MARKETS TODAY June 27th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng +1.88%, China’s Shanghai Composite +1.23%, Japan’s Nikkei 225 -0.49%. European markets finished higher, France’s CAC 40 +0.43%, Germany’s DAX +0.21%, London’s FTSE 100 +0.11%. S&P futures were trading at 0.1% above fair-value.

Today US Markets finished higher, S&P 500 +1.15%, DOW +0.63%, NASDAQ +1.65%. 9 of 11 of the S&P 500 sectors advancing: Consumer Discretionary+2.06% outperforms/ Health Care -0.20% lags. On the upside, Tech Sector, Semiconductor ETF (SOXX), S&P Banking ETF (KRE), USD Index, Oil. In economic news, durable goods orders came in well ahead of estimates, Capital goods orders in line, Case Shiller home prices beat and consumer confidence jumped >7 points.

Takeaways

- China made comments overnight about policy stimulus

- Bullish economic news out today

- Tech rules NYSE Fang+ ^NYFANG gains 2.18%

- 9 of 11 of the S&P 500 sectors advancing: Consumer Discretionary+2.06% outperforms/ Health Care -0.20% lags

- Semiconductor ETF (SOXX) +3.49%

- IPO’s +3.8%

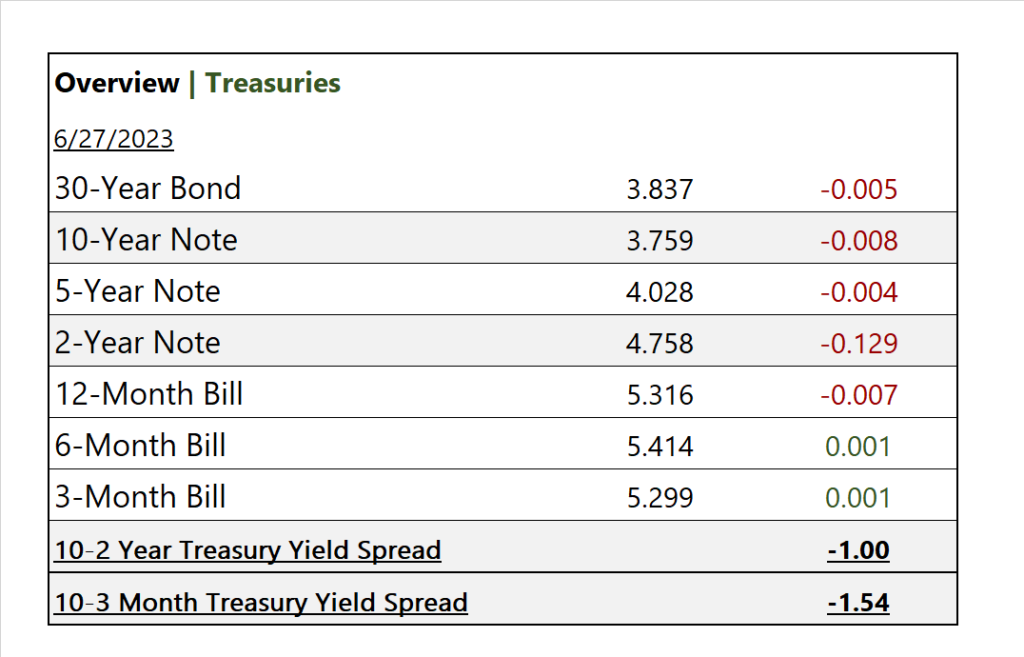

- Yields moderately lower

- Oil gains

- Korn Ferry (KFY) earnings beat

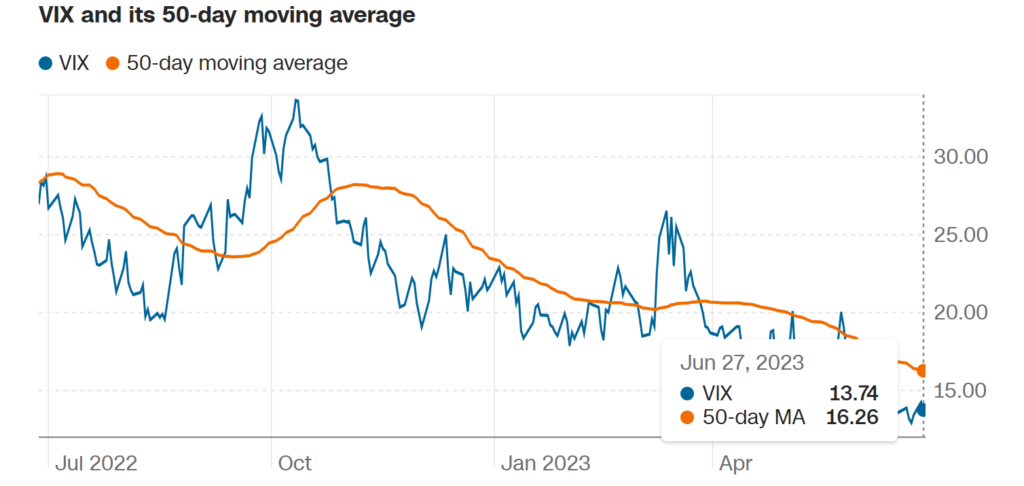

Pro Tip: the CBOE Volatility Index (VIX) measures price fluctuations and or volatility in the S&P 500 Index options over the next 30 days. The VIX drops on days when the market rallies and rises on decline. VIX is lower in bull and higher in bear markets.

Sectors/ Commodities/ Treasuries

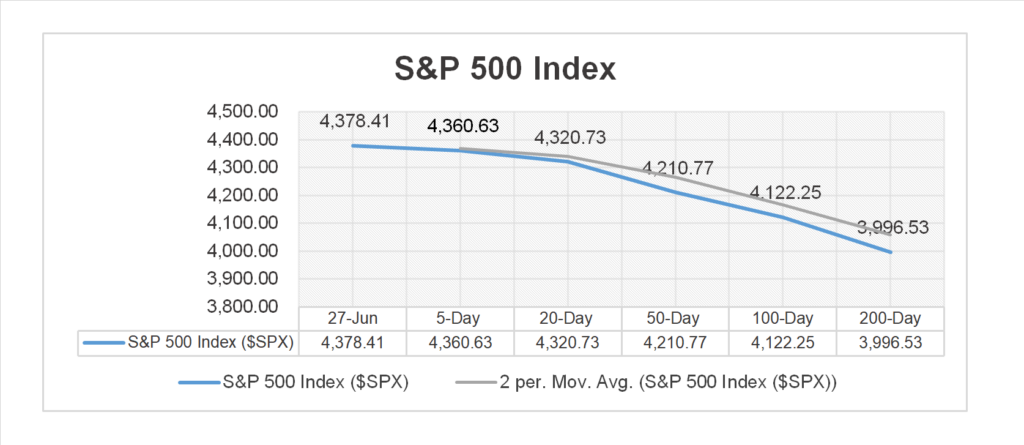

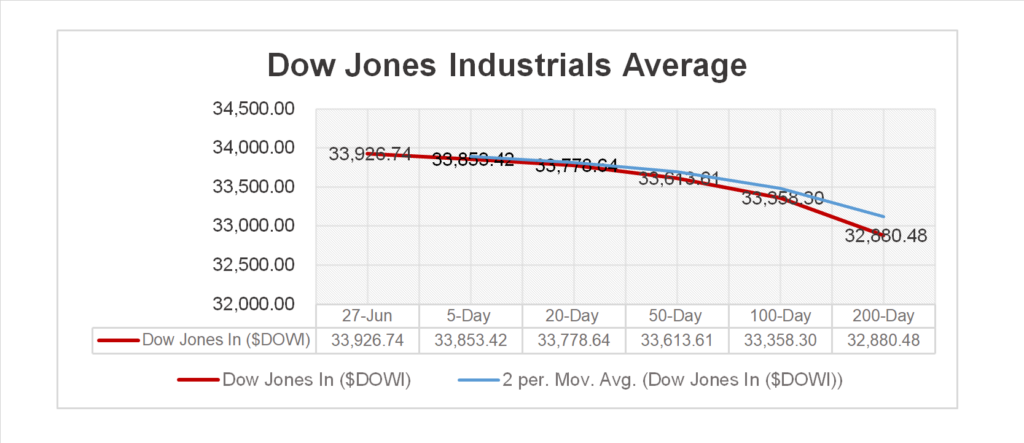

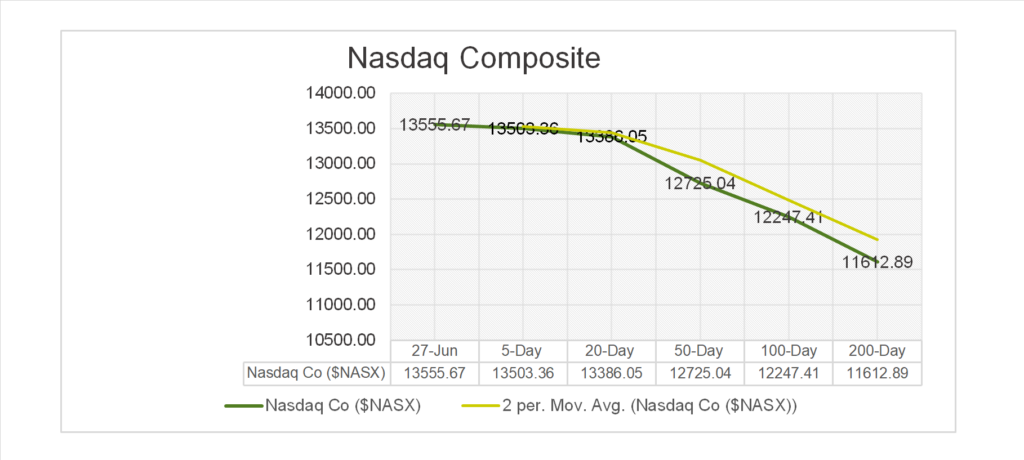

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors advancing: Consumer Discretionary+2.06%, Information Technology +2.04% outperform/ Health Care -0.20% lags

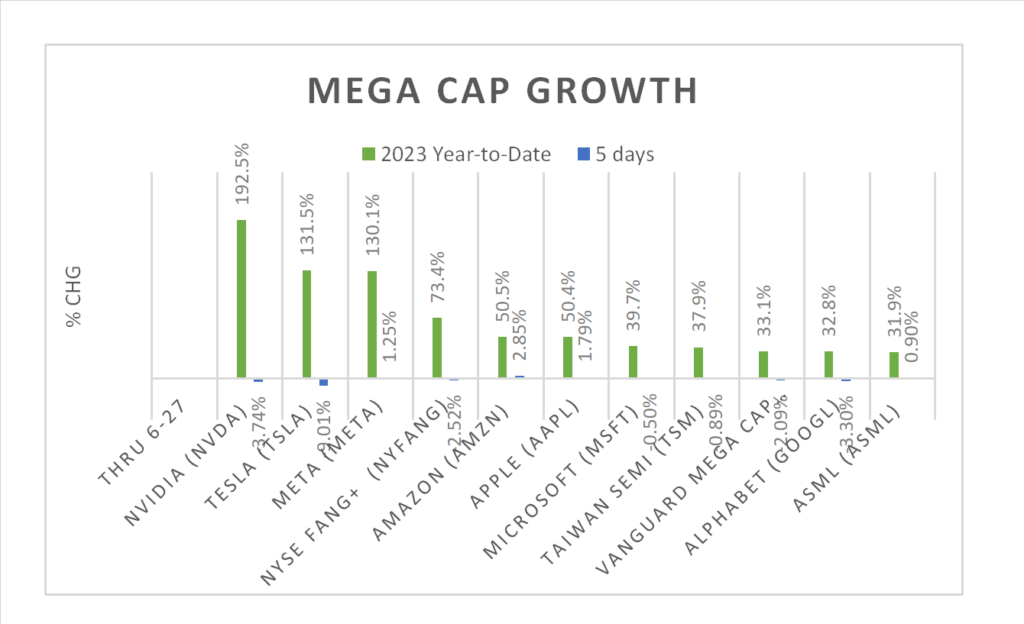

Factor Mega Cap Growth

US Treasuries

Notable Earnings Today

- +Beat: Korn Ferry (KFY)

- – Miss: Alimentation Couche Tard (ANCTF), Walgreens Boots (WBA), Synnex (SNX), Jefferies Financial (JEF)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom Inc (AVGO), Intel (INTC)

Economic Data

US

- Durable-goods orders; period May, act 1.7%, fc -0.9%, prior 1.2%

- Durable-goods minus transportation; period May, act 0.6%, prior -0.6%

- Case-Shiller home price index; period April, act -1.7%, fc -2,4%, prior -1.1%

- New home sales; period May, act 763,000, fc 675,000. Prior 680,000

- Consumer confidence; period June, act 109.7, fc 104, prior 102.5

News

Company News/ Other

- The New M&A Rules That Would Delay Million-Dollar Deals – Bloomberg

- Sequoia Made a Fortune Investing in the U.S. and China. Then It Had to Pick One. – WSJ

Energy/ Materials

- Russia Set to Overtake Saudi Arabia in Battle for China’s Oil Market – WSJ

- The Heat Dome Scorching Texas and Mexico Is About to Spread – Bloomberg

Central Banks/Inflation/Labor Market

- ECB Likely to Hike Rates in July: Lagarde – WSJ

- Pimco Loads Up on Aussie Bonds on ‘Inevitable’ Recession Call – Bloomberg

China/ International

- China Bans ‘Negative’ Finance Writers as Stock Market Sinks – Bloomberg