MARKETS THIS WEEK April 22nd, 2023 (Vica Partners)

Takeaways

- Mixed economic releases indicating more recessionary than inflationary

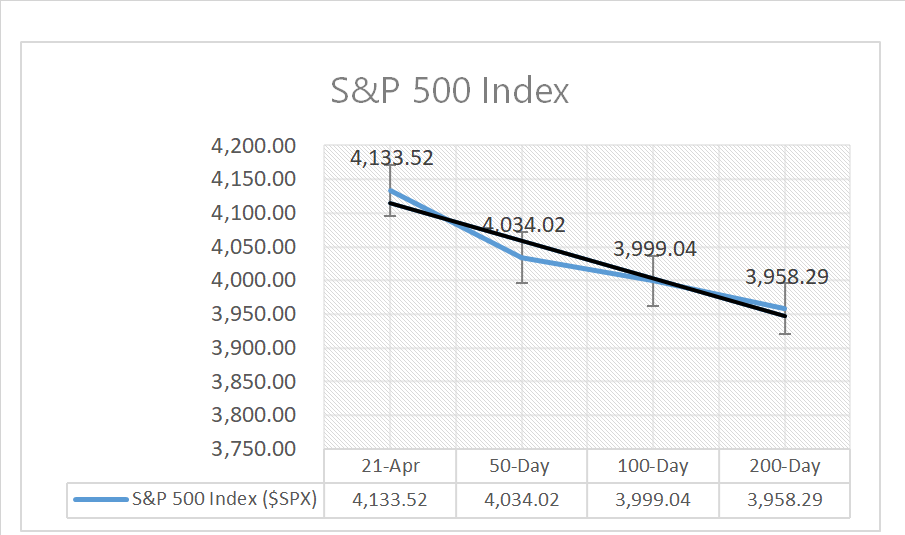

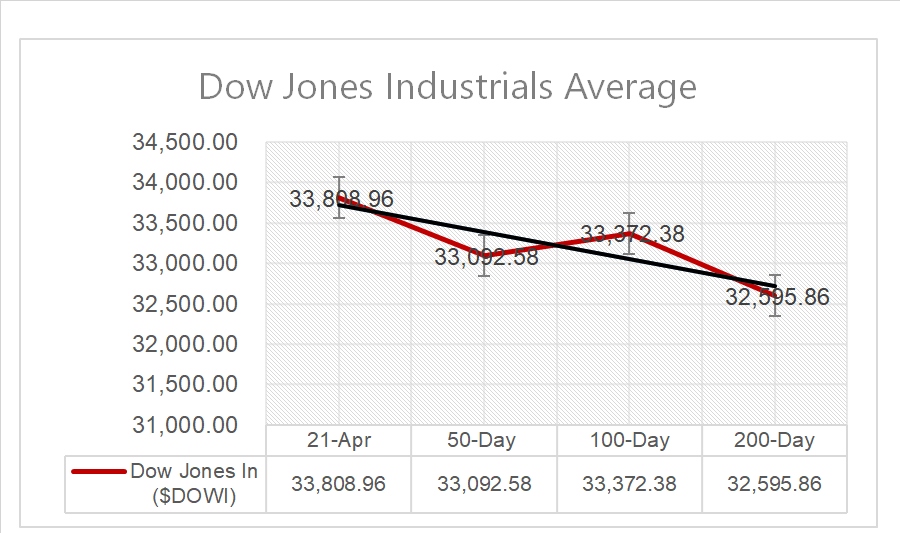

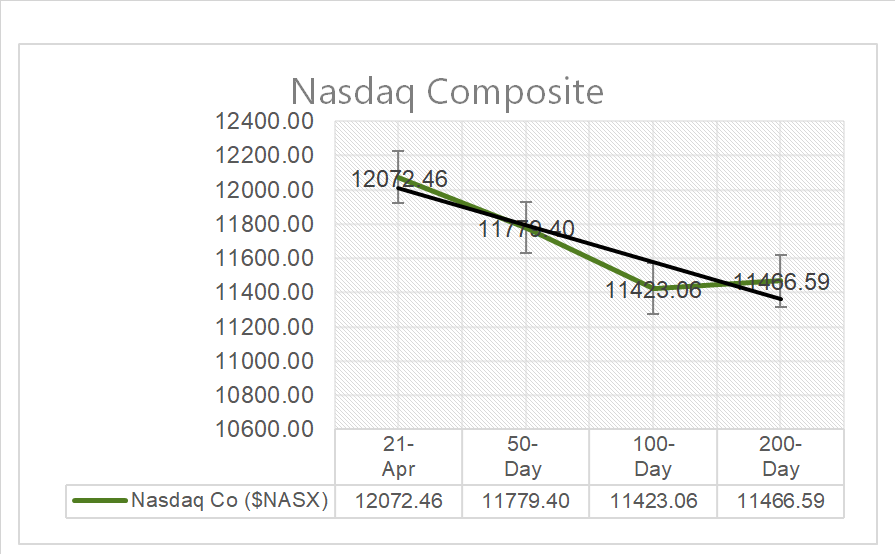

- Muted performance, S&P 500 -0.09%, Dow -0.36%, Nasdaq -0.30%

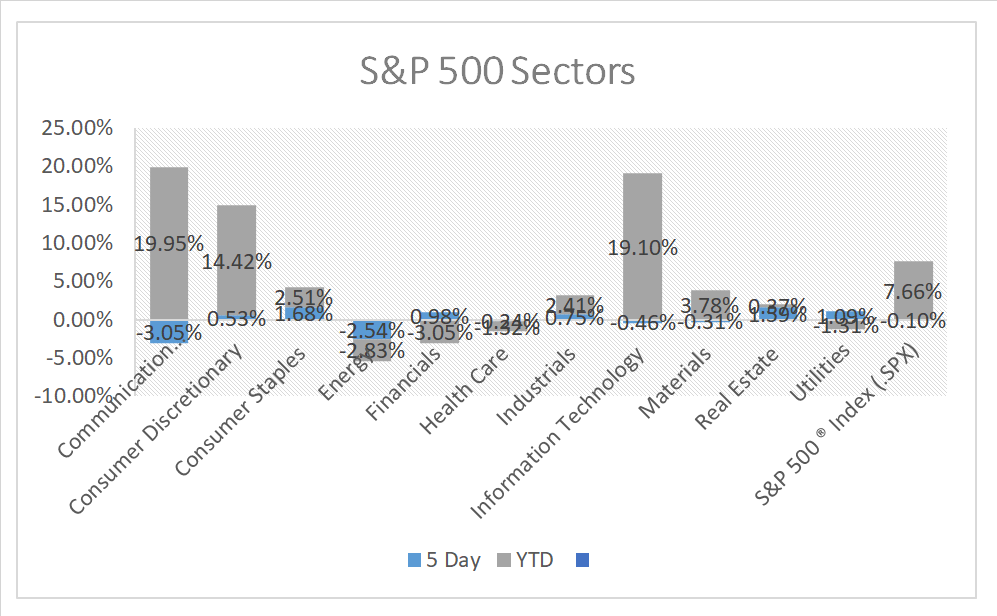

- Sectors, Consumer Staples +1.68%, Real Estate +1.59% outperform/ Communication Services -3.05%, Energy -2.54% lag

- SPDR S&P Regional Banking ETF ^KRE +1.75% … in the FDIC we trust!

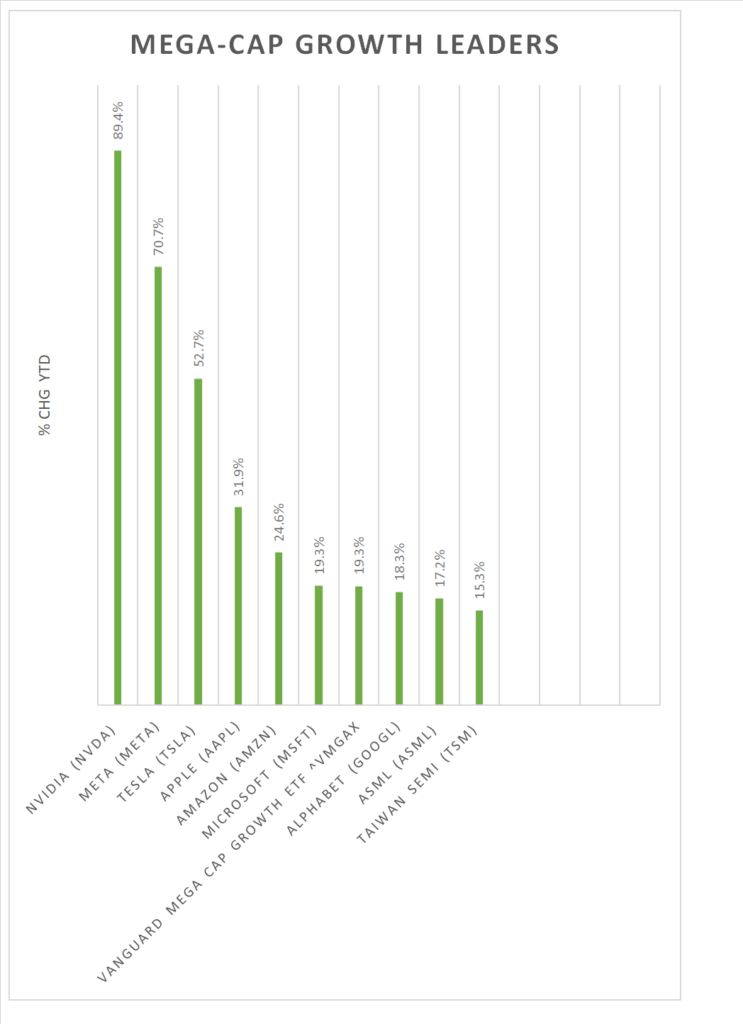

- YTD Mega Cap Growth has strong ROI (see chart below)

- VIX remains below 20 in April

- Greed dominates Investor buying sentiment

- Chile news on State control over lithium sparks Material Sector selloff

- Oil/ Gas reserves highly depleted with OPEC cuts, Q3,4 opportunity?

- Debt ceiling is probably a no-contest, it can be raised

Earnings/ Topline – 18% of S&P 500 companies reported with +75% beating within 6%

- >17% of S&P 500 companies reported to date with >75% beating estimates within 6% and a blended Q1 YoY EPS growth rate at -6.1%

- On just Revenue, 61% of companies exceeding estimates by 1.6%, bringing the blended growth rate to 2.1%.

- S&P 500 Financials >60% have beaten estimates and mostly BIG banks

- Next week >40% of companies in the S&P 500 will report earnings

Notes

- Industrial and Consumer results look good

- Tech / semiconductor helped by forward guidance

- Housing market remains resilient

- Tesla’s earnings miss disrupted markets

- Airlines and travel remain strong

- Companies with higher IT costs are missing on EPS

Sectors

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 Sectors, Consumer Staples +1.68%, Real Estate +1.59% outperform/ Communication Services -3.05%, Energy -2.54% lag

Mega Cap Growth