MARKETS TODAY March 3 (Vica Partners)

Opening Commentary

ISM services headline number bested expectations with U.S. business gains in February, reaching its highest level in eight months. U.S. services sector saw new orders and employment hit 12 month highs.

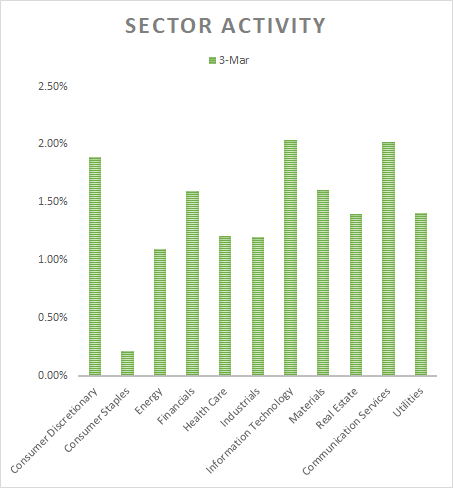

As for equities the Information Technology sector was up 2.04%, with C3. AI up +33% at the bell following solid earnings. Strong China Manufacturing PMIs helped materials and energy outperform throughout the week. On the downside, crypto markets/ bitcoin continued to fall following the Silvergate headlines from yesterday. Friday earning releases were light – MK

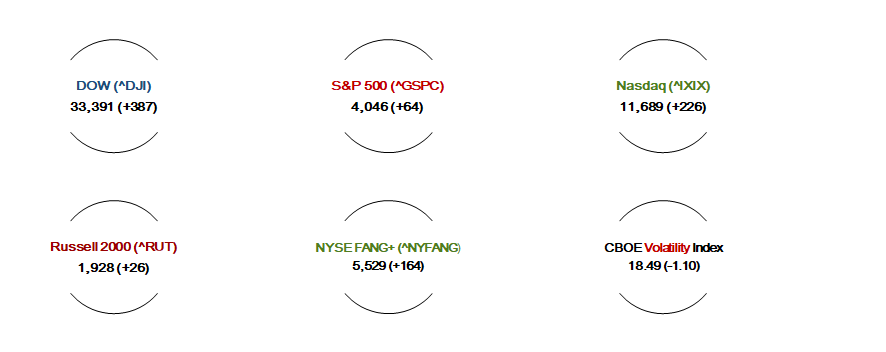

Session Overview

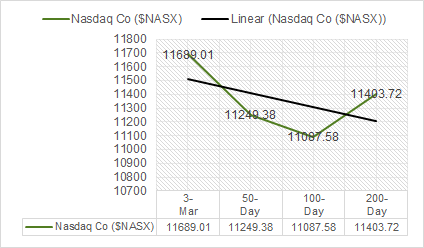

- Indexes all up, Nasdaq/ NYFANG+ lead

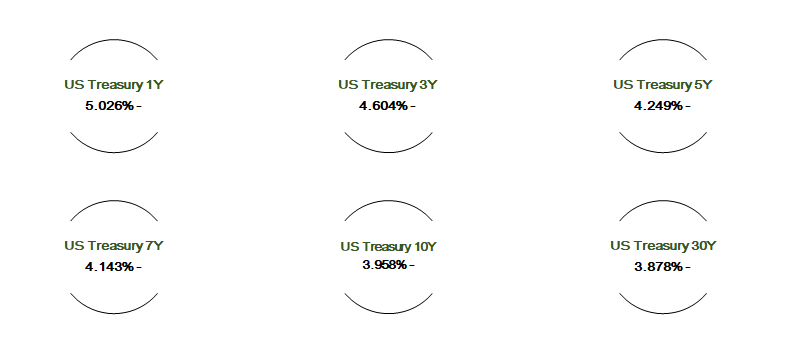

- Yields fall

- All 11 S&P sectors higher: Information Technology and Communication Services outperformed/ Consumer Staples underperformed

- Materials and Energy both continue to outperform on China re-opening

- Ai (AI), Technip Energies NV (THNPY), Marvell (MRVL) with solid earnings

- Oil up, Natural Gas +8%

- USD Index down, Bitcoin falls

- U.S. services sector saw new orders and employment hit 12 month highs

- Fed “acutely aware” of trouble inflation is causing (article link below)

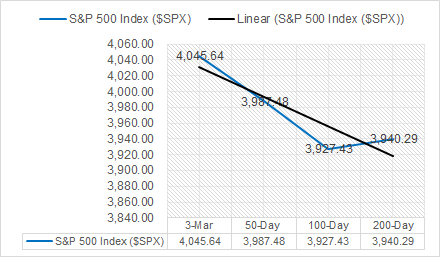

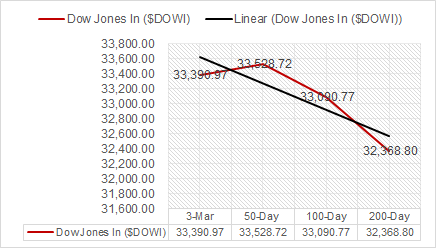

Key Index’s (50d,100d, 200d)

Sectors

- All 11 S&P sectors higher: Information Technology,+2.04% and Communication Services +2.02%, outperformed/ Consumer Staples,+0.22% underperformed

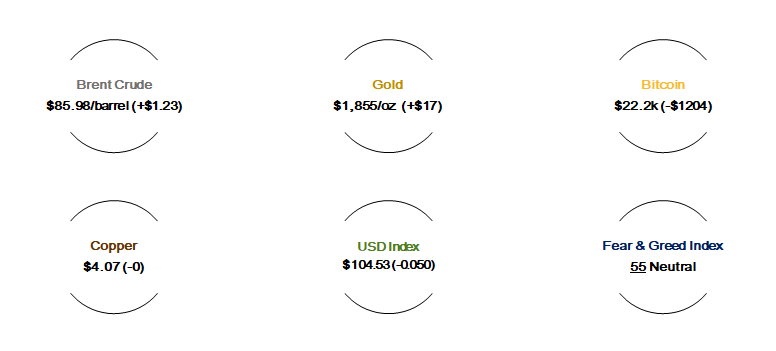

Asset Classes/ Treasuries

- USD index: -0.50 to $104.53

- Oil prices: Brent: +1.45% to $85.98, WTI: +1.94% to $79.68, Nat Gas: +8.22% to $3.009

- Gold: +0.95% to $1,855.37, Silver: +1.45% to $21.26, Copper: -0.12% to $4.07

- Bitcoin: -5.13% to $22.2k

Notable Company Earnings

- Beats/ C3 Ai (AI), Technip Energies NV (THNPY), Marvell (MRVL), inTest (INTT)

- Misses/ Deutsche Lufthansa ADR (DLAKY), Merck ADR (MKKGY), London Stock Exchange ADR (LNSTY)

Economic Data

Topline: Opportune news for the Market today as U.S. business gains in February, reaching its highest level in eight months. U.S. services sector also so a gain in February, with new orders and employment at 12 month highs. Report details below.

- S&P Global U.S. services PMI (final): period Feb., act 50.6, fc 50.5, prev. 50.5

- ISM services: period Feb., act 55.1%, fc 54.3%, prev. 55.2%

Central Banks/Inflation/Labor Market

- Fed “acutely aware” of trouble inflation is causing – report – Reuters

Business News

- Ford looking at ways to boost gas-powered F-150 production – Reuters

- AI stocks surge as investors bet on growth prospects – Reuters

- Airbnb cuts recruiting staff by 30% – Reuters

Energy

- Oil rises by $1/bbl after denial of reported UAE plan to exit OPEC – Reuters

- Exclusive: Russia set to mothball damaged Nord Stream gas pipelines, sources – Reuters

Other News

- Factbox: Silvergate crisis: Crypto industry majors drop embattled lender – Reuters

China

- China opposes U.S. adding Chinese firms to trade blacklist – Reuters

Vica Daily Stock Report

- Occidental Petroleum (OXY) $OXY (Momentum D) (Value A+) (Growth A-), moving averages/ 50-Day -2.53%, 100-Day -12.85%, 200-Day -10.17%, Year-to-Date -3.43%

Strong Value/ Growth Buy Rating

Occidental Petroleum Corporation explores for, develops, produces, and markets crude oil and natural gas. The Company also manufactures and markets a variety of chemicals. Occidental also collects, treats, processes, transports, stores, trades and markets crude oil, natural gas, NGLs, condensate and carbon dioxide (CO2) and generates and markets power.

Market Outlook and updates posted at vicapartners.com