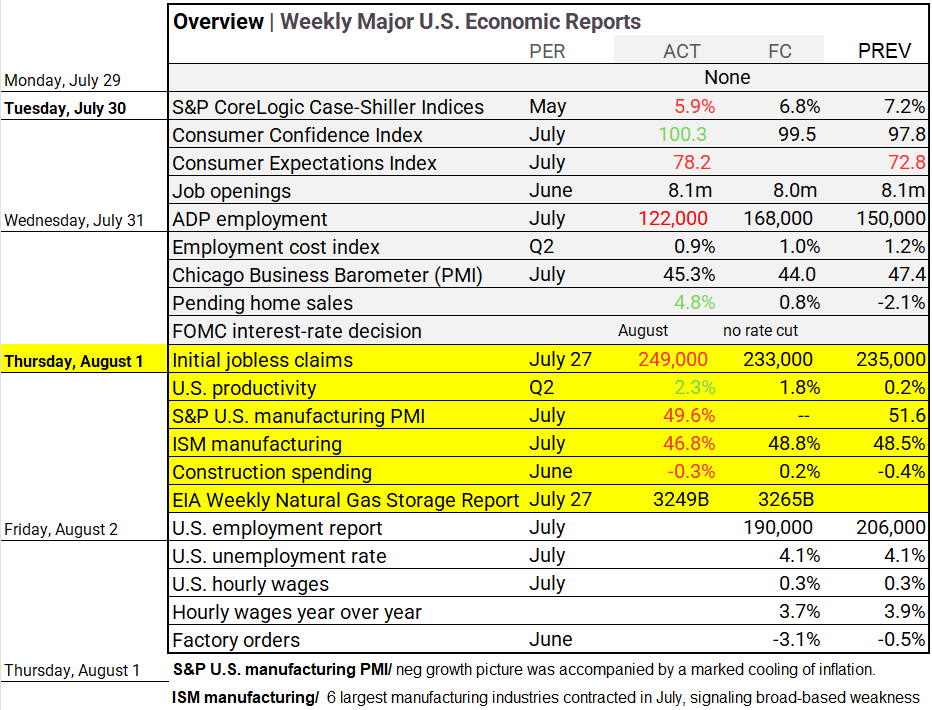

Economic Highlights:

- The S&P U.S. Manufacturing PMI indicates negative growth with a marked cooling of inflation, while the ISM manufacturing report showed that six of the largest manufacturing industries contracted in July, signaling broad-based weakness and Construction spending was soft.

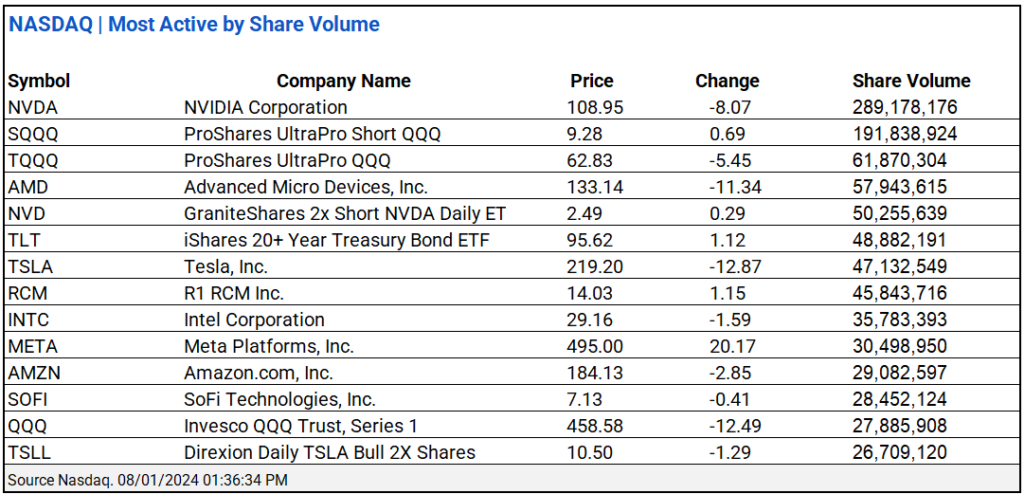

NASDAQ Global Market Update:

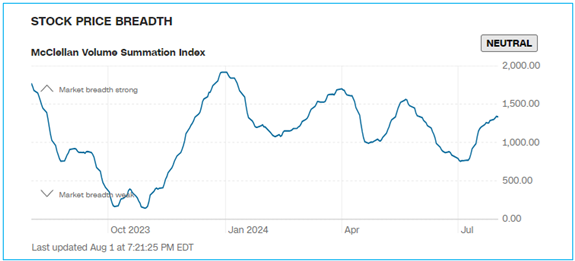

- NASDAQ total share volume was 6.23 billion, with an advance/decline ratio of 0.32, NVIDIA Corporation and ProShares UltraPro Short QQQ led active trading.

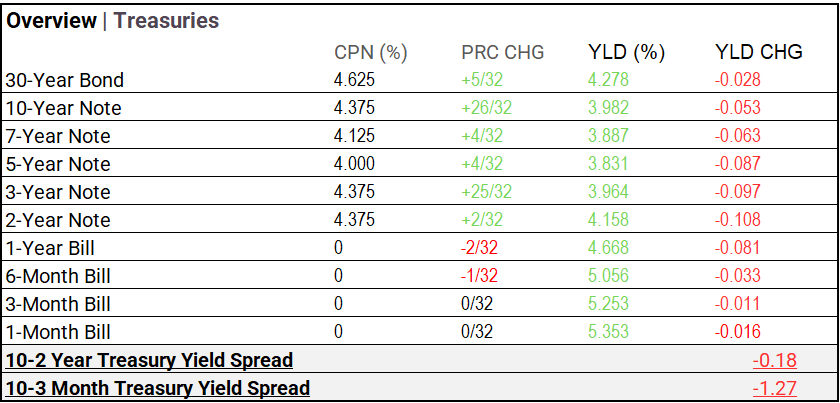

Treasury Markets:

- The yields on the 30-Year, 10-Year, 7-Year, 5-Year, 3-Year, 2-Year, 1-Year, 6-Month, and 3-Month notes all declined, while the 1-Month Bill yield remained unchanged. Notably, longer-term yields, such as the 30-Year Bond, saw less significant declines compared to shorter-term yields like the 2-Year Note, indicating a more pronounced adjustment in the short end of the yield curve today.

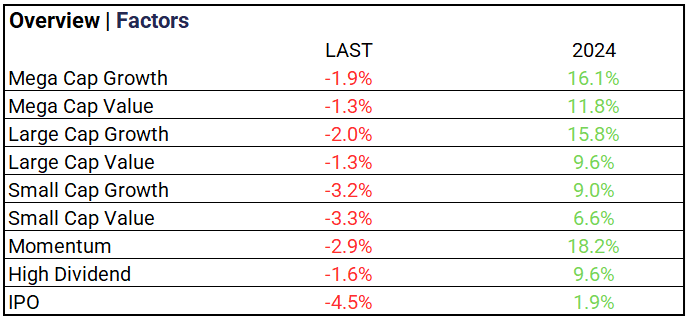

Market Factors:

- High dividend and larger cap Value lead the declining market, while small caps significantly lagged.

Currency & Volatility:

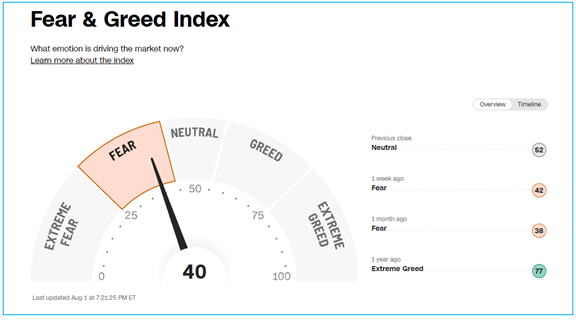

- The VIX rose to 18.59 (+13.63%), and the Fear & Greed Index shifted further eroded to “Fear” from last year’s “Extreme Greed.”

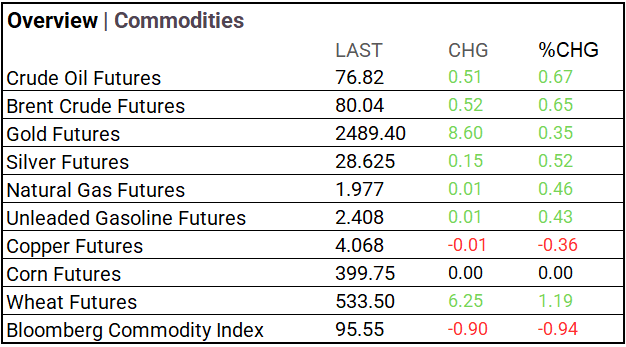

Commodities & ETFs:

- Commodity markets were mostly higher: crude oil, Brent, gold, silver, natural gas, and unleaded gasoline rose, while copper fell; corn remained unchanged, and the Bloomberg Commodity Index decreased.

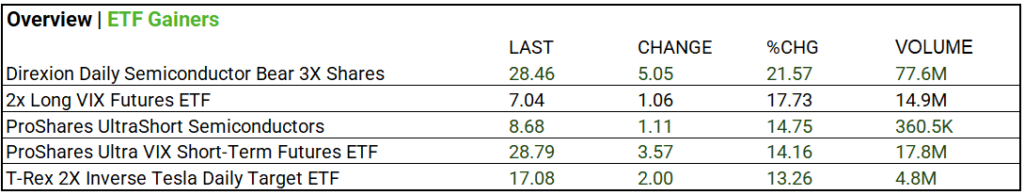

- ETFs: Direxion Daily Semiconductor Bear 3X Shares rose 21.57% on a volume of 77.6 million.

Cryptocurrency Update:

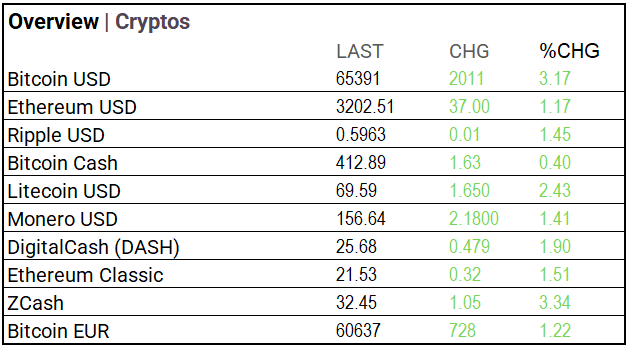

- Bitcoin outperforms while all index cryptos rise.

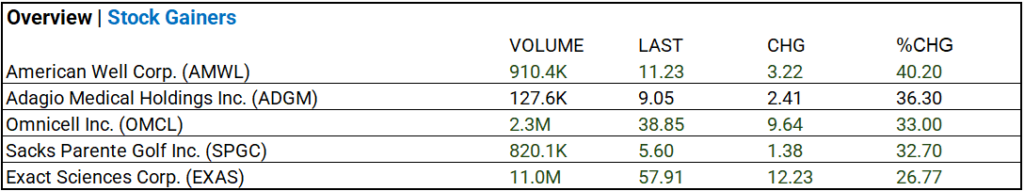

Stocks:

- Exact Sciences Corp. (EXAS) up 26.77% with a volume of 11.0 M.

Notable Earnings:

- Apple (AAPL), Toyota Motor ADR (TM), Booking (BKNG), Cigna (CI), and Southern (SO) beat; Amazon.com (AMZN), Shell ADR (SHEL), Intel (INTC) and Anheuser Busch ADR (BUD) miss. Coinbase Global (COIN) misses on profit but impresses analysts with favorable revenue growth.

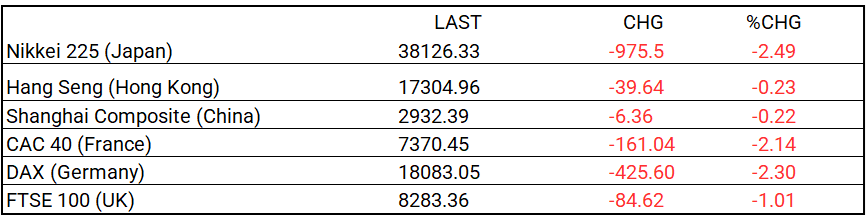

Global Markets Summary:

- Asia’s Nikkei dropped 2.49%, while Europe’s DAX and CAC 40 fell over 2%.

Strategic Investment Adjustments and Historical Market Trends:

- Focus on long-duration bonds, which benefit from rate cuts due to their inverse relationship with interest rates. As the Fed eases rates, their value rises since fixed payments become more attractive compared to new, lower-rate bonds.

- Stay the course with Nasdaq/Tech for long-term growth in semiconductors, while diversifying with small-cap and bank index ETFs to manage risk.

- Historically, election years support market growth due to increased fiscal stimulus and investor optimism.

In the NEWS

Central Banking, Monetary Policy & Economics:

- Bank of England Cuts Rates After Fed Held Off – WSJ

- US Job Market’s Pandemic Unwind Puts Recession Signals to Test – Bloomberg

Business:

- Amazon Shares Slide as Spending Surges and Revenue Outlook Disappoints – WSJ

- Clorox Jumps as Profitability Gains Outweigh Slumping Sales – Bloomberg

China:

- China must ensure future of stock markets to fund innovation: prominent economist – SCMP